JHVEPhoto

Investment thesis

Discretionary spending is slowing, and Target Corporation (NYSE:TGT) has been missing consensus estimates for 3 consecutive quarters as inventory piles up, revenue slows, and margins shrink. The stock has returned a negative 36% and has trailed the S&P Retail ETF (XRT) by >4 percentage points YTD. As a relative underperformer given its exposure to general merchandise vs. necessities, Target may be well positioned to outperform the benchmark as management clears thought excess inventory and establishes a floor for margins. As a result, I propose a barbell play on the current retail landscape, with Costco (COST) being on the low-risk/reward end (more here) and Target on the high-risk/reward end, that should serve investors well exiting the macro.

What’s the problem with Target?

Target is dealing with too much inventory in a highly promotional environment where increased costs of living are crowding out discretionary spending. On the Q3 earnings call, management made the following comments:

- “Consumers are feeling increasing levels of stress, driven by persistently high inflation, rapidly rising interest rates and an elevated sense of uncertainty about their economic prospects.”

- “Our guests are exhibiting increasing price sensitivity, becoming more focused on and responsive to promotions and more hesitant to purchase at full price.”

- “We see our guests holding out for and expecting promotions more than ever, spending less on regularly priced items.”

Almost all of the slowdown in sales was driven by discretionary categories: Apparel, Home and Hardlines. More specifically:

- Apparel comps were down slightly in Q3 driven by softness in swim, women’s accessories and basics.

- Home declined in mid-single digits despite strong performance in seasonal goods.

- Hardlines declined mid-single digits due to soft electronics and sporting goods sales.

- Sales saw weakness in the final few weeks of October which persisted through the first few weeks of November.

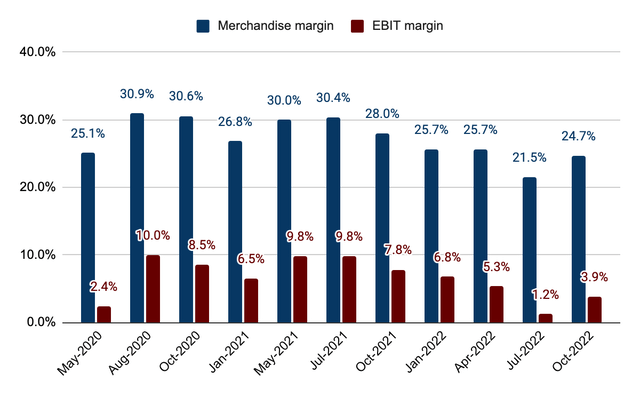

While Q3 gross margin of 24.7% saw an improvement from 21.5% in Q2, it was still materially lower than 28% in 3Q21. The lower gross margin was due to:

- Increased markdowns as consumers have become more price sensitive, while discounts are expected to have a greater impact in the current quarter.

- Inventory shrinkage due to theft and organized crimes, which is expected to reduce gross profit by $600 million C2022.

- Incremental costs of managing early inventory, which should improve in Q4 and going into 2023.

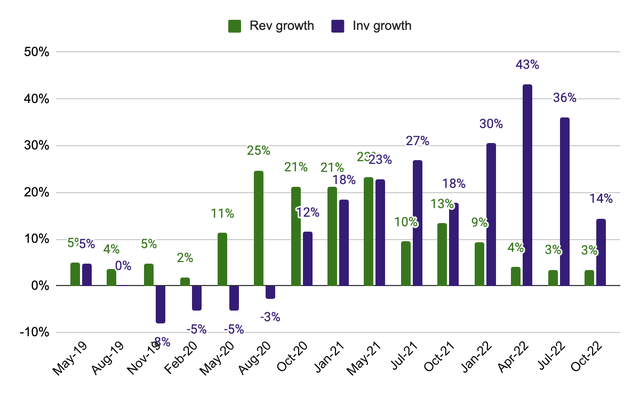

Like many retailers, Target was in an under-inventory position during the pandemic but now finds itself in a position of excess stock. We can see in the chart below that revenue growth outpaced inventory growth by a wide margin for several consecutive quarters but the relationship inverted from C2Q21 and has become rather concerning since. Over the past 4 quarters, the average delta between revenue and inventory growth is -26% (meaning inventory significantly outgrew revenue) compared to -19% of Walmart (WMT) and -6% of Costco.

