Anna Koberska/iStock via Getty Images

With the invasion of Ukraine and the recent increase in defense Intelligence, BlackSky Technology Inc. (NYSE:BKSY) may see a significant growth in its revenue. BKSY also shows ties with large conglomerates in the defense industry. The company also appears to be targeting a massive target market, in which the management expects to enjoy large gross profit margins and future FCF. With all this information in mind and conservative assumptions, I obtained a valuation that is significantly higher than the current stock price.

BlackSky

BlackSky, a geospatial intelligence provider, monitors activities, and facilities worldwide by using world’s sensor networks and offering its own satellite constellation.

In my view, with the war in Ukraine and the recent increase in military budgets, BlackSky’s stock may receive more demand in the coming years. The company’s technology could be valuable in situations of conflict. BlackSky explains its sophisticated intelligence tools with the following words:

BlackSky processes millions of data elements daily from its constellation as well as a variety of space, IoT, and terrestrial-based sensors and data feeds. BlackSky’s on-demand constellation of satellites can image a location multiple times throughout the day. Source: 10-K

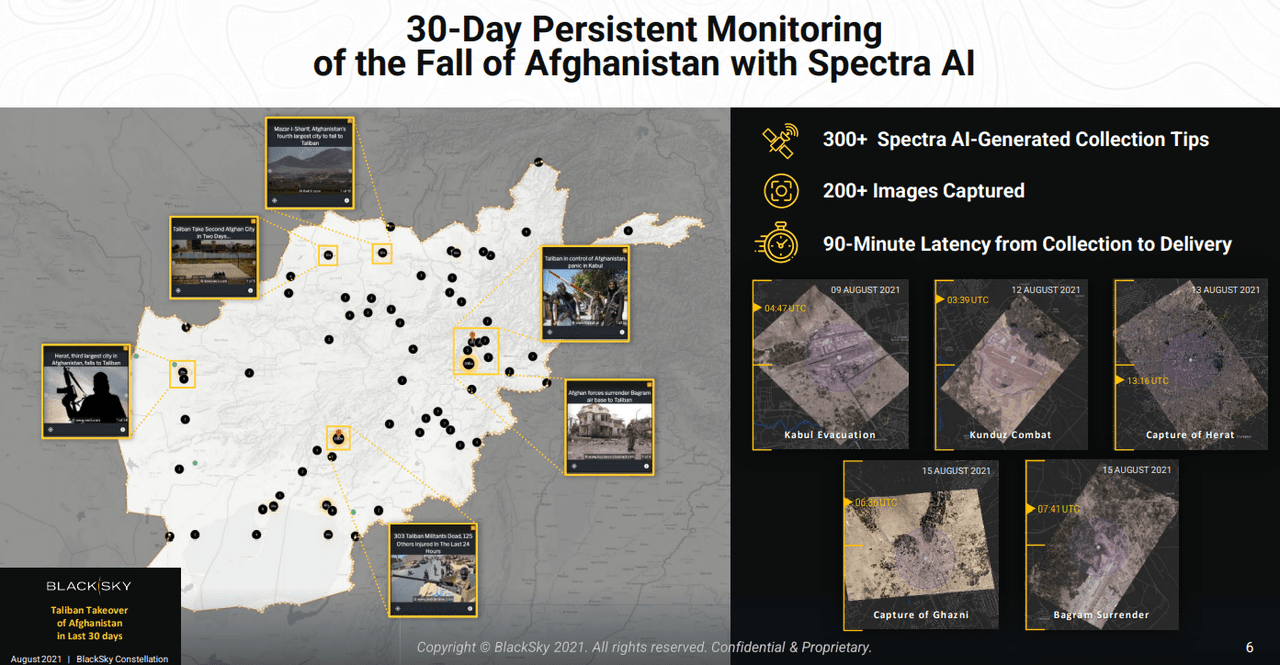

In line with the previous line of thought, let’s note that BlackSky Technology was very useful in Afghanistan by offering monitoring over the fall of Afghanistan very recently. I wonder if the company is present right now in Ukraine:

