Laser1987/iStock Editorial via Getty Images

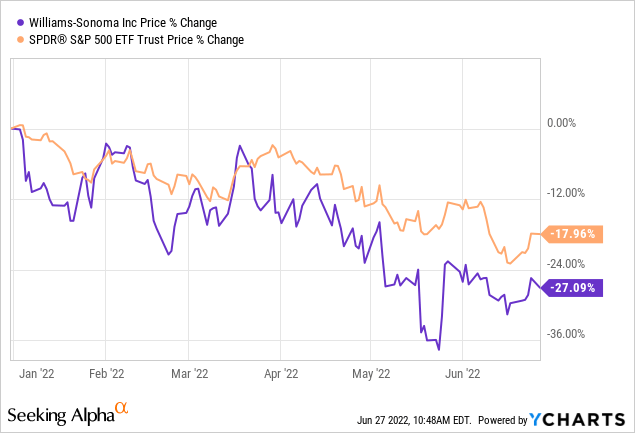

Williams-Sonoma’s (NYSE:WSM) stock price has declined by ~27% year to date, compared to the 18% decline of the broader market.

Despite the strong fundamentals of the firm, its solid Q1 earnings, its improving sales figures and its expanding margins, we believe that this underperformance is likely to continue in the near future, due to the uncertain macroeconomic environment, high commodity prices and the declining consumer confidence in the U.S.

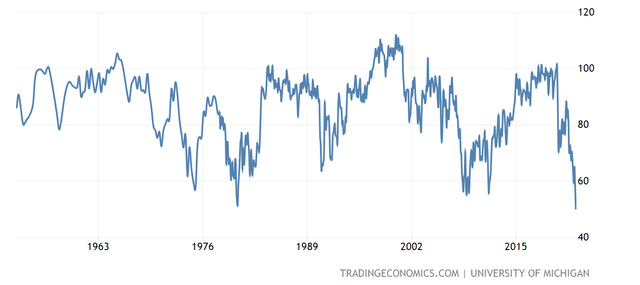

Let us first take a look at consumer confidence.

Consumer confidence

Consumer confidence is often regarded as one of the leading economic indicators, which can be used to predict the near term change in consumer spending. As a rule of thumb, lower confidence generally leads to more caution and eventually to less spending.

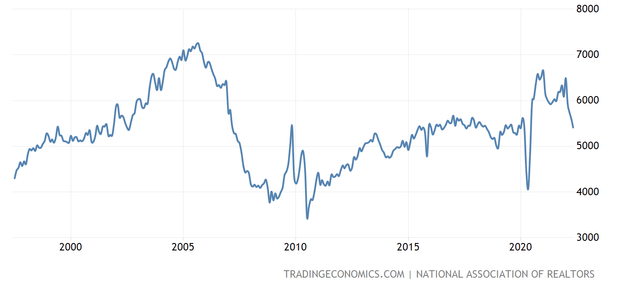

U.S. Consumer confidence (Tradingeconomics.com)

The U.S. consumer confidence has been steadily declining in the last months, reaching its lowest reading in 10 years, and even reaching levels seen in 2008-2009.

Although consumer spending has remained strong so far this year, we believe that the low consumer confidence is likely to lead to a change in the spending behaviour of consumers in the not so distant future. Normally, first, the purchases of durable and discretionary products are cut or delayed, followed by services.

As WSM’s products can be categorised as durable goods, we believe that the firm is likely to be substantially impacted by the low consumer confidence.

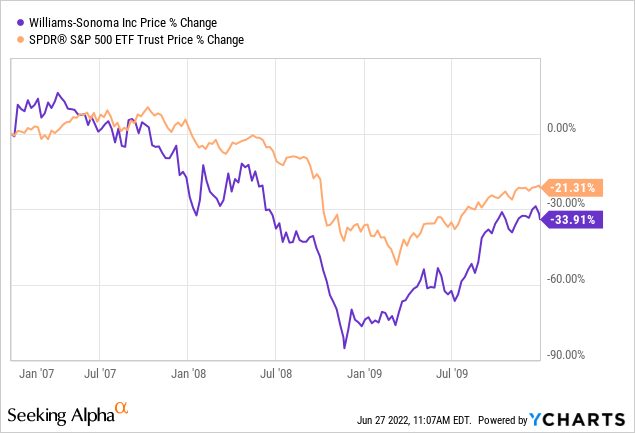

As a comparison, the following chart displays how the stock price of WSM and SPY have developed between 2007-2010, during times of low consumer confidence. Although WSM underperformed the broader market by about 10%, this is not the most alarming data on the chart. Between 2007 January and 2009 January, the firm has lost almost 90% of its market capitalisation.

While history is not necessarily indicative of future performance, we believe that there could be further potential downside from the current price levels.

Demand for WSM’s products is not only driven by the confidence of the consumers, but it is also related to how many new housing units will be built, or home many existing units will be renovated.

