Feverpitched

In a recent article entitled “Why I Stopped Buying Rental Properties to Buy REITs Instead,” I present 12 reasons why REITs are more rewarding investments than rental properties in most cases.

In short:

- REITs have a cost advantage thanks to their scale.

- REITs can access capital at a lower cost to grow faster.

- REITs have the best talent for working for them.

- REITs develop their own assets to boost returns.

- REITs often have side businesses to earn additional profits.

- REITs can grow externally via spread investing.

- REITs do a better job at preserving wealth during downturns.

- REITs are better aligned with shareholders than property managers.

- REITs often buy properties off-market via sales and leasebacks.

- REITs have superior bargaining power with tenants.

- REIT investors do not pay any transaction cost.

- REIT investors can invest each month, resulting in stronger compounding.

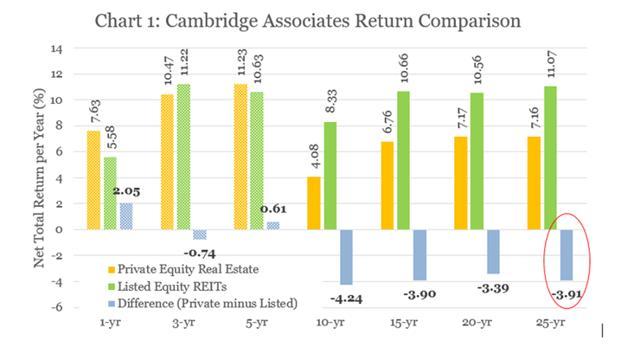

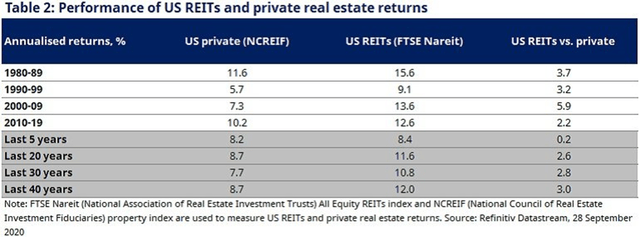

As a result of these advantages, REITs have historically earned 3-6% higher annual returns than rental properties.

That’s not just my opinion. Several studies on this specific topic come to the same conclusion: REITs outperform private real estate. I link the results of a few of these studies below:

But higher returns imply higher risk, right?

That was the response of many rental investors to my article.

They claim that REITs are a lot riskier than rental properties because they suffer the high volatility of the stock market. A few pointed out that REITs (VNQ) are down 20% year-to-date, which is a lot worse than the performance of private real estate.

But are REITs really riskier than rental properties?

No, of course, they aren’t. Rental investors suffer many misconceptions about REITs and they are making poorly-educated observations about them.

In reality, REITs are a lot safer than rental properties. Below, I present 5 reasons why:

Reason #1: REITs are diversified. Rentals are concentrated.

REITs typically own 100s, if not 1000s of properties, which means that they are well-diversified. They don’t rely on a single tenant, a single property, or even a single region in most cases. If one tenant decides to vacate a property, it is no big deal. To give you an example, Realty Income (O) owns … properties across … states. If one property or even one region is performing poorly, the REIT will still be perfectly fine.

Rental investors, on the other hand, typically will only own 1-3 properties, which means that they are highly concentrated. If a tenant leaves your property, you could see your income drop by 50% or more overnight. Can you imagine how volatile a REIT would be if it reported that its income had dropped by 50%? That’s the reality of rental properties.

Reason #2: REITs are conservatively financed. Rentals are highly leveraged.

REITs typically use 35-50% leverage and this leverage is structured in a conservative way with different types of debts, some preferred equity, and well-staggered maturities. They may also have investment grade credit ratings, which gives them far superior access to capital, even when things go south. A good example would be UMH Properties (UMH), which makes use of both, debt and preferred equity (which has no maturity risk), has well-staggered debt maturities, and only uses 40% leverage in total, which nicely boosts returns, without exposing the REIT to too much risk.

