AntonioGuillem/iStock via Getty Images

When the U.S. reported consumer price inflation of 8.3%, markets reacted poorly. The Dow Jones (NYSEARCA:NYSEARCA:DIA) lost 1,276 points. The S&P 500 (SPY) declined by 178 points or 4.3% while Nasdaq (QQQ), sensitive to valuation lost the most. It fell 632 points or 5.16%. The Dow’s four-figure drop is a negative turning point for market sentiment. Not only does it catch the reader’s attention from headlines (irony intended), but it also repeats the drop from the previous month.

Inflation Guarantees Higher Rates

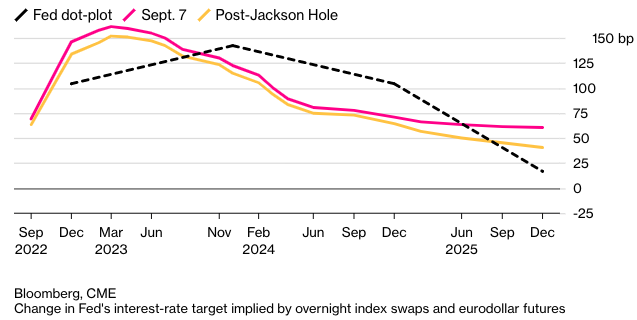

For a few days preceding the CPI report, markets speculated the Federal Reserve would raise rates by only 50 basis points.

Bloomberg

In the chart above, US swaps implied an 80% chance of a 75 bps rise. The 8.3% CPI reading should lift the chances to nearly 100%. Markets did not like core inflationary rates rising. Shelter, food, and medical care indexes contributed to the increase. The energy index fell by 5.0%. This would lower the cost of automobile -related travel. However, persistently high energy prices will lift costs throughout the channel.

Consumers will need to embrace higher costs for the next several months. Weighted by its share price, companies like Microsoft (MSFT), McDonald’s (MCD), and Amgen (AMGN) contributed on the Dow’s fall on September 13, 2022.

|

Ticker |

Company |

Price |

Price Chg. (%) |

|

UNH |

UnitedHealth Group |

$513.96 |

-3.25% |

|

GS |

Goldman Sachs Group |

$328.39 |

-4.14% |

|

HD |

Home Depot |

$277.93 |

-6.59% |

|

MCD |

McDonald’s |

$254.33 |

-2.32% |

|

MSFT |

Microsoft |

$251.99 |

-5.50% |

|

AMGN |

Amgen |

$226.86 |

-4.53% |

|

V |

Visa |

$199.67 |

-3.37% |

|

HON |

Honeywell Intl |

$184.98 |

-3.67% |

|

CAT |

Caterpillar |

$184.31 |

-4.20% |

Data from Stock Rover

Investors may take advantage of Microsoft’s weaker stock to build a position. The software giant’s cloud products are mostly immune to inflationary pressures. Customers will not cancel Office 365 because food prices are rising. They have no alternative to the Office productivity product. Conversely, Intel (INTC) lost 7.2%. Semiconductors are typically a leading indicator of the economic slowdown.

Intel management cannot blame weak stock markets for its underperformance. The company failed to launch a discrete graphics card before prices collapsed. NVIDIA (NVDA) and Advanced Micro Devices (AMD) face a glut in GPUs. This will pressure profit margins until both firms release a product refresh.

NVIDIA faces particularly stronger margin pressures. After the Ethereum merge on September 15, 2022, miners will dump their GPUs. The merge ends “proof of work.” It removes the need to rely on GPU-powered machines to mine Ethereum.

Intel may attract buyers. The U.S. is reportedly considering sanctions to deter China from invading Taiwan. After the U.S. funds domestic manufacturing through the CHIPS act, Intel will benefit. Investors holding NVIDIA and AMD could buy Intel as a hedge against further trade wars between the U.S. and China.

