400tmax/iStock Unreleased via Getty Images

A new premise is forming based on the lack of Alphabet Inc.’s (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) ability to ship new products and the general fear cycle in tech. The implication is that Google is having difficulties staying on the cutting edge and that new AI tech has the potential to disrupt search and other services. Google has been great when it was playing the innovation game, but without it, the traditional corporations like Amazon (AMZN) and Microsoft (MSFT) may dominate.

I suspect that Google’s difficulty in shipping products lies in what they think of as playing a numbers game with their product portfolio. Specifically, they seem to be treating their projects like a probability distribution with a small chance of creating massive returns. However, the same people that are in charge of doing these calculations are also building these projects, and they seem to have a mismatch between the intellect it takes to make good projections and the business acumen it takes to make them a reality.

While I will present some of the risks of Google’s product portfolio – sometimes erring on the side of being overly critical – the conclusion of this analysis is that Google continues to be a long, and is currently undervalued.

Considering that this is a longer write-up, I made sure to include a summary at the end of every section.

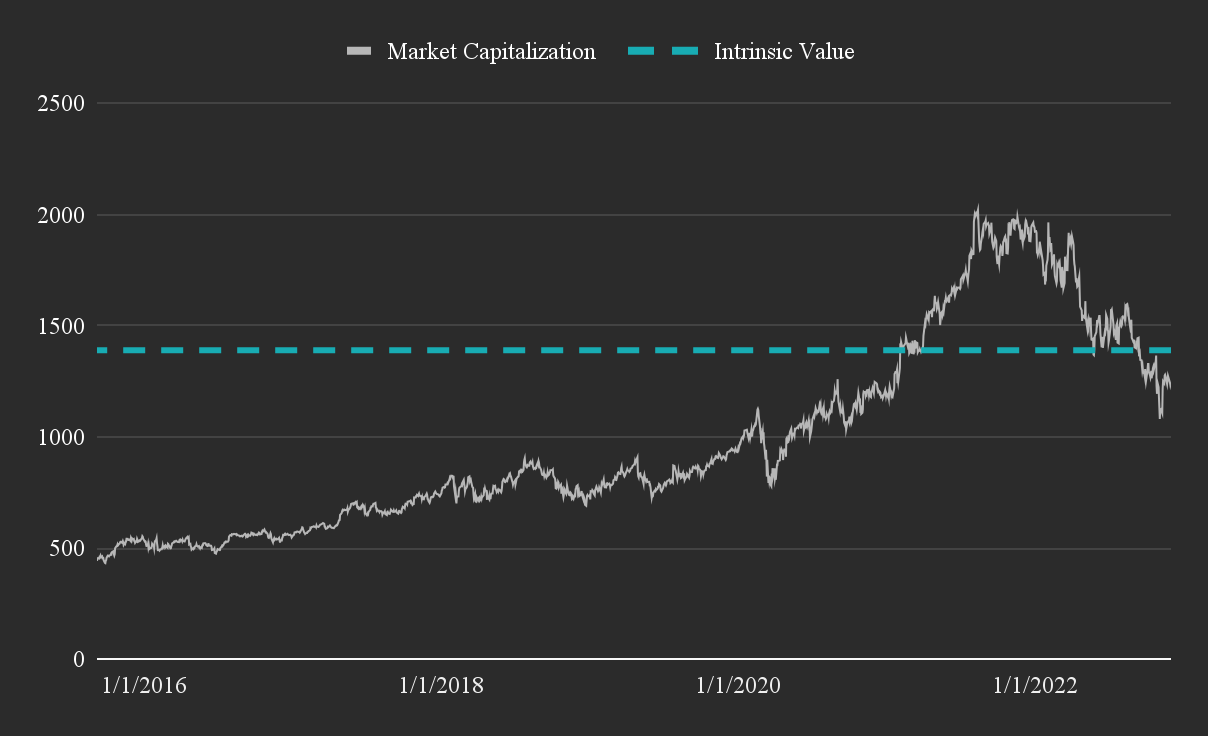

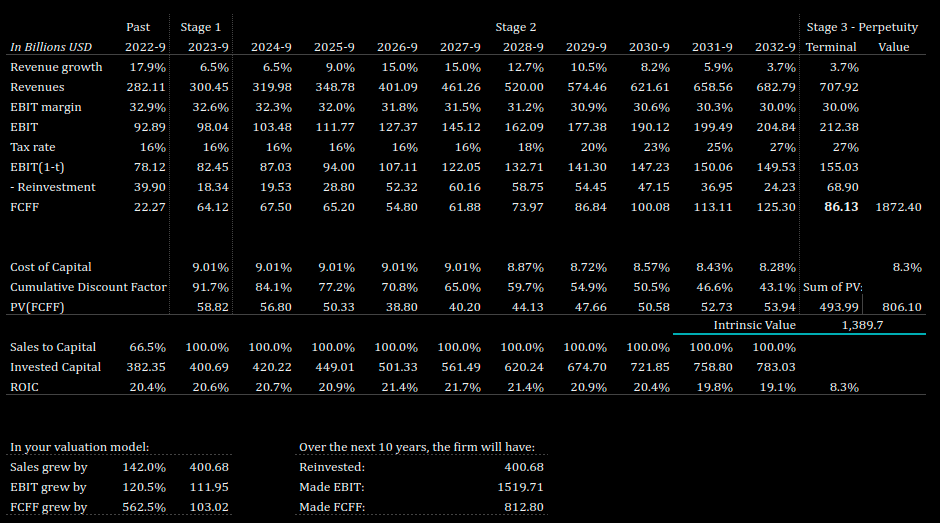

My intrinsic value estimate for the company is $113.2 with a 1-year price target of $132.8. You can explore the full valuation in my spreadsheet.

GOOGL’s estimated intrinsic value and historical market cap (Author image with data from FMP)

One of the signs of age for a company is the loss of the early adopters, which seems to be happening to Google on the search and media front. This means that the company must keep employing strategies to keep the masses using its products, instead of producing exciting products that are promoted by people.

We will start the analysis by looking at the three key segments of Google.

A Review Of Search, Media, And The Cloud

Google’s main business still comes from search, with about 57% of the $69 billion quarterly revenue. The company has been attempting to diversify its product portfolio, but so far, most of its products either are largely unprofitable or serve as a supplement to search.

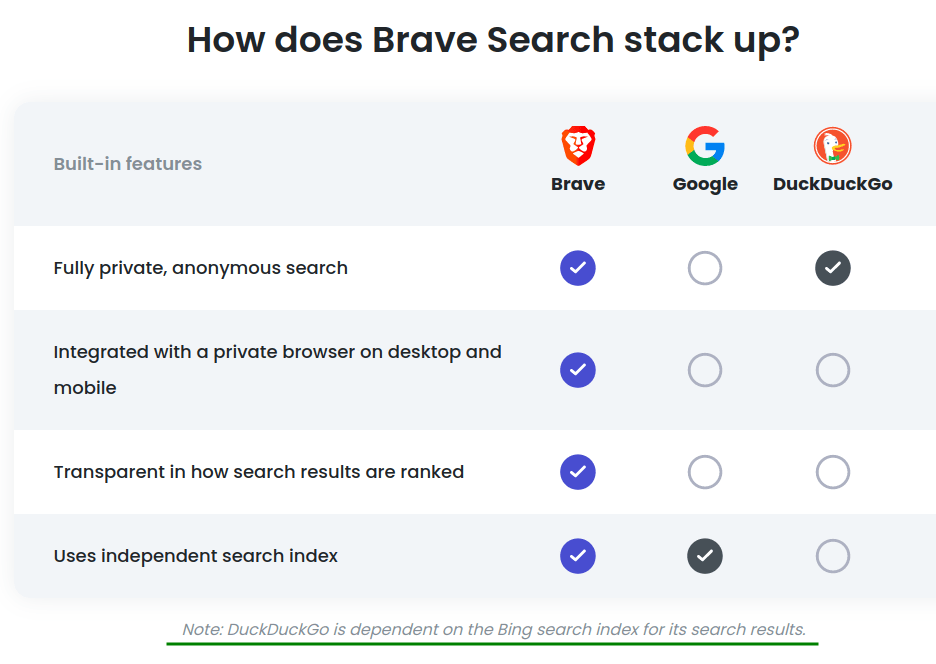

While Google is still dominating internet search, we can see that their monopoly is taking some hits. One problem comes from the advance of alternative, privacy-oriented search engines, which include DuckDuckGo and Brave. While DuckDuckGo is using Bing as the indexing engine, Brave is conducting its own search indexing. These search engines, along with other small players, are catering to a very niche audience. However, that audience happens to be tech-savvy early adopters, a segment that is becoming increasingly distrustful of Google.

