pcess609

Thesis

Willdan Group, Inc. (NASDAQ:WLDN) has a poor financial outlook as earnings as worsening given the high growth in direct costs of the company. Furthermore, the company is overvalued compared to peers, where the share price has a potential downside that is far too great and risky. Therefore we do not recommend buying or holding the stock and give it a sell rating.

Intro

WLDN is a consulting organisation and technical services provider to a range of industries including utilities, public agencies, and many private sector companies, where services range from industrial machinery manufacturing to economic consulting. The group was founded in 1963 and currently has around 1200 employees, with its headquarters in California.

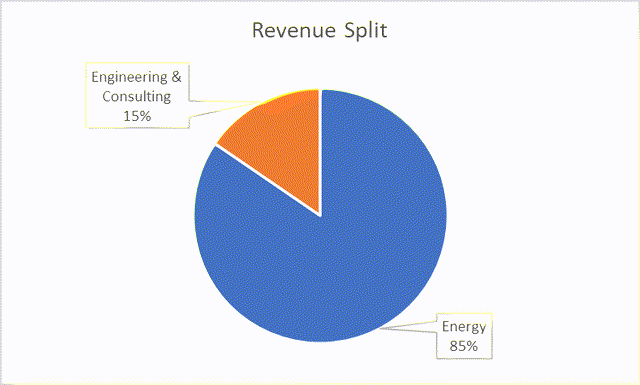

The company operates within two reporting segments: Energy, and Engineering & Consulting, illustrated below by their revenue split (for the last 3 months ending September 30, 2022), where Energy takes up the majority of the business with 85% of revenues.

Seeking Alpha

(Source: Seeking Alpha)

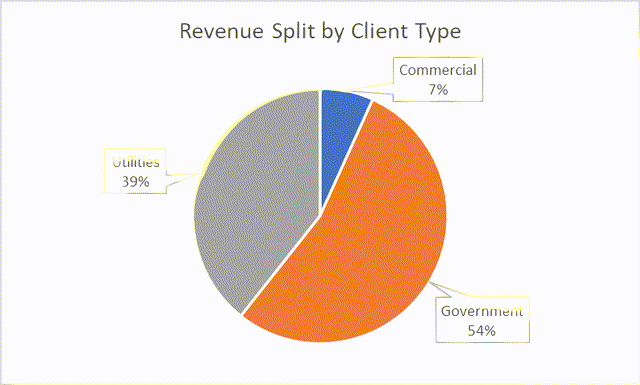

In regard to client types, the client mix is primarily government at over half of sales, followed by utilities. Commercial contracts contribute less than 10% of revenues.

Seeking Alpha

(Source: Seeking Alpha)

Furthermore, the company has not been performing particularly well over the past year, with the stock down by almost 60%, significantly further than the current market downturn.

Seeking Alpha

(Source: Seeking Alpha)

Financial Analysis

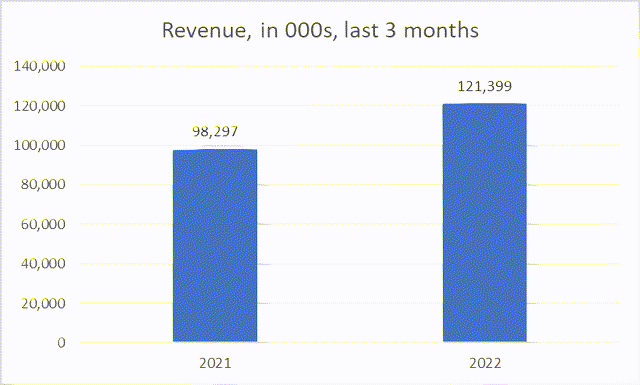

While the share price is down, revenue is up on the year, growing by almost 25% in the last 3 months ending Sep compared to the same period a year prior, reaching just above $121m. This growth is primarily due to growth in the energy segment driven by new governmental construction management and design-build projects. Furthermore, revenue also grew slightly in the Engineering and Consulting Segment but was partially offset by decreased revenues from the Utility segment (due to a decrease in software licensing sales).

