JHVEPhoto

Currently, many investors are worried due to uncertainties in the macro environment from rising inflation and the Federal Reserve’s hawkish stance. This has resulted in them shifting capital from riskier assets to safer assets. As a result, there is hardly any stock in the market which has not seen a significant correction. Lowe’s (NYSE:LOW) stock has also declined ~25% this year. However, I believe this correction is a good opportunity for long-term investors and the company has good growth prospects.

After Marvin R. Ellison took over as Lowe’s CEO in 2018, he has taken several initiatives like supply chain transformation, superior merchandising, improving operational efficiency and customer engagement to strengthen the company’s foundation. Looking forward, the company is now working on its Total Home strategy, to raise its market share and widen its operating margin. Right from the new market-based delivery model to the new store inventory management system, LOW is taking several initiatives as part of the Total Home strategy that should help its financial performance in the coming years. While some investors are worried about the impact of rising interest rates and inflation on the company and hence assigning it a low valuation, I believe there are several positives as well, like rising home equity, ageing housing stock, millennial household formation, etc. which should serve as the long-term tailwinds for home improvement. I find the company’s valuations attractive at 14.23x the current year consensus EPS estimates and have a buy rating on the stock.

LOW Stock Key Metrics

In the first quarter of fiscal ’22, total company comparable sales declined 4% and U.S. comps declined 3.8%. One of the major factors impacting sales in Q1 was the delayed arrival of the spring season which is the peak selling season for the company. So, some of the sales shifted from Q1 to Q2 and I expect strong Q2 sales as a result. According to management guidance, sales for the current fiscal year are expected to be in the range of $97 billion to $99 billion, representing total comp sales in the range of 1% decline to up 1%. Management also said that May sales were in line with their expectations. Further, two-year stack comps are also getting easier going in to Q2 and Q3. So, I expect sequential improvement in comp sales as the year progresses.

LOW Consolidated Comparable sales (Source: Company Filings)

|

Q1 |

Q2 |

Q3 |

Q4 |

Full Year |

|

|

FY 19 |

3.5% |

2.3% |

2.2% |

2.5% |

2.6% |

|

FY 20 |

11.2% |

34.2% |

30.1% |

28.1% |

26.1% |

|

FY 21 |

25.9% |

(1.6%) |

2.2% |

5% |

6.9% |

|

FY 22 |

(4%) |

LOW Comparable sales in the U.S. (Source: Company Filings)

|

Q1 |

Q2 |

Q3 |

Q4 |

|

|

FY 19 |

4.2% |

3.2% |

3% |

2.6% |

|

FY 20 |

12.3% |

35.1% |

30.4% |

28.6% |

|

FY 21 |

24.4% |

(2.25%) |

2.6% |

5.1% |

|

FY 22 |

(3.8%) |

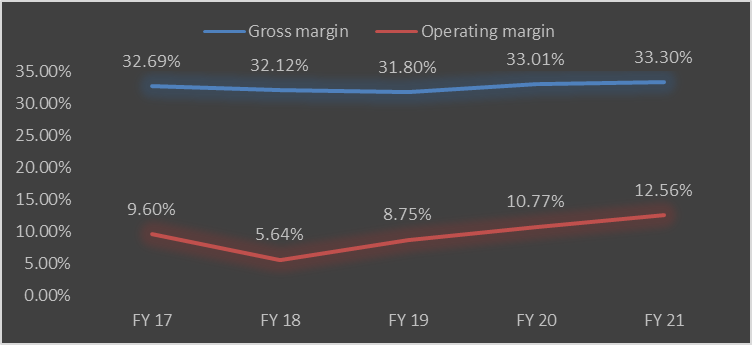

On the margin front, high demand and efforts to improve operational efficiencies have helped LOW, and over the last two years, it has shown a meaningful increase in gross as well as operating margins. In Q1 ’22 the company posted a gross margin of 34.03% and an operating margin of 13.96% which was a further improvement versus last year.

Lowe’s gross and operating margins (Company Data)

Is Lowe’s Stock Expected To Rise Again?

I expect Lowe’s stock to rise again. While investors are overly worried about macros, I believe the company can surprise with its execution. The company’s Total Home strategy continues to gain momentum as Lowe’s is focused on providing a one-stop solution for both DIY and Pro customers. As part of this strategy, the company plans to further enhance its omnichannel capabilities in 2022 across three key areas: expanding online assortment, enhancing the user experience, and improving fulfillment. The company intends to continue expanding Lowes.com assortment to meet customers’ design and lifestyle needs, while at the same time, enhancing the user experience with upgrades to the visualization and configuration tools it offers online. The company has also expanded its supply chain network and entered Q2 with good in-stock inventory levels which should help its Q2 results.

LOW is investing in supply chain and omnichannel capabilities as demand for integrated shopping experience is increasing. It is building a new market-based delivery model where products will flow from bulk distribution centers directly to customer homes, bypassing stores altogether. Another initiative on which the company is focusing is Perpetual Productivity Improvement (PPI). As part of this initiative, it has launched a new store inventory management system that provides associates real-time visibility in their store and reduces non-productive hours spent looking for products.

All these initiatives should help the company perform well despite macro uncertainty. The stock is inexpensive and as the market realizes the company’s market share growth opportunity, the stock price can rise again.

What Is Lowe’s Stock’s Future Outlook?

While some investors are overly concerned about the macroeconomic environment, I believe the long-term outlook for the home improvement industry is favorable. Home inventory available for sale remains near record lows supporting the strong housing prices. As a result, homeowner balance sheets are very strong and home equity is high. Historically, high home equity has been a big driver of home improvement spending as it gives confidence to home buyers to purchase big-ticket items. Other factors like an extension of remote work, the aging of housing stock, millennial household formation, etc, are also long-term tailwinds for home improvement spending. Moreover, the company generates strong cash flows and is doing a good job in terms of returning cash to shareholders. In 2022, management plans to spend ~$12 billion on share repurchases which is ~10% of its current market cap. In addition, the stock also has a healthy dividend yield of 1.80%. So, there is good downside support for the stock if things go south.

Is LOW Stock A Buy, Sell, or Hold?

Lowe’s Companies, Inc. is trading at 14.23x FY23 consensus EPS estimates versus its 5-year average forward P/E of ~18.26x. If we look at consensus estimates Lowe’s EPS is expected to grow in the high single digits or low double digits over the next three years which is better than mid-single digit expected EPS growth for its peer Home Depot (HD). Despite this, it is trading at a discount to Home Depot which has a P/E multiple of 18.3x. Hence, I believe LOW is undervalued and have a buy rating on the stock.

Be the first to comment