Daniel Eskridge/iStock via Getty Images

A lot of SPAC deals have been left for dead, but companies like Workhorse Group (NASDAQ:WKHS) now have a viable business. The last mile EV delivery company forecasts building thousands of units annually now with the company in the midst of a production ramp. My investment thesis is Neutral on the business due to the financial situation, but the stock is compelling at $2 for a risk trade.

Ramping To Production

So far, Workhorse has provided no indication the company started manufacturing EV delivery trucks in Q3 as predicted during the Q2 earnings report. The company has forecasted the production of 150 to 250 vehicles by year-end, generating up to $25 million in sales for 2022.

Once Workhorse has production of new vehicles up and running, the company only has to execute on production ramps to build a solid business case for a large and viable business in a few years. Under the new CEO, the company has transformed from chasing the massive USPS deal with a binary outcome to building an EV delivery platform with medium-duty trucks, vans and drones.

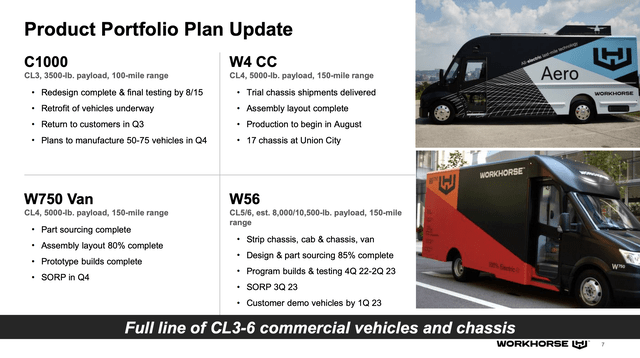

Workhorse will have a full line of Class 3 through Class 6 commercial products in production by 2024. On top of that, the company will have an aerospace business and work with clients on assembling other vehicles.

Source: Workhorse Q2’22 presentation

What really matters at this point is selling vehicles and obtaining orders for new vehicles. Workhorse needs a stronger backlog to attract additional investments to see this big production portfolio plan reach fruition.

In the Q2’22 earnings report, CEO Rick Dauch discussed some signs of orders building:

We secured a new purchase agreement for our C1000, W4 CC and W750 products, which includes over 1,000 build slot reservations in 2022 and 2023.

The company spent the start of Q3 finishing the redesign of the C1000 vehicles, with an expectation to move towards repair and the initial production of up to 74 additional vehicles by year-end. In addition, the company has next-generation W4 and W750 vehicles set to begin production in Q3 and Q4.

The problem here is that Workhorse hasn’t provided any updates since the Q2’22 earnings report back in August. Along with the planned assembly of TROPOS sub-Class 1 vehicle, Workhorse should have a very busy manufacturing facility in Union City.

Burning Cash Fast

Workhorse ended Q2’22 with a cash balance of $140 million and no debt. The company lost $22 million during the quarter and has seen the cash balance fall from $202 million at the start of the year in just 2 quarters.

The flip side of the aggressive product roadmap is high expenses. Not only is Workhorse trying to build out 4 different delivery vehicles, but also the company is building a drone delivery product.

The end result is a very capital-intensive setup when the company really needs to get a couple of vehicles with ramped-up production. Strong cash flows and profits from one vehicle could fund the development of the next vehicle.

Workhorse risks running out of cash trying to build too wide of a business while not executing on the top couple of options. The new CEO has a very aggressive plan with the company building on a lot of fronts. The problem here is a general lack of updates on production, with the calendar already flipping into mid-October and the stock languishing due to a lack of news.

The stock only has a market cap of $400 million. The company has an ATM in place to raise cash via selling shares, but investors probably don’t really want management issuing shares at these stock prices.

Once Workhorse executes on the W4 production start-up and the TROPOS assembly plans, the stock should rise. The company needs to provide visible execution to the market. Workhorse will be able to raise far more capital at vastly higher stock prices, with the new CEO demonstrating strong execution with transforming the manufacturing facilities and pivoting the vehicle production plan in a short time.

Takeaway

The key investor takeaway is that Workhorse is priced for a disaster now. The EV manufacturer actually has a real business setting up here, but the company needs to deliver on forecasts.

Investors should watch from the sidelines as the manufacturing ramp of a wide portfolio plan is ripe with risks. If Workhorse fails to execute, the company could be left without the capital needed to build out the full platform of EV delivery vehicles and be forced to raise capital at a less ideal valuation.

Be the first to comment