svetikd/E+ via Getty Images

Investment Thesis

Wix.com stock gained disproportionately during the first months of the Covid-19 pandemic, consolidating at a relatively high level until July 2021, and has since then lost 80% of its value, standing around the low levels of March 2020. The brand is well known worldwide and its products are used by over 220M users in over 190 countries, but its business is not without competition, and increasingly high marketing expenses and slowing revenue growth are contributing to the pressure on the stock price. I will show that the company is trading at a discount and that long, but also medium-term, investors could take advantage of this situation.

A Quick Look At Wix.com

Founded in 2006 and headquartered in Tel Aviv, Israel, the company was formerly known as Wixpress Ltd. before changing its name to Wix.com Ltd., and has been listed since 2013 in the US (NASDAQ:WIX). The company offers a cloud-based platform that enables individuals, businesses, and organizations to create a website through its drag-and-drop editor, or web applications for their specific needs. The Company provides solutions that businesses can use to operate various aspects of their business online, such as selling goods, taking reservations, and scheduling and confirming appointments. Paid users have access to multiple tools and features enabling them to connect with their customers across various channels, automate their work, grow their business, and implement payment systems. Business owners can also install and integrate vertical applications developed by the company with specific purposes and without the need to write code. Wix employs over 5,900 employees worldwide and has offices in 12 countries.

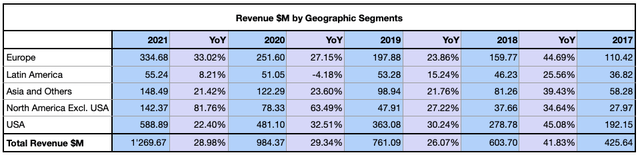

The most important geographical areas in terms of revenue are the US and Europe, followed by Asia and the strong growth market in North America excluding the USA. In 2021, about 68% of the revenue was denominated in USD and 32% in other currencies, primarily in Euros, British Pounds, Japanese Yen, Mexican Pesos, Russian Ruble, and Brazilian Real. While the cost of revenue and operating expenses in the same year were denominated by approximately 69% in USD and 26% in New Israeli Shekels.

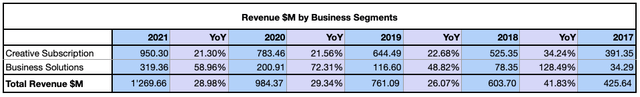

The company divides its business into two segments, Creative Subscription and Business Solutions. The first segment consists of mostly premium paid subscriptions while the second is made of Ascend by Wix, a complete marketing and customer management suite, other services, and the commission that comes from the use of third-party apps on its Wix App Market.

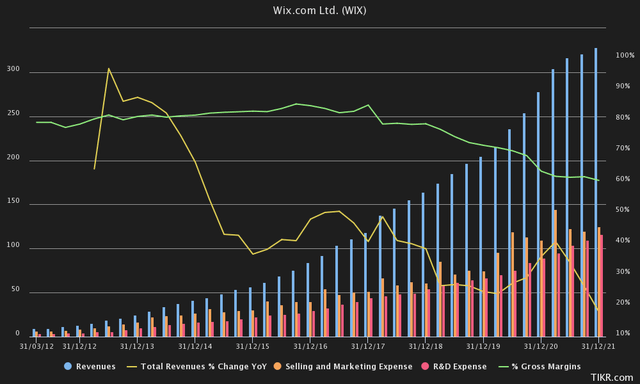

Although Wix reported sustained revenue growth of 55.54% Compound Annual Growth Rate (CAGR) during the past 11 years, the revenue growth is consistently decreasing, and reached 29% for the year 2021, which is relatively low if compared to competitors in the same year: HubSpot, Inc. (HUBS) with 47.3%, Shopify Inc. (SHOP) with 57.4%, BigCommerce Holdings, Inc. (BIGC) with 44.90%, and just a little higher than the smaller competitor Squarespace, Inc. (SQSP) with 26.2% revenue growth in 2021. The Selling & Marketing expenses in this industry are relatively high with over 40% recorded in 2021 by Wix, and an average of 45% among the mentioned competitors. Research and Development (R&D) expenses stood at 33.47% at the end of 2021, slightly over the peer’s average of 29.26%, while General and Administrative expenses grew to 13.40%, an increase of around 2% in comparison to 2020. The company’s gross margin growth rate decelerated from 26.12% CAGR over the last 5 years to 17.89% in the past 3 years, with a gross margin of 61.50% in 2021.

On its balance sheet, Wix significantly increased its debt exposure in July 2018 and further in August 2020, with $1,033.94M in total debt at the end of 2021, while its total cash and short-term investments reportedly reached $1,319.56M. At the end of 2021, the company’s total debt on equity ratio reached 7.10, which is significantly high if compared to some of its peers, with HubSpot’s ratio standing at 2.85, Shopify with 0.11, or BigCommerce with 2.52. Cash from operations was significantly lower than in 2020, mostly impacted by a remeasurement gain on marketable equity, changes in operating lease liabilities, and an increase in prepaid expenses.

