Avalon_Studio

Construction equipment giant Caterpillar Inc. (NYSE:CAT) has seen an extremely volatile 2022. The company, more so than most dividend stocks, tends to see boom and bust periods based upon global economic conditions. If you’re looking for a sleep-well-at-night income stock, that’s probably not that appealing. If you’re looking for a stock to trade, however, it can be quite intriguing.

The last time I covered Caterpillar, I took a cautious stance. That was December 2021, and shares are 8% lower than they were at the time. That’s not amazing but is meaningfully better than the ~15% decline the S&P 500 has seen over the same period. Obviously, economic conditions have changed significantly since then, so in this article, we’ll take a fresh look at Caterpillar’s prospects today.

Signs of caution

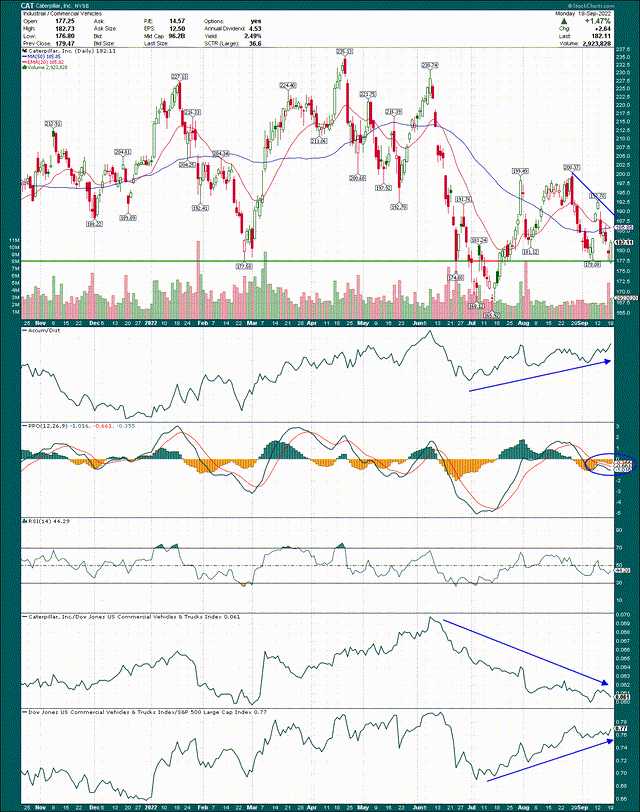

We’ll start with the chart, as we always do, to get a lay of the land in terms of price action. In Caterpillar’s case, I’m not impressed.

I’ve noted key support, which the stock actually bounced off of yesterday, near $178. That’s a key line for the bulls, and if it fails, next up is the 2022 low at $166. Based on what I’m seeing, I put the odds more in favor of a test of $166 than not.

The accumulation/distribution line looks quite good, as investors continued to add Caterpillar on dips throughout the day. While it’s not at a new high, the A/D line looks much better than the price chart itself. However, the A/D line alone is not enough to salvage the rest of the indicators, as we’ll see now.

The PPO is firmly in bearish territory, and the last two rally attempts have produced PPO values of just +2. Both times the PPO quickly dipped back into negative territory, so bullish momentum is quite weak. We’re seeing bounces rather than rallies, and that’s a problem if you’re bullish.

Relative strength has been awful as well, with Caterpillar drastically underperforming its peer group. It has worked in Caterpillar’s favor that its peer group happens to be outstanding right now, but why own one of the weakest constituents of a strong group? Caterpillar is dragging its peers down and that’s one of the clearest indicators you can get from Wall Street; if money is flowing elsewhere, that’s sufficient evidence for me.

On the whole, I don’t like the look of this chart, and I believe it is only a matter of time before price support is broken. Given that, I see no reason to buy it right now, because I think patience will net you a lower price at some point in the future.

