Mario Tama

Warren Buffett put around $34 billion into shares of Apple from 2015-2018. That position is now worth around $140 billion, making up 41% of BRK.A’s stock portfolio. It’s clearly his best trade of recent time, and the following two quotes (not specifically about NASDAQ:AAPL) sum up why he bet big on the company.

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.”

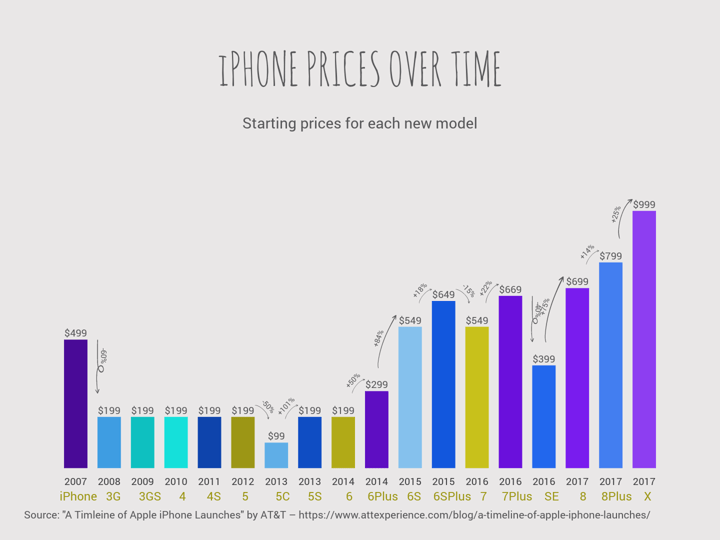

The iPhone will go down as one of the most successful examples of pricing power of all time. The brand is so powerful that it convinced around 1.2 billion people to pay a premium price for a largely discretionary item. Not only that, many of these 1.2 billion will happily pay for an upgrade each year or sooner with price not being an issue. Below we see the price of iPhones over time:

vizzlo

The following quote is on the ideal type of business:

“Indeed, the best businesses by far for owners continue to be those that have high returns on capital and that require little incremental investment to grow.”

One of the best signs for AAPL is the fact that the capital intensity is lowering. For a company of this size to become even more capital efficient is rare and impressive. The table below shows the past decade’s FCF, net income, ROIC, and capital efficiency ratio.

|

Year |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

FCF(BIL) |

41.4 |

44.5 |

49.9 |

69.7 |

52.2 |

50.8 |

64.1 |

58.8 |

73.3 |

92.9 |

|

Earnings(BIL) |

41.7 |

37 |

39.5 |

53.3 |

45.6 |

48.3 |

59.5 |

55.2 |

57.4 |

94.6 |

|

ROIC |

30.3% |

22.7% |

23.6% |

25.7% |

19.3% |

18.3% |

25% |

25% |

27.4% |

43% |

|

CIR |

1.12 |

1.21 |

1.26 |

1.24 |

1.49 |

1.63 |

1.37 |

1.3 |

1.17 |

0.98 |

AAPL is often compared with other big tech companies, even ones that aren’t in the phone business at all, but I’ll only use the ones that are more related to smartphones. Below is the comparison of return on capital metics:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF 10-Year CAGR |

|

AAPL |

12.9% |

44.5% |

28.1% |

19% |

15.3% |

|

9.3% |

16.9% |

19% |

2% |

86.8% |

|

|

21.1% |

16.3% |

15.2% |

14.2% |

19.7% |

|

|

-27.7% |

-6.4% |

-5.2% |

n/a |

n/a |

Capital Allocation

There’s no denying the fact that AAPL is a juggernaut in terms of high profits and returns on capital. Revenue is approaching $400 billion and last year’s FCF margin was 25%. The majority of FCF goes towards dividends and repurchases lately. The majority of that shareholder yield has been repurchases over dividends. The dividend has grown at a CAGR of 19.2% since 2012.

They are consistent in making smaller acquisitions on a regular basis. Over 100 acquisitions have been made, which comes to approximately 3-4 per week. These buyouts are usually integrated within AAPL’s framework instead of being run quasi-independently. The one thing we can definitely expect is that they will never be able to make a major acquisition due to antitrust concerns.

Risk

AAPL’s core has been the Iphone for over a decade now, but the key question is whether this can remain the core of their business eternally. Bears will say that things must change eventually but at this point in time, AAPL has such extreme profitability means that pivoting is ever-easier.

To think that profits will be misused to the level that the company becomes less profitable would mean incremental returns on capital will decline year over year. The numbers so far don’t prove this and the likely possibility that iPhone sales will slow down even more doesn’t mean the brand is actually losing power.

Even if sales were flat or began to fall, EPS would grow due to share count reduction that can be continued for a long time. The big risk is overpaying for the quality of this business.

Valuation

Below is a comparison of price multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

AAPL |

6.3 |

18.9 |

22.8 |

41.3 |

0.6% |

|

SSNLF |

1.1 |

4.6 |

12.7 |

1.1 |

2.7% |

|

GOOG |

4.4 |

12.7 |

18.8 |

5.2 |

n/a |

|

BB |

3.3 |

-40 |

-28.1 |

1.9 |

n’a |

There aren’t any exact replicas of what AAPL has become today, but a premium is definitely being attached as far as multiples. They aren’t extremely high, but the days of upper single digit PE ratio might never return.

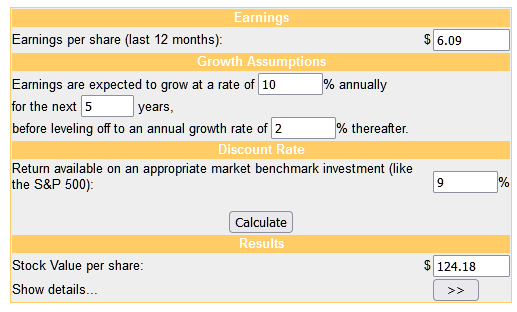

money chimp

The earnings projections above are optimistic considering the law of large numbers affecting the stock with the largest market cap in the world.

Typically with a big, blue chip company I would prefer to have an above average dividend yield in exchange for knowing that fundamental growth will be evermore slow in the future. AAPL is an exception in that it has and likely will keep defying the law of large numbers to some extent. In spite of that, I would still prefer a higher yield. The share price is still more than double the March 2020 Covid lows, and I’m afraid the chance for a better dividend yield won’t be back unless another broad market downturn comes.

The quality of AAPL is well known now, and the multiples will reflect the high quality for a long time. The stock is a hold for me, but I don’t see a deep discount being very likely in the future unless another market crash occurs.

Conclusion

Buffett made the best trade of recent BRK.A history from loading up on AAPL when the PE was in the low double digits. The situation is different today. Even though AAPL was the biggest company in the world the entire time, multiples are much higher now and the quality is obvious to everyone.

The opportunity to buy the biggest stock in the world and still get a multibagger doesn’t exist anymore. There has never been a financial juggernaut as powerful as AAPL, but the price paid today won’t get returns that reflect the extreme profitability for the company. AAPL is a long term play from here, but at this price I won’t be buying.

Be the first to comment