halbergman/iStock via Getty Images

Core Investment Thesis

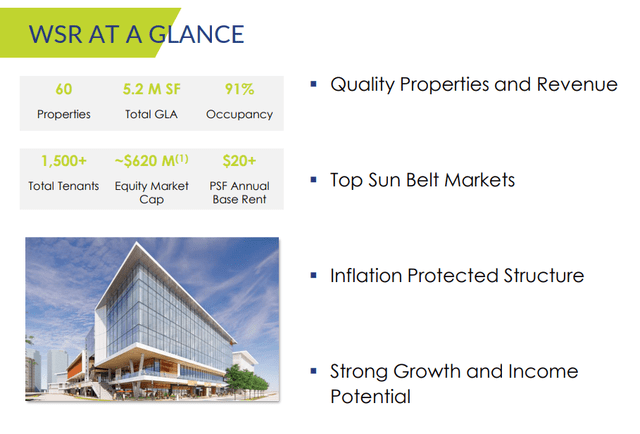

Whitestone REIT (NYSE:WSR) owns and operates a small but dynamic portfolio of high-quality, open-air shopping centers in the largest and fastest growing markets of two Sunbelt states: Texas and Arizona.

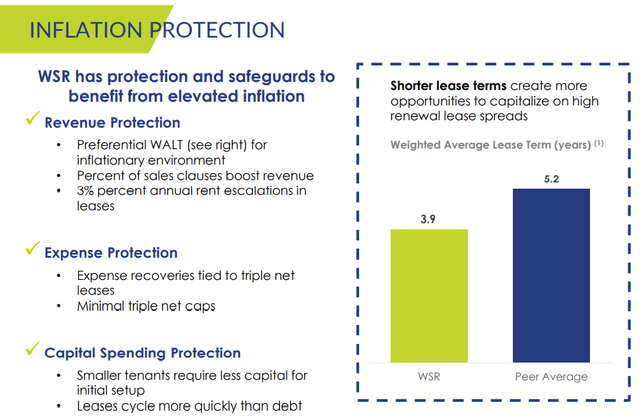

The retail REIT has several things going for it, including inflation protection from short lease terms allowing for more frequent rent resets as well as superlative population and job growth in its four core markets.

Whitestone REIT Presentation

But perhaps the most important factor that makes WSR a strong buy today is the fact that the company is dirt cheap relative to its growth prospects.

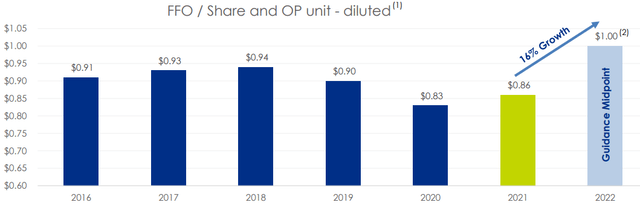

With a $1.00 midpoint of FFO guidance for 2022, WSR is currently trading at around a 10.8x FFO multiple. (It is easy to calculate the price-to-FFO multiple when FFO/share guidance is exactly $1.00!) The flipside of that is that WSR’s FFO yield (FFO divided by price) is nearly 9.5%. That is dirt cheap, which would seem to imply low quality assets or some other big problem.

But that isn’t the case.

Rather, portfolio occupancy is rising, the balance sheet is steadily strengthening, former governance problems have been resolved, and FFO per share is expected to rise 14-17% this year.

As leverage ratios continue to decline in the face of rising asset values and rent rates, WSR’s ultra-low valuation will make increasingly less sense. I believe the market will eventually recognize the value in this hidden retail REIT gem. In fact, I think it has about 50% upside to fair value, assuming a 16x FFO multiple at fair value.

While you wait for WSR to realize its upside, you can enjoy the REIT’s very well-covered 4.5%-yielding dividend that is likely to grow in the years ahead.

Crucial Governance Changes Set Up WSR For Long-Term Success

First off, we must address the former, serious issue of misaligned top management. After the former CEO took over WSR in 2006, he oversaw rapid portfolio growth from $170 million to $1.1 billion in assets by 2021.

But this impressive asset growth provides a valuable lesson in the importance of investing in properties that feature cash yields above a REIT’s weighted average cost of capital (“WACC”).

When you invest at a spread above WACC, you create shareholder value and increase profits per share. But when you don’t invest at a spread above your WACC, you destroy shareholder value and erode profits per share.