In the first 3 quarters of 2022, inventory increased by 43%/36%/14% YoY while revenue grew just 4%/3%/3% YoY. As a percentage of total assets, inventory represented over 30% in the most recent quarter vs. ~23% in periods before the pandemic. Adding insult to injury is a TTM gross margin of 25.5% vs. a 5-year average of 29.6% between 2015 and 2019. This is a result of Target’s higher general merchandise mix of 54% vs. Walmart’s 32% and Costco’s 27% in the current environment where spending patterns have been pivoting towards necessities due to high inflation and services due to reopening.

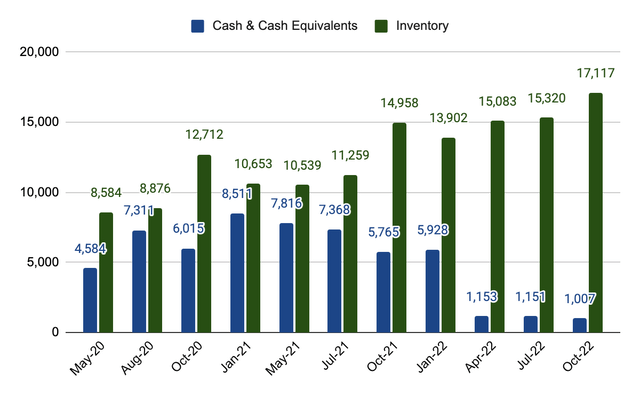

When inventory piles up while sales stagnate and margins shrink, cash goes down and the need to liquidate slow-moving stock becomes an urgent matter. In C4Q20, Target’s cash position reached an all-time-high of $8.5 billion. However, that number is down to just $1 billion in the 3Q22. During this period, inventory grew from just over $10 billion to $17 billion.

Evidently, Target is in a tough spot and operating results will likely remain choppy over the next several quarters as management slashes prices even further to get rid of excess inventory. For Q4, management expects an operating margin of roughly 3% as they work through excess inventory. Longer term, the team expects revenue to grow in low-single digits annually and believes they can realize $2-3 billion in cost savings over the next 3 years (roughly $833 million per year at the midpoint).

What’s priced in?

Street estimates call for 2022 revenue of $108 billion (+2.3% YoY vs. 13.3% in 2021) and diluted EPS of $5.53 vs. $14.10 in 2021. Target provided Q4 comp guidance of negative low-single digits and an operating margin of 3% (subject to a wide range of outcome) vs. >6% previously. The updated outlook suggests a 33% reduction to FY22 guidance (3rd guide down of the year), but encouragingly, shares reacted with a 13% decline on 11/16 and did not breach the July low of $140. This suggests the stock may have de-risked most of the foreseeable negatives.

November retail sales showed continued weakness and an underwhelming Q4 should again surprise no one given the pull-forward in demand last year. While 1Q23 will likely see more pain as it’s typically the slowest quarter of the year, inflation has show signs of peaking and the setup for the rest of 2023 looks quite positive against 2022. Though it would be unrealistic to expect discretionary spending to return to levels seen during the pandemic (driven by many transitory factors including WFH and government stimulus), markets will likely appreciate any early signals of margin stabilization and a more rightsized inventory position going forward.

When to buy the stock?

Over the past 6 months, FY23 EPS estimates have seen a 20% downward revision to $9.82, indicating a forward P/E of 15x. While this not exactly cheap compared to previous lows (9x/11x/11x/13x/12x in 2008/11/18/20/22), markets don’t necessarily work like exact math where the forward multiple will mechanically fall back to 11x (or $108 a share) to reflect today’s dire fundamental prospects. Considering the setup in 2023 looks more favorable than not, I see the risk/reward as compelling with prices consolidating in the technical range of $140-145.

As a result, I would be a buyer at current levels on Target’s prospects as a turnaround story in 2023/24. While any news going forward will be bad, it will likely be less bad than what’s already been discounted in the Target Corporation stock price.

Be the first to comment