designer491/iStock via Getty Images

Monthly or quarterly?

Which do you prefer?

It seems that whenever I write about stocks that pay monthly dividends there are always folks that swarm to read (my article), like bees and azaleas.

Alternatively, there are others who couldn’t care less if the dividend is paid monthly.

I can tell you that after 10+ years of writing articles on Seeking Alpha, there are many loyal monthly dividend investors, who are passionate about owning these frequent payers for a myriad of reasons.

First off, some companies allow investors to use their dividends to buy additional shares through a Dividend Reinvestment Plan (“DRIP”’). With a DRIP, you can use dividends to purchase full or fractional shares of the same company.

This might be preferable to receiving a quarterly or monthly dividend if you’re looking to grow your portfolio, versus creating an income stream. Another advantage of using a DRIP (with stocks that pay dividends monthly or quarterly) is that you may be able to avoid commission fees by reinvesting.

For most investors who prefer monthly dividends, you enjoy receiving the regular income (assuming they aren’t DRIP-ing) because you can live off the dividend income. You can use the money to buy groceries, grow your savings, buy the grandkids braces, or invest through an IRA or college savings account.

Having that extra income stream can also make budgeting and planning for short- or long-term financial goals easier. Those things could be more difficult to achieve with dividends that only arrive on a quarterly basis.

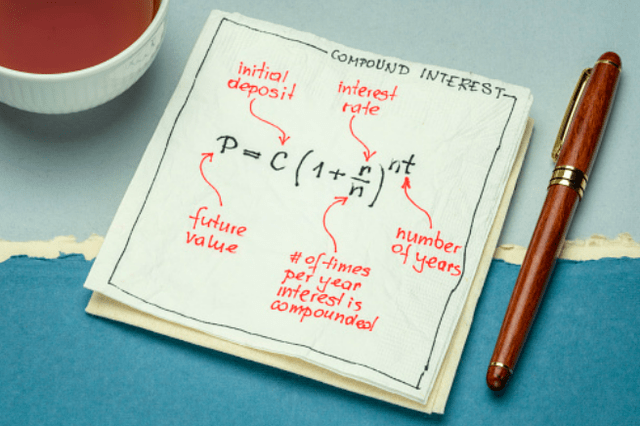

Next, and perhaps more importantly, it may be possible to generate more income from monthly dividends by reinvesting them consistently into additional shares of stock. These tie into the concept of compounding interest and how it works.

Getty Images (iStock – marekuliasz)

Compounding interest is essentially “interest an investor earns on their interest,” and it can be a powerful tool for growing wealth. The more time you have to invest and reinvest dividends, the more time you have to benefit from the compounding’s effects.

In theory, investing in stocks that pay dividends monthly versus quarterly could work in an investor’s favor if they’re able to compound their money faster. So not only could you benefit from more regular dividend income payments, you can also see more income from those stocks over time.

Of course, this depends on the dividend stocks that you own, and of course at iREIT on Alpha we help investors navigate away from the so-called “sucker yields” as we always adhere to our mantra of protecting principal at ALL costs.

It’s possible to reap the benefits of stocks that pay dividends monthly, even if your portfolio only includes stocks that pay dividends quarterly. But this requires a little more work compared to choosing stocks that pay monthly dividends already.

