shank_ali

The Outlook for The Coal Price Is Positive Thanks to Favorable Framework

As of this writing, Newcastle Coal Futures (NCFMc1) expiring in October 2022 was trading at $390 per metric tonne [Mt], up a whopping 147.62% this year thanks to continued robust demand following the recovery from the Covid-19 crisis amid tight international supply.

The coal market fundamentals are expected to change significantly on the demand side and become more robust than ever due to the following factors.

China will continue to be a strong contributor to global coal demand as the Asian country ranks as the world’s largest consumer [50.5% world share]. In addition, economists say coal prices will rise in the coming years as many countries switch from gas to coal as prices for natural gas in spot price markets have skyrocketed following supply shortages caused by the war in Ukraine.

Looking ahead to the next 52 weeks, the coal futures price is expected to rise more than 25% from current levels, giving a target price of $490.15. And who knows what the longer-term price of coal could be as the catalysts — the energy crisis and geopolitical tensions — are likely to last into 2023 and beyond.

If investors are interested in profiting from expected higher coal prices, they could do so by increasing their exposure to US-listed coal mines. Higher coal should benefit the balance sheets of these public companies, which is ultimately good for shares.

Within the coal mining industry, Ramaco Resources, Inc. (NASDAQ:METC) appears to offer a growth opportunity to improve portfolio returns as the stock has some catalysts which, coupled with a benign coal price environment, should potentially lift the shares above current levels.

Ramaco Resources, Inc. Is An Interesting Player in The Coking Coal Industry

Headquartered in Lexington, Kentucky, Ramaco Resources, Inc. is a producer and seller of metallurgical coal [or coking coal] with operations in the United States. The company’s coal portfolio includes the Elk Creek complex and the Berwind Coal Complex.

The company in question produces metallurgical coal [also called coking coal], which is used in iron and steel processes as an essential component to produce steel at the ratio of 770 kg of coal to one ton of steel.

Metallurgical coal is a different product from thermal coal, which is instead used to generate electricity.

The company’s customers include blast furnace steel mills and coking plants in the United States and overseas metallurgical coal users.

Situation and Prospects of the Elk Creek complex

The Elk Creek complex contains 20,200 acres of control minerals and 16 coal units in southern West Virginia.

The plant accounts for about 73% of the total coal production per year, according to the current situation of operations.

The Elk Creek Mining Complex produced 985,000 tons of coal in the first half of 2022, down 7.2% from the same period in 2021.

The lower yield was in anticipation of expansion activities at the Elk Creek complex approved by the Board in July 2022. Based on the project, which includes expanding the capacity of the Elk Creek facility to accommodate a larger volume of material, Ramaco Resources’ main complex in West Virginia should be able to support much larger production in the future.

At the end of the expansion activity, the complex is expected to contribute approximately 3 million tons of coal per year by the end of the first half of 2023, which would represent a significant improvement from 2.05 to 2.15 million tons of coal expected for 2022 and compared to the 1,981 million tons produced instead in 2021.

To ramp up production in West Virginia, the company must have already started operating a continuous miner that provides access to the Maben coal seam. This is a recently acquired asset and the mining technology is operated remotely from the surface. The condition of the Maben mine is such that the mining technique just described is preferable to auger drilling. Maben’s mining activities enable low-cost production of metallurgical coal which is expected to contribute 250,000 tons in 2023 when operations ramp up.

This asset has tremendous potential for future production growth for Ramaco Resources in West Virginia. In terms of profitability, the sale of the coal produced by Maben will allow the capital invested to be recovered in less than two years. As for growth in future metallurgical coal volumes, if Maben were allowed to exploit other nearby underground fields, it would contribute production four times the volume forecast for 2023. This should add up to about a million tons thanks to lower volatile element content.

Situation and Prospects of the Berwind Coal Complex

The Berwind Coal Complex, which covers 41,300 acres of controlled mineral claims, includes an area of coal occurrences known as Squire Jim.

The coal deposit is located on the border between West Virginia and Virginia [part of the Appalachian Mountains]. Berwind includes the Knox Creek property consisting of approximately 62,100 acres of controlled mineral located in Virginia.

The complex accounts for about 27% of the total coal production per year, according to the current situation of operations.

The Berwind Coal Complex produced 347,000 tons of coal in the first half of 2022, a 3.8-fold increase over the previous year.

The Berwind pit and other activities to develop certain deposits and to rehabilitate the processing plant [here the coal product is made suitable for the secondary metallurgical coke market by removing mineral impurities] were partially disrupted by a firedamp explosion in July. Probably, a mixed gas mainly composed of methane [this gas is spontaneously produced in the coal mines] ignited on contact with the air, causing the explosion. Incidents of this type are not uncommon in coal mines.

The cleanup will return the Berwind Coal Complex to its pre-incident condition, although certain mines have been producing coal on a regular basis.

In conclusion: as a result of development and modernization activities, coupled with the anticipated long-term financial benefits from Ramaco Resources’ acquisition of 100% of the land and coal licenses between West Virginia and Virginia, the Berwind complex [including Knox Creek] will remain in place with high-quality coal mining to advance at a lower cost for many years.

Some benefits should begin to materialize as early as this year as coal operations in this part of the Appalachia will increase coal production 3-4-fold from 243,000 tons in 2021 to 750,000-950,000 tons in 2022.

Ramaco Resources Lays Groundwork for Increased Production

Ramaco Resources, Inc. appears to be significantly better positioned than previously in terms of production to offer in the markets.

