Tonkovic/iStock via Getty Images

In previous articles about Altria Group, Inc. (NYSE:MO), I have mentioned the company’s ability to withstand a recession and economic distress. And with a steep recession being a high probability scenario for the next few quarters, Altria might be one of the better picks (and better investments) for the next few years. It is also worth mentioning that the stock was able to outperform the S&P 500 (SPY) since my last article was published. While the S&P 500 declined almost 16%, Altria is trading more or less for the same price as in December 2021.

In the following article, I will explain my reasoning why Altria is a good pick in a recession and why Altria investors should root for a recession (maybe not but compared to many other companies and stocks Altria will most likely perform quite well).

Reason I: Stock is Recession-Resilient

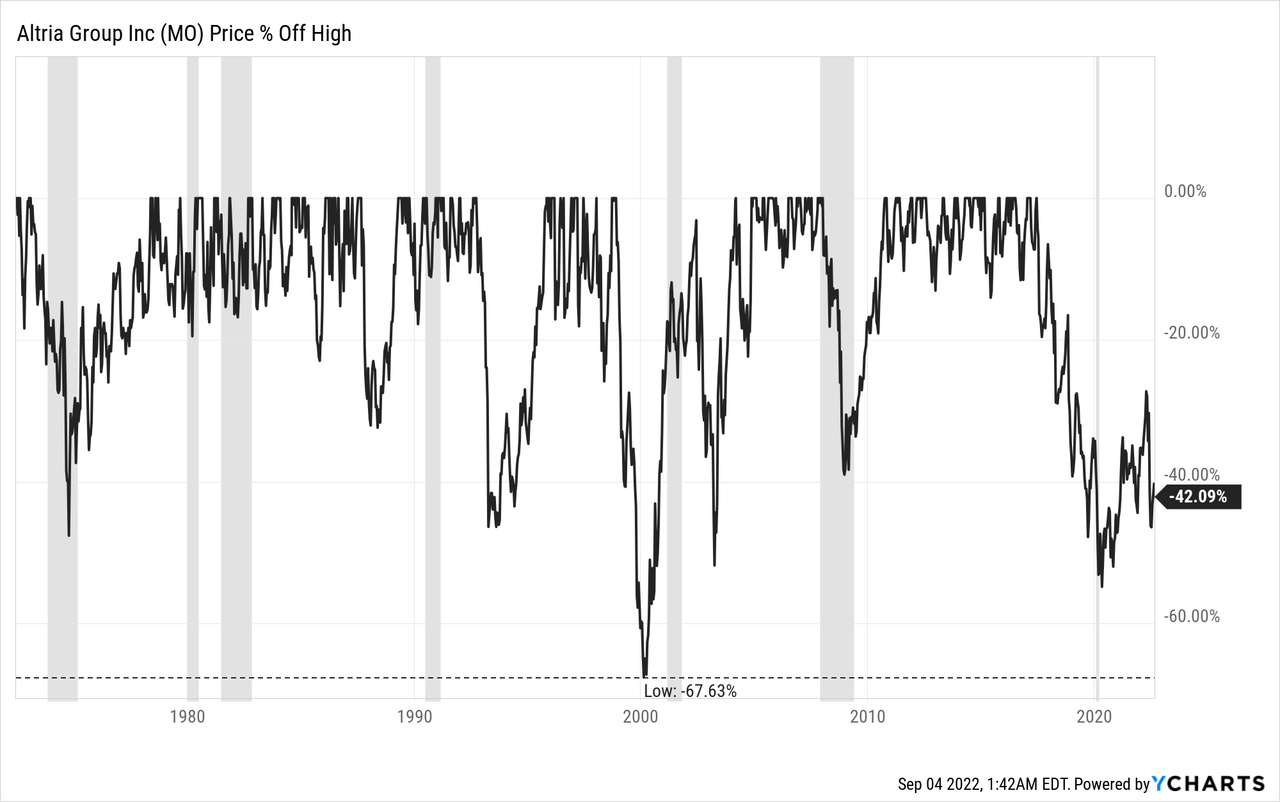

When arguing why Altria is a good pick for a recession, we can start by looking at MO stock performance during the last five decades. And although the stock declined rather steeply on several occasions (and, for example, more than 50% from its previous high in the recent past), the reasons for these steep declines weren’t economic recessions. And when looking particularly at U.S. recessions in the last few decades, the stock held up pretty well during these times. The steepest decline that can be associated with an economic recession was during the Great Financial Crisis, but even here the stock performed better than the overall market.

