Nastassia Samal

Introduction

Adobe (NASDAQ:ADBE) reported earnings last Thursday but made an even more important announcement. The company announced the acquisition of Figma for $22 billion, $20 billion plus $2 billion in restricted stock units for Figma’s management.

Before going over what this acquisitions means and how we interpret it, let’s go over to the market’s reaction to the news.

The market’s reaction

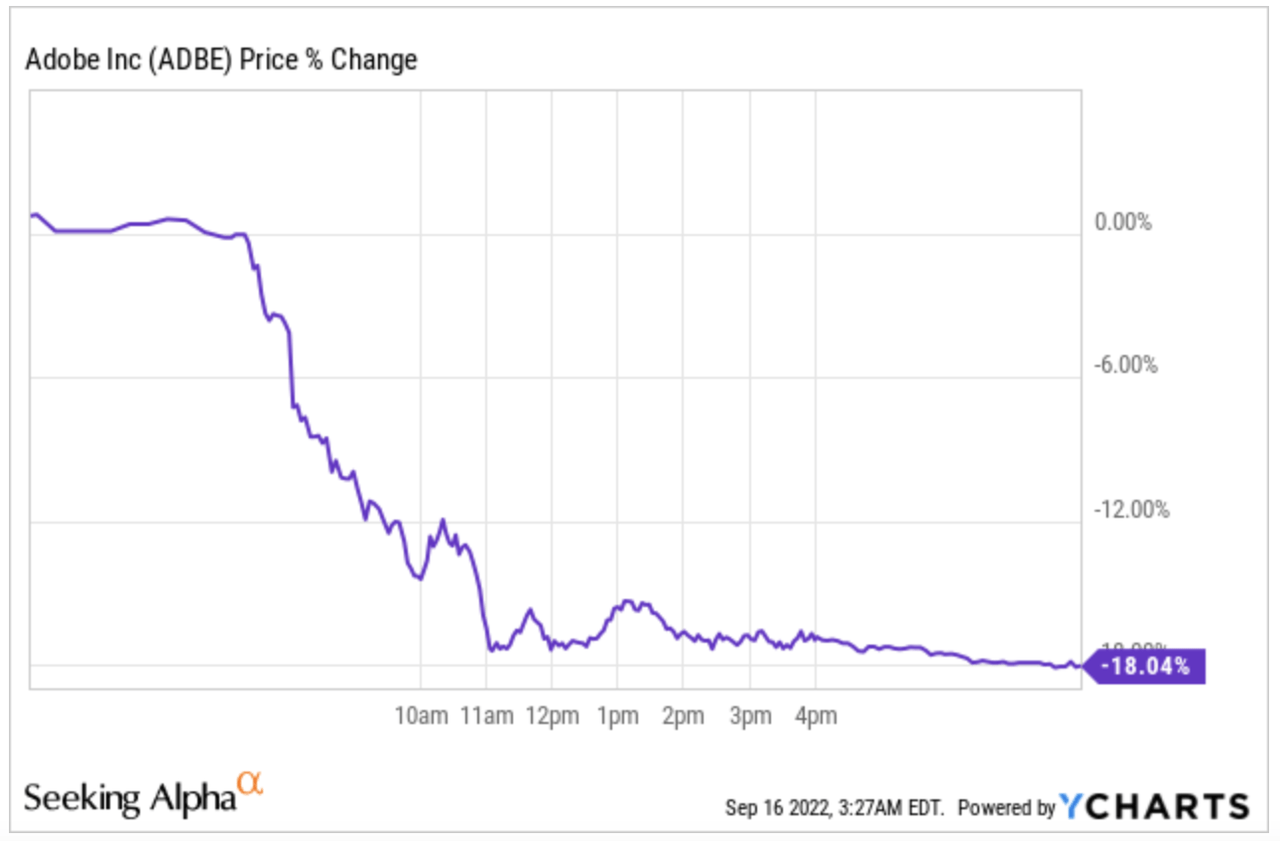

The market reacted harshly to the news. Adobe’s stock dropped 18% in one single day, losing more market cap than what it will pay for Figma:

YCharts

It’s very clear: the market didn’t like the acquisition. We understand the reaction. History suggests that about three quarter of large acquisitions are value-destructing, more so at high multiples such as the one Adobe paid.

