stockstudioX

Transcript

Market fears of a global growth slowdown have replaced worries about higher inflation since June.

This has triggered a fall in bond yields, boosting investment grade credit performance in the past two months.

There are three reasons why we prefer credit versus equities right now:

1) Valuations are attractive

First, valuations are still attractive. Credit spreads have not narrowed much, and higher coupon income acts as a cushion against any yield rises.

Equity valuations don’t reflect a significant slowdown yet, so earnings estimates are still optimistic, in our view.

2) Credit fundamentals are solid

The second reason we prefer credit: solid fundamentals!

Companies are keeping debt under control. Interest coverage ratios that look at a company’s ability to repay debt are still well above pre-pandemic levels.

The number of defaults in 2022 are also the lowest since 2014. Credit ratings have improved too.

3) Corporate bond market showing positive trends

Lastly, the corporate bond market shows positive trends. Low bond issuance is down around 20% year on year. And there doesn’t seem to be many pressing refinancing needs since a surge in issuance in 2021.

We reiterate our overweight to investment grade credit versus equities on a tactical horizon. We think it would weather weaker growth better than stocks.

____________

We prefer investment grade (IG) credit over equities on a tactical horizon as we see a new market regime with higher volatility taking shape. First, yields on IG credit have risen, making for improved valuations and a larger cushion against defaults. Second, balance sheets are strong, we think. Third, supply is low, and we see only moderate refinancing risks. Our conclusion: We believe IG credit can weather a significant growth slowdown, whereas equities don’t look priced for this risk.

Attractive yields

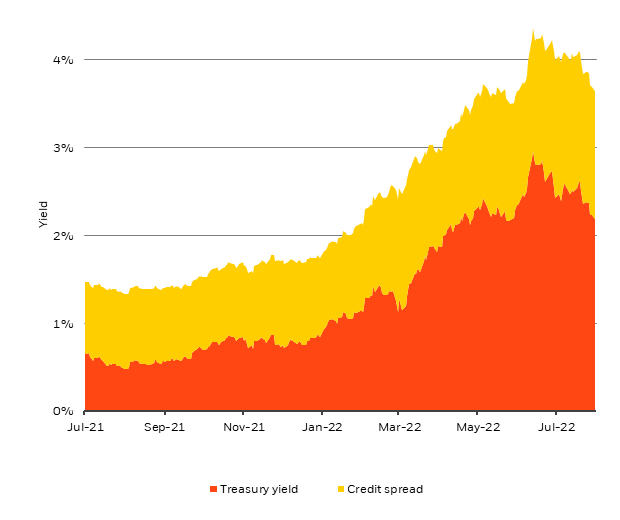

US Treasury Yield And IG Credit Spread, July 2021-July 2022 (BlackRock Investment Institute, with data from Bloomberg, July 2022)

Notes: The yellow stacked area shows investment grade (IG) credit option-adjusted spread of the Bloomberg Global Aggregate Credit Total Return Index Value Unhedged in U.S. dollars over U.S. Treasuries in percentage points. The red area shows the yield of U.S. Treasuries as a portion of the overall index yield.

Yields look more attractive than at the start of the year, in our view. That’s because of a surge in government bond yields (red area in chart) and a widening of spreads (yellow area), the risk premium investors pay to hold IG bonds over government peers. Since June, markets have been captivated by the prospect of lower rates in the face of a growth slowdown. This has resulted in a drop in yields, boosting IG performance and triggering a 10%-plus equities rally. We still like IG credit at these levels. Spreads have only marginally narrowed as investors lean back into equities. Plus, we think higher coupon income provides a cushion against another yield spike as markets price in the persistent inflation we expect. Equity valuations, meanwhile, don’t reflect the chance of a significant slowdown yet, so earnings estimates are still optimistic, in our view.

IG companies are in good shape, in our view. First, debt servicing remains low by historical standards, and leverage has been coming down. U.S. non-financial IG companies lowered leverage, as measured by debt-to-equity, for the seventh straight quarter at the end of last year, according to ratings agency S&P Global. Second, the number of defaults in 2022 is the lowest since 2014, S&P data show. Lastly, we think credit quality is still solid. S&P’s tally shows that rising stars in credit, or those that gain into investment grade status from high yield, have outpaced those going the other way, so-called fallen angels. We are neutral high yield, as we prefer up-in-quality credit amid a worsening macro backdrop. We think parts of high yield offer attractive income, but concern over widening spreads in any slowdown steers us toward IG.

Trends in the corporate bond market also support our overweight on credit, in our view. First, supply is relatively low. Corporate bond issuance is down almost 20% this year versus 2021, according to S&P. Many issuers could be waiting to see if financing conditions improve before issuing more debt. Second, refinancing needs don’t look pressing after a surge in issuance last year. For example, typical U.S. IG bond issuance of around $1 trillion a year easily exceeds upcoming maturities of less than $600 billion a year through 2029, S&P data show.

Our take on inflation

How do inflation and the Fed’s next moves play into our credit view? Markets currently appear to expect that a mild contraction will result in falling rates and lower inflation. We don’t think such a “soft landing” is likely in a volatile macro regime shaped by production constraints. Central banks will have to plunge the economy into a deep recession if they really want to squash today’s inflation – or live with more inflation. We think they’ll ultimately do the latter – but they are not ready to pivot yet. As a result, we see lower growth and elevated inflation ahead. We see bond yields going up and equities at risk of swooning again. IG credit, in our view, benefits from relatively high all-in yields that reflect moderate default probabilities.

Our bottom line

We overweight IG credit versus equities on a tactical horizon. This is a move up in quality in a whole portfolio approach after we reduced risk throughout this year in response to higher macro volatility. IG valuations still look attractive, balance sheets appear strong, refinancing risks seem moderate. As a result, we see IG credit weathering a slowdown better than stocks. We see activity stalling, underpinning our underweight to most developed market equities. Rising input costs also pose a risk to elevated corporate profit margins. When would we turn positive on equities again? Our signpost is a dovish pivot by central banks when faced with a big growth slowdown – a definite sign they will live with inflation.

Market backdrop

The U.S. economy added some 528,000 new jobs in July, double the average of analyst expectations. The labor market has not yet normalized, with labor force participation ticking down, while wages ticked up. This caused the rally in U.S. stocks to lose steam and bond yields to spike as markets priced in higher odds of a 0.75% hike by the Federal Reserve in September. This aligns with our view that markets had prematurely priced in a dovish pivot by central banks amid signs of a slowdown.

All eyes will be on this week’s U.S. CPI and PPI data to gauge whether high inflation is persisting. We see inflation staying above the Fed’s 2% target through next year. We think the Fed will keep responding to calls to tame inflation until it acknowledges how that would stall growth. We’re also watching China’s social financing and CPI inflation data releases.

Be the first to comment