UnitedHealth Fell 3%

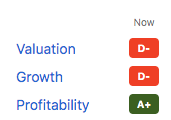

The 3% decline in UnitedHealth’s $514 share price added to the Dow’s woes. UNH stock signaled a peak, or double top, at around $550. When the market failed to take the stock above that level, it created selling pressure on the stock. Seeking Alpha’s quant score warned of weak value and growth:

UNH Stock Grade (SA Premium)

Investors do not appreciate that CVS Health (CVS) beat UNH on the bid for Signify Health (SGFY). As the bearish phase on the Dow Jones resumes, companies that acquired firms at a hefty premium could underperform the index.

In the restaurant sector, rising staff costs could hurt McDonald’s. MCD stock scores a D on both valuation and growth, similar to that of UNH stock. Still, it earns an A+ on profitability.

After Ukraine regained its lost territory from Russia, McDonald’s is poised to re-open more locations in Ukraine. It said last month that it would reopen in the coming months.

Buy Dow Stocks Falling the Least

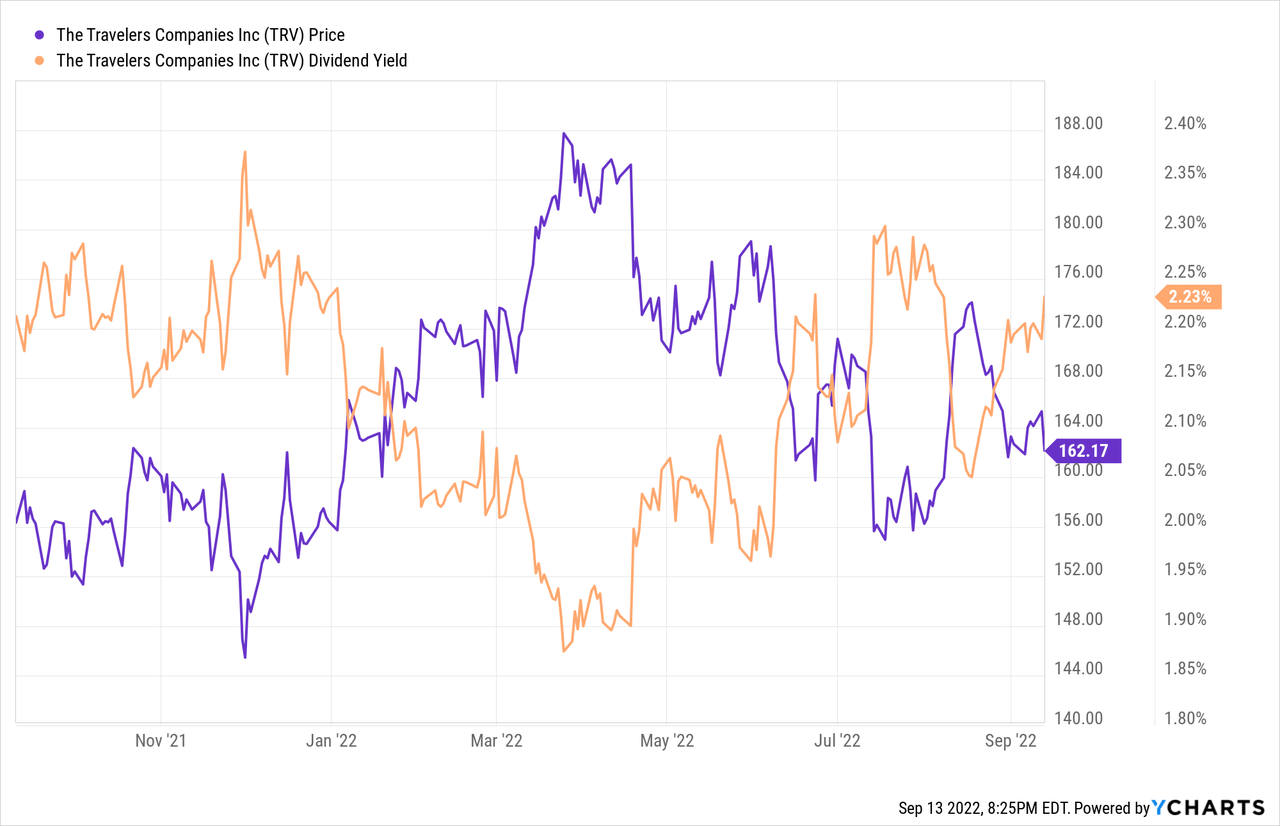

Travelers (TRV) fell the least. Despite scoring a D+ on valuation and a D on growth (per Seeking Alpha’s quant score), the company’s strong profitability matters.

