gguy44

Hopeful of a bottom

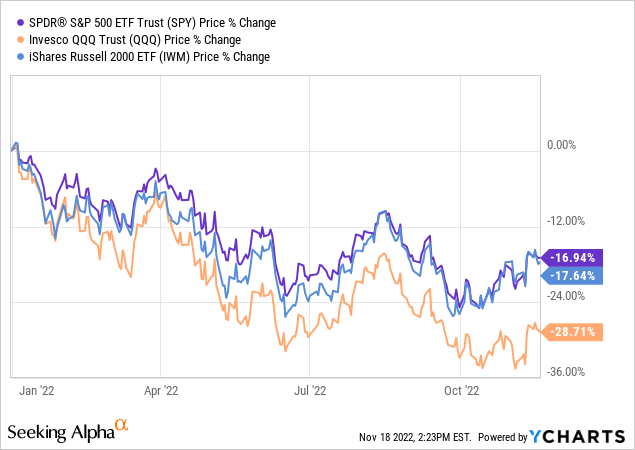

U.S. stocks are still down double digits for the year despite a recent rally. The tech-heavy NASDAQ is down worst by about -29%, while the broader S&P 500 and smaller-cap Russell 2000 indices are down by around -17% YTD.

Chart 1 shows this with the Invesco QQQ Trust (QQQ), the SPDR S&P 500 ETF Trust (SPY), and the iShares Russell 2000 ETF (IWM) funds, respectively.

Chart 1: US Stocks

But market prices are off their October lows and the current bounce has some investors hopeful the U.S. will avoid a recession.

Politicians and policymakers remain confident and optimistic they can pull off a soft landing. In a recent interview, US Treasury Secretary Dr. Janet Yellen said “I don’t see signs of a recession in the economy at this point,” a position she’s repeated several times this year.

This month, the Biden administration made clear “we are not in a recession,” citing economic growth and record-low unemployment. Indeed, it is difficult for a recession to unravel while the labor market is strong.

Cracks in the employment pillar

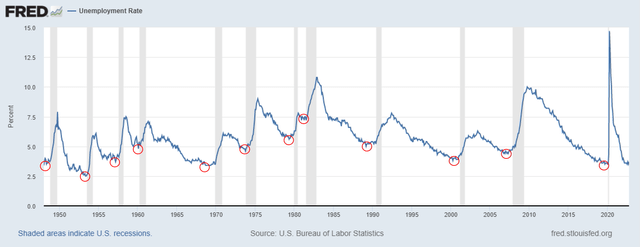

However, low unemployment today is a weak argument for avoiding recession tomorrow. Unemployment is a lagging economic indicator. That means when unemployment is high the economy is usually already in recession. Said another way, the unemployment rate is always low when recessions start.

Chart 1 shows how the U.S. unemployment rate consistently reached lows (red circles) near the start of every recession (grey bars) since 1948.

Chart 1: Unemployment and Recessions

Meanwhile, cracks are forming on the employment pillar. As of now, layoffs remain at benign levels for the economy at large. However, the technology sector did an about-face from hiring sprees in 2021 to cutting headcount in 2022.

Before Elon Musk threw out the kitchen sink at Twitter, Lyft cut 13% of its workforce, Stripe cut 14%, and Robinhood cut 23%. Even old-tech guards like Amazon, Microsoft, Intel, and Cisco announced layoffs. The tech sector is often a first mover so this could be a bellwether for things to come.

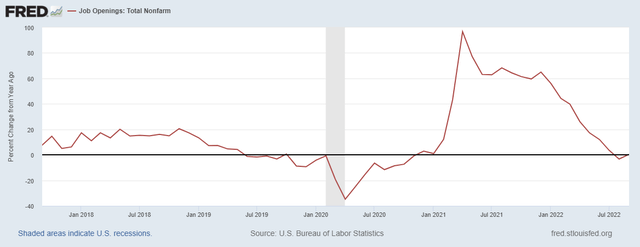

According to a recent PriceWaterhouseCoopers survey, over 50% of businesses are planning to freeze new hires or reduce headcount. Jobs data reflects this change in employer sentiment. Year over year job growth collapsed in the past year following a spectacular post-COVID spike.