Rental investors, on the other hand, commonly use 70-80% leverage and their source of leverage is not diversified. More leverage means higher risk, especially since it is applied to a concentrated investment. 80% leverage essentially means that if your property loses 20% in value, you have lost everything. There are lots of things that could cause your property to lose 20% or more in value and many of these things are completely out of your control. A few examples: a tenant refuses to pay and trashes your property when you try to kick him/her out; your roof has a leak, but your tenant never informs you about it and it causes significant water damage that your insurance won’t cover; the location of your property deteriorates due to rising criminality in its area; etc…

This explains why REIT bankruptcies are extremely rare, but 1000s of rental property investors file for bankruptcy protection each year.

Reason #3: REITs investors enjoy limited liability. Rental investors are exposed to significant liability risk.

Something very important that most investors appear to ignore is that REIT investors enjoy all the benefits of real estate investing without having to put their own liability on the line. REIT investors don’t sign any of the contracts whether it is the loan agreement or the lease agreement.

They are perfectly protected by the limited liability of the REIT structure and they can never lose more than what they invested. Their name is not on the line, which is a huge advantage for anyone who knows something about liability risk.

Rental investors, on the other hand, are very heavily exposed to liability risk. They sign on all the loans themselves and ultimately, even if you have an LLC or insurance, you are the one who will get sued by tenants and have to deal with all sorts of liability issues. LLCs don’t offer perfect protection, far from it, and many rental investors have had to learn this the hard way.

Reason #4: REITs are liquid and public. Rentals are illiquid and private.

REITs are public vehicles that are transparent and highly scrutinized by 1,000s of analysts and investors as well as the SEC. It pushes the management to work in the best interest of shareholders in most cases, and best of all, if you don’t like how things are going, you can exit your investment at any time. That’s the beauty of liquidity.

Rentals are the opposite. They are opaque investments. You don’t have access to much information and so you heavily rely on a broker who wants to sell the property to get a commission and a property seller, who is going to be just as conflicted as the broker. Naturally, there is high risk that you miss some important information as you buy the property. In fact, that information may be even hidden from you.

And worst of all, if you want out of the property, you may be stuck with it for a long time to come. Rental properties are not liquid and selling one may take a lot of time and money.

Reason #5: REITs are less volatile than rental properties in an apple-to-apple comparison.

REITs are diversified, conservatively financed, public, and liquid investments.

Rental properties are concentrated, highly leveraged, private, and illiquid.

It would be perfectly logical, then, that REITs would be less volatile than rental properties.

Yet, a lot of people mistakenly think that rentals are less volatile simply because they don’t get a daily quote and it gives them a false sense of safety. But if you actually tried to sell your property daily, you would receive a lot of different offers, and the value of your equity would be extremely volatile (much more than REITs) since you are more heavily leveraged.

A 5% variation in the offer, would result in 25% volatility in your equity value if you’re 80% leveraged. Remember that what you see in the stock market is the equity value so you need to adjust for that to have an apple-to-apple comparison of volatility.

There has actually been a study on this topic. Brad Case, PhD, CFA found that REITs were less volatile on average than private properties and made the following note:

“Is it believable that public real estate is actually less volatile than private real estate? It’s not just believable, it’s to be expected. Volatility is a measured of uncertainty regarding asset values. Think of a crisis: people trade assets at lots of different values because they have so much uncertainty regarding the factors that determine the asset values: the future stream of earnings, and the appropriate discount rate. A market in which more transactions give investors greater information about those underlying factors-that is, a market that is liquid and information-efficient, such as the stock market in which listed equity REIT stocks trade-SHOULD be less volatile than an illiquid, information-inefficient market such as the market for properties or (worst!) the market for private equity fund shares.”

Bottom Line: Just because something isn’t traded does not mean that it is safer

REITs may occasionally experience the ups and downs of the stock market. As an example, they are down quite considerably this year.

But that does not make them riskier investments than rental properties.

On the contrary, REITs are much safer investments because they are diversified, professionally managed, conservatively financed, liquid, and public.

So ultimately, you are getting better returns with less risk and less effort by investing in REITs in most cases.

This is why I stopped working in private equity real estate and decided to become a REIT analyst, and today, my real estate portfolio is almost exclusively invested in REITs.

Be the first to comment