In this case, though, the market also has to factor in that Adobe eliminates a long-term threat, but you shouldn’t expect the market to look many years out. The market is cautious and wants proof that this will work out for the company, and we completely understand this point of view.

Figma: good or bad?

Figma webpage

A brief introduction to Figma

Figma is an all-in-one design solution focused on collaboration. The company acknowledged from the start that design was a task that required many more players than just designers. Hence, it embarked on a path to build an integrated solution where everyone could collaborate. The company also built everything on the web, reducing user friction and enabling real-time collaboration.

Not only has Figma captured the E2E (end to end) design process, but it has also captured the brainstorming phase through FigJam. FigJam allows team members to brainstorm and collaboratively design workflows, being able to connect designs from Figma directly:

Adobe knew that Figma was a threat and was investing in collaborative tools, but quickly shifting its core offerings toward a real-time collaborative environment proved to be more difficult than expected. The acquisition of Figma is not an acquisition of an Adobe XD competitor, but more so of a whole new strategy to collaborate, which is where the industry is shifting.

Our thoughts on the acquisition

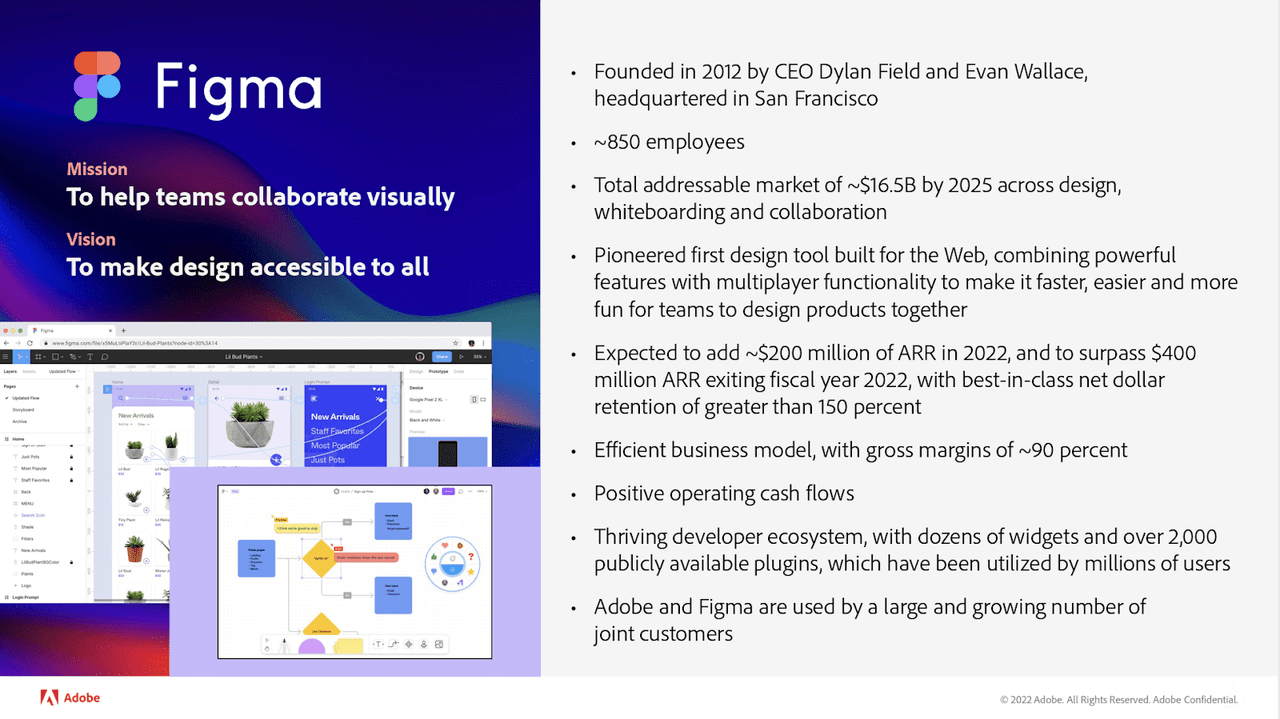

First of all, the deal is pending regulatory approval, but we believe it should go through based on Figma’s size relative to Adobe and the fact that the FTC mostly scrutinizes big tech. Below, you can find some general information about Figma:

Figma Acquisition Presentation

The first thing that stands out is the hefty price tag. Figma is expected to generate $400 million in ARR (annual recurring revenue) in 2022, so Adobe is paying around 50 times 2022 ARR.

