Justin Sullivan

Elevator Pitch

My investment rating for Verizon Communications Inc.’s (NYSE:VZ) shares is a Hold.

I discussed VZ having characteristics of a value stock in my earlier article for the company written on June 20, 2021. I offer an update of my views on Verizon Communications in light of the stock’s poor July 2022 share price performance.

Verizon’s shares didn’t do well in July, as its Q2 2022 EPS growth and key operating metrics were disappointing. I have an unfavorable view of VZ’s future financial outlook that is supported by the company’s management guidance and the sell-side’s consensus numbers. But Verizon isn’t deserving of a Sell rating, as its valuations have already de-rated to factor in the weak outlook for the company. This makes VZ a Hold in my view.

Why Did Verizon Stock Drop So Much In July?

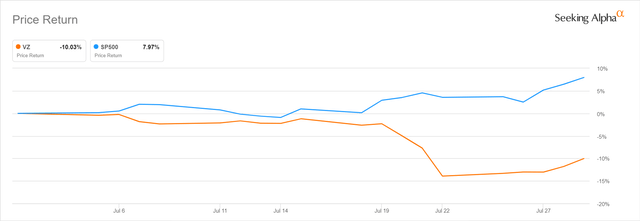

Verizon’s stock price dropped by 10% for the month of July. More importantly, this represented a significant underperformance relative to the S&P 500 which actually rose by 8% in the prior month. Also, VZ set a new 52-week low of $43.77 during intra-day trading on July 22, 2022, which was when it announced its second-quarter financial results.

Verizon’s July 2022 Stock Price Chart

Seeking Alpha

VZ’s shares continued to underperform in the first few trading days of the current month, as the company’s stock price declined by 2% from $46.19 as of July 29 to $45.33 as of August 3.

The drop in Verizon’s shares in July can be attributed to the company’s Q2 2022 earnings miss and its reduced full-year FY 2022 management guidance, which I will detail in the next few sections of the current article.

VZ Stock Key Metrics

VZ’s non-GAAP adjusted earnings per share decreased by 6% from $1.39 in the second quarter of 2021 to $1.31 in the most recent quarter. Verizon’s Q2 2022 EPS came in 1% lower than the sell-side’s consensus bottom line estimate of $1.33 per share. Verizon’s top line rose marginally by 0.07% from $33,764 million in Q2 2021 to $33,789 million in Q2 2022, and this was only 0.03% better than what the market had expected.

Specifically, Verizon performed poorly on a number of key operating metrics for the second quarter of 2022, as indicated in its Q2 2022 earnings presentation slides. VZ achieved a mere 12,000 in wireless retail postpaid phone net additions for the recent quarter, which was much lower as compared to its wireless retail postpaid phone net additions of 275,000 for Q2 2021. Verizon’s post-paid phone churn rate also rose by 9 basis points from 0.72% in Q2 2021 to 0.81% in Q2 2022.

At the company’s Q2 2022 investor call on July 22, Verizon claimed that “involuntary churn” resulting from “the expiration of state consumer protection policies and less stimulus funding” and “the competitive offerings in the marketplace” were responsible for its weaker-than-expected Q2 2022 performance

What Is Verizon Stock’s Outlook?

On top of the company’s weak operating metrics, Verizon’s financial outlook as per its management guidance was another major disappointment for investors.

As per its second-quarter results presentation, VZ revised its guidance for the company’s full-year fiscal 2022 financial performance downward.

Verizon cut its expectations for its full-year wireless service revenue growth from 9%-10% to 8.5%-9.5%. The company also sees its FY 2022 non-GAAP adjusted EBITDA declining by 1.5% at the lower end of its revised guidance (or flat EBITDA growth at the upper end of the new guidance), as compared to its previous 2%-3% EBITDA growth guidance. In addition, Verizon slashed its non-GAAP adjusted EPS guidance for this year from $5.40-$5.55 to $5.10-$5.25.

Wall Street analysts are of the opinion that VZ’s updated management guidance is realistic as evidenced by the current sell-side’s consensus numbers for the company. Based on financial forecasts sourced from S&P Capital IQ, the consensus FY 2022 EBITDA growth estimate for Verizon is -0.9%, which is aligned with management expectations. Similarly, the analysts expect Verizon’s normalized EPS to decrease by 4% to $5.18 for full-year FY 2022, and this falls within VZ’s $5.10-$5.25 bottom line guidance.

Verizon has already highlighted at its Q2 2022 earnings briefing that there will be “a little bit of a problem in churn” for Q3 2022 due to the increase in “prices for some legacy metered plans.” As such, VZ’s wireless retail postpaid phone net additions are expected to remain weak in the second half of 2022, which explains why Verizon’s full-year FY 2022 outlook is poor.

Is VZ Stock Expected To Rise Again?

VZ stock isn’t expected to rise or fall significantly again in the near term, in my opinion.

On one hand, Verizon’s earnings might still be under pressure beyond fiscal 2022. At its second-quarter earnings call, VZ noted that “we would expect to compete effectively during the holiday season as we get into new device launches in the fourth quarter (of 2022).” Verizon also highlighted that “the accounting impact of promotional activity” will have a negative impact on the company’s results for 2H 2022. Furthermore, the company acknowledged at the Q2 earnings briefing that “promotional spend” is “running at a higher level than we thought at the beginning of the year.”

In other words, VZ’s continued dependence on utilizing promotions for new devices as a key marketing tool should lead to higher expenses and lower profits for the company in FY 2023 and beyond as well, as and when such costs are recognized.

On the other hand, Verizon’s current valuations are already reflecting the headwinds that the company is facing, to a large extent.

VZ’s consensus forward next twelve months’ normalized P/E multiple of 8.7 times as per S&P Capital IQ is a mere 6% higher than its 10-year historical trough P/E of 8.2 times. Separately, Verizon’s consensus forward next twelve months’ dividend yield of 5.7% is just slightly below its 10-year historical peak dividend yield of 5.9%.

Is VZ Stock A Buy, Sell, or Hold?

I rate VZ stock as a Hold. In a nutshell, the lackluster financial outlook for Verizon in terms of wireless retail postpaid phone net additions, churn rates, and expenses relating to device promotions will cap Verizon’s upside potential. On the flip side, VZ’s forward P/E and dividend yields are appealing now relative to history, and this will limit the downside for the company’s shares. This suggests that Verizon should be rated as a Hold, rather than a Buy or Sell.

Be the first to comment