YinYang

Introduction

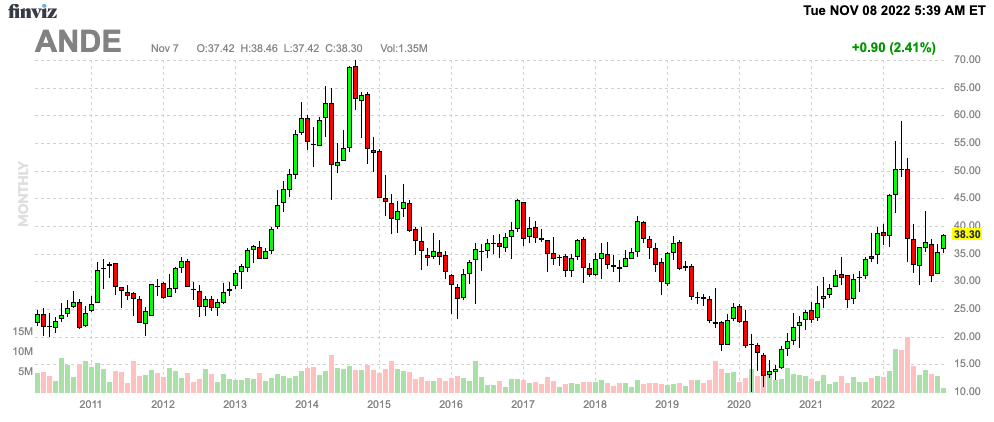

It’s time to talk about one of my all-time favorite agriculture stocks. The Andersons (NASDAQ:ANDE) isn’t just a trade I became bullish on in 2020 but also a company that gives us tremendous insights into the (global) agriculture industry. In August, I wrote my most recent article covering this agriculture giant from Ohio. Back then, I was bullish because the company’s second quarter earnings confirmed a strong bull case based on favorable pricing and demand in ethanol, high margins in nutrients and solid volumes, and a return of its trade segment thanks to favorable basis prices, higher volumes, and good crop conditions.

In this article, we’re going to discuss third quarter earnings, which also beat estimates by a mile, thanks to ongoing tailwinds in the industry. Moreover, the stock is creeping up again after a strong dollar, and commodity headwinds kept a lid on the stock.

I expect that to change again, providing investors with more upside.

Now, let’s dive into the details!

ANDE’s Earnings & Why It Matters

One of the things I care a lot about is providing macroeconomic information in every article I write. In this case, we’re dealing with a rather small company with a $1.3 billion market cap. However, even if people don’t care for ANDE, I think that ANDE is a terrific source of information, allowing us to take a deeper look into the agriculture industry.

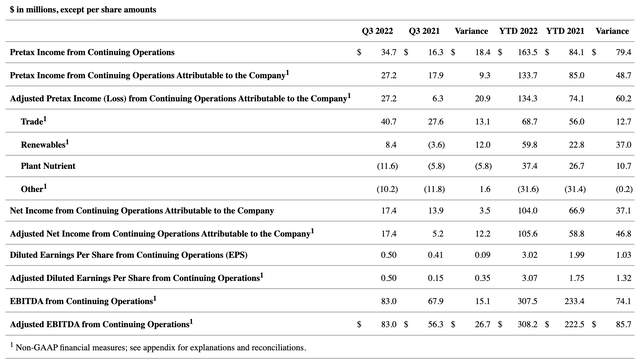

With that said, let’s start with the numbers that hit the wires first after the earnings release.

In its third quarter, ANDE reported $4.22 billion in revenue. That’s 40.7% higher compared to the prior-year quarter and a whopping $910 million higher than expected.

It allowed the company to report $0.50 in adjusted EPS, a result that came in $0.13 higher than expected.

A look at the table below reveals that the trade segment is back on track. Trade did $40.7 million in adjusted operating income. That’s $13.1 million higher compared to the prior-year quarter. Renewables (the ethanol segment) did $8.4 million in operating income, up from a loss of $3.6 million in 3Q21. The plant nutrient segment saw a decline from a $5.8 million operating loss to an $11.6 million operating loss.