It’s also true that this $400 million ARR is probably understated. The rationale is that once under Adobe’s umbrella, Figma will not have to outcompete Adobe on price and will be able to implement value-based pricing. Right now, Figma uses a freemium model. As an ‘individual user’ you can use Figma for free. We all know that a lot of these ‘individual users’ are actually businesses too. They take advantage of the freemium model. On top of that, Figma offers a very low price for its paying customers. It had to take market share as much as possible as fast as possible.

Now that it comes under Adobe’s umbrella, Figma’s pricing power has increased quite a bit. The question we should ask ourselves here is:

What would ARR be if Figma hadn’t had to compete with Adobe?

It’s difficult to put an exact number on this, but common sense says it would be significantly higher just based on pricing power.

Figma’s CEO said in a thread that pricing would not change over the short term, but we highly doubt this will hold true over the long term:

Recognizing that we are in an unpredictable, inflationary environment, we currently have no plan to change Figma’s pricing.

Source: Dylan Field (Figma CEO) on Twitter

Despite Figma’s under monetization, $20 billion is still a hefty price tag. Right out of the bat, the deal’s financials don’t make much sense. Yes, Figma is growing fast (100% year over year ARR growth), but even after factoring in an additional year of 100% growth, Adobe would still be paying 25x ARR. Adobe even states that Figma’s total addressable market in 2025 will approach $16.5 billion, so management is effectively paying 1.2 times the total 2025 TAM. TAMs grow, and Figma is in a solid position to capture much of its TAM under Adobe’s umbrella. Still, it’s better to assume that TAM is not achievable 100%.

The deal still doesn’t make much sense from a financial standpoint if we just look at these figures, that’s pretty obvious. It will be paid with a combination of cash and stock. Issuing stock at near 52-week lows to overpay for something doesn’t seem like a great deal either. It’s true, though, that the number of shares is fixed at a much higher price, which means that the acquisition gets “cheaper” as Adobe’s stock slides.

However, we must also look at the acquisition strategically because it’s pretty apparent that it was the strategy that guided management’s decision, not financials.

Adobe’s management was probably worried about Figma eating too much into its lunch, especially in enterprise, and decided it was best to overpay to preserve the moat long term. Nobody pays $20 billion for an annual recurring revenue of $400 million unless they are afraid the other party could significantly hurt them over the long term.

This means that, while there definitely is some value destruction over the short term, the landscape is different if you look at the long term, where Adobe’s terminal risk has just been reduced significantly. Will the $20 billion prove to be a fair price to reduce terminal risk? We’ll only know the answer to this question in hindsight.

Now it depends on everyone’s investment horizon to judge which of the two weighs more in their decision. Shorter-term oriented investors will put much more weight on the hefty price than the long-term strategic move, whereas long-term oriented investors should do the opposite. Of course, arguing if weights should be 70/30 or 50/50 is something personal. We definitely weigh more the strategic move than the deal’s financials. We’re also very aware of the implication that overpaying for acquisitions might have for long-term shareholder value creation too, though.

There’s one crucial thing here. While Adobe is erasing a long-term risk, it must tackle the problem at its roots. The fact that a small company could scale so fast and erode a moat built over decades shows that Adobe may have become too complacent. It also indicates that technological moats can deteriorate quickly if management doesn’t act fast enough.

Complacency and bureaucracy are the most significant risks for a large company, and Adobe showed with this acquisition it was exposed to at least one of these risks. It was able to react now (by paying a hefty price), but it should make sure that it doesn’t happen again (or at least not anytime soon). In the future, there will undoubtedly be a venture-capital-backed company that challenges once again Adobe’s moat. VCs have just seen Adobe make the largest acquisition ever of a private tech company (yes, even more than WhatsApp), so we can expect venture capital to flood design businesses from now on. The rationale is that the market is large, has growth opportunities, and a large player is willing to overpay to maintain its moat. It’s a VC’s dream.