|

Ticker |

Company |

Price |

Price Chg. (%) |

|

TRV |

Travelers Companies |

$162.22 |

-1.88% |

|

CVX |

Chevron |

$159.41 |

-1.90% |

|

WMT |

Walmart |

$135.22 |

-2.06% |

|

PG |

Procter & Gamble |

$138.18 |

-2.07% |

|

MRK |

Merck & Co |

$86.28 |

-2.13% |

In the quarter ahead, Travelers should report lower catastrophe losses. Investors should expect ongoing weakness in net investment income and weaker core return on equity. This would continue the trend from the last quarter. The company reported net written premiums rising by 12%. It benefited from higher renewal premium charges in both domestic automobiles and the Homeowner and Other segment.

Travelers will thrive as inflation remains elevated.

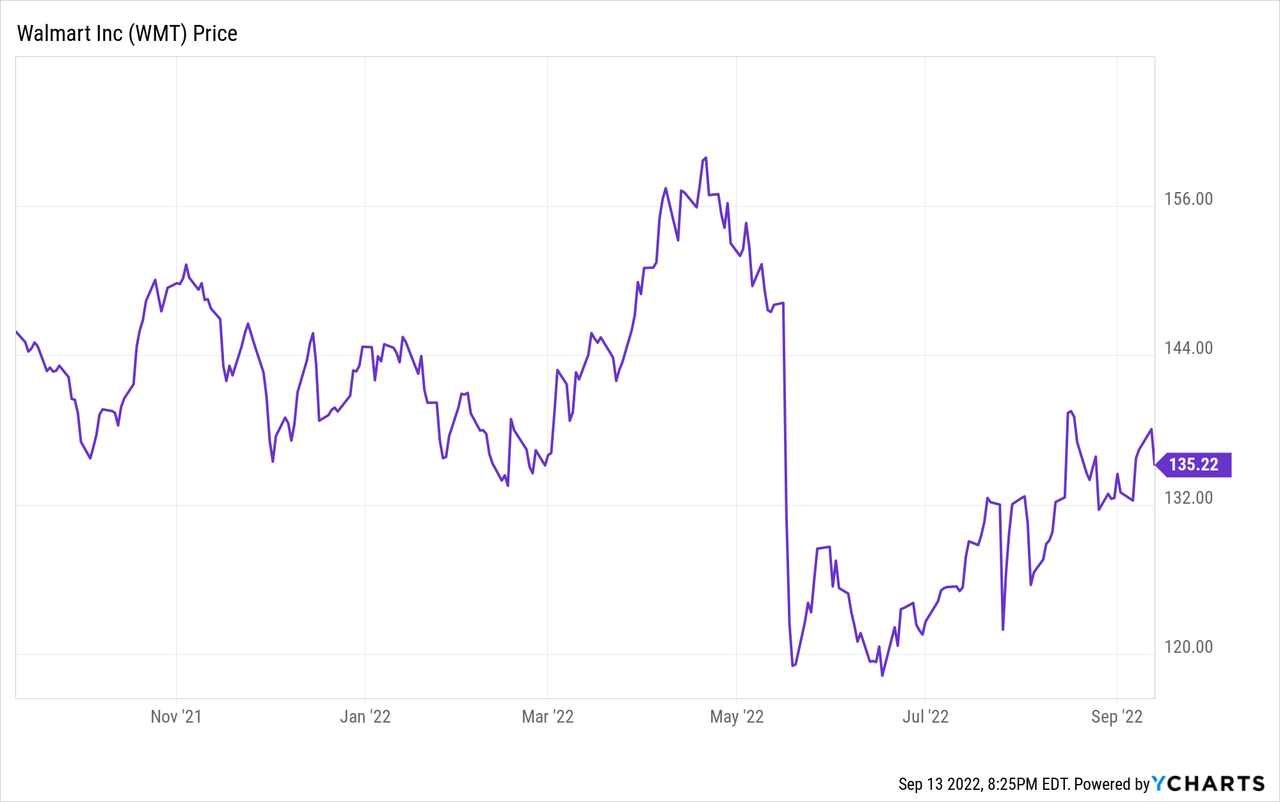

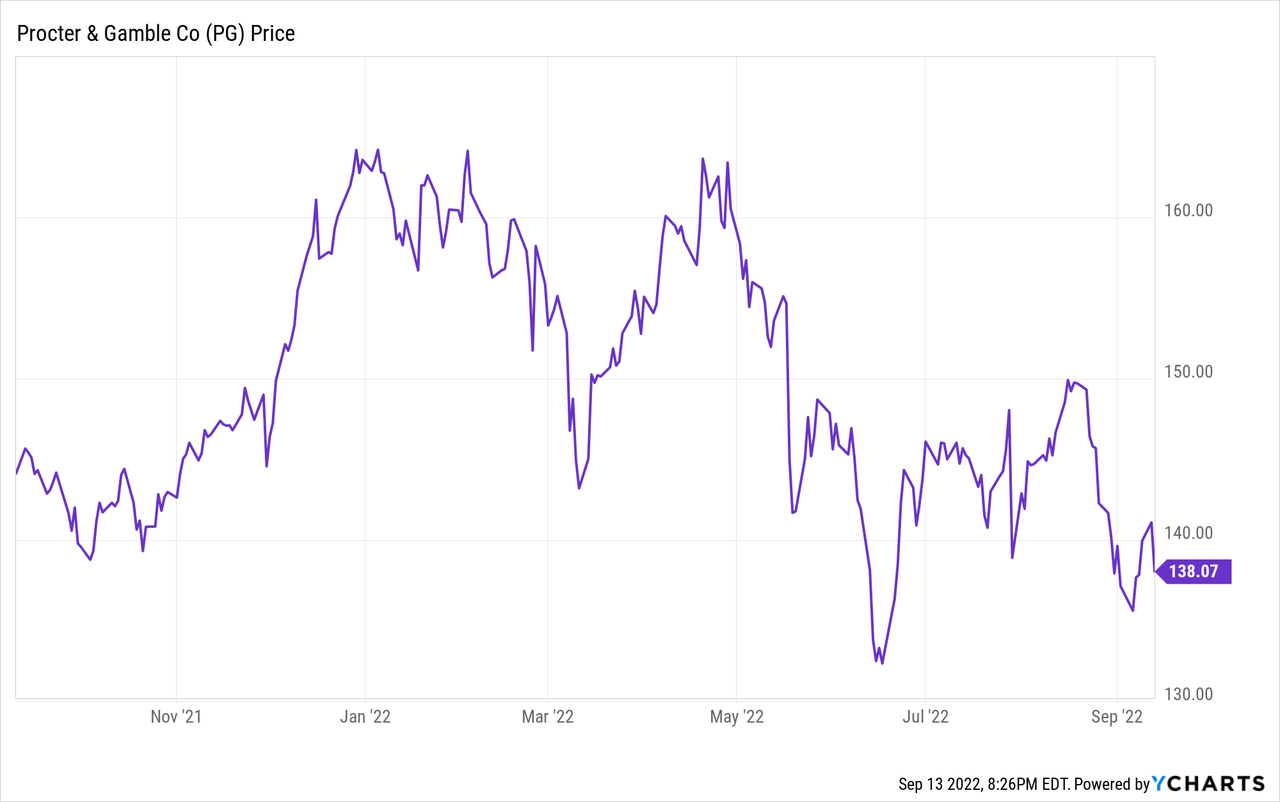

In the consumer sector, Walmart (WMT) already worked through its mismanaged inventory. WMT stock bottomed at around $120 in May 2022. Its product mix is ready for higher inflation levels. Conversely, investors are not convinced with P&G (PG). PG stock is only 6.7% above its 52-week low.

