If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes. – Warren Buffett

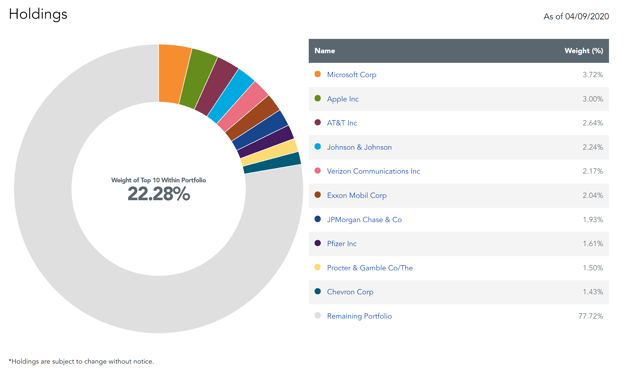

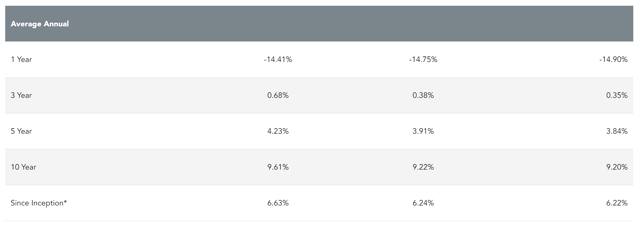

I’ve been addressing great longer-term yield opportunity for longer risk-on/risk-off signals I outlined in The Lead-Lag Report lately, and the WisdomTree Total Dividend ETF (DTD) is looking like a bargain at these levels. While DTD is down 18% YTD, I think recent performance is providing a buying opportunity for the astute investor. When you look at the underlying holdings, this is a well-diversified portfolio with mature companies and a dividend yield that is attractive. A look at the sector breakdown, this holding has 16.9% in the information technology sector, 14.3% in financials, 13.5% in health care, 12.4% in consumer staples, and 7.8% in real estate as the top 5 sectors, which makes up almost 65% of the fund. For me, that means that while DTD is looking for dividend payers, it has plenty of upside as well with a 10-year annualized return of 9.22% to March 31, 2020. A look at the top holdings is easy to see why, as it is led by Microsoft (MSFT), Apple (AAPL), AT&T (T), Johnson & Johnson (JNJ), and Verizon (VZ), all companies you want to own long term despite a currently choppy environment.

Source: WisdomTree

In understanding that the coronavirus recession will likely be a sharp pullback, DTD is the type of ETF you want to own coming out of it. The reason is simple, you want the companies that can pay a dividend yield that are leaders in their space and that can take advantage of a pullback and come out stronger on the other side. Do we think that the likes of Microsoft and Apple will cease to exist a year down the road? Or do we think they are going to take advantage of the weaknesses in their sector and maybe put some of their cash piles to work.

Apple had over $200 billion in cash going into this recession – not a bad place to be when company valuations are tanking globally. Why wouldn’t you want to own a piece of these companies and better to do it in a diversified way with the likes of DTD? The dividend yield is a place where you want to concentrate your investments in a recessionary environment because, as the saying goes, a bird in the hand is worth two in the bush. i.e., you want to have the cash being paid to you upfront, it’s worth more than counting on future growth – not to say that there won’t be growth but get that dividend yield to help cushion some volatility. After the pullback we have seen in DTD, now is a great time to be buying or adding to your position. DTD uses a stock screen that has a universe of all dividend-paying companies meeting the market cap and liquidity requirements, and then they make appropriate size and yield cuts based on the strategy.

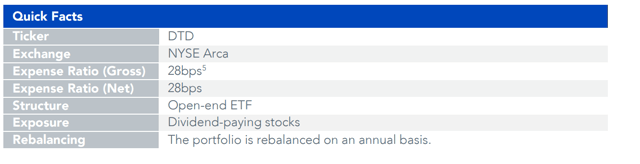

Another thing to like about this dividend seeker is the cost of it is minuscule. 28 bps is your all-in expense ratio. The current SEC 30-day yield of 3.64% is well above the S&P 500’s (SPY) yield of just over 2%. That dividend yield is covering more than enough of the fees to be worth it on a continuing basis. In the past few decades, dividends have been about rewarding shareholders for believing in companies. DTD gives you easy access to a diversified, well-managed play in the dividend-yielding space. It has lower fees than an actively-managed fund, and it gives you a different look than just investing in something like the S&P 500 – it tilts your portfolio towards dividend yielders. The fund tracks its own index, the WisdomTree U.S. Dividend Index, and more on their methodology can be found on their website here. It is not a market-cap weighted index, but a “fundamentally-weighted index that defines the dividend-paying portion of the U.S. equity market.” Because of the tilt, DTD generally has a lower beta, which is a strong characterization to have in a recession. While it does come with risks, as you can see with the pullback in 2018 and also in 2020, the underlying holdings should be around for the longer term and make a compelling investment case.

Like this article? Don’t forget to hit the Follow button above!

Subscribers warned to go risk-off Jan. 27. Now what?

Subscribers warned to go risk-off Jan. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Be the first to comment