CentralITAlliance/iStock via Getty Images

Wise Plc. (OTCPK:WPLCF) is going after the large opportunity of disrupting traditional banking. It started with international transfers, but is now going after core banking products.

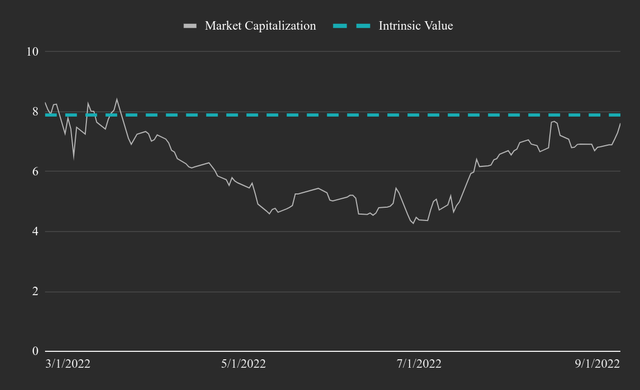

We rate the stock a high-risk buy, with an investment horizon of 10 years+, and an intrinsic value of $9.15 billion USD or $8.9 per share (7.8 GBP or 7.7 GBP per share). The 1-year price target is estimated at GBP 8.4 (or $9.7) with a 63% upside.

The most important risk with an investment in Wise is the possibility of growth deceleration as it is a top-line focused business that needs to deliver network effects. The value from the business is primarily expected to come from additional services it will incorporate alongside its money transfer service.

The company has some 13+ million customers (around 5 million active) and has adopted a profitable model, with an emphasis on cutting costs for customers that seek to transfer funds and hold an international low–cost account. Active customer growth is developing at a 29% and 36% rate for personal and business accounts, respectively.

What Does Wise Sell

The company claims (02:40) to have “rebuilt the way money moves in the world”, which showcases their ambition to move beyond transfers and become an international online financial services company. Wise currently has 3 key products: Wise Account, Wise Business and Wise Platform.

Users with a personal account can transfer money, receive income, hold deposits and spend with a debit card. New features include UK investing, scheduled payments, and auto-convert. Wise has a transfer service that allows users to send and receive money internationally at a low 0.72% take-rate, which is part of their competitive strategy. Wise also offers a multi–currency account, which allows users to hold and exchange multiple currencies. The personal accounts currently have a 29% YoY growth, but may experience a deceleration as the economic climate slows down.

The next key product are business accounts and services. The deposits that businesses are holding with Wise have increased 240% from 2bn GBP in FY2020 to 6.8bn GBP in FY2022.

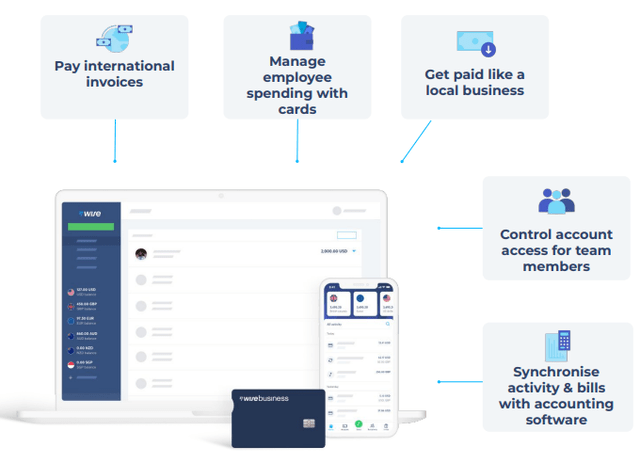

The company sees large opportunity in its business accounts, as it has started offering services closely resembling those of PayPal (NASDAQ:PYPL) and Stripe. The business service allows companies to open a banking alternative account with a sort code, IBAN and debit card. It can be used in invoicing, payrolls and other transactions.

Image 1. Wise’s Business Account Offering Deck (Investor Presentation)

The fast execution and low costs of the account are becoming an attractive alternative for businesses, and Wise has grown active business customers by 36% YoY to 270 thousand, while transaction volume has expanded 54% YoY to GBP 5.5 billion.

The company is intent on expanding its product offering to an asset platform, where it will allow international users to hold equities and other assets on their Wise account. It is currently available in the UK, with expansion plans to Europe. Note, management indicates that this will take some time to realize.