In trade, the company benefited from strong merchandising profit centers, which had a great quarter with gross profit and pre-tax earnings growth of more than 40% year-on-year. This includes strength in its food and specialty ingredients business and animal feed merchandising business.

The comment below is important because it highlights the agricultural environment. Especially margins, which were under pressure in the first quarter. Also, it seems that my comments in my August article were right. The company is benefiting from tight agricultural supplies as it sees strong harvests in its operating areas. That’s a huge benefit.

The food and specialty ingredients business continued their strong results, and our assets had improved gross profit, capturing increased elevation margins. With the current global supply disruptions yield reductions due to the western U.S. drought are significant and should continue to keep grain markets volatile. Fortunately, we are experiencing a good harvest in our elevator dry areas with the majority of our assets located in the eastern greenbelt. This tight supply environment is conducive to continued merchandising opportunities.

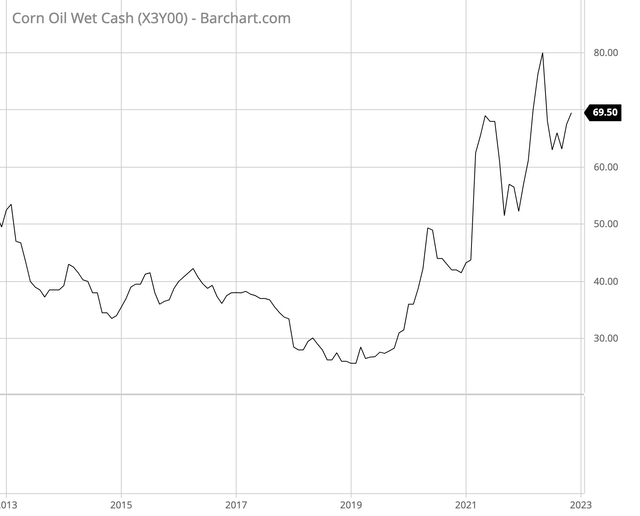

The renewables business – again, that’s ethanol production – benefited from strong ethanol margins, efficient plant operations (no major outages and issues), and high values for co-products. In particular, corn oil.

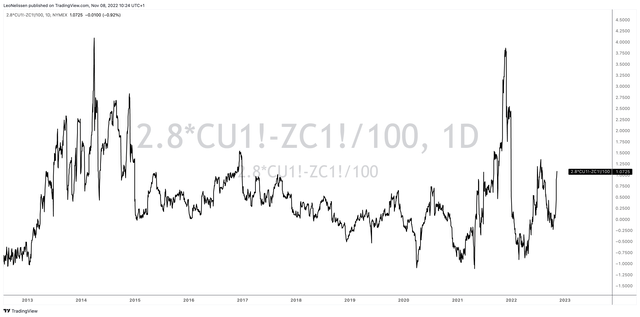

Using my “homemade” ethanol profitability indicator, we see that ethanol margins are indeed quite strong. The indicator is volatile, but overall, 2022 has offered great opportunities for producers to capture high margins. Note that the chart below basically shows the difference between the price of ethanol (output) and corn (input). In this case, I’m assuming that 1 bushel of corn produces 2.8 gallons of ethanol. Needless to say, this indicator does not incorporate by-products like dried distillers grains. These futures were discontinued a few years ago. Also, note that this indicator does not take into account how producers hedge their costs and sales prices. It’s really just a rough estimate. Yet, it has done a great job in the past indicating trends in margins.

TradingView (Implied Ethanol Margins)

However, when looking at corn oil prices in a different chart, we see a strong uptrend that started when prices bottomed in 2019.

Barchart.com (Corn Oil Wet Cash)

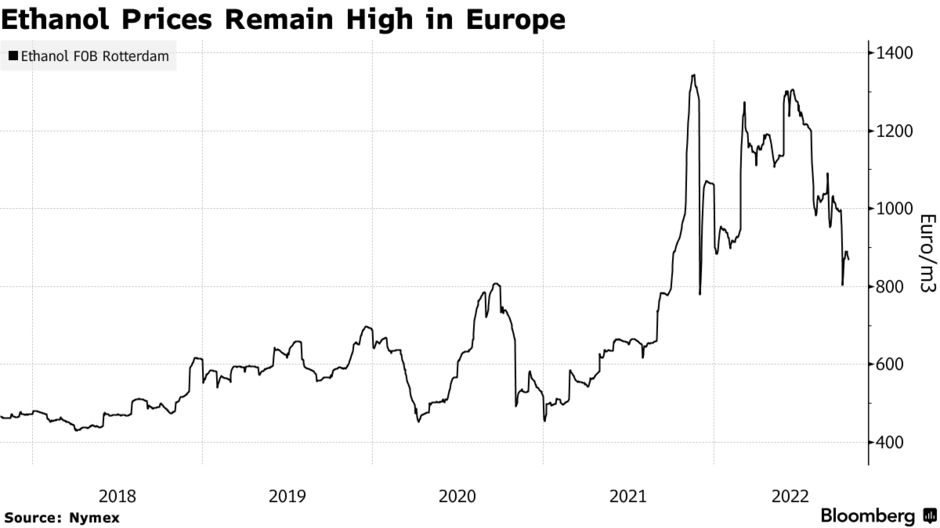

One of the reasons for high margins – across all segments – is tight supply. This is made worse by horrible weather conditions in major agricultural regions like Europe and the fact that the war in Ukraine is making ethanol production in Europe less profitable. While prices have come down, ethanol prices are still extremely elevated in Europe.

Bloomberg

Brazil alone boosted its ethanol exports to almost 520 thousand cubic meters in the first nine months of this year. Exports haven’t exceeded as far as my data goes back.

Moreover, according to the company:

We believe that our eastern ethanol plants are favorably located, while western plants are facing much higher corn bases. We continue to see strong demand and good values for coal products, particularly distillers corn oil, which supports our overall margins. In addition, our renewable diesel feedstock merchandizing business is performing well. And we’re evaluating additional renewable diesel low-carbon intensity feedstock opportunities.

Moving on to plant nutrients, the company typically records its lowest results in the third quarter due to the crop cycles. This somewhat ruined the third quarter, given that last year was quite strong.

However, as usual, the bigger picture counts. And in this case, the company confirms everything we’ve discussed in any prior agriculture article when it comes to demand, margins, and volumes of companies in this business:

The plant nutrient business outlook is mixed with strong farm income and a need to cover loss worldwide grain production, we expect continued strong global demand. That should keep prices higher than historical averages. We have favorable harvest weather that should allow for good fall application. With more stable supply as compared to the fourth quarter of 2021, we do not expect to repeat last year’s record fourth quarter fertilizer results where we capitalize on an outsized margin environment.

Moreover, it is extremely important to be aware that we are now in a period where most companies cannot beat margins in certain segments. 2021 was strong. The same goes for the first half of 2022. Margins were sky-high, which makes it hard for agriculture companies like fertilizer producers to beat these numbers.

However, that does not make any of them a bad investment at this point. If anything, we will continue to be in an environment of high margins and high demand, which will allow stock price valuations to be adjusted to this new environment. There’s still a lot of upside potential as we will discuss in this article.

The company bought Bridge Agri and Mote Farm Services. Bridge Agri is part of the trade group. Mote Farm Services is part of plant nutrients. Mote Farm Services is a farm service center in Indiana and Ohio. Bridge Agri is in the pet food ingredients space. The company did not disclose M&A sizes, which makes it likely that these deals won’t have a major impact on financials.

Yet, it’s still good to see that the company is using its increasingly healthy balance sheet to reshape its business. After selling the railcar business, and restructuring its business segments, it now complements existing segments with value-adding services that go further down the supply chain. Without having too many details, I believe that’s a winning strategy.

Balance Sheet & Valuation

Speaking of the company’s balance sheet, the company is in a pretty good spot to accelerate M&A, if it wanted to. The balance sheet is also supporting repurchases. In the third quarter, management bought back $7 million worth of shares. To date, the program has repurchased shares worth $12 million. That’s not a huge deal, but it is 1% of shares outstanding, and there’s more to come if agricultural fundamentals offer any indication.

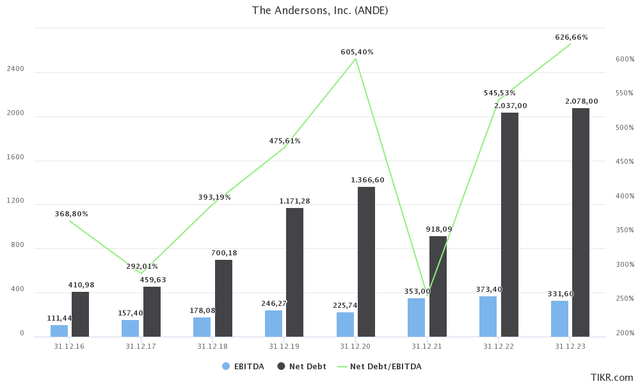

That said, the company targets a long-term debt-to-EBITDA ratio of less than 2.5x. On a twelve-month-trailing basis, the company is now a bit below 1.5x EBITDA.

This explains why the company is starting to buy back shares more aggressively while buying growth through M&A.

With that said, bear in mind that the company’s aim is to monitor LONG TERM debt. If we include short-term debt and cash, the net debt ratio is much higher at more than 5.0x EBITDA (see the chart below).

As of September 30, the company has roughly $3.0 billion in total liabilities. $2.3 billion of this is short-term. $930 million of this is trade and payables. On the other side of the balance sheet, it has $1.6 billion in inventories and roughly a billion in accounts receivables.

Long-term debt is at just $500 million, which is indeed close to 1.3x 2022E EBITDA of $373 million.

That said, using the “official” net debt number of $2.0 billion for 2022, $230 million in minority interest, and the company’s $1.3 billion market cap, we get an enterprise value of $3.5 billion. That’s 9.5x 2022E EBITDA of $373 million.

Note that EBITDA estimates have come up by roughly $20 million since my August article.

When going a bit less mainstream, the company has an enterprise value of $1.8 billion. This is based on its $1.3 billion market cap, $230 million in minority interest, $500 million in long-term debt, $110 million in long-term debt maturing within 4 quarters, $650 million in short-term debt, and $950 million in net-working capital, to account for its huge inventories, receivables, and cash (versus short-term liabilities). When looking at the bigger picture, I think these issues need to be incorporated. This would give us an EV/EBITDA multiple of 4.7x.

In my last article, I wrote the following, which I still stand behind:

This valuation is too cheap as investors are pricing in a decline in sentiment and agriculture prices on a longer-term basis. I don’t see that happening.

Hence, I stick to my fair value of $65-70. However, as I said in my prior article, we’re more than likely not getting there this year. I hope to see a rebound towards $45 this year followed by a move to my target by the end of 2023.

However, my year-end target is looking a bit shaky with less than two months to go. It now looks like we may get there in 1Q23.

Takeaway

ANDE is back on track. The third quarter was great as the company benefited from high demand, sufficient supply, high ethanol margins, and the ability to keep delivering despite ongoing supply headwinds. The balance sheet is very healthy, allowing the company to engage in buybacks, a bit more aggressive M&A, and related projects to reshape the ANDE business model.

Given my bullish agriculture outlook and the company’s ability to benefit from these tailwinds, I remain bullish. I think ANDE is one of the best businesses in the segment, offering investors a top-tier business model and a very fair valuation.

FINVIZ

However, bear in mind that ANDE is very volatile. If you decide to buy, keep your positions small.

Needless to say, I remain long as I like the risk/reward.

(Dis)agree? Let me know in the comments!

Be the first to comment