Search engine comparison (Brave website)

From a market point of view, it stands to reason that these alternative search engines are not powerful enough to bring down Google, and the company will retain its dominant search position. If anything, these alternatives are helping Google by giving them an argument that they are not a monopoly.

Bing!

Of the more traditional browsers, it seems that Bing is emerging as a serious player on the search scene. Microsoft’s search engine is a testament of the power of “default settings” as the company has leveraged its operating system to push Bing as the default search engine. Additionally, Bing works well enough for people that don’t want to bother changing their built-in solution, which is the key factor that made Bing account for 8.9% of the search engine traffic in July 2022.

In summary, Google is experiencing pressure in its search leadership both from legacy tech like Bing and new competitors that cater to niche audiences that tend to be early adopters.

Note: the main appeal to early adopters is that they have trend-setting influence.

The Media Segment: YouTube

YouTube is Google’s creator media platform. The company allows anyone to upload videos to the platform and engage in revenue sharing with approved creators. This is a great service, but unlike traditional software it is a very low-margin product. The main cost of this business is the video storage expenses the company has for hosting millions of videos. With the increase of video quality, even more storage is needed, and the company needs to duplicate the videos across multiple storage locations in order for the viewers to enjoy fast streaming. That being said, on a quarterly basis, the company made $7 billion from YouTube Ads, roughly 10% of the total quarterly revenue.

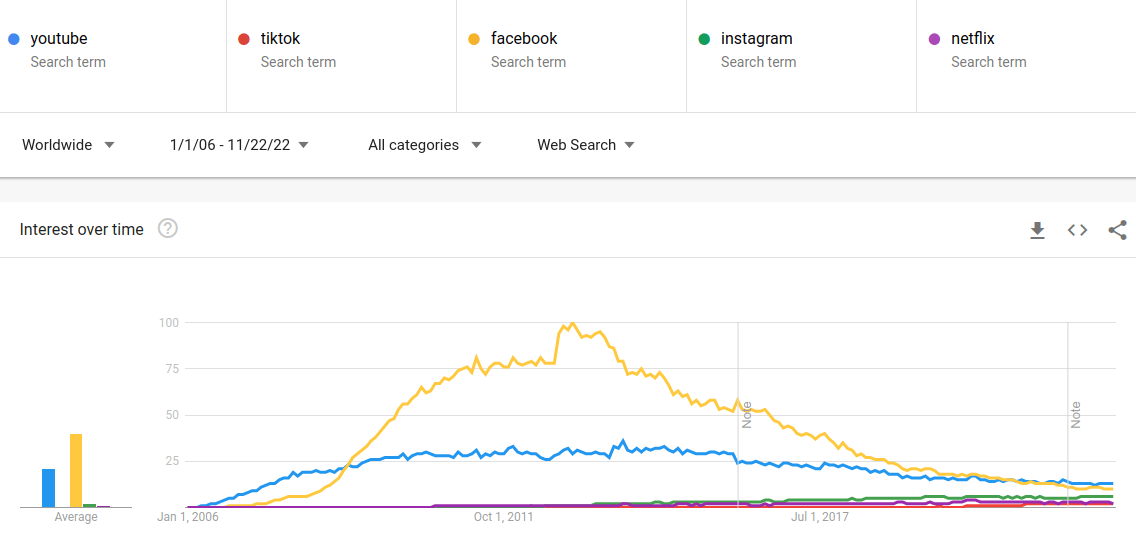

The way YouTube’s media business is being run, investors can’t be sure if the company is catering to viewers or advertisers. It’s the classic Shopify (SHOP) vs. Amazon problem, where one company caters to the end user (Amazon) while the other caters to businesses (Shopify). In the case of Google, it seems that they are erring on the side of advertisers. However, the consumers are ultimately the ones that give the platform value, not the tech or advertisers, and it seems that consumers are not as much on-board with YouTube as they used to be:

Search interest for key media peers (Google Trends)

It’s hard to know if some of their staff thinks that they have a customer or that they are at a research university. For example, the scientifically-oriented minds at Google commissioned a meta-analysis in which one key takeaway was:

“…[A] study from Nielsen shows that brands can increase their average weekly frequency from one to three on YouTube with a consistent ROI. This is a huge opportunity for marketers to maximize their impact across the same set of people they are already reaching today.”

So viewers will get more ads, and according to the study, most of them switch. However, by the time a viewer switches, it can be too late. So it may be a good approach to keep some goodwill, as most of the brand damage is initially invisible. Common sense implies that the customers shouldn’t be this aggravated, but alas, we have a meta-analysis set within the context of a media monopoly – the problems will show up if people start adopting YouTube alternatives.