What’s Coming Next

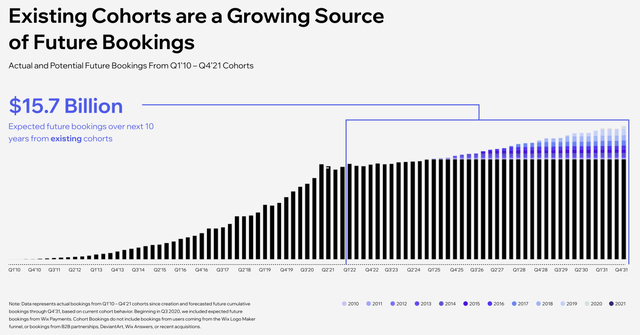

The company recorded an increase in bookings of 70% over the past two years and 29% in 2021. At the end of 2021, Wix reported expected future bookings of $15.7B over the next 10 years, a number that is constantly increasing over the past years.

Wix has been capable of steadily attracting both registered and paid users, by adding 31 million users only in 2020. Creative subscriptions Annualized Recurring Revenue (AAR) expanded by 43% over the past two years, and by 15% in 2021 sustained by both new subscriptions and higher-priced subscription packages. Although, for every 100 registered users, only about 3 are premium subscribers and Wix success relies on the monetization of this cohort. The current total addressable market considered by Wix is estimated to stand at $185B, divided into $98B for online presence and business operations software, and $87B for payments. Business owners are becoming more aware of solutions that offer partnerships to cover a significant portion of the needed processes in their company or businesses, and in my opinion, it’s here where Wix could significantly improve its offer and attract more paid subscribers. Shopify for example partnered, among other companies, with Meta Platforms, Inc. (FB) and Alphabet Inc. (GOOG) to expand its e-commerce functionalities and reach billions of daily users who log on to Facebook or shop across Google. Etsy (ETSY), eBay (EBAY), and Amazon (AMZN) are helping attract millions of daily users on their platforms, where the sellers take advantage of this funneling. Wix could consider helping more of its subscribers and offer advanced partnerships with online platforms and social media, by offering not only tools to build and manage websites but help small- and medium enterprises to build their audience, increase traffic on their websites, or address problems that need operational tools to be solved. This could, in my opinion, lead to increased paid subscribers and substantially sustain Wix’s brand awareness and the customers’ loyalty towards its services. A step in this direction was recently made with the announced partnership with DoorDash (DASH), for on-demand restaurant deliveries with customers using Wix Restaurants.

Valuation

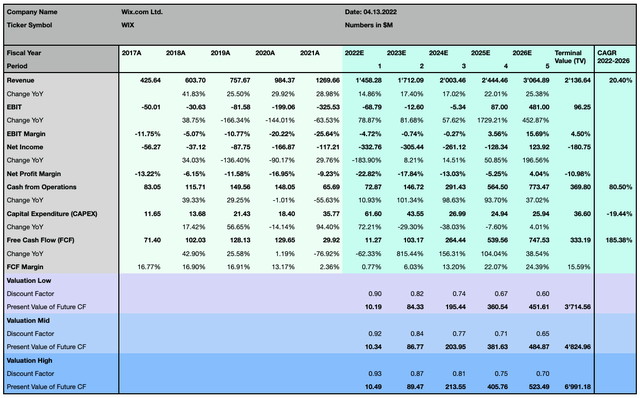

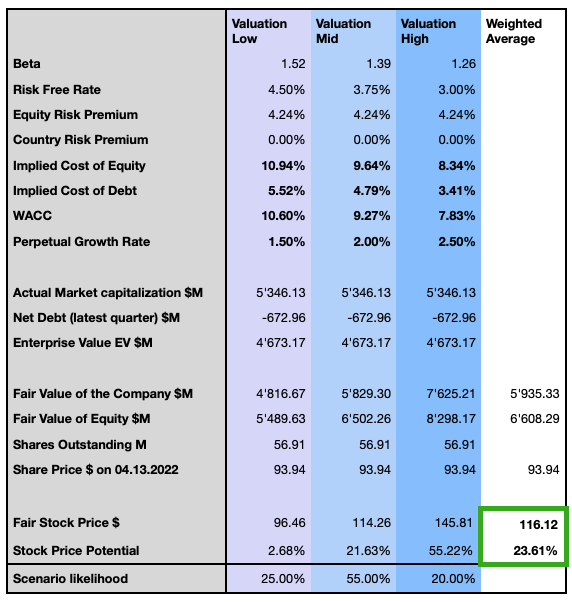

To determine the actual fair value for Wix’s share price, I rely on the following Discounted Cash Flow (DCF) model, which extends over 5 years based on 3 different sets of assumptions ranging from a more conservative to a more optimistic view, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. Wix never reached profitability until now, but the company is expected to break even only in 2026 with expected revenue growth of 20.40% CAGR over the next 5 years. I consider a similar cautious forecast in my valuation model, especially concerning the perpetual growth rate, which ultimately has a significant impact on the DCF valuation model.