Decent fundamentals, but not great

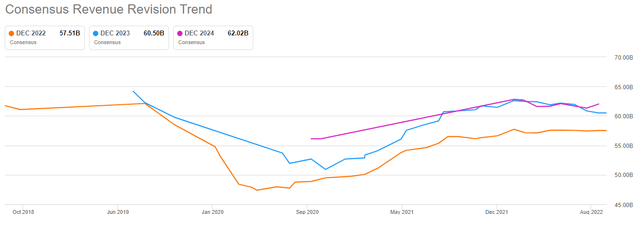

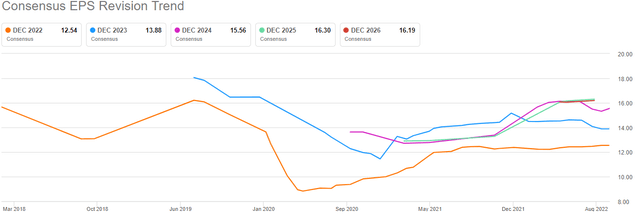

One of the first things I check when reviewing a stock is the company’s revenue and earnings revisions. This gives us a great idea of what analysts are thinking about the company’s prospects, and whether we should expect improving or worsening conditions in the months and years to come. In Caterpillar’s case, it certainly appears the best days are behind it for now.

Revenue cratered into the COVID recession but quickly climbed out of the hole. However, we can see that at the start of this year, revenue estimates made a high early and have been largely flat since then. In the out years, revenue estimates continue to come down, indicating there’s some excessive optimism that must be worked off. That’s not a good situation for Caterpillar, as it means sentiment is in a cycle of worsening, rather than improving. This could be a big reason why the stock has so badly underperformed its peers recently.

If we’re in for a prolonged recession, or if we’re going to see global construction activity fall due to higher interest rates in the developed world, Caterpillar is going to suffer. It needs construction activity to generate higher revenue, and construction activity needs low interest rates. I’m concerned that Caterpillar is just on the cusp of one of its “bust” cycles I mentioned earlier, where massive demand creation during the “boom” cycle is rapidly unwound. We’ve seen it before, and while I’m not saying there’s a bust coming, I’m not willing to say it isn’t. This is what estimates look like before a downturn, so if you own Caterpillar, that’s something you’ll need to keep a keen eye on.

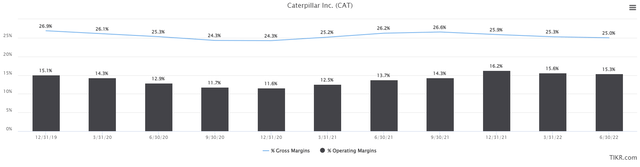

The other problem Caterpillar is having is the lack of margin expansion. Any cyclical stock is going to face big moves in margins given revenue tends to ebb and flow, and we can see Caterpillar’s margins have been declining for some time already.

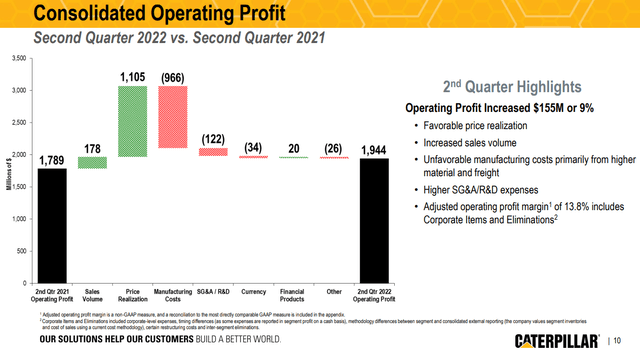

These are trailing twelve months gross and operating margins as a percentage of revenue, and it’s not pretty. Margins began declining a few quarters ago, and that’s despite the company’s attempts to fight inflationary pressures with pricing actions.

This slide from Q2 results shows price realization added a huge amount to operating profits in Q2 of this year, but almost all of it was undone by higher manufacturing costs. There are other factors in this equation as well, but the point is that labor, freight, raw materials, etc. are all more expensive than they were in recent quarters, right as demand appears to be waning for Caterpillar. This cycle could lead to much lower earnings estimates in the quarters to come, and in my view, the stock simply isn’t priced for it yet.