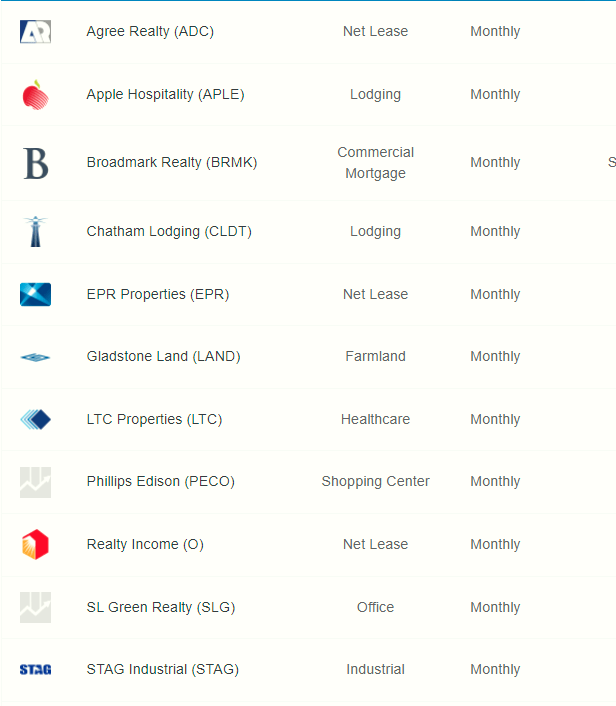

Within our iREIT Tracker there are 11 REITs that pay monthly dividends out of over 175 companies. That represents less than 5% of the REITs (that pay monthly). These REITs that pay monthly include.

iREIT on Alpha

In Canada, there are over 70 REITs and many of them pay monthly dividends.

Why is that?

My guess is that small Canadian investors love real estate and perhaps the institutional investors in Canada prefer private real estate.

There are numerous U.S. REITs that should pay monthly dividends (in my opinion). Here is my short list:

- Alpine Income Property Trust (PINE)

- City Office (CIO)

- Gaming and Leisure Properties (GLPI)

- Global Medical (GMRE)

- Innovative Industrial (IIPR)

- Iron Mountain (IRM)

- KKR Real Estate (KREF)

- Ladder Capital (LADR)

- Medical Properties (MPW)

- National Retail (NNN)

- NETSTREIT (NTST)

- NewLake Capital (OTCQX:NLCP)

- Omega Healthcare Investors (OHI)

- Orion (ONL)

- Physicians Realty (DOC)

- Sachem Capital (SACH)

- Spirit Realty (SRC)

- STORE Capital (STOR)

- VICI Properties (VICI)

- W. P. Carey (WPC)

I’ll continue to pester the management teams for each of these REITs in hopes that they recognize the power of the retail investor. Many investors own monthly-paying REITs for the reasons cited above, and it does not really cost the company much to make the conversion from quarterly to monthly.

Meanwhile, I’ll provide you with a list of 5 monthly-paying REITs that we have buy ratings on right now.

5 REITs that Pay Monthly

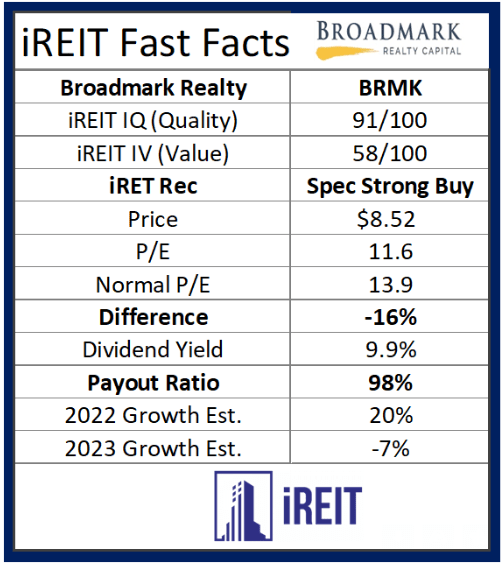

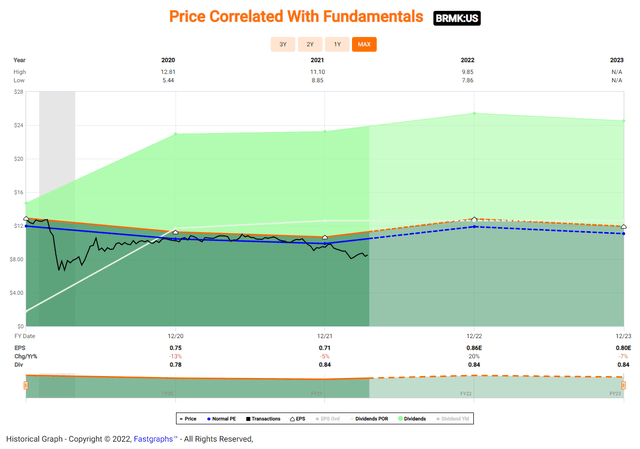

Broadmark Realty Capital Inc. (BRMK) is a commercial mREIT that is currently trading at $8.52 per share. The dividend was not covered in 2022, and that’s one of the primary reasons shares are now trading at such a low multiple (of 11.7x). The dividend yield is 9.9% and as see below (black line is the price line), shares have traded down substantially (~11% YTD).

A few days ago I spoke with BRMK’s new CEO, Brain Ward, and I provided members of iREIT on Alpha with my thoughts (of that interview). For the time being, we are maintaining a Spec Strong Buy and we’re forecasting shares could fetch $12.50 by year-end 2022 – that will generate annualized returns of over 75%. Once again, you should always maintain diversification, and remember that we consider this name “speculative.”

Good Luck!

iREIT on Alpha

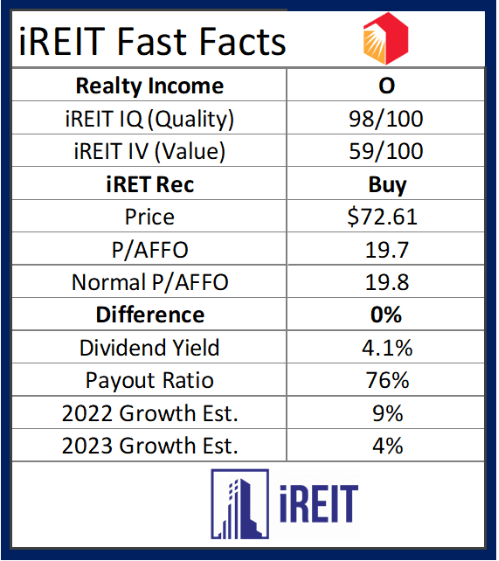

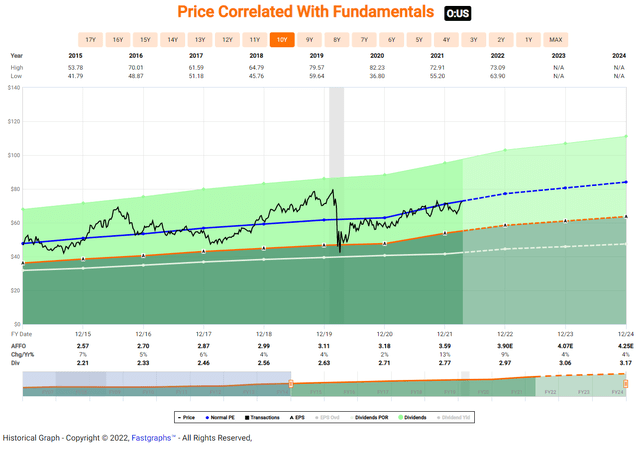

Realty Income Corporation (O) is a net lease REIT that is currently trading at $72.61 per share. The dividend is well-covered (~76% based on AFFO) and we recently increased our buy below target, which also prompted us to upgrade from a Hold to a Buy. The dividend yield is 4.1% and analysts are forecasting AFFO per share growth of 9% in 2022.

I plan to meet with O’s CEO, Sumit Roy, in San Diego next week, and I’m looking forward to the conversation. As I referenced in a recent article, O is perhaps the greatest REIT of all-time and I’m happy to be a large investor in this “sleep well at night” business.

Maintaining Buy.

iREIT on Alpha

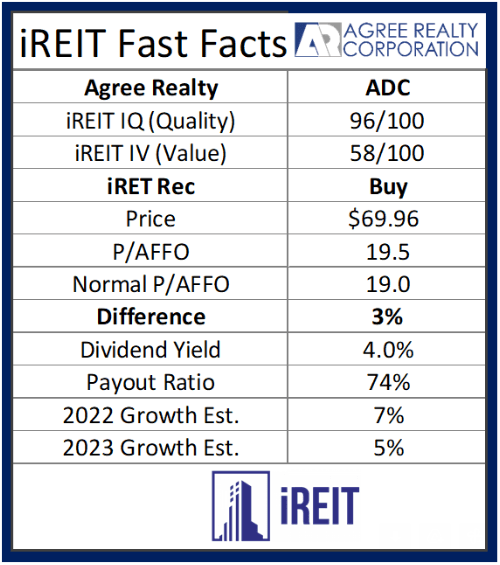

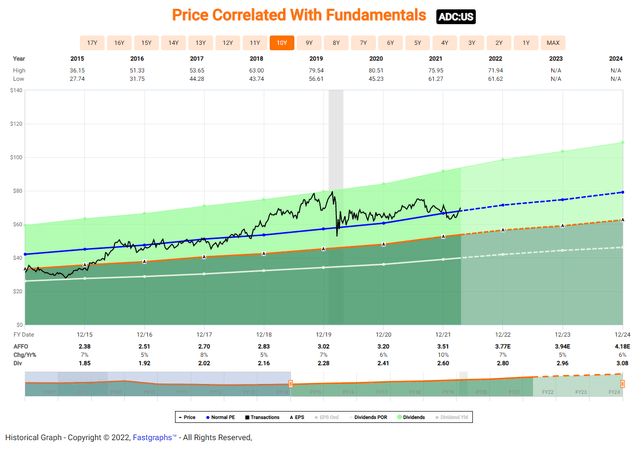

Agree Realty Corporation (ADC) is another net lease REIT that is trading at $69.96 per share and a P/AFFO of 19.5x. The dividend yield is 4.0% and also well-covered (74% payout ratio). Analysts forecast AFFO per share to grow by 7% in 2022.

We are maintaining a BUY and we are especially pleased to see the CEO, Joey Agree, putting his money where his mouth is. He recently purchased additional and 1,560 shares in multiple transactions at prices ranging from $64.13 to $64.36, inclusive (he had also acquired 1,749 shares just a day prior.).

See my latest article HERE.

Maintaining Buy.