The key takeaway here is that Wise is slowly becoming an online international bank with high cost-effective financial services for individuals and businesses. While the company is not including this in their messaging, it seems that they are taking on much more than fund transfer companies.

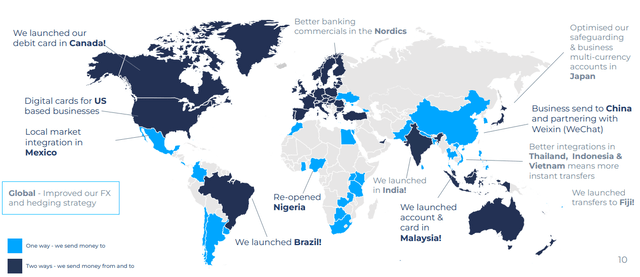

Image 2. Map of Wise’s Latest Developments (Investor Presentation)

Building The SWIFT Add-on

The latest development from Wise is an expansion whereby they have built a new SWIFT Receive feature for Wise Platform partners. This allows financial institutions not connected to the SWIFT network to now receive payments from all over the world via SWIFT using their existing customer account details. The feature also enables financial institutions with an existing SWIFT setup to process these incoming SWIFT more efficiently.

A Wise Approach

It is important to recognize that the product strategy for Wise may not follow the traditional path of capturing market share and then vertically increasing monetization, rather, the team seems to be focused on building the most cost-effective product, and supplementing it with higher margin add-on services.

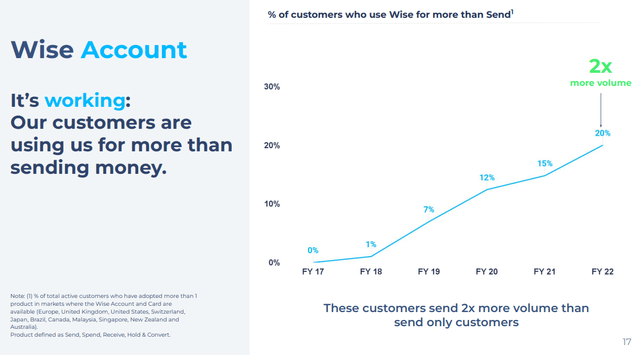

The company highlights the increased use of their services as evidence of the success of their approach.

Image 3. % of Customers That are Using Additional Wise Services (Investor Presentation)

This would allow Wise to compete with larger companies on a price basis, and gain profitability from the additional services available on their platform.

A risk with this approach is that the company must be strong on multiple products, and competitors may eat away on their secondary services. Given the fact that Wise is not rushing its product development, the company may be able to pull-off a competitive edge on more than one service – this also implies that investors will have to wait longer before they see growing margins, which hides the potential of the company and may not be a bad proposition for retail investors.

Note: VC and private equity investors normally seek a profitable exit in the short term, but retail can afford to wait out a longer build-up, which ultimately selects for a truly valuable and disruptive business. Something which Valar Ventures (9.5% stake) may be also supporting.

Reinvesting Into the Business

As a company, Wise focuses on disciplined spending, market share expansion, product development, and heavy price competition in order to lower the cost for customers. They are positioned in an industry with high barriers to entry, tight competition, and rapidly evolving technology. However, they are one of the cheaper platforms for transferring funds, which are also targeting debit cards and business payment processing services.

With a net income of GBP 42 million (5.8% margin) in the last 12 months, the company is operating profitably and uses the free cash flows to reinvest into the products, which is intended to feed into customer adaptation.

Customer Satisfaction Needs Work

Customers have decreased the average rating of the Wise app in the Play Store from 4.3 in February 2022 to 4.2 in September. While a rounded number, the Play Store shows 10 million+ installs, which is roughly the same number in the period February-September. Their score on Trustpilot also decreased from 4.6 in February to 4.5 in September.

Finally, Wise points out that their Net promotor score is above 70%, with 2/3rd of the new customers coming from referrals. The net promotor score is based on an internal survey asking customers to what extent they are willing to recommend a service. As the survey is fairly easy to manipulate by any company, e.g. curating the sample, we cannot rely on NPS as a metric.

Looking at the customer experience, it is reasonable to assume that the company needs to put in more effort to streamline their products for users. The ratings are still among the best in the class, but the platform needs to be pristine in order to create value.