Seeking Alpha

(Source: Seeking Alpha)

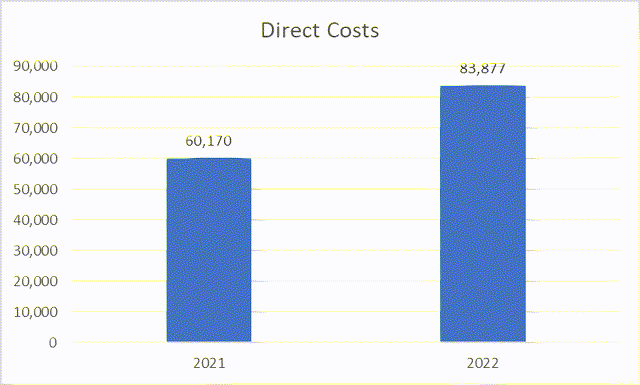

Direct costs grew by almost 40% in the period compared to the year prior, growing by around $24m to reach $84m. This is due to a ramp up of new projects that had higher project start up costs relative to recognised revenue (primarily material cost). The growth was primarily driven by subcontractor services, which grew by 43%, and staff costs, which rose 31%.

Seeking Alpha

(Source: Seeking Alpha)

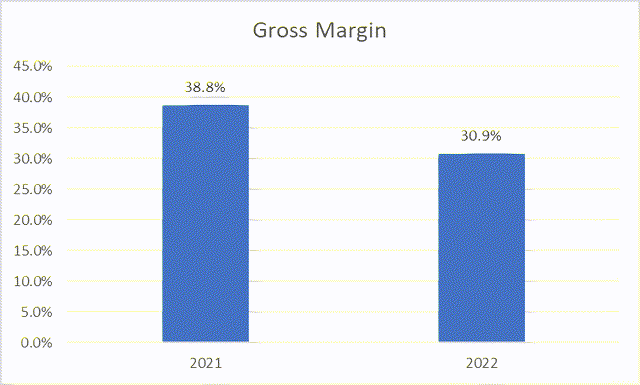

This unfortunately led to a decline in the gross margin by around 8 percentage points, dropping from around 39% in the period the year prior, to 31% today, as growth in costs well outpaced the growth in sales.

Seeking Alpha

(Source: Seeking Alpha)

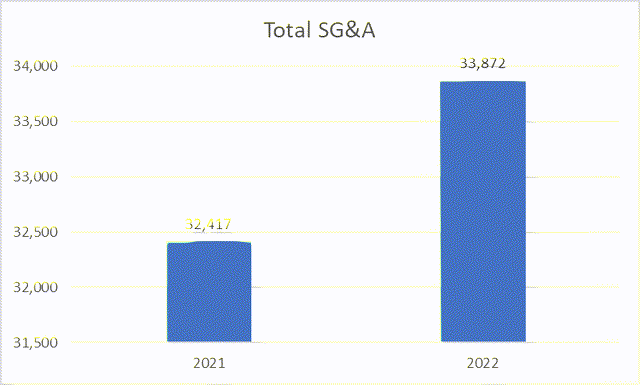

Fortunately, SG&A costs did not rise as quickly as sales or direct costs, as SG&A (excluding D&A figures) only grew 4% in the period compared to the year prior, reaching almost $44m, which is 28% of revenue (far lower than the 33% of revenue back in 2021)

Seeking Alpha

(Source: Seeking Alpha)

The reason for the improved cost figure was due to a decrease of around $1.6m for unallocated corporate expenses, showing an increase in efficiency for the company, as well as lower stock-based compensation expenses.

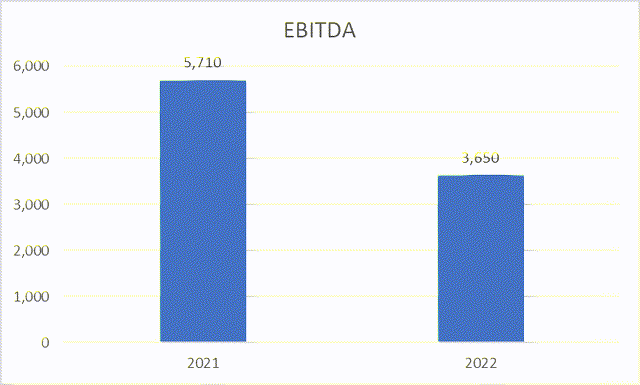

While we are seeing growth in sales and improvements made in some areas of costs, unfortunately, the growth in direct costs offset gains made elsewhere, and EBITDA for the period actually declined compared to the same period a year prior and has led to a drop in the EBITDA margin from around 6% in 2021, to 3% today.