Chart 2: Job Growth YoY

To be fair, the growth rate in jobs last year was not sustainable. It was driven by unique circumstances that can also help us understand what is happening now. The COVID lockdowns caused substantial disruptions to global supply chains and inventories. That naturally led to pent-up demand and a build-up in back-orders.

Post-lockdown manufacturers, suppliers, and providers scrambled to fill those backorders while also trying to keep pace with a rebound in demand. Businesses could not hire fast enough and that helped fuel the spike in job growth we saw in 2021.

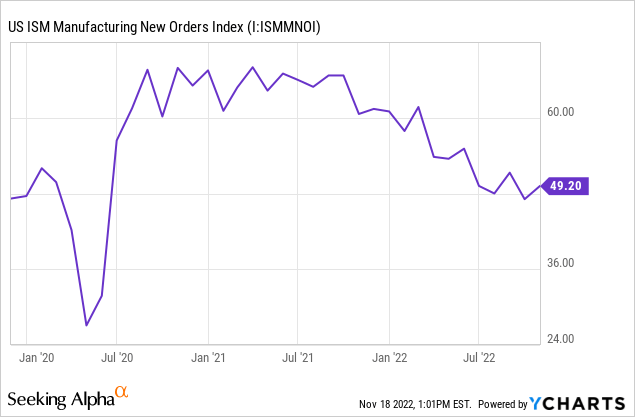

However, circumstances are reversing in 2022. As businesses deliver on existing backlogs, order books are not replenishing at the same rate as in 2021. The US ISM Manufacturing New Orders Index shows new orders have been declining all year. The index slipped into contraction in June (below 50).

Chart 3: US Manufacturing New Orders

Businesses had to staff up to address outstanding work in progress, but as those needs subside the question is will businesses retain all their staff? If big tech is an indicator, then probably not.

Other indicators point to a foregone conclusion

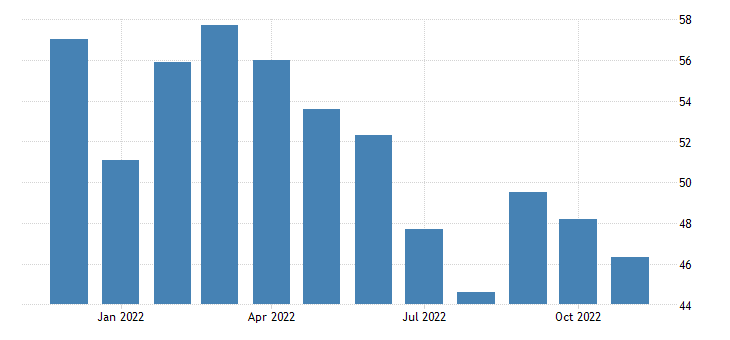

That is a bad omen because employment looks to be the last bright spot among a growing list of dimming economic indicators. Similar to new orders, business activity as measured by the S&P US Composite PMI fell into contraction (below 50) in July.

Chart 4: US Composite PMI

TradingEconomics.com

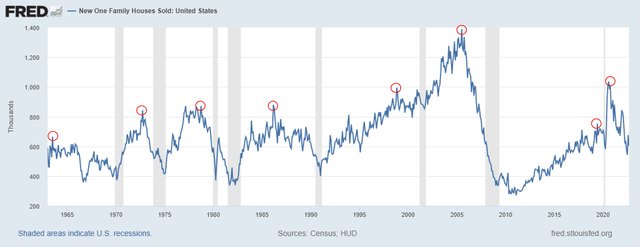

The cyclical housing sector is in a clear downtrend. A housing recession is a well-known concern in 2022, but the downturn likely started well over a year ago. Chart 5 shows how new home sales have a reliable history of peaking (red circles) before recessions begin (grey bars).

Chart 5: New Home Sales

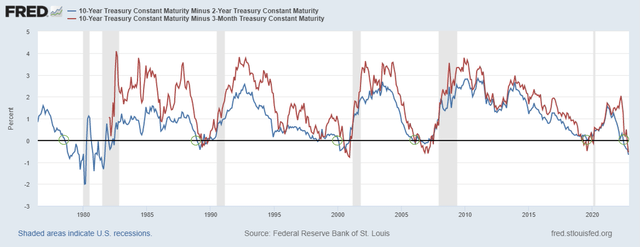

The Treasury Yield curve officially inverted last month. That is one of the most reliable and well-known harbingers of recession. Some segments of the yield curve were inverted for some time.

The 2-10 Year Treasury curve first inverted in early 2022. Many dismissed the signal as less reliable than the 3 Month to 10 Year curve. But as I wrote in April, the 2Y-10Y curve tends to lead the 3M-10Y curve, and the divergence would reverse one way or another.

As of October, both curves were fully inverted. Regardless of which measure is preferred Chart 6 shows how both curves have a consistent history of inverting (green circles) prior to recessions (grey bars).

Chart 6: Treasury Yield Curves

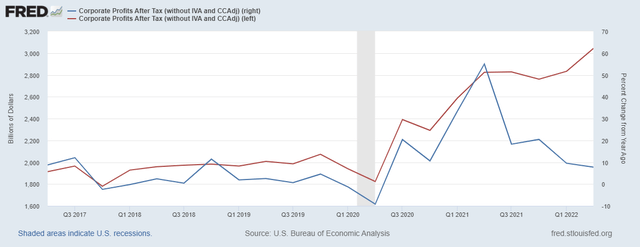

Last but not least is corporate profits. As Chart 7 shows, despite a continued rise in dollar earnings (red line), earnings growth (blue line) has seen a substantial decline in the past year.

Chart 7: Corporate Profits

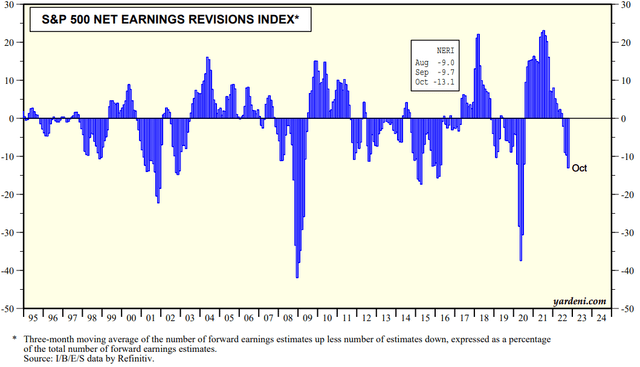

Looking ahead, average analysts’ earnings revisions have also become increasingly pessimistic and reached a low for 2022 in October. This matters because earnings and profits lead the stock market which in turn leads the economy.

Chart 8: S&P 500 Earnings Revisions

A growing number of economic indicators are pointing to what seems like a foregone conclusion. As Yale Economist Dr. Stephen Roach said, “the U.S. needs a miracle to avoid recession.“

The bottom line

Politicians and policymakers are flaunting a strong economy and labor market, but the “no recession because of low unemployment” argument is naive at best and deceptive at worst. Public servants sing what their constituents want to hear. Often that is a song of eternal hope and optimism.

The economy is noisy enough without political chatter. Better to ignore what is being said and to focus on what is going on. As of now, leading economic indicators like cyclical sector activity, interest rates, and corporate profits suggest a recession is likely.

Employment still offers hope for a soft landing, but if that capitulates then recession becomes a near certainty and stocks are likely to see new lows ahead. However, anything is possible and unlike the politicians, I do not know what happens next. So ignore the chatter, watch the data, and do as it does (not as talking heads say).

Be the first to comment