And during many other recessions, MO stock sometimes declined only in the teens and hardly entered bear market territory. When also considering the rather low valuation multiples the stock is trading for right now (we will get to this), the downside potential might seem rather limited.

Reason II: Hardly Declining Demand

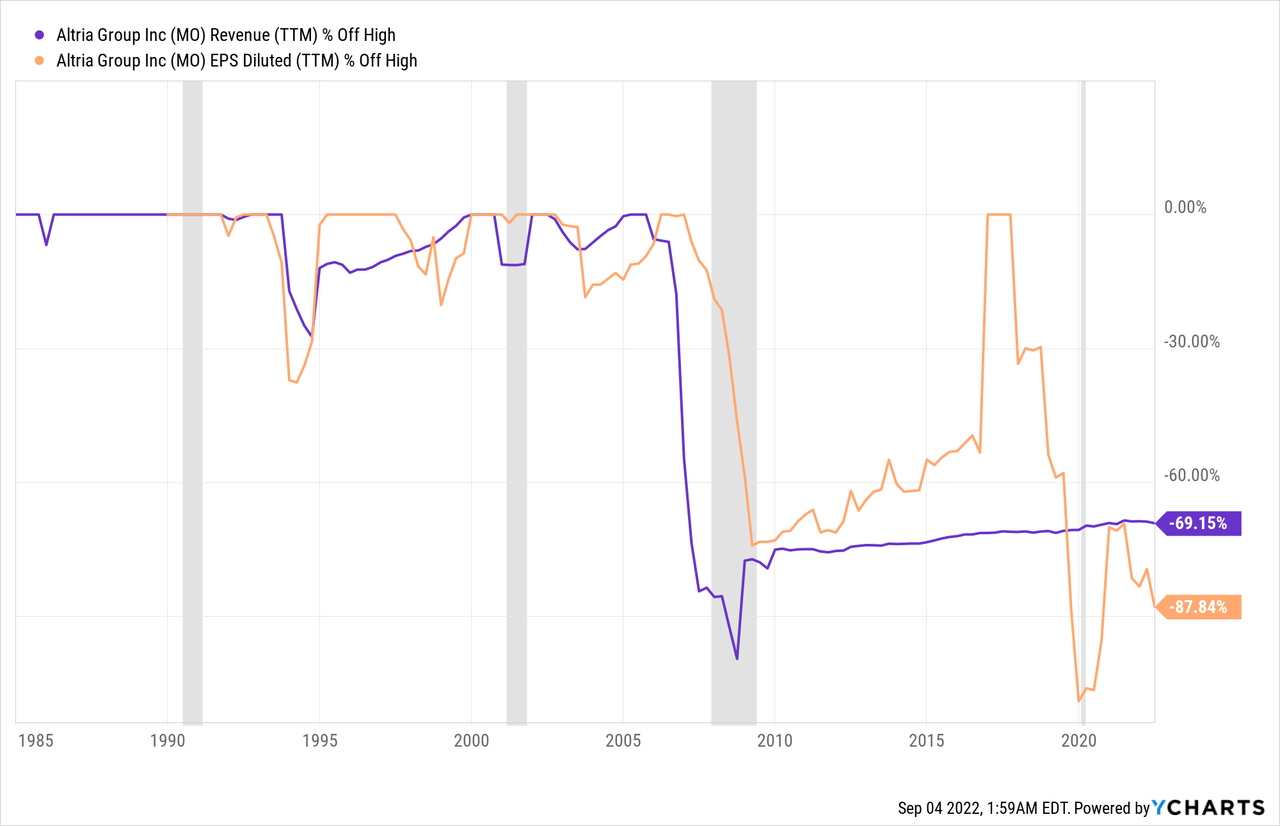

Without doubt, the stock performance is important for investors, and nobody likes to see investments losing two thirds of the previous value. But much more important than the stock price performance is the performance of the fundamental underlying business. And not only has Altria’s stock performed rather well during times of economic distress, but the fundamentals also held up rather well. When looking at revenue, for example, we saw declines, but once again most of these declines can’t be associated with recessions. The steep revenue decline before the Great Financial Crisis stemmed from Philip Morris International (PM) being spun off from Philip Morris USA.

When looking at earnings per share, the picture is similar. We saw several steep declines for earnings per share – for example, in the last few years, but it is once again difficult to make connections between these declines and recessions.

Of course, it is not really surprising when thinking about the business model and the products the company is selling. In my first article about Altria, I wrote:

Although cigarettes and cigars are not basic needs customers have, they sure as hell make addictive and this leads to a stable demand for the products – even during economic downturns.

In the same article I also described how these addictive products lead to switching costs for the consumers:

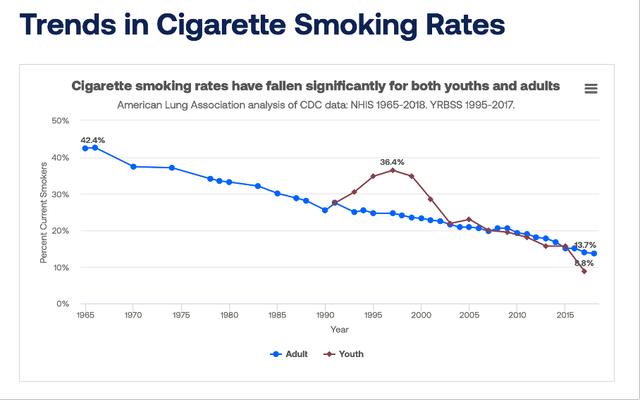

It might sound a bit strange to describe an addiction as switching costs but switching away from the product is extremely difficult for Altria’s customers. It seems possible to switch to the product of a competitor but switching away from cigarettes is very hard for many smokers. While a huge part of smokers is trying or intending to quit only a small fraction manages to quit (although numbers of smokers are constantly declining as fewer young people start smoking and some smokers manage to quit).

It is also problematic that cigarettes are rather cheap and are purchased like an everyday item. Paying around $8 for a pack of cigarettes is affordable for most people. Of course, costs mount up over time and heavy smokers will spend a huge part of the monthly disposable income on cigarettes. But every pack of cigarettes is an individual buying decision, and we usually are looking at buying decisions in isolation (and don’t see follow-up costs or costs mounting up over time). Therefore, installment payments could be such a problem for people – we only see the (rather small) monthly payment and ignore the huge overall costs. We don’t get the feeling an $8 purchase is a problem – and continue buying (especially if the product is highly addictive). While consumers will be able to postpone the purchase of a new care or a new smartphone (see my last article about Apple (AAPL)), they will not postpone buying a pack of cigarettes – again and again.

Reason III: Severe Recessions and Smoking

A stable customer base is great for every business – especially during economic downturns. But we can go even one step further and not just assume current smokers continuing to smoke. Research is suggesting that already existing smokers might smoke more, and people might even start smoking again in case of a recession (or depression).

A study analyzing the effects of the Great Financial Crisis on the number of smokers in the United States revealed no significant changes in smoking prevalence trends over the period 2005-2010. But the same study saw an increase of 2.4 million smokers among unemployed individuals and the overall number of smokers also increased during the Great Financial Crisis. When considering that cigarette smoking rates are constantly declining in the United States, an increase from 19.8% in 2007 to 20.6% in 2009 (numbers for adults) is certainly worth mentioning.

Other studies come to similar conclusions. A study from Canada states that the unemployment rate increases the number of cigarettes smoked by daily smokers. And parents in the United Kingdom, which became “income poor” during the Great Recession were more likely to start smoking or smoke more (according to this study).