With the increased ad frequency, managers are justifying short-term boosts in ad revenue at the expense of the company’s brand. As part of the new approach, Google is now allowing advertisers to choose how many times an ad will appear on platforms such as YouTube and Music. However, users aren’t furious at advertisers, they are furious at YouTube – and blame it for the bad UX. As for advertisers, knowing that they can offload the brand damage to the platform, they have an incentive to maximize ad frequency.

In summary, YouTube, is by no means a solid business. It does have potential, but the company should be more strict with the success KPIs of its team, and take the training wheels away from YouTube. Investors would be more comfortable if managers are accountable to maximizing the long term free cash flows. The growth of the business should not be considered value-creating until YouTube shows that it can increase profitability.

Note: in the case of YT, cutting costs by allocating resources to higher ranking videos may be a more appropriate strategy instead of pushing more monetization.

Utility In The Clouds

Google Cloud now comprises some 10% of the total quarterly revenues, and it’s likely that this portion will continue to increase, as the cloud seems to be one of the key verticals for the company. This business direction seems to be the right call for a maturing company that has trouble shipping innovative products.

Key software that used to come in a physical form such as movies, office, games, etc. can now be accessed from the cloud and the technology is moving in the direction of making the computation happen on the cloud instead of the home/office device. Media content was the first to go, as it is essentially a file stored in a bucket on a remote server. However, with startups like Figma and Canva, we can see that it’s becoming easier to have software computing remotely, while we are working at home. Finally, most of the office is already in the cloud, and it is enjoying accelerated adoption after 2020, as companies can have a unified version of the software, managed from a centralized location.

This leads us to Google Cloud Platform, which is a set of computing, data storage, and application services. Customers can effectively “rent” Google servers in the form of customizable infrastructure, platforms, and managed services.

This gives clients a choice on the level of granularity which they exercise on their software. For example, a small startup may opt for getting a product to market with a one-click-deployment solution from the Google marketplace, while an enterprise can buy large scale infrastructure and configure it from scratch. Except for foreign governments, and innovators that are possibly competing with Google, most software oriented companies have an appealing reason to work within the cloud, and Google is one of three main providers besides Amazon and Microsoft.

The key Google cloud services include:

-

Compute Engine: A virtual computer service that provides users with access to Google’s infrastructure. People can “rent” this VM and develop a wide variety of software remotely.

-

App Engine: A platform-as-a-service that allows developers to build and run applications on Google’s infrastructure. Similar to compute engine, but with less configuration and focused for developing and scaling software.

-

Cloud SQL: A relational database service that provides users with access to Google’s infrastructure. Cloud Datastore: A NoSQL database service that provides users with access to Google’s infrastructure.

-

BigQuery: an analytics database, which is practically the same as Snowflake and Databricks.

Google keeps rolling out new services for the cloud and the barrier to entry is decreasing with services like AppSheet intended for non-professionals or as they call them “citizen coders.”

While Google Cloud is expected to keep incurring serious competition from other large providers like Microsoft’s Azure and Amazon’s AWS, it is conceivable that the large cloud players will gang up on startups like Datadog, and even Snowflake. Barring a high innovation stride, large providers will likely dominate the industry.

In summary, cloud services are an affordable, and effective way to serve software throughout the world. We may increasingly see large cloud providers behaving like utilities that allow companies and users access to high speed infrastructure.

Fundamental Analysis

In this section, we will look at the reasons behind Google’s past fundamentals, and use them to build our valuation. First, we need to look at growth, because it reveals why Google has been such a success story.