Above: WMT stock recouped most of its losses.

Below: PG stock.

P&G is confident that it has the right product mix. It is not ignoring the $6 billion in extra costs coming from inflation. Instead, it will prepare for volume growth as it manages through the supply chain disruptions, region by region.

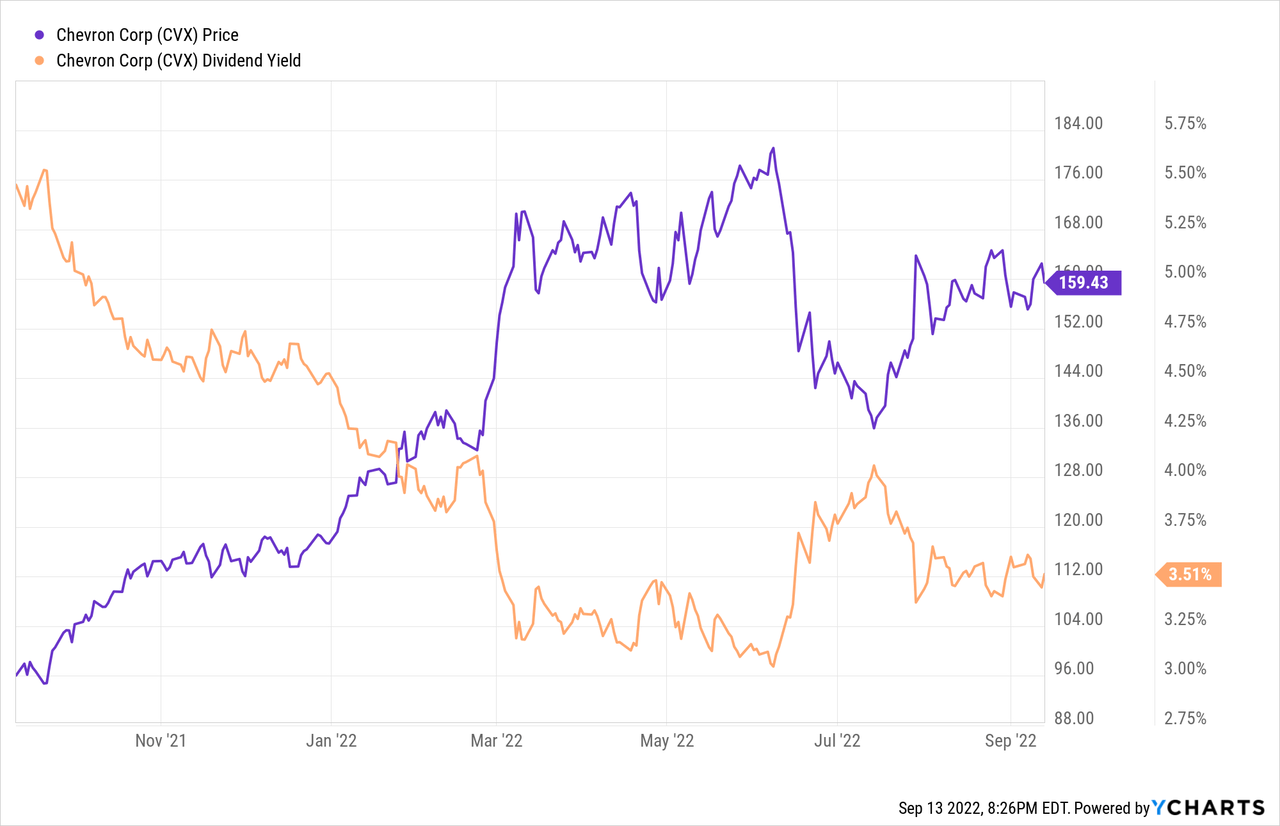

In the energy sector, Chevron (CVX) is unlikely to underperform the Dow Jones. Energy inflation will persist. The stock’s dividend yield of 3.56% might rise. Chevron has strong cash flow generation. It is very disciplined in allocating its capital. Unlike past energy booms, the firm will not add debt to its balance sheet.