The discussion paper “Smoking and the Business Cycle: Evidence from Germany” however comes to a different conclusion and is also stating about the related literature:

Most of the previous literature on the relation between economic fluctuations and smoking behavior identifies a procyclical tendency, meaning that individuals smoke less (more) during an economic downturn (upturn).

The authors also make the following statement, which contradicts findings from above:

In fact, most U.S. studies provide evidence that when economic conditions weaken heavy drinking and drunk driving, smoking, obesity, and physical inactivity decrease while diets improve

I don’t know if we can make a strong case for the number of smokers increasing during a recession and people smoking more, but it seems like a possibility that Altria will sell more cigarettes in case of a severe economic recession in the United States.

Dividend

When talking about Altria, we also must mention the dividend, as it is playing an important role for the company. Right now, Altria is paying a quarterly dividend of $0.94 after the dividend was recently increased by 4.4%. This is resulting in an annual dividend of $3.76 and a dividend yield of 8.36%.

A dividend yield in the high single digits is certainly tempting for every investor, but also raising the question right away if the dividend is safe. When trying to determine if a dividend is safe, we usually compare the dividend to earnings per share. In the last four quarters, Altria generated only $0.95 in earnings per share, and we don’t even have to calculate a payout ratio – the company is paying about four times its annual earnings per share in dividends right now and that is not sustainable. And when looking at GAAP numbers, the dividend was higher than the TTM EPS for at least 10 quarters in a row now. Of course, we can also use the adjusted earnings per share. For fiscal 2022, expectations are $4.83 in earnings per share, which would result in a payout ratio of 78% for Altria. This could be called sustainable but is still a rather high payout ratio.

Aside from earnings per share, we can also look at the generated free cash flow. In the last four quarters, Altria generated a free cash flow of $8,088 million. When comparing this amount to dividend payments of $6,529 million in the same timeframe, we get a payout ratio of 81% – also a rather high number.

Despite being positive about Altria managing a recession quite will – and maybe even seeing increasing revenue in such a scenario – I would be cautious about the dividend and the company’s ability to raise the dividend in the years to come. Although the capital expenditures for the business are extremely low, the company also needs cash to repay the debt on its balance sheet.

Balance Sheet

I already looked at the balance sheet in my last article and will do so once again. On June 30, 2022, long-term debt was $25,046 million and short-term debt was $2,634 million. When subtracting $4,544 million in cash and cash equivalents from the total debt, we get a net debt of $23.1 billion to repay. And with only about $1.5 billion in free cash left over after paying dividends, it is possible to repay that debt. However, it would take about 15 years leaving no cash for anything else but the dividend and cash repayments.

And as long as talking about the balance sheet, we also have to mention that Altria is reporting a shareholder’s deficit for two quarters in a row now. This is also making it impossible to calculate a reasonable debt-equity ratio for the business.

Intrinsic Value Calculation

While the payout ratio seems a little high and the balance sheet is far from perfect, the stock could be called reasonably valued. And it certainly helps Altria when the stock is trading for reasonable valuation multiples as it limits the downside risk. During recessions and bear markets stocks trading for a high valuation multiple usually get punished and might decline rather steep – and this will also happen to well-performing businesses.

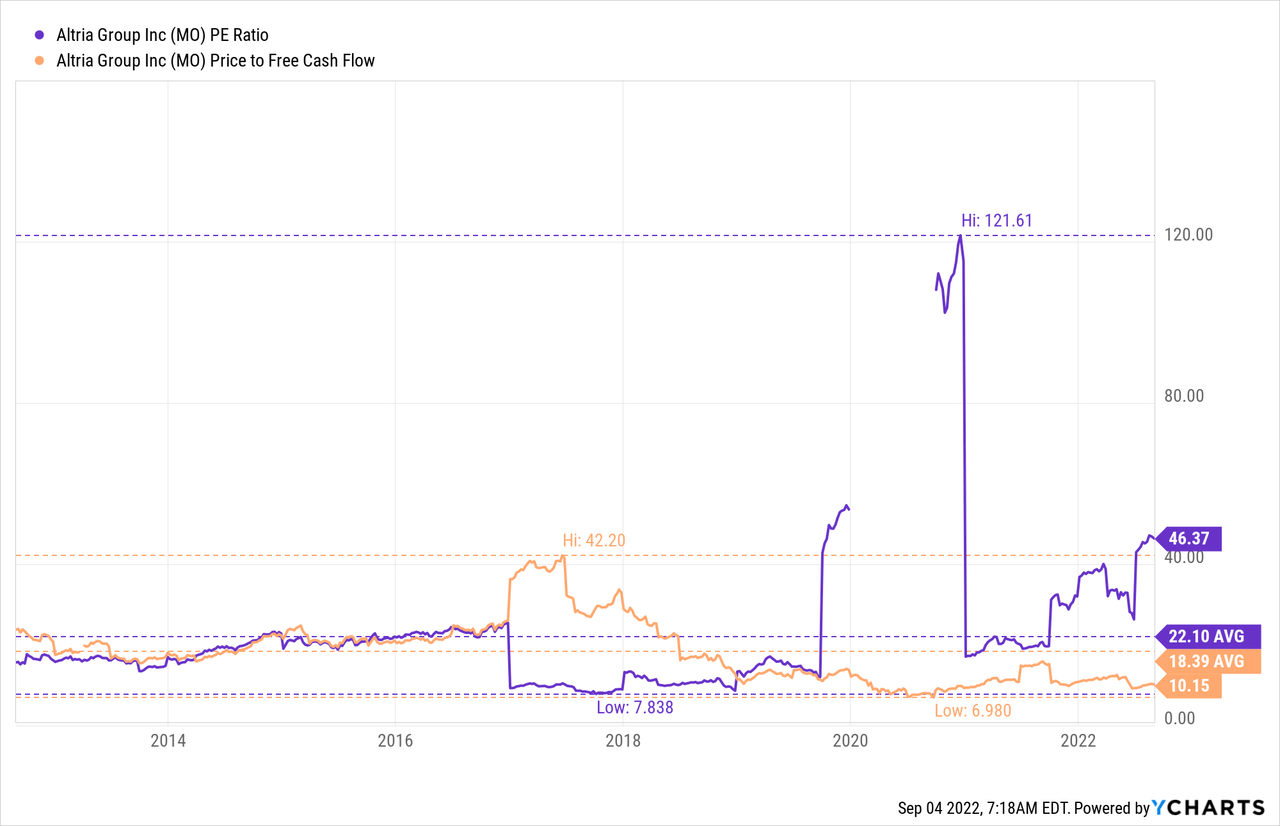

When looking at the P/E ratio, Altria does not seem cheap at all. Not only did the price-earnings ratio constantly get higher over the last few quarters, Altria is now trading for 46 times earnings, which seems extremely expensive for a business having trouble to increase its top line. But instead of the P/E ratio, we should rather focus on the way more important price-free-cash-flow ratio. And Altria trading for 10 times free cash flow seems reasonable – even if the business has trouble to grow in the years to come.

That assessment can be backed up by a discount cash flow calculation. When using the free cash flow of the last four quarters and assume no growth (and I would be very cautious about any growth assumptions), the stock appears to be fairly valued at this point (assuming 10% discount rate).

Conclusion

I will still not invest in Altria for several different reasons. Aside from reasons that don’t have to do much with fundamental investing and which I don’t want to discuss here, I want to invest for the long term and not just in companies and stocks that might perform well over the next few years (or during the next recession).

And I don’t want to call Altria a bad investment (especially as shareholders holding on to the stock in the last decades have been rewarded). But aside from the dividend maybe not being sustainable, Altria is facing troubles to grow its top line and the business model is certainly seeing structural challenges as the number of smokers might continue to decline. There are certainly two valid perspectives on Altria – a bearish and a bullish one – and both perspectives can somehow be justified, and I am choosing to stay on the sidelines as it is not the kind of business I like to invest in.

Be the first to comment