JHVEPhoto

Investment Thesis

Wingstop Inc. (NASDAQ:WING) is a fast-growing and profitable fast-casual restaurant specializing in chicken wings and tenders. I’ve had my eye on Wingstop for a few months now and lament not taking up a position back in June when shares were trading at $70. Admittedly, I’ve never eaten at Wingstop because there just aren’t that many nearby, but I’m intrigued by their business operations and growth trajectory. Indeed, it was Wingstop’s past financial performance which resulted in the company landing on one of my favorite stock screens.

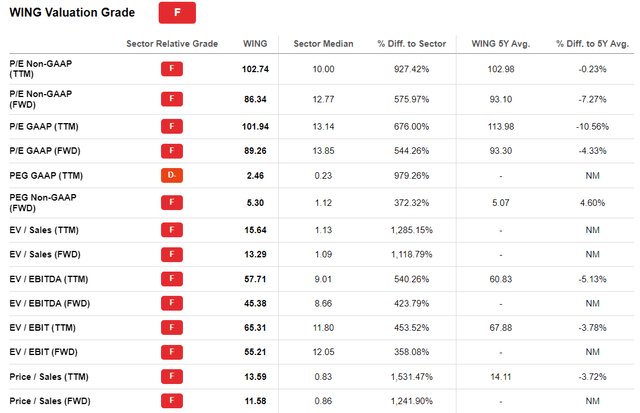

What’s preventing me from purchasing today is the same thing that prevented me from purchasing back in June (though to a lesser extent), and that is its frothy valuation. Wingstop’s current P/E is 102 and the company scores a big fat F on Seeking Alpha’s valuation grade. I don’t think I’ve ever seen such a dismal report card.

WING Valuation Score (Seeking Alpha)

It’s difficult to know for certain, but the lows may already be in for Wingstop in 2022. Personally, I have a hard time believing the stock will drop another 50% back to around $70, but that’s where I’d be most comfortable taking up a new position. Unfortunately, this may result in my missing out on an opportunity. But, as a value-oriented investor, I can’t bring myself to pull the trigger with a P/E north of 100. I can somewhat justify a P/E around 40 or 50, but that’s a long way from Wingstop’s current share price of $135.

Typically, I look for risk-reward scenarios of 2 or better and I don’t have confidence Wingstop offers such an opportunity. Multiple compression is likely more probable than multiple expansion at this point. Perhaps now is a good opportunity to take some profits and/or reduce exposure to Wingstop, especially considering today’s tough economic environment.

A Comparable Story

There’s no denying Wingstop is a fast-growing restaurant chain, having increased revenue from $52 million in 2012 to $283 million in 2021, representing an 18.5% CAGR. Reminder – Wingstop operates a franchise model, so these numbers aren’t indicative of total sales, which were $2.3 billion in 2021.

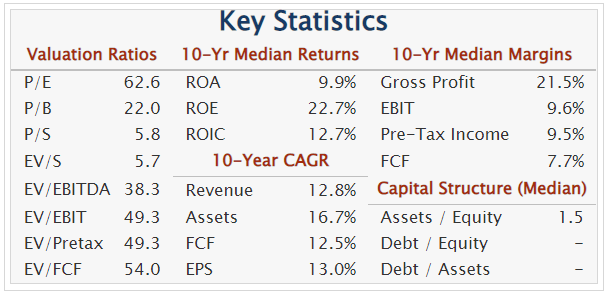

As I review Wingstop, I can’t help but think of Chipotle Mexican Grill (CMG), the fast-casual restaurant chain offering overstuffed burritos and bowls. Chipotle, while more mature than Wingstop, has experienced similar growth. Over the past 10 years, Chipotle has grown revenue and earnings at around a 13% CAGR. A little subdued compared to Wingstop, but strong growth, nonetheless.

CMG 10YR Financial Metrics (Quickfs.com)

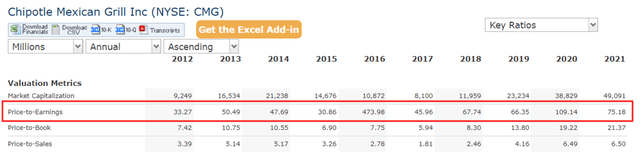

What I find odd, though, is that Chipotle’s P/E has rarely gotten over 100 other than in 2016 and 2020. In 2016, the chain struggled to gain back customers after a string of food poisoning outbreaks in 2015 that resulted in hundreds of patrons becoming ill. Then, in 2020, Chipotle was one of the many companies impacted by the Covid-induced flash crash. However, excluding 2016 and 2020, Chipotle’s P/E has averaged around 50 since 2012.

CMG Historical P/E (Quickfs.com)

I’m a big fan of Chipotle as a consumer and investor and believe it to be a long-term winner, so I struggle to rationalize how Wingstop deserves a P/E of 100 if Chipotle doesn’t. Like I mentioned, I’ve never eaten at Wingstop so I have no anecdotal evidence, but Chipotle sets a pretty high bar. Does Wingstop deserve to trade at 2x the P/E of Chipotle? Probably not, so investors should factor in some amount of multiple compression in their valuation models.

Future Growth Already Priced In

Previous articles on Wingstop have done a pretty good job explaining the business and long-term financial targets, so I won’t rehash them here in detail, but shares appear to be priced like it’s 2025 or 2026.

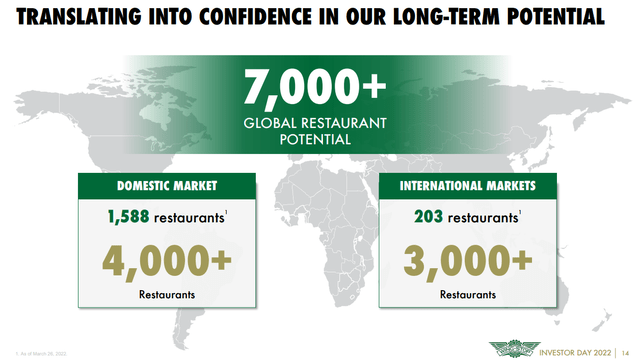

Wingstop’s two primary growth drivers are average unit volume (AUV), which is basically annual revenue per store, and new store additions. Wingstop is targeting AUV of $2.0 million (currently sits just shy of $1.6 million) and 7,000 restaurants globally, with 4,000 in the U.S. and 3,000 in international markets. In their Q2 2022 earnings release, Wingstop reported having a total of 1,858 restaurants. This leaves substantial room for growth both domestically and internationally. My gut says this long runway is one of the main reasons Wingstop is priced at such a premium.

WING Long-Term Store Target (WING IR Presentation)

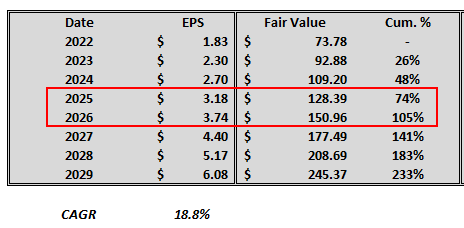

If I assume Wingstop’s EPS continues to grow 19% annually and that a fair P/E is 40, shares wouldn’t hit $135 for another 3 or 4 years. I understand the market is forward-looking, but I believe it looks 12 to 18 months into the future, not 36 to 48 months. It’s for this reason I think the market has gotten a bit overzealous on Wingstop.

WING Est’d EPS (Author’s personal data)

Valuation

Using the past as a guide, I can back into an estimate of what Wingstop may look like in the future.

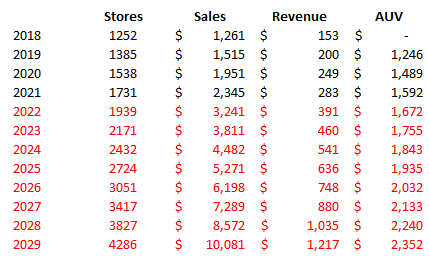

Since 2018, Wingstop has increased total store count by around 11-12% annually while their AUV typically increases in the mid to high single digits, aside from a hefty bump in 2020 due to the Covid pull forward. If I assume Wingstop continues to add stores at a 12% clip and grow AUV 5% annually, I arrive at a 2029 total sales estimate just north of $10 billion. From 2018 to 2021, Wingstop was able to convert 12.5% of total sales to revenue. Carrying this forward arrives at a 2029 revenue estimate of $1.2 billion and a near 18% revenue CAGR.

WING Est’d Sales & Revenue (Author’s personal data)

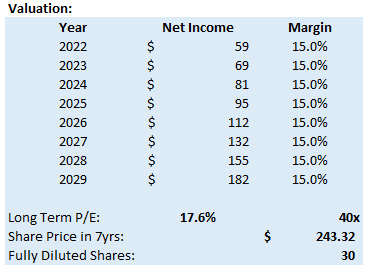

Further, Wingstop’s net margins have ranged from near 10% to as high as 15% over the past 5 years. Assuming a long-term P/E of 40 and an optimistic 15% net margin, I arrive at a 2029 target price of $243, which equates to a 9% share CAGR. Not too bad on the surface.

WING Net Income Estimate (Author’s personal data)

Bear Case

I could get on board with an estimated 9% share CAGR for Wingstop if I believed the inevitable multiple compression would be gradual and systematic. My bear case for Wingstop is that it won’t be and that there could be a quick and tumultuous rerating of the stock. With a current fair value somewhere near $70 or $80 and a 2029 target price of $243, investors are left with a risk-reward ratio of 1.7; this isn’t enticing enough in my opinion. If I thought Wingstop offered a 5x or better opportunity within the next 7 years or so, I’d have a larger appetite for a lower risk-reward ratio, but we’re only talking about an 80% gain compared to a 50% loss. If I purchased today, I’d be worried about a quick drop resulting in my sitting on a major unrealized loss for quite some time.

Conclusion

Wingstop is a fast growing and profitable business with solid fundamentals and bright future, but I believe the market has gotten a bit overzealous in marking up shares to irrational levels. Using Chipotle as a gauge, I could see Wingstop warranting a long-term P/E near 40 or 50, but its current P/E of 102 is bound to compress. If multiple compression is gradual and systematic, investors could still make a decent return, but if the market is quick to rerate shares, investors may find themselves sitting on a hefty unrealized loss.

I don’t believe Wingstop’s risk-reward ratio is enticing enough for investors to take up a new position at current levels. Perhaps now is a good time to take some profits and/or reduce exposure to Wingstop in hopes of buying back in at a more favorable valuation.

Be the first to comment