Michael Vi

The market has been challenging this year. The S&P 500 and other major stock market averages are in bear markets, and many individual stocks have declined precipitously from their highs last year. Moreover, despite the relentless selling, more pain could lie ahead. Due to the bearish environment, my portfolio is around 35-40% cash right now, remarkably high.

However, Palantir Technologies Inc. (NYSE:PLTR) is one company that I would like to discuss. I recently doubled my Palantir position at $7.40, around the recent low. I made this move for several reasons. First, the market is going through a bearish period, and many great companies have sold off to ridiculous levels. Second, I believe the market misunderstands Palantir in some fundamental respects and is treating the stock as any other “overvalued growth company.” Also, I think there are some misconceptions about the company’s share dilution, profitability potential, growth prospects, and other aspects.

Nevertheless, I view Palantir a little differently. Palantir is a unique, dominant, market-leading company with a remarkably long growth runway and immense profitability potential. Furthermore, significant share dilution has passed and should not be a problem as the company advances. Palantir’s stock is also down by 84% from its all-time high last year. The company’s market cap has melted to $15 billion, and the stock is now trading at only six times forward sales estimates, substantially lower than many comparable stocks. Palantir’s long-term growth is tremendous, and the company should continue growing revenues at 20-30% for many years.

Moreover, Palantir has a remarkably profitable business and should deliver substantial profits to shareholders as the company moves on. Palantir’s stock is highly oversold and exceptionally undervalued. Therefore, Palantir’s stock should appreciate substantially in the coming years.

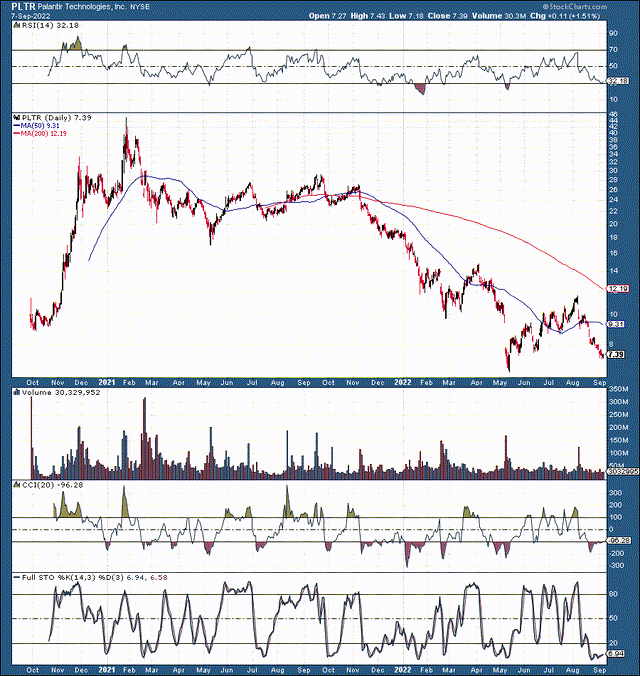

The Technical Image

Remarkably, one of the most exciting growth companies with immense potential is now trading below its IPO price. The stock is getting relatively oversold again as the RSI approaches 30. Moreover, the full stochastic is starting to turn up, illustrating a shift towards positive momentum. Palantir could attempt to put in a long-term double bottom around current levels, and even if the stock moves marginally, lower downside should be limited from here. On the other hand, the upside potential is considerable, especially if looking out long-term, 5-10 years.

Growth Is Phenomenal

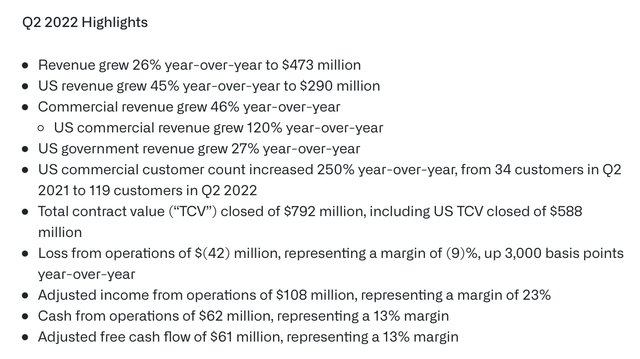

Q2 Highlights (investors.palantir.com )

Despite the broad economic slowdown, Palantir’s growth remains phenomenal. The company reported 26% YoY revenue growth last quarter. However, commercial revenue surged by 46%. This dynamic illustrates that Palantir continues to expand its corporate business and should generate substantial growth from the private sector in future years.

The number that sticks out most is the staggering 250% YoY rise in U.S. commercial customer count. This illustrates that Palantir is creating business relationships with many new corporations. Palantir’s new customers will enable Palantir to continue growing revenues and expand profits for many years. Additionally, Palantir’s products and services are highly sticky and costly to switch away from. Therefore, the company’s revenues and profits should increase significantly as the company advances.

Profitability Potential is Exceptional

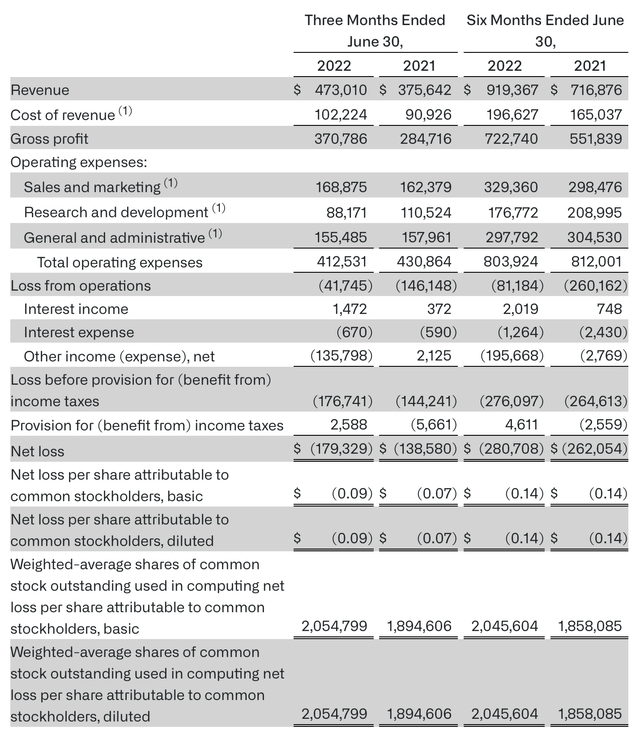

Statement of Operations

Income statement (investors.palantir.com )

Palantir reported $473 million in revenues last quarter, and the company’s gross profit was approximately $371 million (78%). 78% gross profit is exceptionally high. However, if we adjust for the $11.2 million SBC expense, we see Palantir’s gross profit increase to nearly 81%. As Palantir expands revenues, the company will become increasingly profitable in the coming years. Moreover, the SBC expenses will continue to become less significant as the company matures.

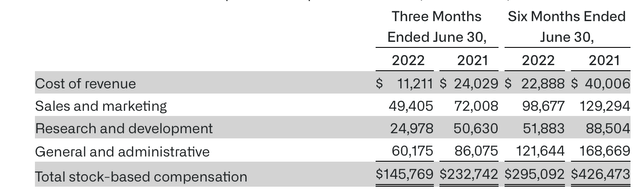

Stock-Based Compensation (“SBC”)

While stock-based compensation is still significant, it has decreased dramatically since last year by 37%. We should continue seeing fewer SBC-related expenses as the company advances. More importantly, as Palantir increases revenues and profitability, SBC should become relatively insignificant.