Author, using data from S&P Capital IQ

The valuation takes into account higher interest rates, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital, by particularly affecting growth stocks like Wix and other companies in the technology sector.

Author

The low-valuation scenario based on the assumptions of the DCF model, prices the shares almost at its actual level, with a minimal upside potential of 2.68% and a share price of $96.46. The mid-valuation model sees the share at $114.26 or 21.63% higher than the actual price level, and the most optimistic scenario, despite being the least likely in my modelization, prices the stock at $145.81 with 55.22% upside potential. I then express my opinion in terms of likelihood for the different scenarios, which gives a weighted average price target with 23.61% upside potential at $116.12.

Risk Discussion

A major risk for the company includes higher pressure on its margins as a consequence of tougher global competition in the e-commerce industry from peers with similar solutions, such as Shopify, WordPress, BigCommerce, Squarespace, or platforms like Etsy, eBay, and to some extent also Amazon. Risks related to the recent conflict in Eastern Europe are also considerably high, since Ukraine is known to be a particularly attractive location for Israeli technology companies, and Wix is reportedly among those with a higher exposure with 871 contractors and 11 employees, with 56% of them in engineering roles focused on R&D and 44% in customer care roles. The company indicates that some of those people could relocate within Ukraine or to other countries, but many are unable to perform their work duties as expected. As of December 31, 2021, Wix carries $1.03B of debt, with $937.70M under the form of convertible senior notes; $362.70M is due in 2023, while $575M is due in 2025. This is a significant risk factor for a company that is still not profitable and will most probably have to refinance its debt under less favorable conditions in the coming years. I also want to mention the possibility of stricter policies or legal frameworks in terms of data protection and data sharing, in particular among social networks and search engines, a very important marketing and communication vector for Wix. This could negatively affect the return on advertising expenses and ultimately the sales of the company.

Market Timing

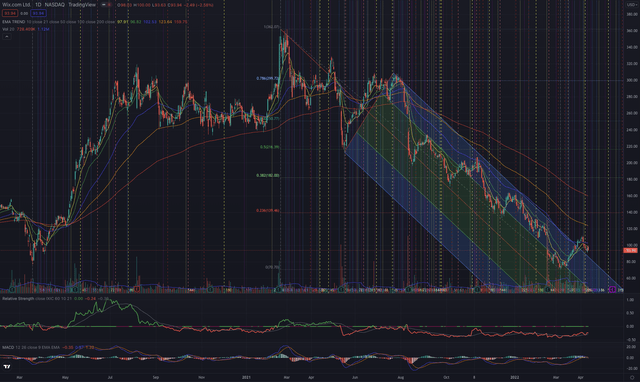

From a technical analysis point of view, the stock has been in a long-term downtrend since August 2021, underperforming the NASDAQ Composite since May 2021, and has lost about 80% since its All-Time High (ATH) at $362.07 on February 19, 2021. The stock is now trading at the levels at which it was priced in January 2019, before the Covid-19 pandemic hit the world’s economies.

The most relevant support level in the short term can be found at $70.70, while the closest resistance levels are now around $103, $111, $123, and $139. The stock broke out of the recent low and crossed the EMA50 but soon returned its recent gains and looks now inclined to pursue its negative trend. My considerations are that this stock will now need some time to establish a sound base, digest the long-lasting sell-off, and eventually then try a reversal of the trend if some positive catalyst can attract investors. Long-term investors could take advantage of this relatively low price level to set up their long-term position, by keeping in mind that the upside potential of the stock is limited, when considering my valuation model, and by considering the general market situation which is now quite volatile and uncertain. Momentum and position traders could instead observe the stock closely before identifying an appropriate entry point since the recent price-action is still not suggesting the completion of a sound base and a possible trend reversal. The stock price could also be supported by the recently announced security buyback plan of over $500M.

The Bottom Line

The company has a significant potential to attract new users and turn more registered users into premium users, by offering more attractive solutions with expanded tools and selected partnerships. The slowdown in growth, increasingly high marketing, and R&D expenses, as well as rising competitive pressure, are instead sources of worry. The stock lost 80% in 12 months, largely underperforming its reference index, and is now priced at pre-pandemic levels. I estimate a moderate upside potential of 23.61% based on my valuation model, but would still be cautious in setting up a significant position in the stock since the downside risk is still relatively high.

Be the first to comment