While this acquisition has strengthened the moat for the next 5 to 10 years, it may have made it more vulnerable over the very long term. There’s little Adobe can do against VC flooding the industry, but it should identify these threats before and avoid paying such a hefty price. For context, Figma was valued at $2 billion in 2020, but already at $11B in 2021. That was a market top, though.

Now Adobe “only” has to worry about Sketch for the next couple of years, the other viable alternative to Figma and Adobe XD. Sketch was founded in 2010 with a similar goal than that of Figma: enable collaboration throughout the design process. The problem is that Sketch “only” offers a natively built OS application (so only mac users can access it), making collaboration much more complicated than on Figma.

We could argue that most designers own a Mac (at least this is my experience when working with several design teams), but when it comes to E2E collaboration, one has to think that not all the design value chain will be dominated by Apple.

In my previous job, I used to work hand in hand with designers. They all used Macs, but I personally used Windows. Sketch penalized my ability to collaborate seamlessly with them. With Figma, I would’ve been able to collaborate in the design process with my Windows computer, so we could argue that while Figma is a truly E2E collaboration platform, Sketch is geared to the Apple ecosystem and those players in the value chain that use Apple products. Unlike Figma, Sketch is also not only cloud-based, but mostly on-prem, which feels a bit old-fashioned, to be honest.

Of course, it goes without saying that the landscape changes dramatically if the deal doesn’t go through. In this scenario, Adobe would have admitted that Figma is a real long-term risk, but at the same time, it would not have been able to eliminate it. In this case, we would definitely consider trimming our position.

The initial reaction is likely to be bad when one reads that Adobe is paying 50x sales for a competitor. Nobody likes to see their company overpaying, especially if it creates significant dilution. However, things are different once the strategic view is considered. If we were to ask owners of a +$100 billion market cap company what they would be willing to pay to erase a long-term risk, what would they say? Probably less than 50x sales (for sure), but probably much more than what can be considered fair from a financial standpoint. Another way to see it is: What can be considered a “fair” price to ensure 5 or 10 additional years of compounding?

For this reason, we will keep adding to our position, and our long-term view remains optimistic. Also, we must admit that we hadn’t paid enough attention to Figma as a risk, which we hope doesn’t happen going forward.

Management won’t tell you they acquired Figma to eliminate a long-term competitive risk because this would surely raise the eye of the regulator. During the earnings call, management argued that there were several reasons behind the acquisition. Let’s go over them.

Why did Adobe buy Figma?

According to management, there were three main reasons behind the acquisition:

-

Accelerate top-line growth

-

Roll out additional Adobe offerings on the web

-

Expand the addressable user base thanks to collaboration

We believe number 1 is quite apparent and can be looked at from two angles. First, Adobe can now roll out Figma to its extensive user base. Secondly, this volume growth can be coupled with increased prices, as they’ll be virtually no competitor to Adobe + Figma. Adobe also protects the top line of its core products, so growth should be more robust there too.

Reason number 2 is also quite important. Adobe had already rolled out some products on the web (Photoshop, Acrobat…), and it was seeing strong growth. It’s undoubtedly easier for a user to open something on Google Chrome (or another browser) than to download a specific app. Friction is reduced, so engagement ticks up. While Adobe was fairly new in this venture, Figma was born this way, so Adobe can take advantage of its experience to continue taking its core products to the web. While many people might be used to downloading apps to work, new generations are much more used to having everything on the web. Adobe lost this customer segment and is now trying to gain it back.

Point number 3 is probably the most important. Figma was founded with collaboration at its heart. When we say collaboration, we don’t mean collaboration between designers. We mean collaboration between all the players in the design workflow. Adobe had been working on collaboration features, but these were mainly geared to designers, and the company struggled to make this collaboration real-time. Now, with Figma, Adobe has gained instant access to real-time collaboration, to which it can add its core products to enrich the experience. This Twitter thread explains why achieving real-time collaboration is so hard.