iREIT on Alpha

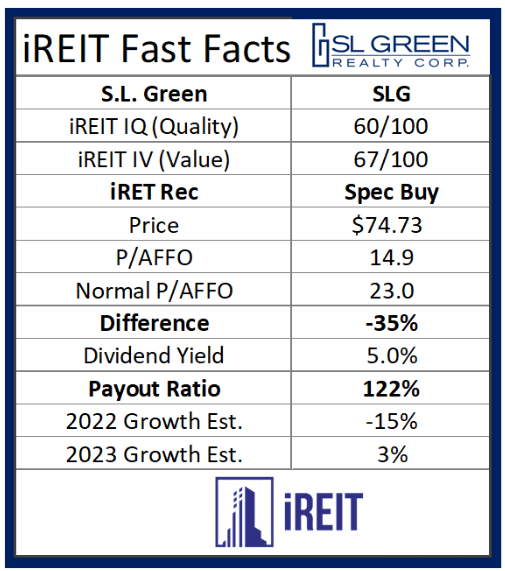

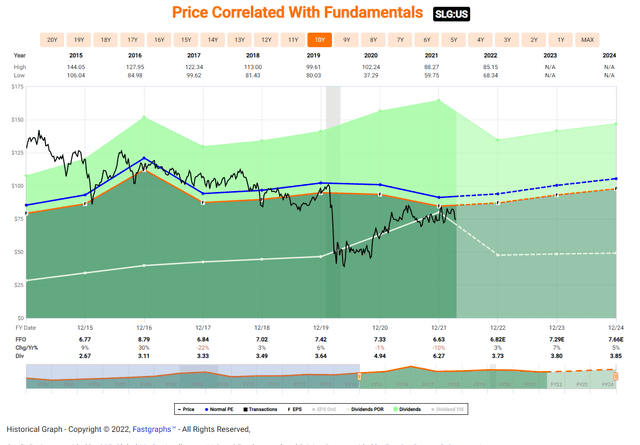

SL Green Realty Corp (SLG) is an office REIT focused on New York City real estate. Shares are trading at $74.73 with a P/FFO multiple of 11.2x (normal multiple is 13.8x). The dividend yield is 5.0% and the payout ratio is over 100% (based on AFFO). Given the extreme payout ratio (in Q4-22) we are downgrading to a Spec Buy.

We have become much more cautious within the office sector, and we are especially sensitive to the impact-related to NYC office properties. We consider SLG a longer-term trade as analysts forecast 7% growth in 2023 and 9% in 2024. The elevated payout ratio triggered a quality score reduction from 73 to 60.

iREIT on Alpha

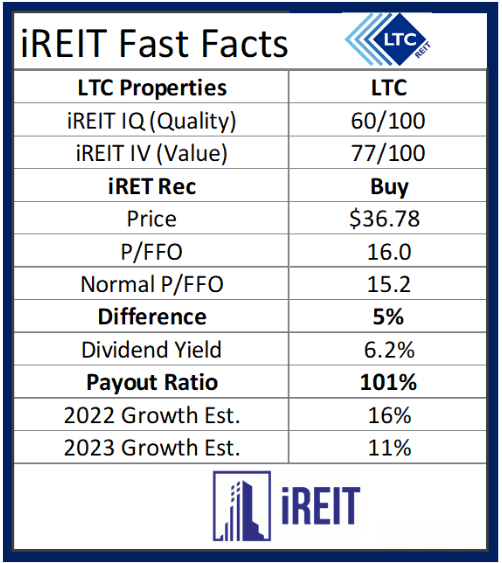

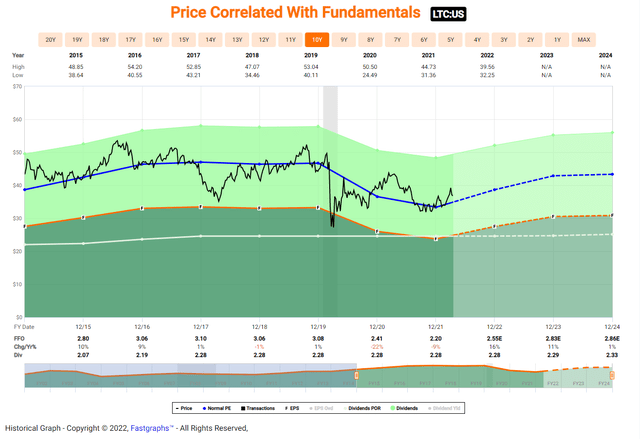

LTC Properties, Inc. (LTC) is a healthcare REIT, and shares are now trading at $36.78 per share with a P/FFO multiple of 15.9x. The dividend yield is 6.2% and that is primarily due to the elevated payout ratio of 101% (based on AFFO per share). However, that’s an improvement over the Q3-21 payout ratio of 109%.

We have always admired LTC for its defensive balance sheet and risk management discipline. We recently upgraded the quality score from 30 to 60 and we’re maintaining a BUY rating as analysts forecast growth of 16% in 2022 and 11% in 2023.

iREIT on Alpha

Why Don’t More REITs Pay Monthly Dividends?

I hope you enjoyed this edition of our monthly-dividend report and I’ll make sure to send a copy of this article to many of the REIT management teams referenced here (in this article).

While we would like to see more REITs paying monthly, we recognize that the most important thing to remember about dividend stocks is that,

“the safest dividend is the one that’s just been raised.”

Happy REIT Investing!

Be the first to comment