Fundamentals & Value

In the last 12 months, the company had revenues of GBP 622.3 million, which grew 11.1% from GBP 559.9 QoQ, while YoY growth was 35.7% from 458.2m in the TTM ending Q1 2022.

Operating income was GBP 86.8m, up 5.6% from GBP 82.2m, representing an 11.8% margin. This gives us the basis for our intrinsic valuation.

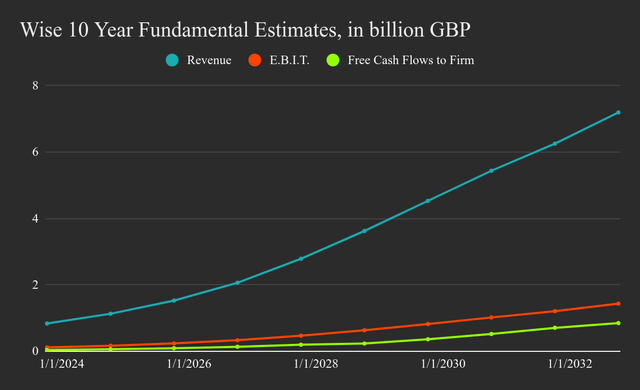

By estimating that the company continues to display strong top line growth, and a converging EBIT margin, we get the following model for Wise:

Image 4. Wise Future Estimates Valuation Model (Author Image Created With Data from Seeking Alpha)

Analysts covering Wise are projecting annual revenue growth rates of around 35% next year, and a dampening of around 25% for the next few years. We are more bullish in our estimates, and forecast a 35% growth rate in the next 5 years, with a slight decline afterwards.

This is accounted for by the 2 key product categories of services:

- The transfer service which is on par, if not better than Western Union (NYSE:WU).

- The emerging online banking service, which is the real disruptive catalyst for the company.

We have also extended the high growth period, from the standard 5 years to 7 years in our model (est. growth >25% in year 6 and 7), as we believe that the company will start seeing additional growth as network effects materialize.

In our view, investors are pricing the stock as a money transfer app, while it is more akin to what Airbnb (NASDAQ:ABNB) did to traditional hotels – offering a quality low-cost service that allowed them to acquire massive market share.

We view that the true competition for Wise are traditional banking services, which have become rigid and ineffective. While banks may modernize and offer faster and convenient services, it seems that Wise is laying the foundation for consumer trust and wide network effects while pretending to be just a money transfer app. We believe that the company will increase in intrinsic value as it takes on additional online banking services, and also increase the price per share as it starts providing investor returns at the late stages of (or after) the 10-year forecast period.

The other side of the company is profitability, while we trust (as posited by management) that Wise will eventually reach an EBIT margin of 20%, investors should be more focused on the top line, and trust the company to reinvest as much as possible into infrastructure and growth.

In conclusion, we estimate an intrinsic value of GBP 7.9 billion or GBP 7.7 per share. We set a 1-year price target at GBP 8.4 per share, representing a 63% upside from Friday’s close. Converted to USD, the intrinsic value adds up to $9.15b or $8.9 per share, with a price target at $9.7.

Image 5. Wise’s Estimated Intrinsic Value vs Market Cap (Author Image Created With Data from Seeking Alpha)

You can copy the full excel model here, or open the view-only version here.

Risks and Possible Investment Approach

We have seen a decrease in customer satisfaction on public rating sites. If the company rushes its products, then network effects will be harder to produce. The presented valuation model is very bullish, and should a deceleration of growth occur, the company can immediately drop in value. In this event, investors will need to ask themselves if a drop is a temporary reflection of macro variables or a permanent decrease of the viability of their business model.

The other notable risk is competition, however, Wise seems to have set-up an agile process that is hard to incorporate in mature companies, especially banks. The bigger risk factor are small tech startups that may make use of future technological improvements which decrease the cost of building fintech infrastructure. Large cloud providers are also increasing their tech offerings, which are intended to make the building of this infrastructure cheaper and easier.

This stock is likely the most suitable for a long investment strategy, where investors will need to be aware that the stock is estimated to be highly volatile, before starting to reap the investment returns. Given the young stage of the company in its lifecycle, this seems to be a 10 year+ investment, with possible position increases when the price drops below value. Based on the company’s Black-Scholes model (p. 151), the expected annual volatility of the stock is 48% which gives investors a frame of reference for discriminating between signal and noise in price movements.

Be the first to comment