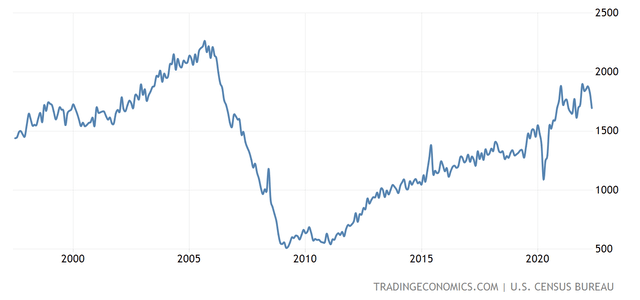

Housing

Building permits

Not only has consumer confidence been declining recently, but also the number of building permits, which is another leading economic indicator. The number of building permits issued can signal the demand for new housing units.

U.S. Building permits (Tradingeconomics.com)

Although the number of building permits issued remains above pre-pandemic levels, the current decline may be signaling a change in the trend. In our opinion, as interest rates increase, and mortgages become more and more expensive, the demand for new housing units will decline, as they are normally financed through loans.

Existing home sales

Not only is the demand for new housing units expected to decline, but also the number of existing home sales.

Existing home sales (Tradingeconomics.com)

All in all, we believe that the current direction of the housing market, with declining demand, may also result in lower demand for WSM’s products.

Because of these two leading economic indicators we believe that it is better to avoid WSM’s stock at the moment.

But what about the long term? We cannot simply ignore WSM’s excellent financial performance over the years, expanding margins, growing dividends and its valuation.

We will now take a brief look at what we like about WSM and why we believe that it could be an excellent choice for long term investors.

Dividends

WSM has a strong track record of returning value to its shareholders in form of dividend payments. The firm has been paying dividends and simultaneously increasing its dividend for the last 15 years, consecutively.

As the current Dividend Payout Ratio (TTM) (GAAP) of the firm is 18.1%, which compares favourably both to the sector median of the consumer discretionary sector and to the firm’s own 5 year historic average, we believe that the company’s dividend payments are currently safe and sustainable.

We believe that a yield of 2.5%, combined with steady dividend growth, could make WSM’s stock an attractive choice for many dividend and dividend growth investors.

Valuation

From a valuation stand point, according to a set of traditional price multiples, WSM also appears to be an attractive option.

Currently, WSM’s P/E Non-GAAP (FWD) is 7.4x, which is substantially lower than the consumer discretionary sector median of 11.1x, and also lower than the firm’s 5 year average P/E of 14x.

Not only according to P/E, but also according to EV/EBITDA and P/CF, the stock seems to be trading at a 40% discount compared to its sector and its own historic averages. In our opinion, despite the low consumer confidence, a discount to such an extent is not justified.

On the other hand, we have seen that macroeconomic headwinds, including elevated commodity prices, a tight labour market, rising interest rates and supply chain disruptions have had a significant negative impact on the financial performance of a large number of firms in the first quarter. Although in WSM’s first quarter earnings report there were no signs of potential headwinds, we believe that the macroeconomic uncertainties remain high in the near term, and we expect WSM to be impacted as well.

For this reason, we do not exclude the possibility of further decline in the stock price, and therefore we are not recommending to start a new position as long as the macroeconomic uncertainty persists.

Share buybacks

In the last decade, the firm has been buying back its shares, creating value for its shareholders.

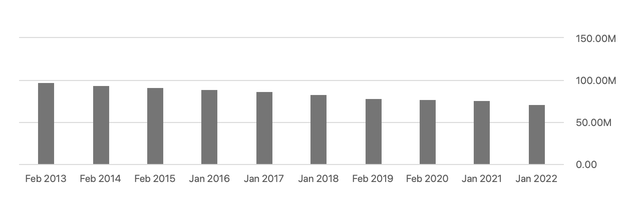

Number of shares outstanding (Seekingalpha.com)

Impressively, in this timeframe, WSM has managed to reduce its number of outstanding shares by as much as 30%.

Further, in the first quarter, the firm has announced that they have authorised a new share repurchase program up to $1.5 billion. As the market cap of the firm is about $8.7 billion (at the time of writing this article), the $1.5 billion repurchase program is a very substantial one, and could be attractive for a large group of investors.

Key takeaways

We believe that WSM has attractive fundamentals, combined with strong financial performance in the first quarter, with a high, growing and healthy dividend and with a substantial share repurchase program. In our opinion, the stock is also trading at a significant discount with respect to its sector.

On the other hand, macroeconomic headwinds, including low consumer confidence, a slowing housing market, elevated commodity prices and last but not least, increasing interest rates could lead to further decline in the stock price.

If you are interested in other firms in the home furnishing retail industry, which also have excellent fundamentals, but also face near term headwinds, take a look at our previous article on RH.

Right now our recommendation for the stock is “hold”.

Be the first to comment