Presentation

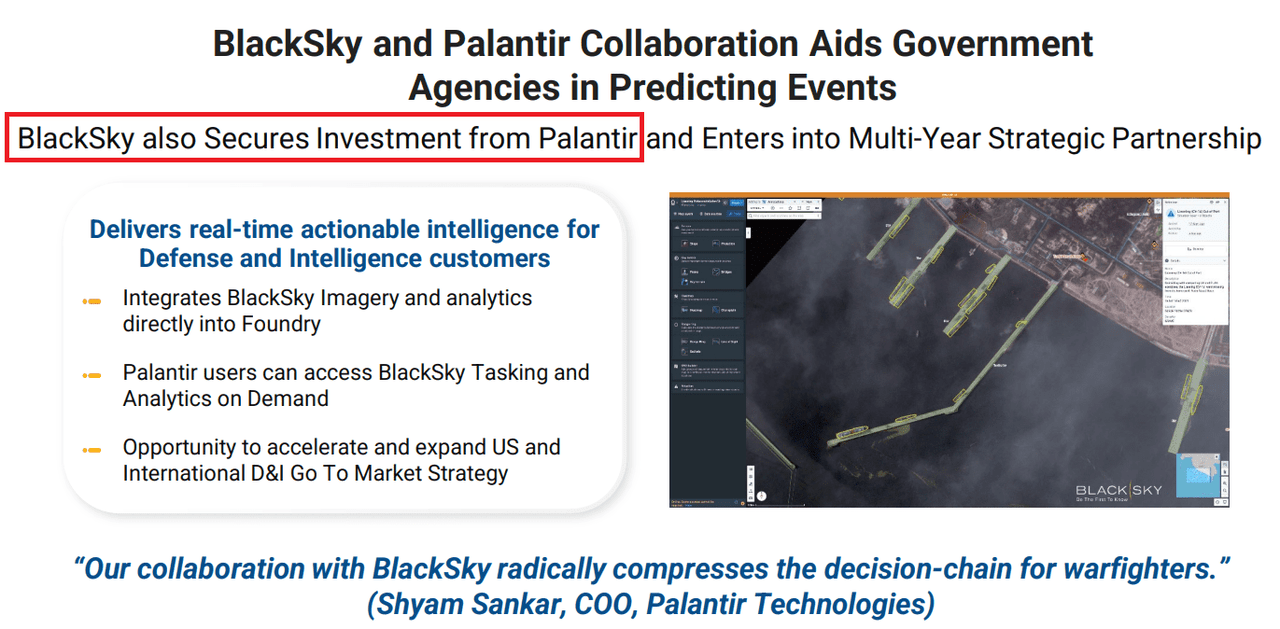

It is quite relevant noting that BlackSky Technology Inc. does not seem to be alone. Palantir (PLTR), a well-known business in Wall Street, signed a partnership with the company. PLTR appears to be offering BlackSky’s tools to its clients. The collaboration with PLTR is very relevant because other large corporations may be willing to work with BlackSky once they learn about PLTR’s ties:

Presentation

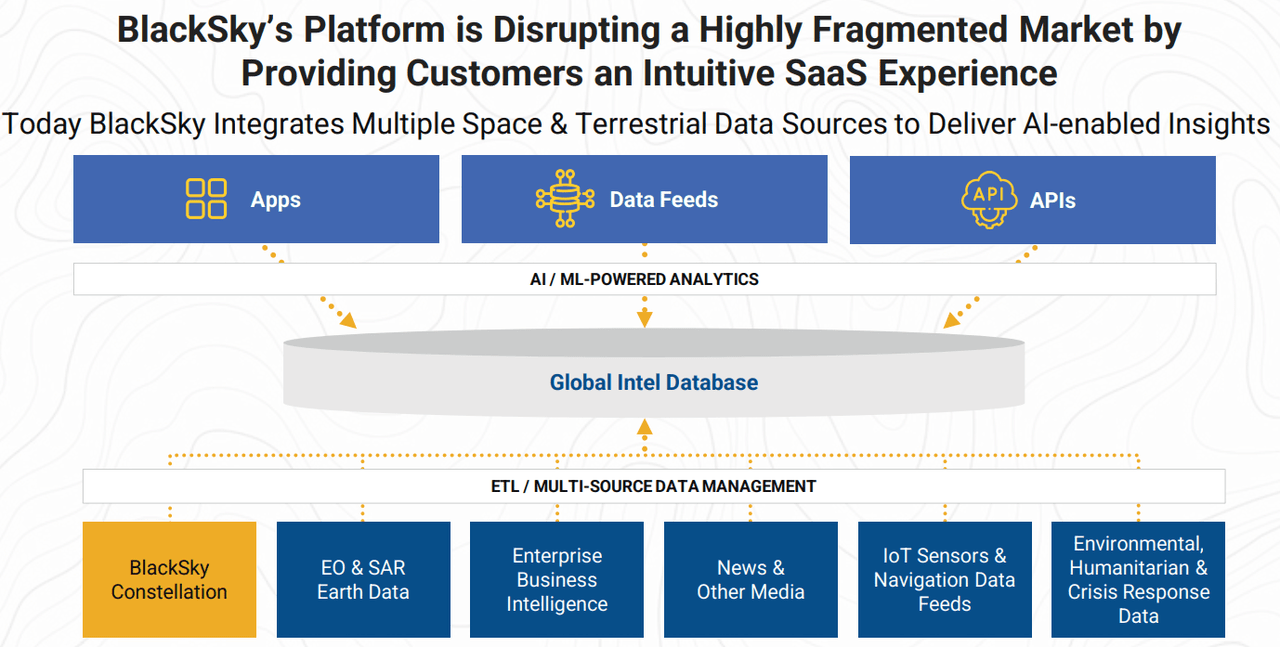

With that, let’s understand the market potential of BlackSky Technology Inc. The company appears to be integrating a fragmented market of sources including apps, data feeds, and APIs to deliver AI-enabled insights:

Presentation

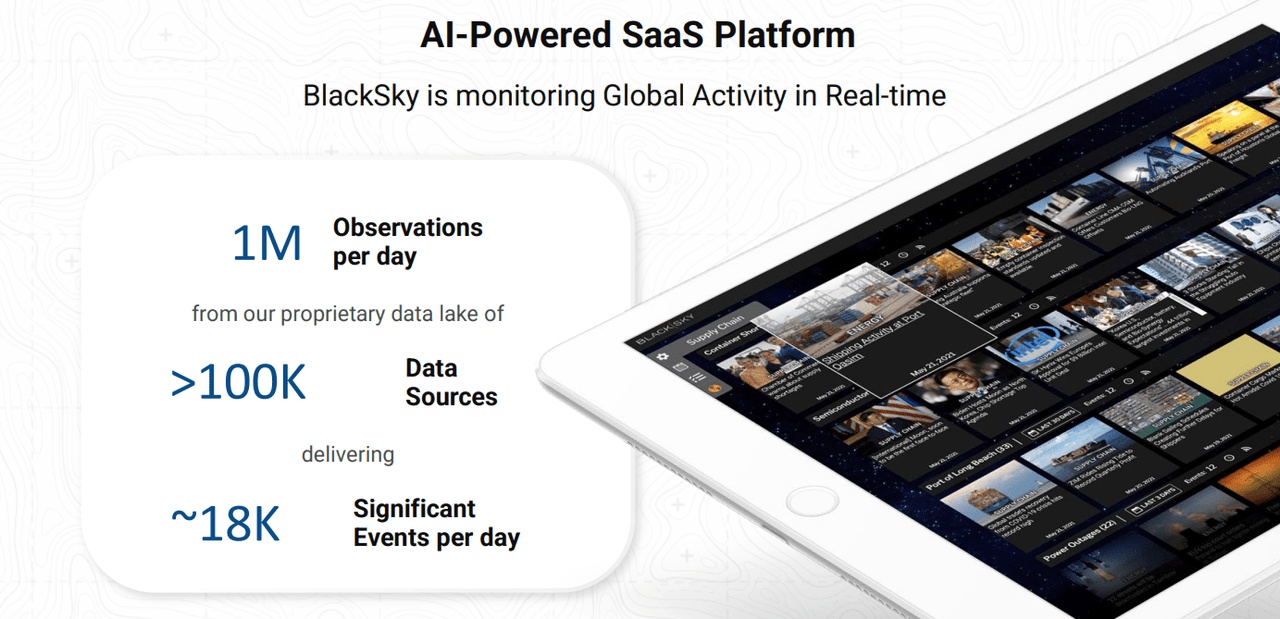

Resultantly, users are observing more than 18k events per day from more than 100k data sources. I couldn’t find a lot of information about the price of BlackSky’s tools, but let’s say that only governments and large corporations will likely be able to afford it:

Presentation

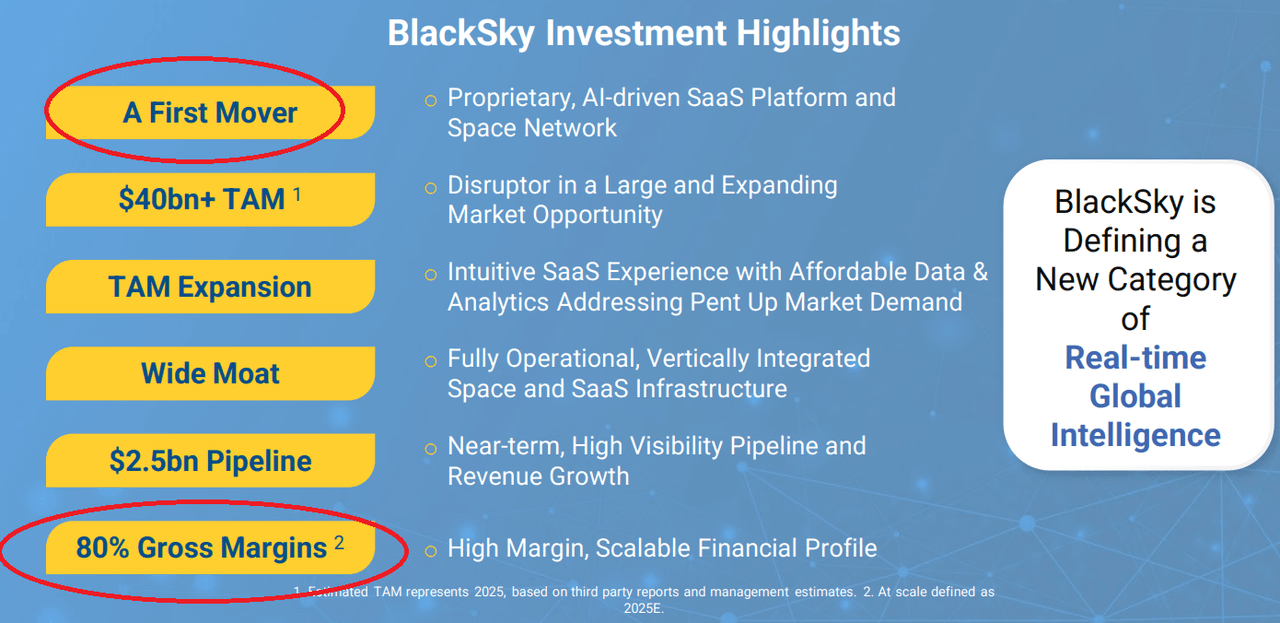

Finally, I want to mention what the management expects for the future. The company does not only expect a massive 80% gross margin, but also a target market of more than $40 billion, and a near term visibility of $2.5 billion in the pipeline:

Presentation

If Commercial Clients Learn Sufficiently About BlackSky’s Tools, I Would Expect A Valuation Of $5.8

Under this case scenario, I expect that BlackSky Technology Inc. will continue to launch new satellites to offer services to commercial clients. In this regard, let’s note that the company expects to offer four new satellites by the end of 2022. In my view, more satellites mean more clients and more future sales growth:

Our current constellation consists of twelve LEO smallsats in commercial operations. We expect to add up to four additional satellites to our commercial operations by the end of 2022. Source: 10-k

I would also expect management to increase and scale operations with commercial customers. Notice that the list of industries which may be interested in the company’s services appears quite extensive. As a result, the target market could grow as customers learn about BlackSky’s tools:

Commercial customers represent a small but important portion of our business to date. We intend to expand and scale our sales to commercial customers by targeting a wide range of end markets in which we anticipate rapidly growing demand for geospatial intelligence, including energy and utilities, insurance, mining, manufacturing, agriculture, environmental, engineering and construction, commodities, and supply chain management. Source: 10-k

The global artificial intelligence market is expected to grow at a CAGR of 40.2%, and the global geospatial imagery analytics market may grow at a CAGR of 28%. With these figures, I believe that BlackSky’s sales growth will likely not be far from 40%-28%:

The global artificial intelligence market size was valued at USD 62.35 billion in 2020 and is expected to expand at a compound annual growth rate of 40.2% from 2021 to 2028. Source: Artificial Intelligence Market Size Analysis Report, 2021-2028

As per the report published by The Brainy Insights, the global geospatial imagery analytics market is expected to grow from USD 5.85 Billion in 2020 to USD 69.06 Billion by 2030, at a CAGR of 28% during the forecast period 2021-2030. Source: Geospatial Imagery Analytics Market Size

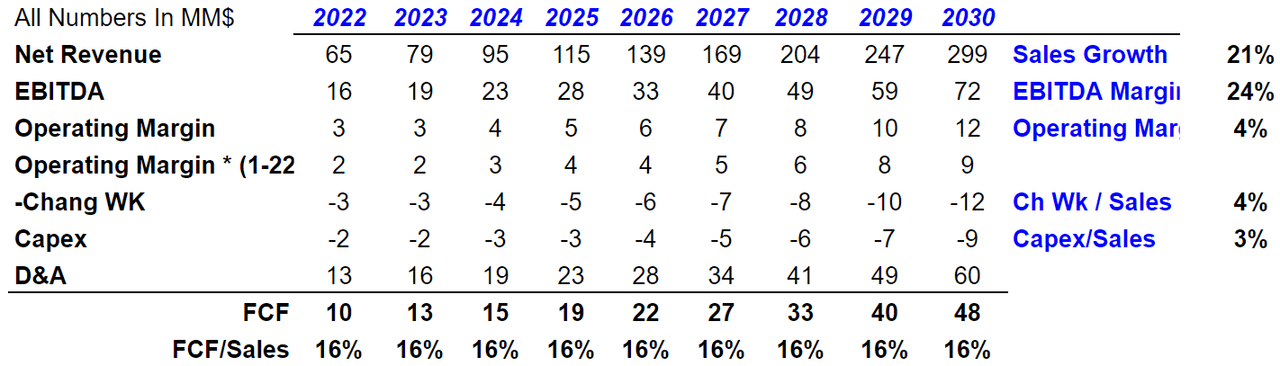

In my predictions, I tried to be as conservative as possible. I assumed sales growth of 21%, EBITDA margin of 24%, and operating margin of 4%. I also believe that the capital expenditures would grow from $13 million in 2022 to more than $60 million in 2030. Therefore, the free cash flow will likely grow from $10 million in 2022 to more than 48 million in 2030. Note that for the next eight years, I am expecting a stable FCF/Sales close to 16%.