Palantir vs. The Others

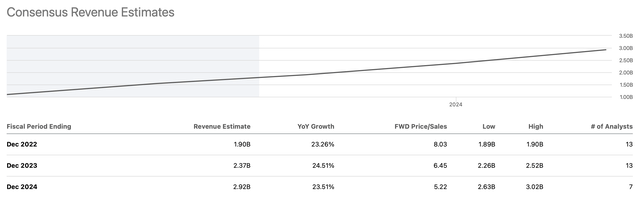

Revenue Estimates

Revenue estimates (SeekingAlpha.com )

We cannot evaluate Palantir based on earnings as Palantir is a high-growth company with an incredibly long growth runway. Palantir primarily focuses on expanding its operations rather than producing profits in this stage of its business development cycle. However, we can evaluate the company’s valuation based on its future revenue projections.

Next year’s consensus revenue forecasts are for approximately $2.4 billion. However, projections could be lowballed due to the general bearish atmosphere surrounding stocks. Moreover, Palantir still derives the lion’s share of its revenues from government contracts that should not be significantly affected by the economy slowing down. Furthermore, any softness Palantir sees in its commercial segment should be transitory. Thus revenue and EPS forecasts should improve as we advance.

Therefore, I expect Palantir to deliver revenues closer to the higher-end of analysts’ estimates, roughly $2.5 billion in 2023. Additionally, while 2024’s consensus forecast point to approximately $2.92 billion in revenues, my estimate is for around $3.1 billion. Based on Palantir’s current market cap of $15 billion, the stock is trading at approximately 5-6 times 2023-2024 sales projections.

How Palantir Stands Up to Other Stocks

Palantir

- 2023-2024 P/S valuation: 6-4.8

- Market Cap: $15 billion

- Expected revenue growth rate 2023: 30%

Tyler Technologies (TYL)

- 2023-2024 P/S valuation: 7.5-6.7

- Market Cap: $15 billion

- Expected revenue growth rate 2023: 9.7%

CrowdStrike (CRWD)

- 2023-2024 P/S valuation: 13.3-10

- Market Cap: $40 billion

- Expected revenue growth rate 2023: 37%

Cloudflare (NET)

- 2023-2024 P/S valuation: 15-11

- Market Cap: $20 billion

- Expected revenue growth rate 2023: 36%

Nvidia (NVDA)

- 2023-2024 P/S valuation: 10.5-9

- Market Cap: $335 billion

- Expected revenue growth rate 2023: 17%

The Takeaway

I could have added many more prominent tech names to this list, but the theme is similar. Most companies with similar growth rates are trading at much higher P/S multiples. Moreover, companies with far lower growth prospects, like Tyler Technologies, Nvidia, and many others, still trade at significantly higher multiples than Palantir.

So, what is it with Palantir? Are investors throwing out the baby with the bath water? Are they concerned about SBC and the share dilution when Palantir went public? Perhaps, market participants are troubled that Palantir is not posting profits yet. I believe the market is underestimating Palantir for various reasons, and the company’s stock is irrationally low.

Remember what Benjamin Graham said – “In the short run, the market is a voting machine, but it is a weighing machine in the long run.” Therefore, Palantir’s stock should be priced much higher as the company continues expanding revenues, improving profitability, and increasing income in future years.

Here’s what Palantir’s financials could look like as the company advances:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| Revenue $ | 1.9b | 2.5b | 3.2b | 4.1b | 5.3b | 6.6b |

| Revenue growth | 24% | 30% | 28% | 29% | 28% | 25% |

| Forward P/S ratio | 6 | 8 | 10 | 10 | 9 | 8 |

| Price | $7.40 | $12.60 | $20.13 | $26.17 | $31.40 | $40.20 |

Source: The Financial Prophet

Projections are based on reasonable (relatively modest) growth and multiple expansion assumptions. Nevertheless, we see Palantir’s stock price has the potential to appreciate considerably in the coming years.

Risks to Palantir

Despite my bullish outlook for Palantir, market participants should consider several potential risks associated with this investment. While the growth story is strong at Palantir, shares are not cheap by traditional metrics. Furthermore, the company’s earnings are still minimal and may not increase as much as I envision. Moreover, if the company’s growth picture were to turn less bullish, the stock could head in the wrong direction. For instance, if Palantir lost favor with the government or had a data breach, the stock could experience a notable decline. Please consider these and other risks carefully before investing in Palantir.

Be the first to comment