LilliDay

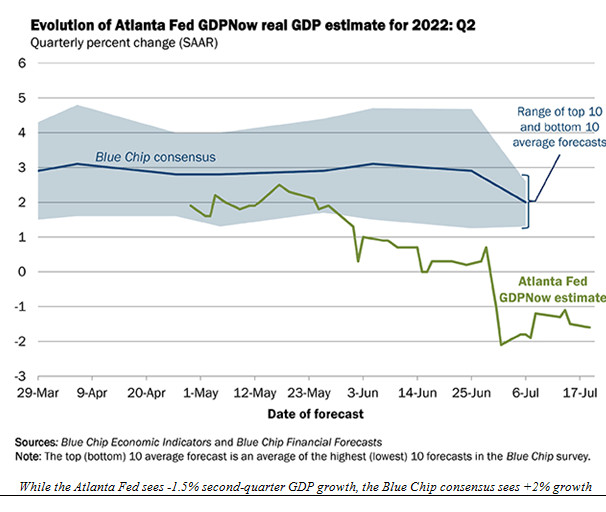

One major clue that we’re not in a “real” recession is that the Atlanta Fed publishes a summary of Blue Chip economic GDP estimates alongside its own growth model, called GDPNow. These Blue Chip economists are estimating second quarter growth of between 1.3% and 2.6% growth rather than the negative -1.5% decline which the Atlanta Fed’s model predicts. On Thursday morning, July 28, the U.S. Bureau of Economic Analysis will issue its first estimate for second quarter GDP. The bottom line is that if we are in a recession, it is a weird one, with rising corporate earnings as well as continued job growth.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In all fairness to the Atlanta Fed, some of last week’s statistical releases indicate an economic slowdown, but at a very slow pace, nothing like the rapid contraction that accompanied serious contractions in 2008-9 or 2020. Here’s a rundown of last week’s major economic releases, to monitor the economic situation now. (Note: For ease of scanning, I’ve underlined the gains, and put the declines in bold type).

- On Tuesday, the Commerce Department announced that housing starts declined 2% in June to an annual pace of 1.559 million, the slowest pace in nine months (since September 2021).

- Also, building permits declined by 0.6% in June to a 1.685 million annual pace.

- On Wednesday, the National Association of Realtors announced that existing home sales declined 5.4% in June to an annual pace of 5.12 million, the slowest pace in two years.

- However, median home prices rose 1.9% in June and have risen 13.4% in the past 12 months to $416,000, but according to the Mortgage Bankers Association, mortgage demand is now at a 22-year low since mortgage rates have almost doubled to 5.51%, compared to 2.88% a year ago.

- On Thursday, the Labor Department announced that weekly unemployment claims rose to 251,000 in the latest week, up from 244,000 in the previous week. Continuing unemployment claims rose to 1.384 million, up from a revised 1.333 million in the previous week.

- Also, on Thursday, the Conference Board announced that its leading economic index (LEI) declined 0.8% in June, its fourth straight monthly decline, but the LEI’s current economic conditions rose 0.2% and its lagging economic index rose 0.8% in June.

Overall, that’s a fairly dismal list of statistics from last week’s economic dashboard, but don’t forget the previous week’s strong retail sales report, or the robust job growth reported the previous week.

Finally, Apple last week joined Google and other companies in winding down its hiring plans. Apple is also scaling back some of its spending plans due to the current economic environment. This news from Apple initially caused the stock market to reverse, but our stocks were not significantly impacted. (With second quarter announcement season reaching cruising speed, it will be every stock for itself most days.)

Navellier & Associates owns Apple Computer (AAPL), and Nvidia (NVDA) and a few accounts own Tesla (TSLA) in managed accounts but does not own Alphabet Inc. Class C (GOOG) (GOOGL). Louis Navellier and his family own Apple Computer (“AAPL”), and Nvidia (“NVDA”) via a Navellier-managed account, and Apple Computer (“AAPL”), in a personal account. He does not Alphabet Inc. Class C (“GOOG”) or Tesla (“TSLA”) personally.

The Latest Energy Developments in Europe

Russia’s Gazprom (OTC:GZPMF) last week notified major customers in Europe that it could not fulfill its natural gas supply obligations due to “extraordinary circumstances,” as the Nord Stream 1 pipeline was shut down for its annual maintenance. Then, on Thursday, July 21, Gazprom reopened the Nord Stream 1 pipeline at 40% capacity. Before the natural gas shutdown, Gazprom had reduced natural gas deliveries, citing a delay from a Siemens (OTCPK:SIEGY) pipeline turbine that was in Canada for maintenance. This natural gas cut-off is devastating for Germany’s vast chemical industry, which is dependent on cheap Russian natural gas.

I should add that Russia has already stopped supplying gas to France, Poland, Bulgaria, Finland, Denmark, and the Netherlands. When Russia recently reduced natural gas supplies to Germany and Italy, it blamed Western sanctions for the cuts. Last Tuesday, Putin said that Russia would fulfill its commitments, but warned that flows via the Nord Stream 1 pipeline could be curbed soon if sanctions prevent additional maintenance on the pipeline. Putin also warned that Nord Stream 1 flows might fall to 20% capacity as soon as next week if the Siemens pipeline turbine undergoing repairs in Canada is not returned to Russia.

The Financial Times reported on Tuesday that the European Commission in Brussels is planning to tell its EU members to cut natural gas consumption “immediately,” since the EU runs the risk of running out of natural gas to heat homes this winter. Specifically, the European Commission document says, “Acting jointly now will be less disruptive and costly, facilitating solidarity and avoiding the need for unplanned and uncoordinated actions later in a possible crisis situation with gas reserves running low.”

European natural gas prices resurged last week in the wake of the Gazprom cut-off. Furthermore, since Saudi Arabia did not significantly boost its crude oil production after President Biden’s recent visit, crude oil prices firmed up last week, until falling later in the week on news that China had to dispatch tanks to banks after protests that Bank of China deposits were “investment products” that cannot be withdrawn.

Clearly, China has brewing economic problems and President Xi’s leadership is now being questioned. I should add that when Sri Lanka defaulted this year on $12 billion in foreign debt, $6.5 billion was held by China, since Chinese lenders had invested in Sri Lanka’s highways, a port, airport, and coal power plant.

Britain’s Office of National Statistics reported on Wednesday that inflation in June rose to a 9.4% annual pace, a new 40-year high. The cost of food rose 1.2% in June and has now risen 9.8% in the past 12 months. Britain has historically imported much of its food, so a weak British pound is contributing to food inflation. I should add that Britain now has the highest rate of inflation of all the G7 countries, so its new Prime Minister will have a lot of work to do to reduce both food and energy inflation!

In monetary news, the European Central Bank (ECB) on Thursday finally raised its key interest rate to 0%, up from -0.5%. This rate increase was more than the ECB had telegraphed and was welcomed as inflation has spun out of control in Europe. This was the first ECB key interest rate hike in over a decade.

In a formal statement, the ECB said, “Further normalization of interest rates will be appropriate,” adding, “The frontloading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions,” so the euro finally rallied!

I think we can conclude that Europe remains at a high risk for recession. Former ECB President Mario Draghi, who is now Prime Minister of Italy, resigned last week. Essentially, Draghi’s ruling coalition has fallen apart over concerns about Italy’s cumulative debt burden as interest rates have risen….to zero!

The U.S. is still producing 12 million barrels of crude oil per day, based on the latest weekly data, which means that we remain energy independent, since demand dropped as gasoline prices rose. I expect the prices at the pump will continue to moderate as U.S. production continues to steadily increase.

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment