Dan Kitwood

Shares of American International Group, Inc. (NYSE:AIG) have fallen about 13% over the past year, not a stellar performance, but a bit better than the markets overall. It has been an eventful year for the company, which recently completed a long-awaited IPO of its life and insurance unit. That requires us to look at results from its remaining General Insurance unit to determine fair value for the stock. Ultimately, AIG looks to have material upside potential.

Earlier this month, AIG raised $1.68 billion from its IPO of Corebridge Financial (CRBG). The company still owns 78% of Corebridge. Considering it had sold a 10% stake in this business to Blackstone (BX) last year for $2.2 billion, this was not a great valuation and reflects the weaker market environment. Corebridge houses what used to be its life insurance business, and its spin represents the final step in AIG’s transition from a financial conglomerate ahead of the 2008 financial crisis to a pure-play property and casualty (P&C) insurance company.

The remainder of AIG’s stake in CRBG is worth about $10 billion. When the company reports Q3 results in November, I would expect management to offer more specifics on its plan to separate out Corebridge entirely. Ultimately, AIG can sell shares directly in the secondary market. It could declare a stock dividend to spin-off shares directly to shareholders like AT&T (T) did with Warner Bros. Discovery (WBD), or it could do a split-off by offering a share swap similar to 3M (MMM) when it split-off its food safety business. Either way, AIG will be solely a P&C insurance business at the end of this journey.

Today, AIG is worth $38 billion, so the remaining property & casualty business is being valued at about $26 billion, netting out its $1.7 billion in cash and $10 billion in stock in CRBG. Based on my analysis of the general insurance unit, this is a meaningful discount to its fair value.

In the company’s second quarter, AIG earned $1.19, which exceeded expectations by $0.06. Again, though, these results included AIG Life & Retirement, which had not yet been split off. For investors in AIG now, we need to focus on the remaining P&C or general insurance business. The news is good.

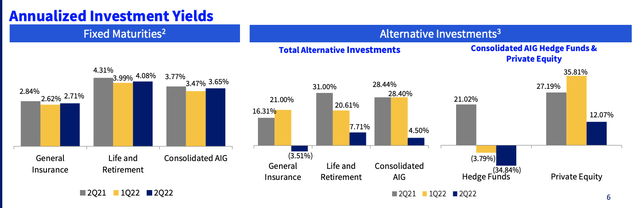

General insurance premiums were flat at $6.9 billion (up 5% on a constant currency basis). The unit generated pre-tax income of $1.3 billion with underwriting a $330 billion tailwind, offsetting declining investment income. Operating profits were up 5% from last year on the power of that underwriting improvement. Investments in alternatives (i.e., private equity) lost $43 million, a $259 million swing from last year. These returns tend to be correlated with the stock market. Just as last year’s strong numbers were too high to be sustained, this will not be a permanently loss-making allocation. Average earnings are likely in between the two.

Indeed over time, I expect the general insurance unit to generate higher investment returns. The majority of its assets are invested in fixed income assets (bonds). With the Federal Reserve raising interest rates, AIG should be able to redeploy cash and maturities into higher yields. This is especially true because the portfolio has an average duration of less than four years. This is not a portfolio of 30-year bonds that will take a long-time to roll over; it is a relatively short-dated portfolio, which means yields should become more responsive to changes in market levels. During Q2, its portfolio average yield rose 9bp, and with yields rising further, I expect to see ongoing increases in Q3 and Q4, which will boost earnings power. Additionally, 89% of the fixed income holdings are rated investment grade. This is a conservative portfolio that should not suffer material credit losses if a recession occurs.

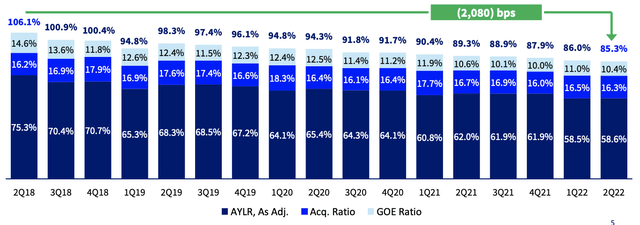

Beyond the better investment backdrop, I am extremely encouraged by the company’s improving underwriting. The combined ratio is down to 87.4, a 5-point improvement from a year ago. A level of 100 means an insurer’s underwriting losses and expenses equal its premiums earned, so at 87.4, AIG is making 12.60 for every $100 in premiums earned. As you can see below, AIG has now had four straight years of underwriting improvement, turning what had been a loss-making operation into a highly profitable one.

I believe in the wake of the financial crisis, having suffered such brand damage, AIG had to bid aggressively to win business, offering too much insurance at too little premium and suffering losses as a result. As that memory has faded, management has grown more disciplined, and the company has raised premium pricing, results have gotten better. AIG no longer aspires to be the biggest company, but rather a profitable one that earns an attractive return on capital, which is what shareholders want.

With these profits, AIG has been aggressively buying back stock. In Q2, AIG repurchased $1.7 million shares and has $5.8 billion of remaining capacity under its authorization. Over the past year, the share count has fallen by about 9.6% to 771 million. Management hopes to get this to 600-650 million, using proceeds from the Corebridge IPO alongside ongoing profits.

Based on my expectation that AIG’s general insurance operations can generate $1.3-1.35 billion in pre-tax profits each quarter, given higher interest rates and stable underwriting, alongside corporate costs of about $460 million, the company going forward has about $2.55-$2.75 billion in annual post-tax earnings power. With an implied value for its P&C business of $26 billion, AIG is trading at about 9.5x its go-forward earnings power. At 15x earnings, it would be a $67 stock representing about 34% upside.

Until AIG discloses how it will dispose of its stake in Corebridge, I expect shares will trade at a discount to its stand-alone value as that complicates the analysis of its stand-alone value, and there is risk CRBG shares fall and erode some of that $10 billion value, though it could nearly halve, and AIG would still be worth $60. At $50, the uncertainty is more than fully being priced in, and I would be a buyer here, expecting shares to move into the $60s over the next year.

Be the first to comment