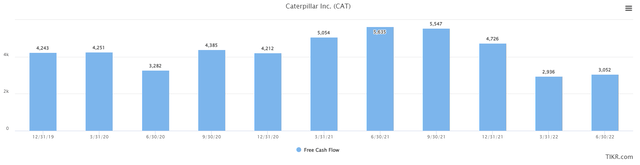

The margin issue has another consequence, and that’s in the production of free cash flow. Below we have TTM free cash flow (“FCF”) for the past three years, and it’s quite clear there’s a problem here as well.

FCF peaked on a TTM basis at ~$5.5 billion last year, but the last two quarters saw just ~$3 billion on a TTM basis. While that’s plenty for Caterpillar to continue investing in its business, and pay the dividend, it does reduce flexibility for things like acquisitions and share repurchases. Caterpillar will almost certainly defend its nearly three decades of dividend increases with everything it has, so I have no concern there. But it is already heavily indebted, so borrowing to fund additional capex, acquisitions, or share repurchases is less of an option.

Let’s boil all of this down into EPS revisions to get a sense of what we’re valuing given the factors above.

This year’s EPS revisions look nearly identical to revenue, as do the out years, with their downward sloping lines. While that’s not great by any means, there is at least ample room between the lines, indicating meaningful year-over-year growth. If estimates stay this way, Caterpillar is probably fine. However, given the factors discussed above – potential revenue destruction and lower margins – I’m quite concerned we’re just seeing the tip of the iceberg when it comes to downward EPS revisions. My assessment is the risk to EPS estimates is firmly to the downside, so there’s not a lot of incentive to jump in and own this stock right now.

Let’s value this thing

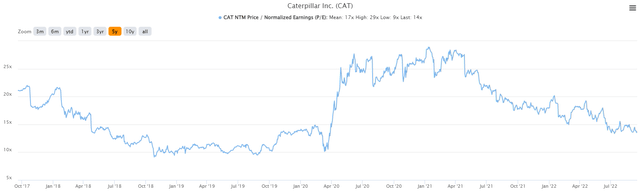

We’ll start with a look at the forward P/E history of Caterpillar to get a sense of where the stock has come from for the past three years.

The stock traded for some time with a very low forward P/E in the area of 10X earnings, before exploding higher during the COVID rally to nearly 30X. We’re back to 14X earnings today, as the market has been much less willing to pay for Caterpillar’s earnings than it was a year or two ago. This, like the relative strength we looked at earlier, is an indication to me that Wall Street thinks (or knows) that downward revisions are coming. If the opposite were the case, the forward P/E ratio would be expanding, not contracting.

In addition, 14X earnings just isn’t that cheap for Caterpillar, even if you think it’s going to see strong revenue and earnings in the years to come. Maybe it will, but if it doesn’t, we could easily see 10X earnings again during an earnings contraction. That’s a lot of downside potential from 14X, particularly if the estimates themselves are declining; a lower valuation on lower earnings is a nasty combination.

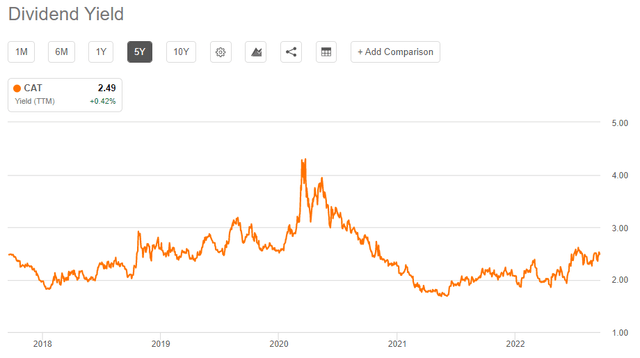

Finally, since Caterpillar is a dividend stock, we can value it on the yield it provides shareholders, which is below.

The yield was at its nadir during the peak of the COVID rally, which makes sense. It’s come way off the floor since then but still sits essentially in the middle of its historical range. So, like the forward P/E info we looked at, the yield suggests Caterpillar is probably fairly priced, but certainly not cheap.

Final thoughts

To my eye, this is exactly the wrong time to buy Caterpillar. We have a significant risk of revenue and earnings revisions downward, margins are struggling and face continued challenges, and the stock isn’t even cheap. Given all of this, it certainly appears to me the best course of action is to sell Caterpillar and invest elsewhere.

Be the first to comment