BING-JHEN HONG

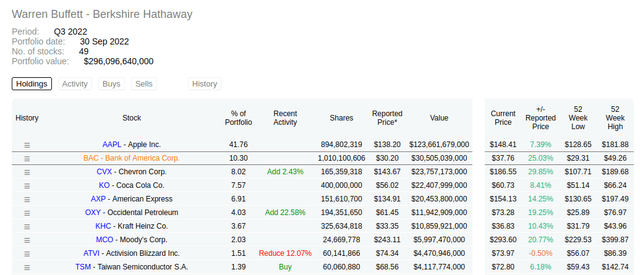

One of the big surprises in Berkshire Hathaway’s (BRK.A)(BRK.B) latest 13-F is that the company just invested several billions of dollars in Taiwan Semiconductor (NYSE:TSM). Given the size of the investment it is likely that Buffett himself made the investment, or at least gave his approval. While Berkshire has been increasingly getting more comfortable with making technology investments, it was still a surprise given the size and the fact that it is not a US based company. Out of the gate Taiwan Semiconductor is already one of the top positions in Berkshire’s stock portfolio.

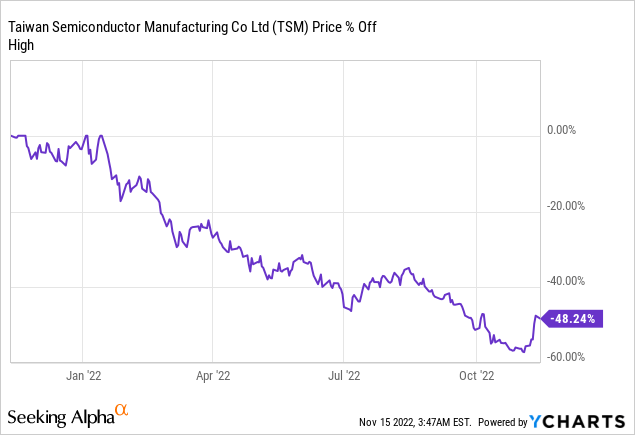

So what attracted Buffett to Taiwan Semiconductor? We believe it was a combination of factor. For starters, the share price seems detached from the fundamentals. While the shares had been in a free fall, losing more than 50% of their value from the peak, the company was posting excellent results.

We analyzed the company’s third quarter results in a previous article, where we pointed out that earnings had skyrocketed 80% higher compared to the previous year, easily beating analyst expectations. Revenue for the third quarter was up 36% year over year, and the company guided fourth quarter revenue to be up approximately 29% year over year. We also pointed out how it didn’t make sense for one of the most important companies in the planet to have a market cap of only ~$332 billion.

Financials

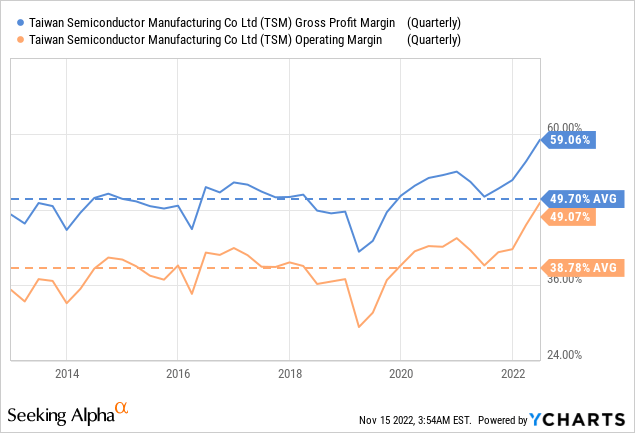

We know Buffett likes companies with strong competitive moats, and Taiwan Semiconductor’s profit margins reflect a very strong moat, which appears to be getting even stronger. Not only is the ten year average operating margin an impressive 38%, but it has recently increased to close to 50%. It is extremely rare that a company gets to keep such a large portion of its revenues as operating profit.

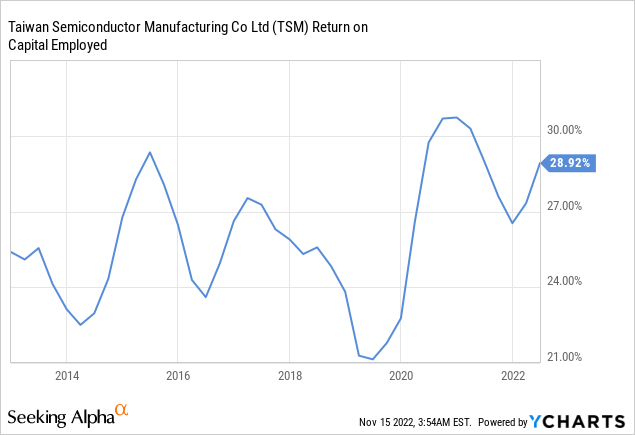

One can also get an idea of the size of the moat by looking at the return on capital employed. This has been cyclical, but has not been less than 20% in the past decade.

The excellent returns on capital employed, together with the massive investments Taiwan Semiconductor makes, end up making the company an impressive compounding machine.

Growth

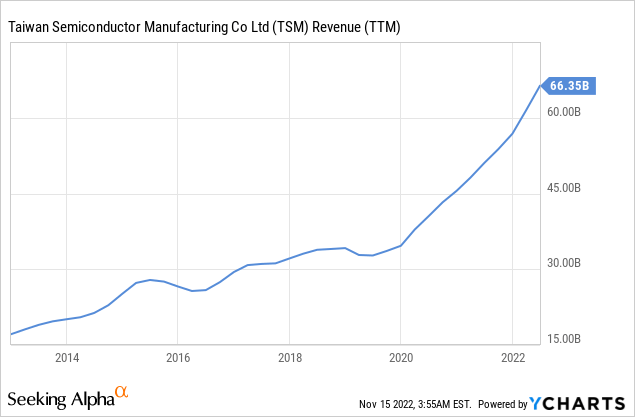

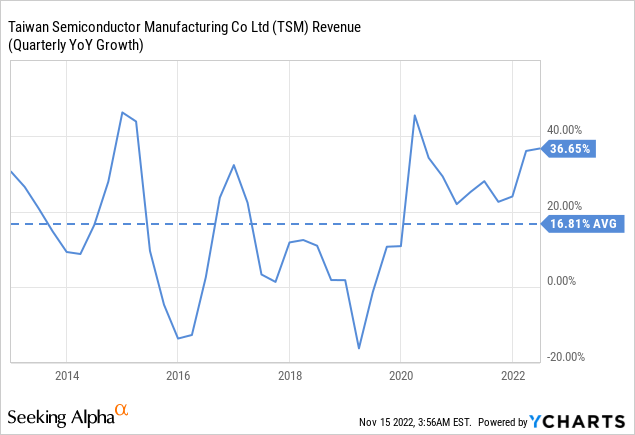

In addition to a strong moat, Taiwan Semiconductor has been delivering impressive growth too. In the past decade it has increased revenue from a little over $15 billion to over $66 billion. This has been thanks to market share gains, and growth in the end markets it serves, many of which have important secular tailwinds. Some of the key end markets for Taiwan Semiconductor include smartphones, high-performance computing and data centers, Internet of Things devices, automotive, etc.

The average quarterly y/y growth rate the company has delivered over the past decade has been ~16.8%, and recently that has been more than twice as high.

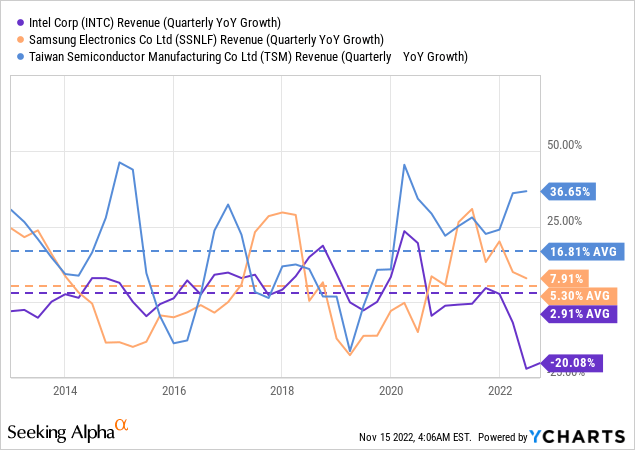

This growth rate is much higher than that of competitors such as Intel (INTC), which has averaged only ~2.9%, and Samsung Electronics (OTCPK:SSNLF) which has averaged only ~5.3%. In other words, Taiwan Semiconductor has delivered over 3x the growth of competitor Samsung Electronics.

Balance Sheet

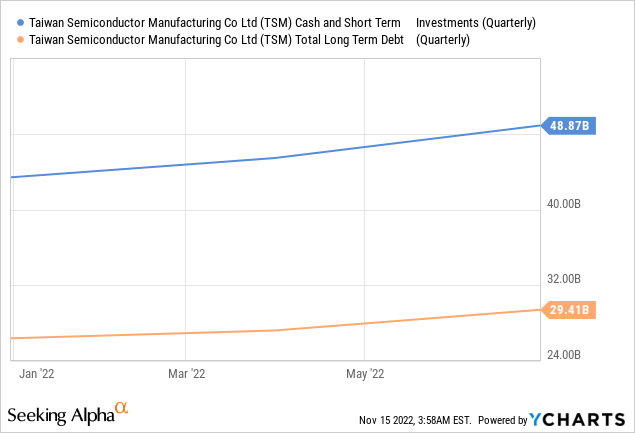

Something else we know Buffett appreciates is a solid balance sheet, and Taiwan Semiconductor has a rock solid one. It has more cash and short-term investments than long-term debt, putting the company in an excellent position to continue investing for future growth, and to weather any potential downturn in the economy.

