Dr_Microbe/iStock via Getty Images

Healthcare is Down on Bearish, Persuading Investors to Unload Some Names

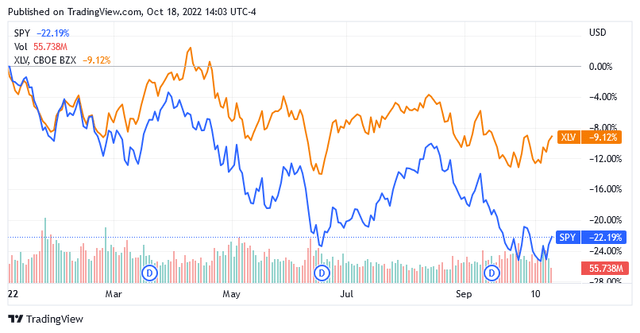

Bearish sentiment raging in the markets due to a series of stalled negative macro issues such as runaway inflation and high commodity prices due to the war in Ukraine has not been good for US-listed stocks for some time, as well as healthcare stocks.

The Health Care Select Sector SPDR Fund (XLV), a benchmark for healthcare stocks, is down more than 9% so far this year, but that’s just one benchmark performance. The downturn for many healthcare stocks has been much harsher, and many observers argue that healthcare is one of the hardest-hit sectors.

But not all ills come to harm, as they say.

The depreciation creates an opportunity to add to positions in quality healthcare companies and take advantage of incredibly low share prices. But it can also help persuade even the most die-hard to unload positions in subpar healthcare stocks holding poor prospects.

Reata Pharmaceuticals, Inc. (NASDAQ:RETA) appears to be one of those healthcare stocks that investors may be less confident about continuing to hold in their portfolios.

Reata Pharmaceuticals, Inc. in the Healthcare Industry of Biotechnology

Based in Plano, Texas, Reata is a biopharmaceutical developer of novel therapeutics for patients suffering from serious or life-threatening diseases.

Currently, the treatment portfolio that Reata is developing includes two lead investigational compounds which, as the company notes in its most recent earnings results report, have not been recognized by any regulatory body for either their safety or efficacy.

The two potential treatments are based on the chemical compounds bardoxolone and omaveloxolone, which have anti-inflammatory and tissue-protective functions.

Bardoxolone

The first compound is in phase 3 clinical trials and is aimed at treating patients with an inherited form of chronic kidney disease [CKD] and hypertension in the pulmonary arteries or the right side of the heart. The first condition is caused by Alport syndrome while the second condition is called pulmonary arterial hypertension [PAH]. This latter can be caused by several diseases, but the one that’s the target of Reata’s treatment candidate is associated with connective tissue disease.

Bardoxolone has been granted orphan drug designation by the US Food and Drug Administration [FDA] and also by the European Commission for its use in the treatment of Alport syndrome and autosomal dominant polycystic kidney disease [ADPKD].

The FDA’s designation of an orphan drug means the drug presents itself as a promising treatment for a disease that affects 200,000 people or fewer in the United States. Since this disease is considered a rare disease or condition due to the small patient population, hence it is also called an orphan disease.

Orphan drug status allows a company to be the exclusive marketer of the product for a period of up to 7 years, among other benefits. These consist of reimbursement for costs related to research and development of the treatment for orphan diseases.

Targeted Medical Condition:

Alport syndrome is a form of kidney inflammation [nephritis], but it has a genetic basis, as the condition is caused by a specific mutation in a gene that produces a protein in connective tissue. The disease presents itself with several symptoms such as blood and protein in the urine, high blood pressure and swelling in the legs, feet, joints and close to the eyes [edema].

If not treated with dialysis or an operation of a kidney transplant, male patients with Alport syndrome typically have a shortened lifespan, while female patients typically have a normal lifespan. Alport syndrome is a rare disease affecting 0.01% to 0.02% of the US population, resulting in approximately 30,000 to 60,000 US citizens living with the condition.

Pulmonary arterial hypertension [PAH] associated with connective tissue disease, the second condition targeted by Reata’s bardoxolone, cannot be cured according to the current state of medicine, but treatments can help relieve symptoms somewhat. Amazingly, although there is no cure for PAH, median survival has increased significantly, from 2.5 years 30 years ago to 7 to 10 years today and even up to 20 years for someone.

Unfortunately, even with therapy, PAH can get worse over time, but if left untreated, the condition can progress to life-threatening heart failure.

PAH is an orphan disease as it affects 0.0015 to 0.005% of the general US population, with peaks of incidence in certain groups of patients, such as patients with sickle cell disease, of whom 2% to 3.75% also have PAH.

Regarding the proposed bardoxolone treatment for CKD patients with Alport syndrome, the FDA denied the approval of the drug in a Complete Response Letter [CRL] last February. That means the company needs to fix some deficiencies before launching a new one or resubmitting the application for US approval.

Omaveloxolone

Omaveloxolone’s second chemical compound is in the second phase of a clinical trial aimed at developing the drug to treat patients with Friedreich’s ataxia and various forms of chronic kidney disease [CKD].

Omaveloxolone has received orphan drug designation and accelerated review from the FDA for its use in the treatment of Friedreich’s ataxia. The accelerated review designation helps to facilitate the development of the treatment. The compound has also received the designation for rare pediatric diseases.

Targeted Medical Condition:

Friedreich’s ataxia has a genetic cause, namely a specific gene mutation that is inherited from both parents. Friedreich’s ataxia shows a predisposition to disturb some of the nerves in the body and symptoms can very often appear as early as late childhood. These include difficulty walking, extreme fatigue, and various sensory and language disorders, including slowed speech. These symptoms have a tendency to aggravate with age.

Unfortunately, people with this condition have a shorter life expectancy than people in a normal condition, with most patients reaching 30 years. However, the number of patients who can reach 60 years or even beyond is significant.

Among the inherited disorders of ataxia, Friedreich’s ataxia is the most frequent one in the United States. But fortunately, it still occurs in a small 0.002% percentage of the general North American population.

More insights into the perspectives of the Treatment:

According to Reata Pharmaceuticals’ second quarter 2022 financial results report, when reviewing data from clinical trials conducted to date, the FDA was concerned about the effectiveness of the company’s omaveloxolone in treating the disease. From a clinical safety standpoint, the FDA was still reviewing the data, specifically to assess how safe omaveloxolone is for the heart of Friedreich’s ataxia patients.

The company proposed to address the FDA’s concerns by submitting additional and updated data to the New Drug Application [NDA] to show its product is safe and effective in treating patients with Friedreich’s ataxia.

For the time being, however, the FDA is not considering convening an advisory committee meeting to review Reata Pharmaceuticals’ NDA on the safety and efficacy of omaveloxolone in Friedreich’s ataxia patients.

Additional Portfolio Treatments:

The portfolio also includes additional treatments being developed for neurological diseases and various autoimmune, inflammatory and fibrotic diseases.

The Financial Situation to Support Pipeline Development

As of June 30, 2022, the balance sheet provided the company with nearly $482 million in cash and short-term investments, compared to $142.5 million in total debt comprised primarily of operating lease liabilities. Those liabilities currently carry about $45 million to $50 million in annual interest expense, which the company doesn’t appear to be recovering.

The company, which is still in clinical development, is unable to generate operating income to meet its financial obligations.

In addition, the company incurs annual operating expenses of between $105 million and $110 million, still funded entirely from cash, with the expectation that the first treatment can be approved for commercialization as soon as possible.

The company believes it has sufficient funding to continue advancing its pipeline of potential treatments and to pay administrative staff for the next two years, but the outlook is not good at this time.

A Bleak Outlook

There isn’t much news regarding the treatment of CKD patients with Alport syndrome under the FDA’s CRL, which, while not implying rejection, does nothing to be optimistic about the future of this potential treatment.

Regarding the company’s treatment of patients with Friedreich’s ataxia, this is currently shrouded in very thick clouds. Initially, it was rumored that the FDA was planning an advisory committee meeting, with a decision expected by the end of November. Then this was pushed ahead to the end of February 2023. The company later said that no advisory committee meetings would be scheduled by the US regulator.

This juxtaposition of information that first corrected and then contradicted what had previously been indicated downgrades hopes of approval by U.S. regulatory agencies that would put the potential treatment on track to the final stages of commercialization.

In addition, Reata’s treatments are aimed at very rare diseases and, regardless of their future price, which will be very expensive to compensate for an extremely small number of patients, they are certainly not up to par in terms of the income they can generate compared to the most common treatments.

In light of the foregoing, investors who may decide to sell some shares of this company cannot be blamed, while the current headwinds, which appear to be particularly persistent, could lead the share price to further downside.

The Stock Price Looks Overvalued Due to The Ongoing Bearish Sentiment and a Poor Outlook for the Company’s Treatments

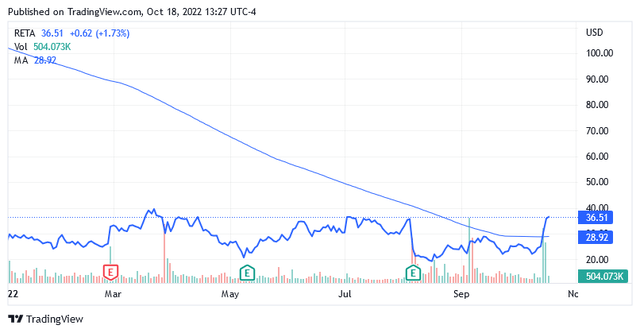

The shares of the stock were trading at $36.51 per unit s of this writing for a market cap of $1.10 billion and a 52-week range of $18.48 to $114.80.

The stock price is currently not at its lowest compared to its recent valuations and is trading well above the long-term trend of the 200-day simple moving average of $28.92.

Furthermore, the entrenched bearish sentiment that has hurt healthcare stocks so far will persist as long as headwinds from the war in Ukraine affect markets and the hawkish stance of monetary policymakers to curb runaway inflation fails to deliver meaningful results.

What will also most likely weigh on the stock’s future price is the poor outlook for the treatments the company is developing.

Wall Street, on the other hand, continues to view the stock in a different light, as analysts have issued an average buy rating with an average price target of $51.89.

Conclusion – Strong Market Headwinds and Meager Prospects Are Likely to Lead to Price Downsides

The company develops products to treat very rare genetic diseases that have received orphan drug status. The company has submitted phase 2 and phase 3 clinical trial data to regulators, but the U.S. Food and Drug Administration has still not addressed concerns about efficacy and safety.

There are still some shortcomings in the treatment of CKD patients with Alport syndrome.

The presence of conflicting information about an uncertain FDA meeting is thickening the clouds over the future of a potential treatment for Friedreich’s ataxia patients.

Additionally, the current bearish market sentiment, a hack for healthcare stocks, is not helping at all.

Be the first to comment