As early as 2022, there are expectations for significant growth in coal production volume, which could reach 3.1 million, an almost 40% increase from 2021.

Production is then expected to increase to 4.3 million tons next year and 6.5 million tons before the end of 2025.

Coal Prices to Trade Higher Going Forward

This production growth potential is likely to be offered at higher metallurgical coal prices due to favorable macroeconomic and geopolitical factors, with tremendous benefits to the company’s balance sheet and likely share price.

The company already felt the importance of a higher price in the first half of 2022, mainly thanks to a rapid increase in the price of coal in the early months of the year.

As a benchmark, coal futures were up 205% year-over-year to an average price of $266.68 in the first quarter of 2022, leading Ramaco Resources, Inc. to report unprecedented earnings per diluted share of $1.66 and pro forma EBITDA of $122 million for H1 2022.

There is a good chance that increasingly higher prices in the markets could lead to further improvement in both lines of profit for 2022, on the order of 4-5x more than last year.

Furthermore, it is expected that a significant stock of some 180,000 tons of coal, which has been unable to sell in recent months due to transport problems, can now be offered at a much higher price. This will also help increase the profitability of the company, because, as they usually say, not all evil comes to harm.

As thermal coal increasingly displaces natural gas, which was made more expensive by the war in Ukraine, the price of thermal coal will exceed the price of metallurgical coal in the future.

But even in Ramaco Resources’ markets, the price of metallurgical coal is likely to increase as all markets gradually adjust to those that use thermal coal as a benchmark to determine the selling price.

These price-bound offshore thermal coal markets will initially attract increased interest from operators on the supply side, which is currently under-stretched relative to international coal demand. Even this mismatch in the global coal balance will drive up the price of the commodity.

Ramaco Resources’ markets are domestic and overseas with favorable pricing dynamics that could very well favor both at this time. Ramaco Resources promises flexibility and logistics organization to be able to profit from both foreign and domestic markets or those that can be reached by sea.

Ramaco Resources’ Competitive Advantage Over Many Coal Mining Companies

Finally, Ramaco Resources has the following competitive advantage over many other metallurgical coal producers. The expansion of the Elk Creek complex, the development of the Maben mineral asset, and the development and modernization activities of the Berwind complex will be funded entirely from internally generated funds without resorting to an additional capital loan.

As borrowing costs are on track to rise because of the US Federal Reserve [FED]’s policy of raising interest rates to curb galloping inflation, many competitors will not be able to keep up with Ramaco Resources’ growth as they will have to slow coal projects or suffer a decline in profit margins.

About costs: higher inflationary pressures due to the high cost of fossil fuels and other raw materials needed for mining activities posed a problem for Ramaco Resources as they translated into higher production costs. Current geopolitical conditions give the company reason to believe that this operating load will tend to decrease.

As the Fed works on inflation and Europe weathers the energy crisis by collectively managing fossil fuel stocks and linking energy prices to more stable markets, spot prices for fossil fuels such as natural gas and oil will fall, benefiting Ramaco Resources and other coal operators.

The Stock Price Seems Cheap

The stock was trading at $11.21 per share as of this writing for a market cap of $490.19 million and a 52-week range of $8.47 to $21.73.

The share price is trading below the middle point of $15.1 of the 52-week range and below the long-term trend of the 200-day simple moving average of $13.46.

Since its last high of $17.63 on June 7-8, shares are down 37.2%, providing an opportunity to increase exposure to this stock with very interesting growth potential by taking advantage of cheaper market prices.

The share price decline could be because part of the market believes a possible recession will affect demand for steel products and its main ingredient, metallurgical coal, forgetting that industrialization and urbanization are still strong in China.

China could still experience some economic disruption due to what appears to be too much of a zero tolerance to an outgoing Covid-19 virus, perhaps a way of not creating too great an imbalance in growth compared to the western world, as the latter is likely to be in recession.

Geopolitically, this could be a way of showing the western world that China is not an adversary but an ally to work with to achieve global growth and tackle climate change.

The stock also offers a dividend yield [TTM] of 2.99% as of this writing, as the company pays dividends on a quarterly basis. The next of $0.11 per common share is scheduled to be paid to shareholders on December 15, 2022. As a benchmark for assessing the attractiveness of Ramaco Resources’ dividend yield, the S&P 500 dividend yield is around 1.69%.

Wall Street’s Target Price and Recommendation Rating

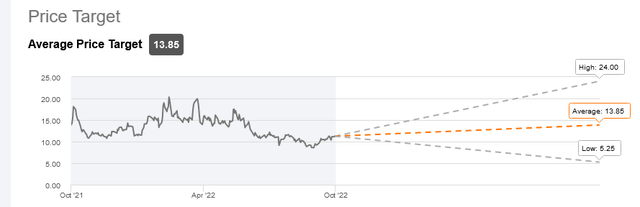

The stock has an average price target of $13.85 while recommendation ratings are 3 Strong Buys, one Buy and one Hold rating.

Analysts’ Recommendation Ratings:

seekingalpha/symbol/METC/ratings/sell-side-ratings

Analysts’ Average Price Target:

seekingalpha/symbol/METC/ratings/sell-side-ratings

Conclusion – This Stock Has Growth Potential at Cheap Conditions

Ramaco Resources has growth potential.

This can be financed with its own resources and without additional debt. The latter is no small feat as the cost of borrowing is rising due to the Fed’s aggressive interest rates to combat elevated inflation.

The prospects for the company’s coal markets appear positive given the likely evolution of the macroeconomic and geopolitical situation.

Be the first to comment