Dividend

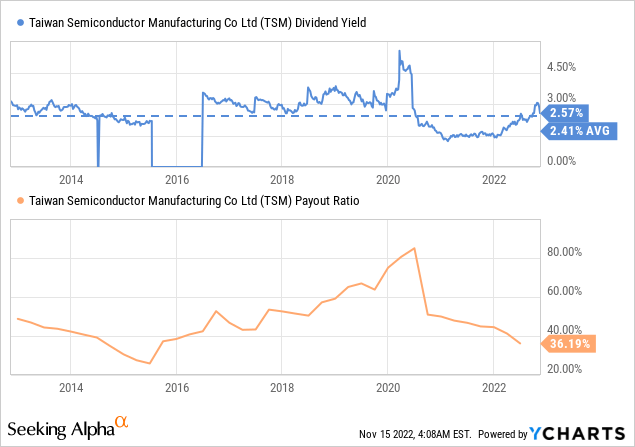

Something else to like about Taiwan Semiconductor is that it shares a significant portion of its earnings with shareholders in the form of dividends. At current prices shares yield ~2.5%, and this is a well-covered dividend given that the payout ratio is only ~36%.

Valuation

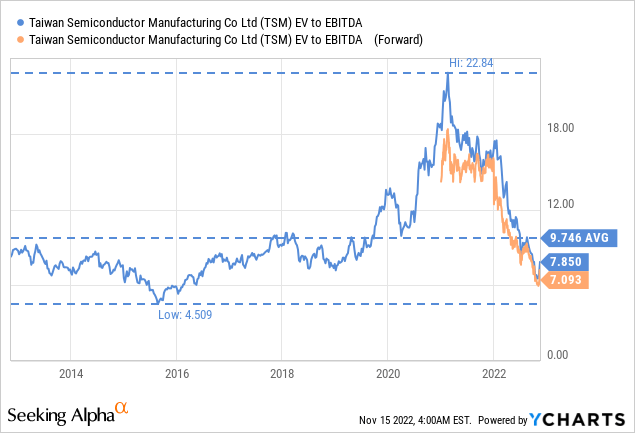

Finally, we think Buffett bought Taiwan Semiconductor because he was getting a bargain. Despite all the excellent attributes that we have listed above, shares have been trading recently at a relatively low valuation. The EV/EBITDA ratio is only ~7.8x, and the forward multiple is even lower at ~7x. This is below the ten year average for the company.

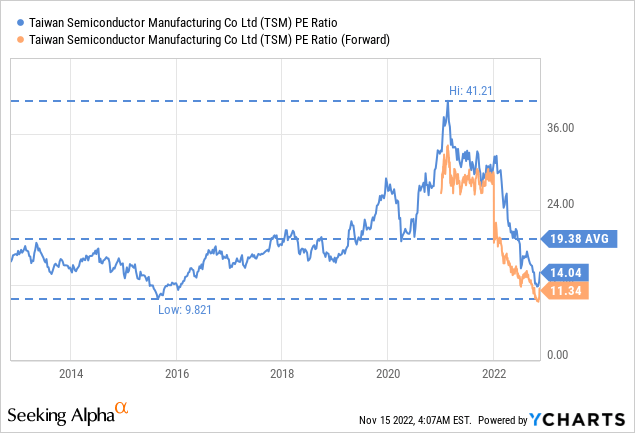

Similarly, the price/earnings ratio is ~14x, and only ~11.3x based on the forward earnings estimates. This is considerably cheaper than the ten year average p/e of ~19x.

Risks

Taiwan Semiconductor still has some important risks, one of which has been particularly present in investors’ minds recently. Investors have been fearful of a potential Chinese invasion of Taiwan. In any case, Buffett likes to be greedy when others are fearful, and that seems to be the case here.

Conclusion

Berkshire Hathaway just disclosed a massive investment in Taiwan Semiconductor, and we can see multiple things that attracted Buffett’s attention. Taiwan Semiconductor has a massive competitive moat, excellent profit margins and returns on capital employed, and has been growing at an impressive rate. Despite these great qualities, shares have recently been trading at low valuation multiples, which is probably what made Buffett decide to start a significant position in the company.

Be the first to comment