Revenue Growth

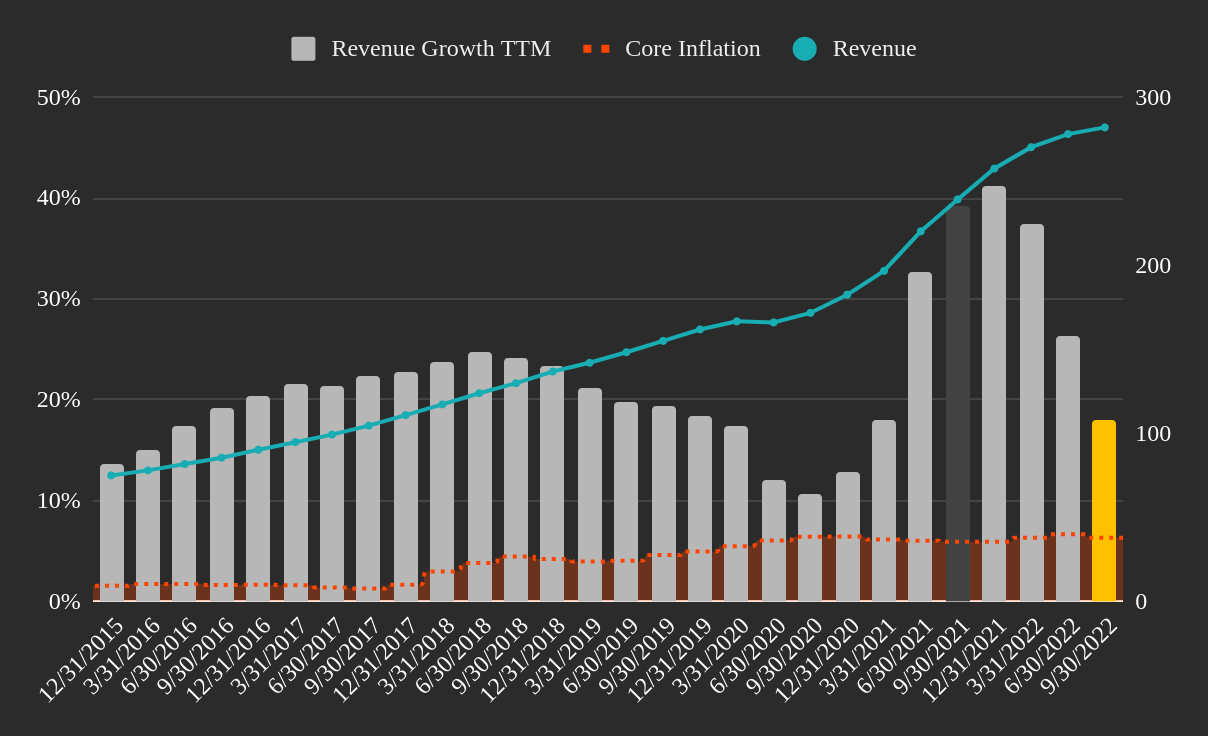

Google had more than a decade of high double-digit growth, which has brought its revenues close to $300 billion.

Unfortunately, extrapolating these growth rates forward may not be the right call. Most of the revenues came from search, and the company seems to have saturated that vertical. The media business may continue to grow, but it needs some rethinking, which leaves us with the expected growth driven from the cloud.

TTM revenue growth vs core inflation (Author image with data from FMP)

The question for the cloud becomes, “is there a massive demand?”, or will there be a slow bid for domination among larger competitors. To me, it currently seems that growth will be high, but not massive, at least not yet. Large competitors will entice corporations to move to the cloud in order to cut costs. But this will likely happen within the next few years, and then the cloud world will need to find significant innovation in order to onboard the rest of the smaller businesses or consumers.

We can also see that growth is stagnating, but this appears to be a temporary issue, especially if Google can place the cloud segment at the forefront of their business.

The AI Growth Avenue

In the past, there were multiple trends or even fads that promised rising on the back of the cloud, but most of them are having trouble sticking, or are proving to be good options for niche audiences. These trends include: IoT, Blockchain, No/Low-Code Apps, Smart Cities, Big Data, Online Classrooms – all of which played a part of an industry, but were extensively overestimated regarding their market size and value creating potential.

The new excitement seems to be garnered around AI search, self-driving, conversational interactions, virtual reality, etc. Many companies, including Google, are on-board with these “excitement” trains. In fact, Google was among the first to enter the race for AI communication with the development of their Google Assistant, along with products like Microsoft’s Cortana, Amazon’s Alexa, and Apple’s Siri. All of these products were revered as having the potential to replace call centers, become personal assistants and synthesize intelligent output. However, most of them ended up finding niche applications – and Google’s assistant AI moved to the back on the priority list right until the appearance of OpenAI and related products. This made a noticeable innovation boom, however I see the large players benefiting more than the startup and here is why:

While OpenAI has made significant strides in the AI landscape, there seem to be two major aspects working against them. One, is that large companies like Google are likely able to come up with a similar enough approach which will take the edge away from OpenAI. Second, and more important, is that these companies are sitting on mountains of proprietary data, which can easily be leveraged to surpass the quality and number of offered services of OpenAI.

In summary, the cloud is an emerging utility for which Google is in a unique position to distribute. The company, along with peers, will likely absorb any innovation produced by OpenAI, and leverage their proprietary data to offer superior services. If there is a growth avenue in AI, then Google will be fighting peers instead of small innovators for the market share.

Reinvesting Into The Business

Google invested $75.5 billion into the business, $36.7 billion of which are net new capital expenditures, and the rest can be viewed as maintenance capital that covers depreciation. The company is also using more working capital to fund its operation, but that is a minor point.

Looking at it from a CapEx perspective, the company invests largely on par with Meta Platforms (META), although the market seems to be less trusting of Meta’s new direction.

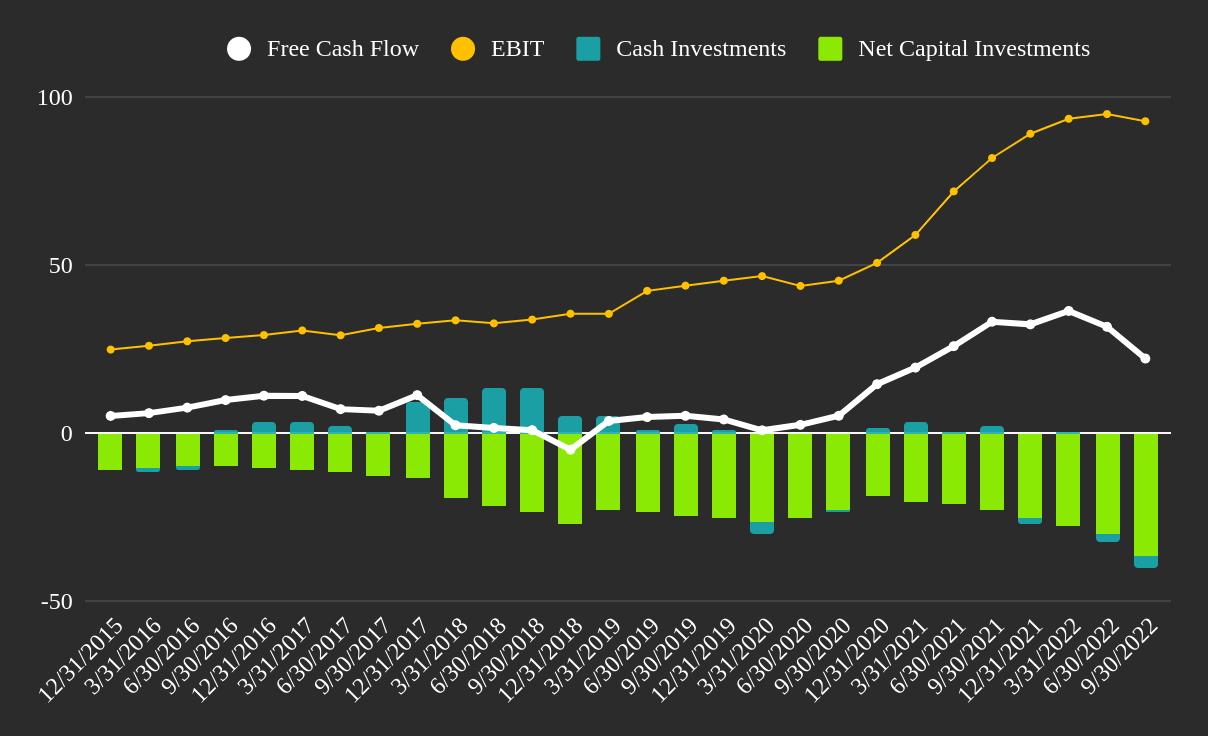

TTM free cash flows, profitability and reinvestment (Author image with data from FMP)

These large-scale investments are likely going to be part of the solution that keeps the business as a market leader, with the central segment being the cloud. A capacity and performance service like the cloud is precisely the kind of business that requires this scale of investments.

This is why the cloud is the strongest future vertical for Google, it doesn’t need to lead, pouring capital can do most of the work, while others innovate.

Peer Comparison

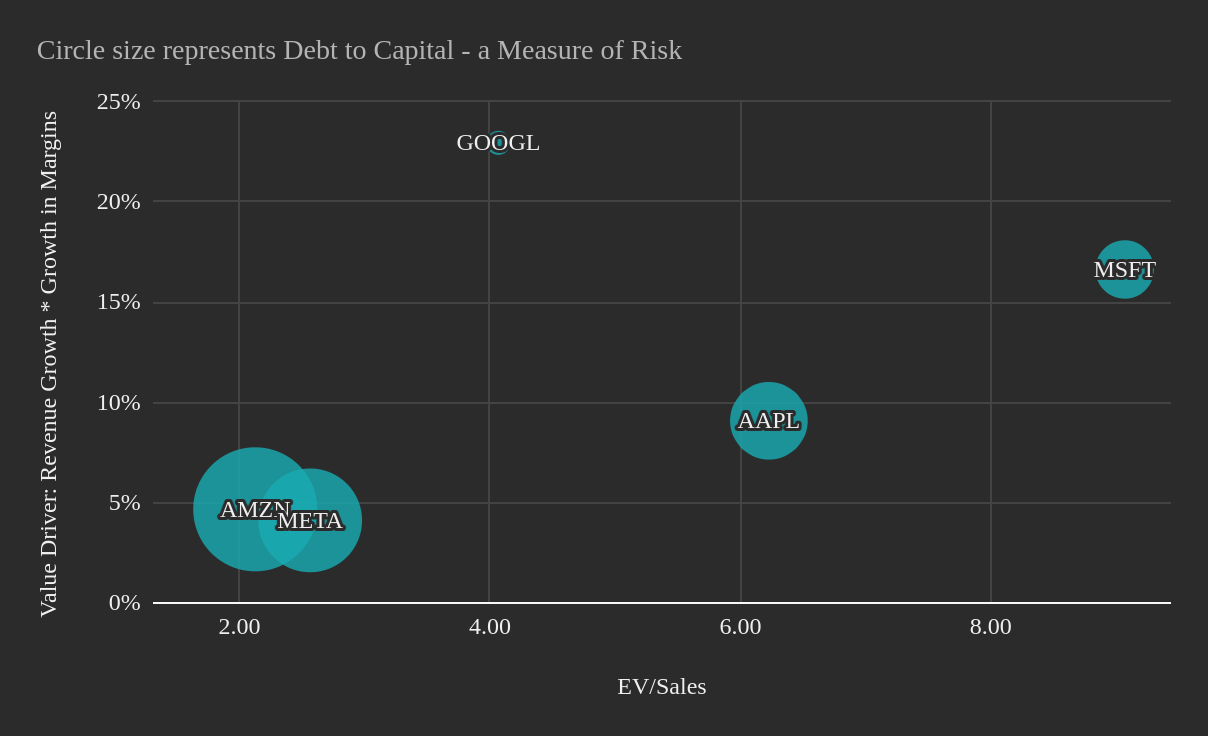

Before we get to the valuation, it is important to see why Google is an attractive company to consider. When we line up the usual suspects, we get the sense that Google may be in a rare position among competitors.

The company seems to have dropped in relative pricing, while its growth fundamentals remain significantly higher than its competitors’ fundamentals. This indicates that the market is expecting Google’s growth & profitability to drop much faster than the growth of peers, which may be a rushed position. This is something that we can capitalize on, if we think that the company is trading near or below its intrinsic value.

Google’s key peer pricing vs fundamentals comparison (Author image with data from FMP)

Valuation

Given what we discussed, I created a future estimates model with the following assumptions:

- Revenue growth of 6.5%-9% in the next 2 years, double-digit recovery in year 4 to 5, then converging to 3.7% in year 10

- EBIT margins around 30%

- Efficacy of reinvestment 100%

- Discount rate of 9%, converging to 8.3% at year 10.

This yields the following model:

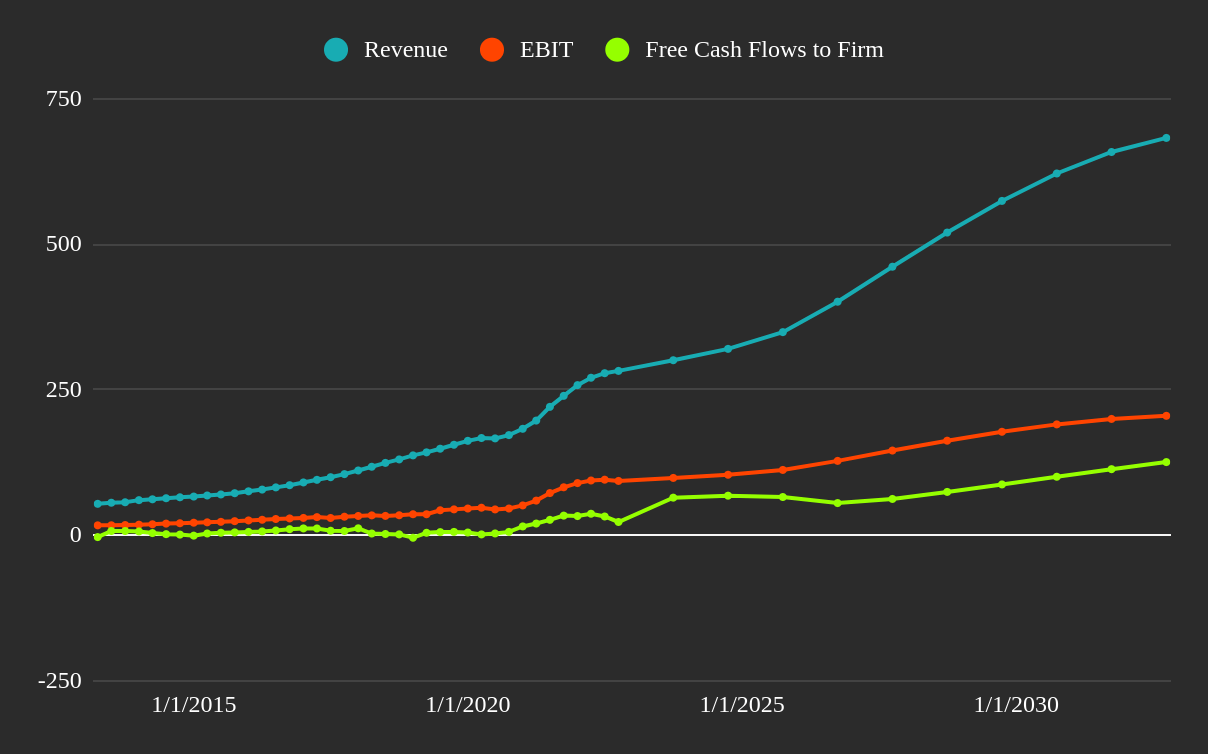

Estimated future model for Google’s fundamentals (Author image with data from FMP)

We can use a valuation table to see what we can expect from the company’s future performance:

Google’s intrinsic valuation table (Image created by author)

Key Risks

Google risks losing its dominant position from the following possible developments:

- New approaches to search and further splitting up of the search market.

- Stagnation in YouTube and an under-performance from YT shorts.

- Google cloud bottlenecks i.e. failing to close key potential clients, bad developer experience, tech stagnation, meek marketing.

Result And Investment Thesis

I estimated Google’s intrinsic value at $1.39 trillion or $113.2 per share, making it slightly undervalued, but near a 10% margin of error. This implies a 1-year price target of $133 per share, with a 31% upside. The key assumption behind the estimated growth is a successful expansion of Google cloud.

You can view and tweak the full model here.

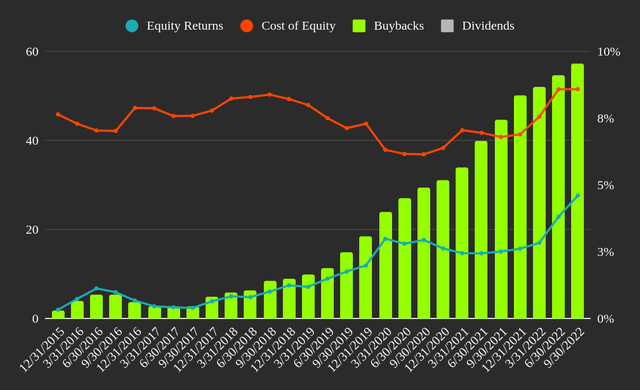

Google also has a massive buyback program, which will produce increases in price per share even if the value doesn’t increase. Additionally, the return to investor’s equity via buybacks is at a multi-year high of 4.6%, which investors can equate to the dividend yield. The chart below shows the spread between Googles cost of equity and its return to equity investors:

GOOGL’s payout vs its cost of equity (Author image with data from FMP)

While I have been quite critical of Google in my analysis, I still think that the company is trading below intrinsic value, and getting a few bad quarters will be a great productivity factor for the future.

I expect to see stricter growth projects from management in the future and a productivity-oriented environment with clear KPIs focusing more on execution rather than innovation.

Google seems to be fairly valued, with the cloud as the main growth avenue. The key shareholder returns will stem from an increase in free cash flows, as well as a growth in future buybacks. Instead of lump sum investing, investors should consider mitigating their risk by spreading their investments in Google over time.

Be the first to comment