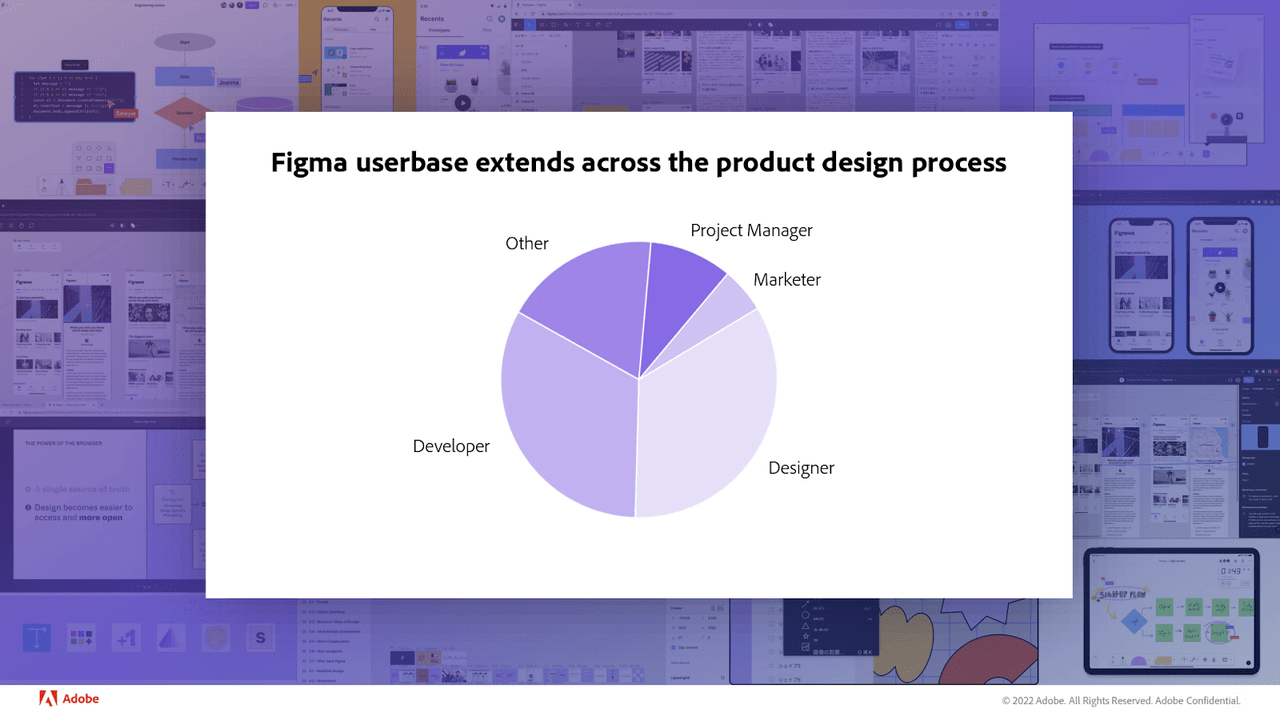

Bringing new players to the design process played out quite well for Figma, as nearly two-thirds of its users were non-designers:

Figma Acquisition Presentation

This, of course, expands the reach of Adobe’s products to new users. Nevertheless, it’s pretty astonishing that Figma could open up new markets in an industry dominated by Adobe for several decades.

They are all valid reasons to acquire Figma, but maybe not enough to justify paying $20 billion for $400 million ARR. The key lies in the strategic move more than in the financials; although many might be surprised that the financials might end up playing well over the long term for Adobe, we’ll have to wait and see. We think it all boils down to the following question that Adobe management probably answered to set the price:

How much of my market cap do I have to pay to protect the rest?

It turns out the answer was $22 billion.

Conclusion

We hope this article helped you with all the context necessary to understand Adobe’s acquisition of Figma. There’s no denying that some investors are worried about Adobe’s competitive position now, but we believe the drop in valuation also reflects this new risk of future disruption.

If you have any questions, don’t hesitate to leave them in the comments.

In the meantime, keep growing!

Be the first to comment