Justin Sullivan/Getty Images News

Right now, there is an opportunity to start, or double down on, an investment in Ford Motor Company (NYSE:F). The car brand is accelerating its transition to becoming a full-fledged electric vehicle (EV) manufacturer, and new product launches this year could power shares of Ford materially higher. Additionally, Ford is accelerating its push in the electric vehicle market by targeting about 600,000 electric vehicle sales just in Europe by FY 2026. As new electric vehicle models go on sale this year, Ford is set for a major revaluation!

Strong electric vehicle sales in February

Ford’s electric vehicle sales are surging, but I believe the market still fundamentally undervalues Ford’s electric vehicle potential. The car brand is gearing up to launch new electric vehicles this spring and customers, based off of reservations, seem to be eager to take Ford’s newest slate of electric vehicles off the company’s hands.

Ford is making serious inroads into the electric vehicle market in the U.S., and the density of its product lineup is increasing. The car brand just launched its new E-Transit in February, which is seeing rapid customer uptake from both small and large commercial companies. These buyers placed more than 10,000 orders with Ford for the E-Transit, ensuring that the firm’s newest electric truck solution is receiving a warm welcome.

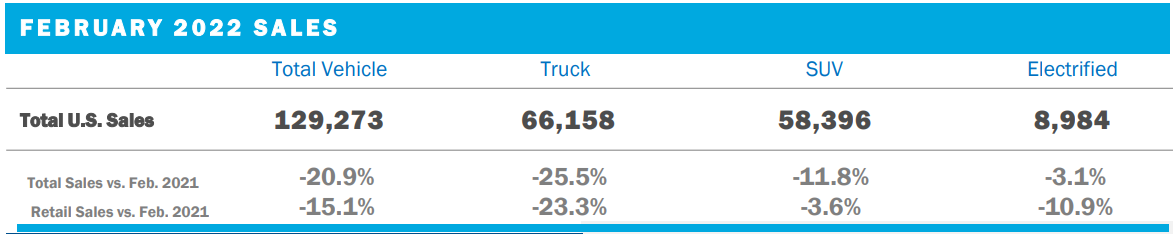

In total, Ford sold 129,273 vehicles in the U.S. in February, of which 8,984 units were electrified vehicles. Electrified vehicles, based off of Ford’s definition, include both battery powered vehicles as well as hybrid models, such as the Ford Escape. Ford’s electric vehicle sales in February represented a 7% share of total sales, and the electric vehicle share is set to go up dramatically until FY 2026 which is when Ford expects to produce 2M electric vehicles annually.

Ford

Ford’s total electrified vehicle sales surged 55.3% year-over-year in February. Ford’s current EV lineup consists of the Mustang Mach-E SUV, the E-Transit, the Maverick Hybrid, and various other hybrid passenger sedan models. The F-150 Lightning, which is coming to market this spring, is set to make a big impact on Ford’s EV sales as the model has amassed more than 200,000 reservations so far.

Europe is becoming central to Ford’s electrification plans

Ford has said that it wants to grow annual EV production to 2M units by FY 2026, and Europe is going to play an important part in Ford’s growth plans. Ford wants to produce and sell 600,000 electric vehicles just in Europe by FY 2026, which calculates to a roughly 30% share of expected global electric vehicle sales. To accomplish these sales goals, Ford is going to increase the density of its product lineup in Europe through the introduction of the E-Transit next quarter and six other EVs. Ford is accelerating its EV transition with heavy investments in Cologne/Germany, where the car brand is investing $2.0B to bring new EV models to market.

Tremendous free cash flow value

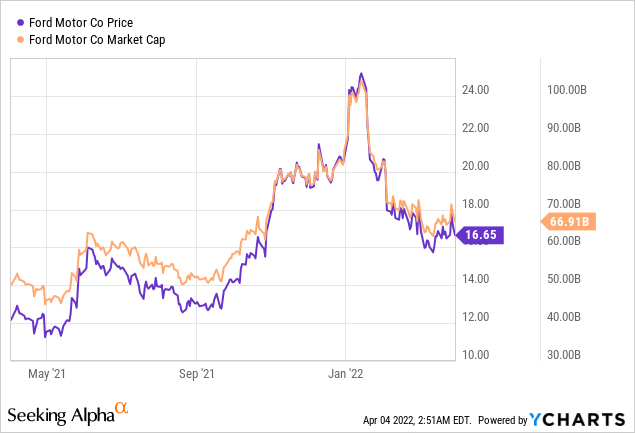

Shares of Ford have corrected lately and are now trading 36% below the January high of $25.87.

The drop has made shares of Ford significantly cheaper, especially its free cash flow. Ford projects free cash flow of $5.5B to $6.5B in FY 2022 which now calculates to a free cash flow multiplier factor of 10-12 X. I believe Ford’s free cash flow is undervalued as the firm ramps up EV production in Europe and the U.S.

Risks with Ford

The biggest short term commercial risk for Ford, as I see it, is a potential botched market introduction of its various electric vehicle models. The car brand is bringing to market the F-150 Lightning truck this spring and the E-Transit just launched in February. Safety recalls or poor reviews could hurt the image of Ford’s electric vehicle lineup and result in weaker than expected sales going forward.

Also a risk for Ford and the stock is the supply chain crisis, which could impact electric vehicle production, especially if computer chips remain in short supply. Should the supply situation get worse in FY 2022, Ford may be forced to idle plants again and fail to deliver strong sales results this year. What would change my mind about Ford is if the company were to see a steep drop-off in pre-orders for its various electric vehicle models.

Final thoughts

This is the perfect time to buy Ford: shares have declined 36% from their all-time high and I believe the correction creates an opportunity to buy into one of the greatest transformation stories in the auto industry at a very low FCF valuation. Ford is set to become an all-electric car brand, possibly by the end of the decade, but the firm’s valuation still doesn’t show it. Ford’s heavy investments in its European electric vehicle capabilities are underrated and will play a crucial part in Ford achieving EV dominance this decade. I believe the risk profile heavily favors an investment in Ford as the car brand gets ready to roll out new products!

Be the first to comment