YC

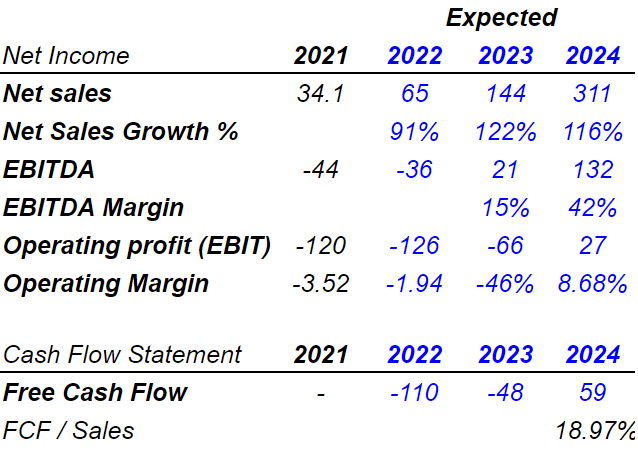

I would like to note that my figures are not at all far from the expectations of other analysts. My predictions are even more conservative. Analysts out there believe that net sales growth for 2024 could be close to 116%, and they expect an EBITDA margin of 42%. Finally, their FCF/Sales in 2024 will likely be equal to 18%:

YC

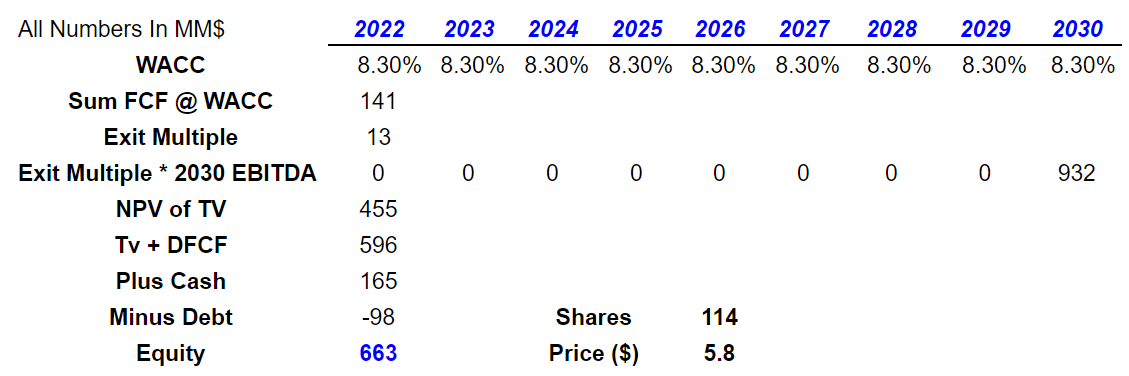

With a weighted average cost of capital of 8.3% and an exit multiple of 13x, close to the median in the industry, the terminal value would be equal to $455. Also, summing future FCF of $141 million, the total enterprise value should be $596 million. Finally, the stock price should be equal to $5.8:

YC

The Worst-Case Scenario For BlackSky Technology

BlackSky Technology is a contractor for several agencies of the United States government. The company is therefore subject to strict regulations about organizational conflicts of interest, bids, and other related laws. Any investigation about the practices of BlackSky Technology could damage the company’s reputation, and send the stock price down:

Our role as a contractor to agencies and departments of the U.S. government results in our being routinely subject to investigations and reviews relating to compliance with various laws and regulations, including those associated with organizational conflicts of interest, procurement integrity, bid integrity and claim presentation, among others. These investigations may be conducted without our knowledge. Adverse findings in these investigations or reviews can lead to criminal, civil or administrative proceedings, and we could face civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines and suspension or debarment from doing business with U.S. government agencies. Source: 10-K

Changes in the data regulation with respect to whether the company can obtain images could affect future free cash flow. Management mentioned this risk in the annual report:

Current U.S. government policy encourages the U.S. government’s use of commercial data and space infrastructure providers to support U.S. national security objectives. We are considered by the U.S. government to be a commercial data provider. U.S. government policy is subject to change and any change in policy away from supporting the use of commercial data and space infrastructure providers to meet U.S. government imagery and space infrastructure needs, or any material delay or cancellation of planned U.S. government programs, could materially adversely affect our revenue and our ability to achieve our growth objectives. Source: 10-k

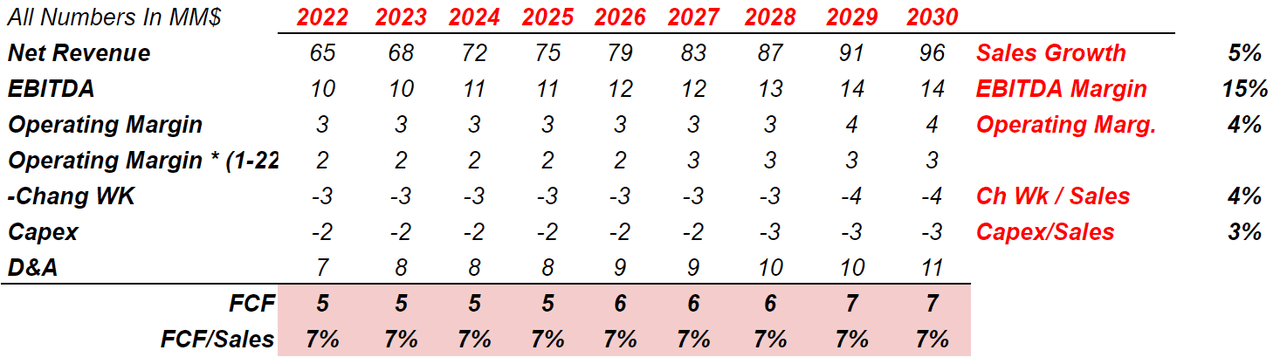

Under this scenario, I assumed sales growth of 5%, an EBITDA margin of 15%, and a capex/sales ratio close to 3%. The results include 2030 net sales close to $95 million, and 2030 EBITDA around $15 million. I also obtained 2030 NOPAT of $3 million, and 2030 FCF of $7 million. Note that my free cash flow margin is significantly lower than that in the previous case scenario, and is equal to 7%:

YC

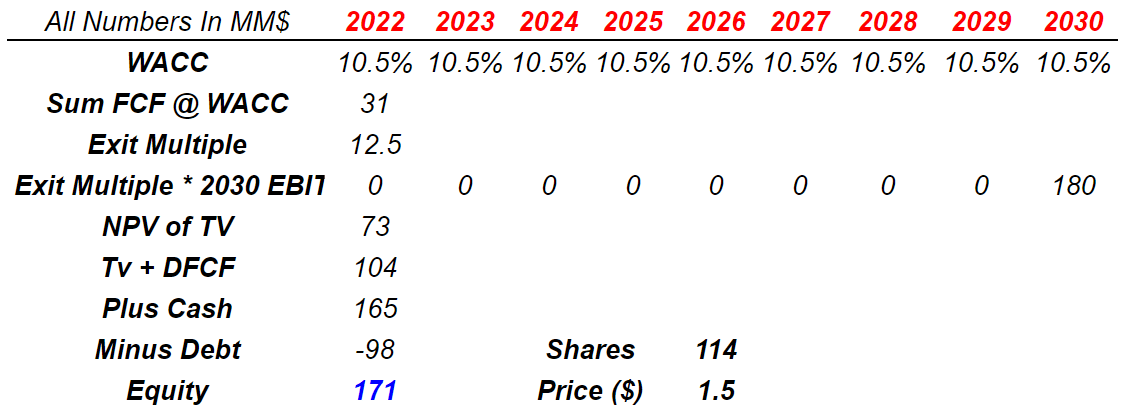

For the DCF model, I used a weighted average cost of capital of 10.5%, which implied a sum of FCF of $31 million. I also assumed an exit multiple of 12.5x, which resulted in a net present value of the terminal value of $73 million. The implied stock price is equal to $1.5, which is not far from the current stock price:

YC

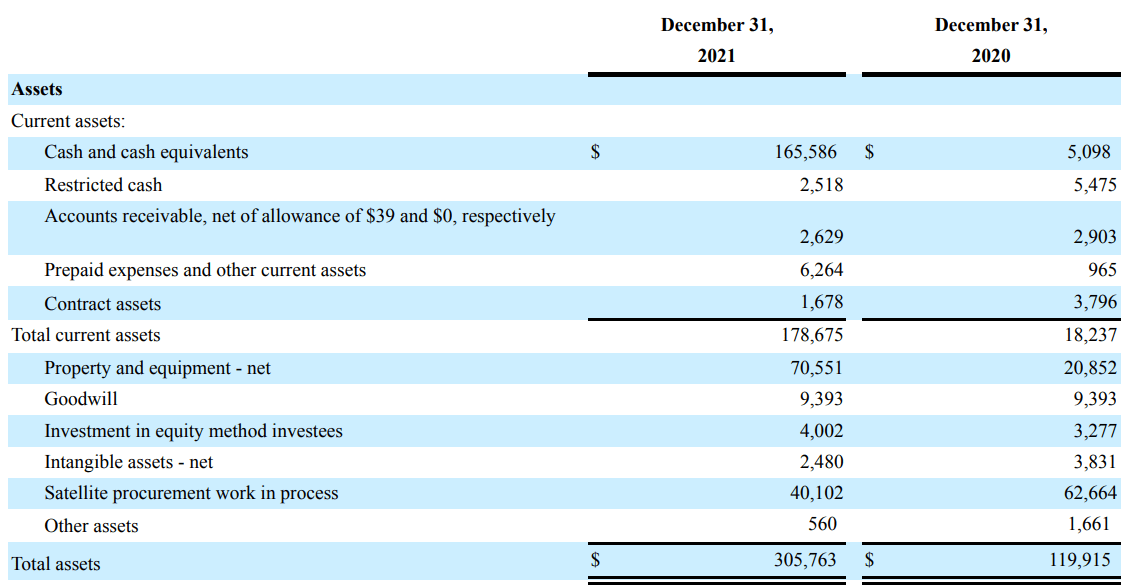

BlackSky’s Balance Sheet Includes Tons Of Cash To Hire More Personnel And Develop More Projects

With cash of $165 million and an asset/liability ratio of more than 2x, in my view, management has sufficient cash to hire many more employees to sustain sales growth. I also believe that bankers will likely help the company finance future satellite procurements:

10-k

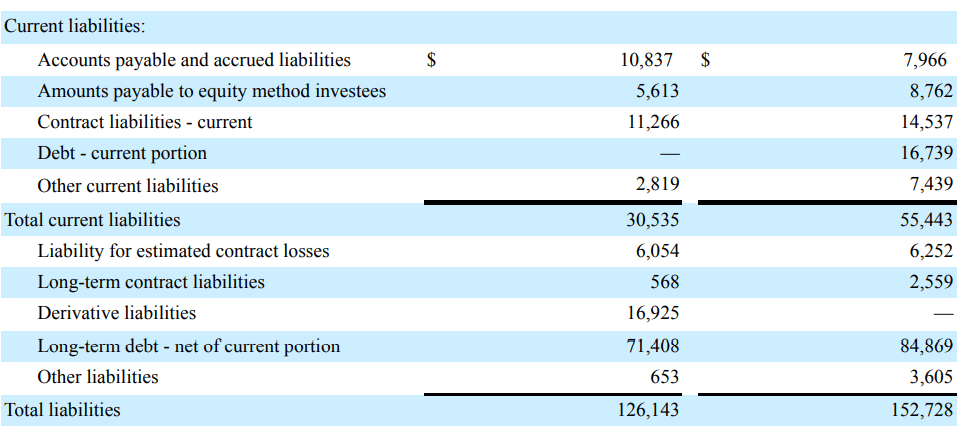

The company’s debt does not seem significant. Long-term debt is equal to $71 million, with derivative liabilities worth $16 million and contract liabilities of $11 million. In my opinion, most financial advisors will not be worried about the total amount of debt. Keep in mind that analysts are expecting significant free cash flow in the coming years, which will likely help management reduce its debt:

10-k

My Takeaway

BlackSky Technology Inc. will likely see revenue growth as more governments increase their defense budgets. If management also signs new agreements with large corporations like Palantir, both the demand for the stock and revenue growth will likely increase. Despite the regulatory risks, in my opinion, BKSY looks like a buy. My DCF models also show that the downside risks don’t seem that significant.

Be the first to comment