inhauscreative/E+ via Getty Images

In the real estate sector, net lease REITs are usually the first to come to mind for many investors when one thinks of a reliable income stream. However, cell tower REITs like American Tower (AMT) and Crown Castle Inc. (NYSE:CCI) are likely even more reliable, given their mission critical assets and small but powerful tenant base that includes the big wireless carriers.

Moreover, cell tower REITs offer the potential for higher income growth, as evidenced by their dividend growth track records. Fellow contributor Hoya Capital recently named CCI as one of the best ideas in the REIT space and in this article, I highlight why that is, so let’s get started.

Why CCI?

Crown Castle, along with peer American Tower are the 2 largest cell tower REITs on the market today. CCI owns and operates 40K+ cell towers and 85K+ miles of fiber, supporting fiber solutions and small cells across every major market in the U.S. Its moat-worthy collection of assets connects populations to essential data, technology, and wireless service.

It enjoys a very steady income stream as it leases valuable tower space to the top mobile carriers, T-Mobile (TMUS), AT&T (T), and Verizon (VZ). Its assets are also naturally moat-worthy, as there is little to no need for a competing tower to be built nearby once they are up and running, and leasing out additional space for equipment requires minimal incremental capital spend.

Management continues to see high growth visibility, as they are guiding for 10% site revenue growth and 6% AFFO per share growth for this full year. Furthermore, they expect to accelerate small cell growth next year by doubling small cell deployments to 10,000 nodes, more than half of which will be co-located on existing fiber, thereby enabling better lease-up economics.

Meanwhile, the long-term growth driver behind CCI remains large scale 5G deployments in the coming years, and fixed wireless offerings by the wireless carriers as an alternative to traditional home internet providers Comcast (CMCSA) and Charter Communications (CHTR) serve as a catalyst. The big telecom players are still in the early stages of their development cycle in the U.S., thereby giving CCI a long runway of revenue and growth visibility. This was highlighted by management during the Q&A session of last month’s Morgan Stanley (MS) Telecom Conference:

We are very early on with the build-out of 5G in the U.S. If you think about historically, these upgrade cycles have been the better part of a decade long. And we are probably less than 2 years in to kind of the first phase of that build-out, which has been driving a significant amount of growth across our business

The overall demand environment is very healthy, very robust. And our expectation is for that to continue for quite some time. And we are seeing the benefit of that, again, across our infrastructure of assets, the 40,000 towers that we have really concentrated in the top markets in the U.S. and then starting to see the benefits as our customers plan for the next phase beyond the initial upgrade cycle where they are deploying a lot of new spectrum that they have gotten control over the last couple of years and really start to plan for the next leg of the investment that will come around densification, which will be critically important for them to add significant capacity to the network.

Meanwhile, CCI carries a strong BBB rated balance sheet with a low net debt to EBITDA ratio of 4.9x. More than 85% of its debt is fixed rate with limited maturities though 2024, and it has an impressive $4.5 billion in liquidity comprised of cash on hand and unused capacity on its credit facilities. Notably, CCI also pays a higher starting yield than American Tower, with a current dividend yield of 4.5%. The dividend is also protected by an 81% payout ratio based on forward FFO per share of $7.70.

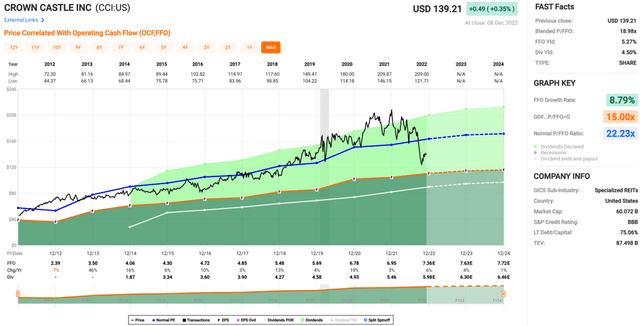

Turning to valuation, CCI is attractively priced at $139 with a forward P/FFO of 18, sitting meaningfully below its normal P/FFO of 22.2. This is considering the moat-worthy nature of the enterprise, strong balance sheet, and forward growth outlook. Hoya Capital has a target P/FFO of 22.8 and target price of $176, suggesting strong potential upside from the current price.

Risks

Potential risks include satellite based communications, but we believe that remains distant, if even realistic, as it would be extremely challenging and uneconomic to deploy vast amounts of bandwidth from space when land-based deployments are readily available.

A more reasonable concern, at least in the near term, may be related to a potential slowdown in 5G deployments from the major telecom carriers if customers are slow to adopt the technology. In addition, higher interest rates for longer adds uncertainty to the debt markets and would raise CCI’s long-term cost of funding.

Investor Takeaway

CCI is well positioned to benefit from the 5G build-out underway in the U.S., with plans to aggressively roll out its small cell deployments next year. Furthermore, CCI carries a strong balance sheet with ample liquidity and limited refinancing needs through 2024.

CCI is attractively priced at the moment, making it an attractive opportunity for income investors and long-term growth investors alike. With strong revenue visibility and excellent fundamentals, we believe that CCI offers a compelling investment opportunity with upside potential.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment