J. Michael Jones

Generally speaking, I tend to stay away from retail-oriented businesses. I don’t like the low margins and intense competition they often have to deal with. But every so often, I will come across a prospect that offers attractive upside potential. A great example of this playing out over the past few months can be seen by looking at Winmark Corporation (NASDAQ:WINA), a franchisor of five retail concepts, the most popular of which is called Plato’s Closet. Despite difficult economic circumstances, the company seems to be holding up pretty well in the current environment. In response to this, shares have risen nicely over the past several months. Having said that, I do think that upside from here might be more limited. In addition to risks mounting when it comes to the economy, the stock does look less appealing from a pricing perspective than it did previously. Because of this, I’ve decided to reduce my rating on the company from a ‘buy’ to a ‘hold’, reflecting my belief that it should generate returns that more or less match the broader market moving forward.

Solid performance

The last time I wrote an article about Winmark was back in May of this year. In that article, I talked about how the company’s shares had followed the broader market down in the preceding months. Even though times are proving difficult for shareholders, I remained confident that the company would continue to grow and create value for its investors. That ultimately caused me to increase my rating on the business from a ‘hold’ to a ‘buy’. So far, that call has played off nicely. While the S&P 500 is down by 9.6% since the publication of that article, shares have generated a return for investors of 21.3%.

Author – SEC EDGAR Data

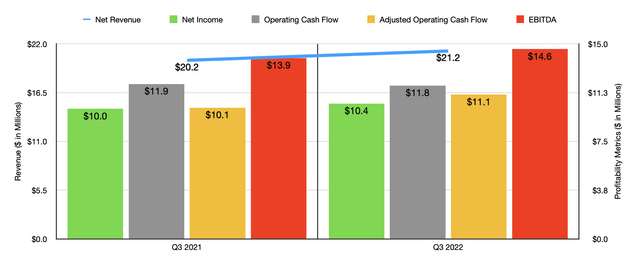

To understand why this return disparity exists, we should touch on the fundamental data reported by management in recent months. Since the publication of that article, management has come out with two additional quarters worth of data. In the latest quarter, the third quarter of the company’s 2022 fiscal year, revenue actually increased year over year, climbing from $20.2 million in the third quarter of last year to $21.2 million the same time this year. The firm does continue to benefit from an increase in store count. In fact, from the end of 2021 through September 24th of this year, the company opened 20 net locations, increasing store count from 1,271 to 1,291. For the latest quarter, the biggest driver of revenue growth for the company appears to have been its royalties. Royalties jumped by 9.1% year over year, driven largely by higher franchisee retail sales and from having additional franchise stores in the third quarter compared to the same time last year.

Even though we are experiencing inflationary pressures, it’s worth noting that profitability remained quite robust for the firm. Net income in the latest quarter totaled $10.4 million. That was up from the $10.1 million reported one year earlier. Operating cash flow did drop, falling from $11.9 million down to $11.8 million. But if we adjust for changes in working capital, the metric would have risen from $10.1 million to $11.1 million. We also saw an increase when it came to EBITDA, with the metric climbing from $13.9 million to $14.6 million.

Author – SEC EDGAR Data

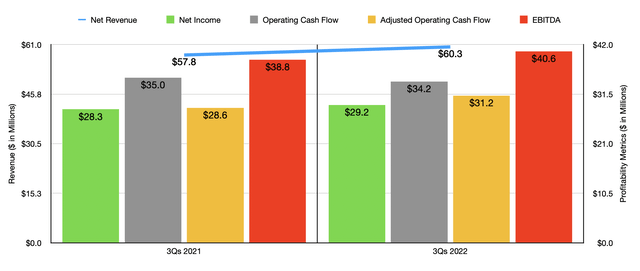

For the most part, the third quarter was a picture of what the company has experienced for the entirety of the 2022 fiscal year so far. In the first three quarters of the year, for instance, revenue came in at $60.3 million. This was up from the $57.8 million reported only one year earlier. This increase in revenue brought with it higher profitability as well. Net income, for instance, rose from $28.3 million to $29.2 million. Having said that, operating cash flow did fall, declining from $35 million down to $34.2 million. But if we were to adjust for changes in working capital, the metric would have risen, increasing from $28.6 million to $31.2 million. Another increase came from EBITDA, with the metric rising from $38.8 million to $40.6 million. This robust performance encouraged management to take another interesting move. On top of increasing the dividend for the third quarter of the year to $0.70 per share, management also announced the issuance of a special dividend totaling $3 per share. Both of these distributions will be paid out on December 1st, amounting to a 1.6% benefit on the current share price of the company. On top of this, management has also been active in buying back stock. So far in 2022, they allocated $49.1 million toward share purchases.

Author – SEC EDGAR Data

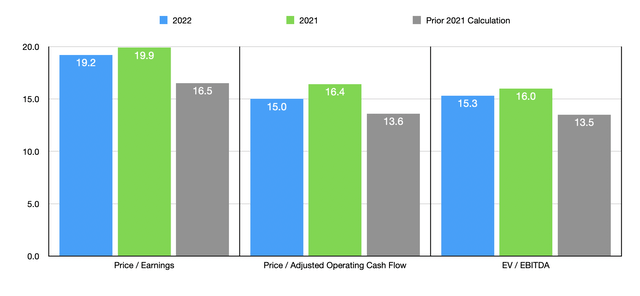

When it comes to the rest of the 2022 fiscal year, we don’t really know what to expect. If we were to annualize results seen so far this year, we would anticipate net income of $41.2 million, adjusted operating cash flow of $52.7 million, and EBITDA of $55.5 million. Given these numbers, the company is trading at a forward price to earnings multiple of 19.2, at a forward price to adjusted operating cash flow multiple of 15, and at a forward EV to EBITDA multiple of 15.3. As you can see in the chart above, these numbers are lower than what the company would be trading at if we used data from the 2021 fiscal year instead. But also, as the table illustrates, the company is more expensive, using the data from 2021, than when I last wrote about it. As part of my analysis, I also decided to compare the firm to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 1.6 to a high of 82.2. In this case, four of the five companies were cheaper than Winmark. Using the price to operating cash flow approach, the range was between 4.6 and 23.7, while using the EV to EBITDA approach, we end up with a range of between 2.8 and 26.9. In both cases, three of the five companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Winmark | 19.9 | 15.0 | 15.3 |

| Hibbett (HIBB) | 7.3 | 22.8 | 4.3 |

| Party City HoldCo (PRTY) | 1.6 | 8.1 | 21.9 |

| The Container Store (TCS) | 3.5 | 4.6 | 2.8 |

| Sportsman’s Warehouse Holdings (SPWH) | 3.8 | 6.7 | 2.5 |

| JOANN (JOAN) | 82.2 | 23.7 | 26.9 |

Takeaway

The past few months have been particularly good for Winmark and its investors. The company has generated performance that exceeded my own expectations. Long-term, I expect that the enterprise will do well. Having said that, shares are now trading at a point that I think would signify fair value both on an absolute basis and relative to similar players. Because of this, I have decided to reduce my rating on the company from a ‘buy’ to a ‘hold’.

Be the first to comment