Above: CVX dividend is steady at around 3.5%.

Chevron modeled for a downside of $50/bbl and an upside of $75/bbl.

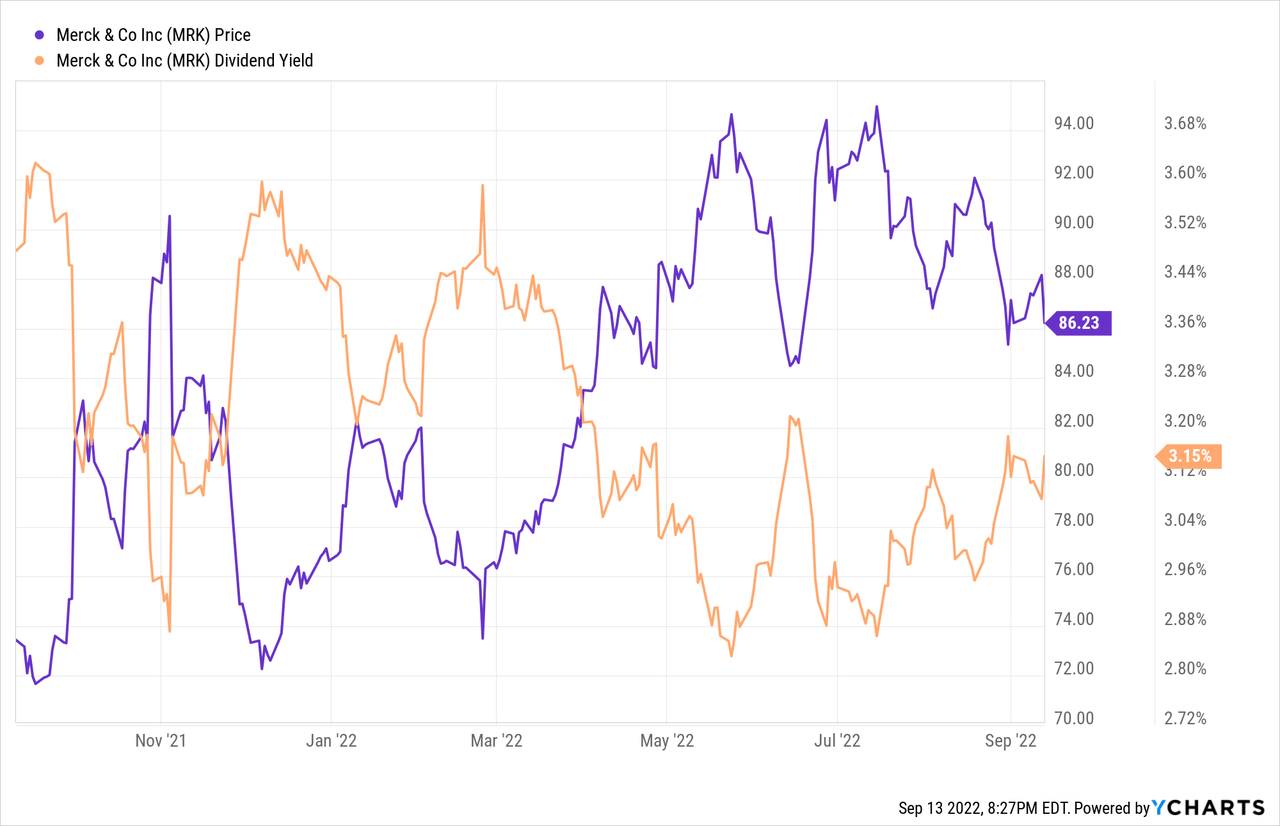

In the drug sector, Merck (MRK) demonstrates strong cash flow.

Above: MRK stock dividend yield rose since bottoming in May 2022.

Investors will gravitate to companies with that characteristic. All of Merck’s growth drivers are durable. Its business will withstand a slowdown and high inflation. Merck is working on combination products. After governmental approvals, it should lead to profit expansion.

Be the first to comment