Seeking Alpha

(Source: Seeking Alpha)

Valuation

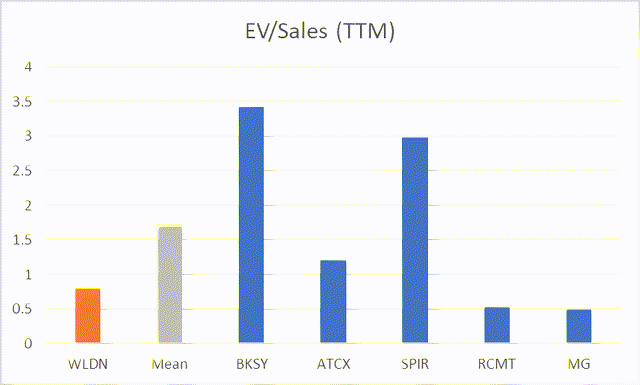

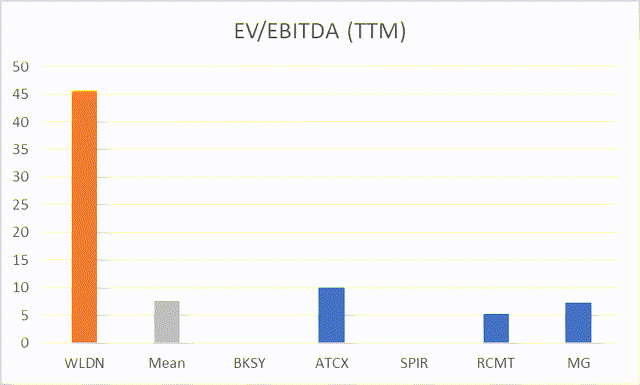

Suppose we collate a set of peer companies with similar market cap/EV and in the same industry and compare valuations. In that case, we could see if WLDN is undervalued, overvalued, or even fair-valued.

If we look at EV/Revenue, WLDN looks to be undervalued by a fair amount, where their EV/Sales are far below 1x, but the average of peers is almost at 2x, implying a significant amount of upside.

Seeking Alpha

(Source: Seeking Alpha)

However, if we look at EV/EBITDA, the picture is entirely different. WLDN looks to be substantially overvalued compared to peers, where the EV/EBITDA figure is so high for the company that investors have yet to reflect the recent drop in earnings with the share price. On this valuation basis, the company has a significant amount of downside.

Seeking Alpha

(Source: Seeking Alpha)

Overall, there is clearly too much risk in this stock, where different valuation methodologies show entirely different pictures, where one depicts potential upside and the other implies potential downside. As the picture is too volatile, it is hard to say what the valuation is right now of WLDN, but given that earnings are dropping and are volatile, there is too much risk of downside here.

Risks

• We could see a brighter picture if growth in direct costs slowed down and no longer outpaced growth in sales. This would lead to a more positive outlook, take away the uncertainty and risk of downside, and lead to an improved EBITDA figure and thus an improved EV/EBITDA ratio. However, this is unlikely the case given that direct costs are growing due to higher start-up costs, which are believed to be due to a high inflation environment which is expected to stay for at least the next 12 months.

• A second risk would be much greater growth in sales, one that would lead to sales growth outpace the growth in direct costs. Given that the primary driver of sales growth is energy projects with the government, this scenario could become likely and could lead to an improved earnings figure. However, direct cost growth is substantially high, at around 40% YoY, so there would need to be huge project wins for this scenario to become reality.

Conclusion

While WLDN has grown revenue this year and has had some success in improving operating expenses, unfortunately, direct costs growth outpaced sales and offset all gains made and has led to a decline in EBITDA and thus a decrease in EBTIDA margin by almost 6 points. In regard to valuation, it isn’t easy to compare the company to peers as we get many different pictures. But EV/EBITDA, given the recent drop in earnings, implies that the company is overvalued. And given the declining health of the P&L statement, we can conclude that the stock is too risky, and the downside is far too great. Therefore, we recommend a sell rating.

Be the first to comment