Unfortunately, much of the portfolio expansion under the previous CEO proved to be shareholder-destructive empire building, as demonstrated by declining funds from operations (“FFO”) per share from 2016 through 2020:

Whitestone REIT Presentation

Despite boasting a strong portfolio of high-quality properties located in fast-growing markets, the former CEO oversaw a long period of slow-growing or declining FFO per share.

This was a motivating factor behind the ousting of the ex-CEO, who is now suing WSR for $25 million, alleging wrongful dismissal. In fact, the former CEO alleges that he was in the process of negotiating a sale of the whole company to a third party before he was fired and that his firing was motivated by a desire from other executives not to sell the business.

Of course, WSR’s current management denies these allegations. And even beyond their flat denial, it is hard to argue with the shareholder-friendly actions the new CEO, David Holeman, has taken along with his explicit goal to grow per share FFO going forward.

As of the beginning of 2022, Dave Holeman, who has been with WSR for 15 years and previously served as the Chief Financial Officer, took on the role of CEO but not the role of Chairman.

In addition to the change in the CEO role, the company instituted some key governance changes to prevent this sort of problem from happening again, such as the separation of the Chairman and the CEO roles and the commitment to reasonably reducing G&A costs (including top executives’ salaries). In Q1 2022, G&A expenses dropped 46% year-over-year.

G&A costs to total revenue has decreased dramatically from 19.4% in Q1 2021 to 8.9% in Q1 2022.

Under Holeman’s leadership so far, WSR is very much looking like a new and improved version of itself that is poised to thrive without the weight of an overpaid CEO and poor governance structure that allowed sliding FFO per share to continue for so many years.

Expanded Case For Whitestone

I covered the management/governance issue first, rather than the portfolio or balance sheet, because no matter how good the portfolio or balance sheet are at a given moment in time, they can always be mismanaged by an unskilled or misaligned management team.

That said, with a better and more shareholder-aligned CEO now in place, WSR’s balance sheet looks set to strengthen on the back of its top-notch portfolio of Sunbelt retail centers.

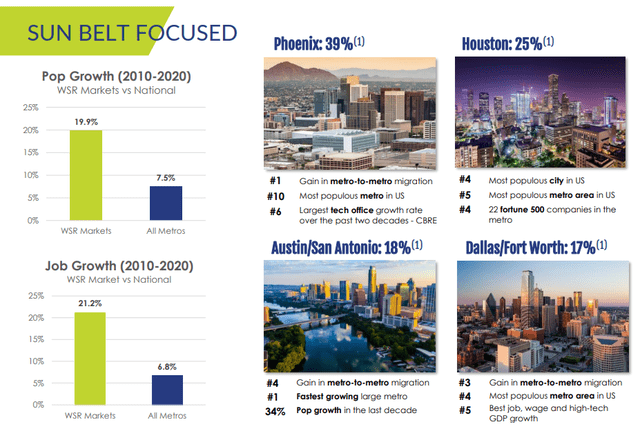

This portfolio is spread across five markets in Texas and Arizona (counting Austin and San Antonio separately).

Whitestone REIT Presentation

These are business friendly states that feature lower unemployment, lower taxes, and less regulations than the average state. Hence why so many corporations and workers have been relocating to these states in recent years.

It isn’t just Elon Musk and Tesla (TSLA). Texas recently surpassed New York and California to become home to the most Fortune 500 companies in the nation, with 53 of those 500 (over 10%) now calling the Lone Star State home. This is slightly higher than New York’s 51 and California’s 50.

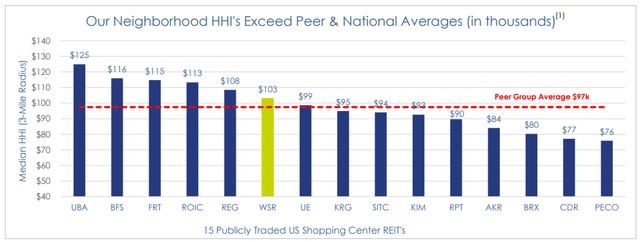

WSR’s suburban properties are located in areas with high household income and an above-average share of workers that work from home, which should increase foot traffic, all else being equal.

Whitestone REIT Presentation

WSR has a highly diversified tenant roster comprising 1,560 tenants, mostly made up of well-capitalized local and regional tenants with strong track records. For perspective, the top tenant makes up only 2.6% of WSR’s total rent.

The REIT has a below-average amount of national credit-rated tenants, but it does still feature these tenants at certain locations. For example, one of its larger centers is anchored by Whole Foods (AMZN).

Another feature of the portfolio that is a positive in the current, inflationary environment is shorter lease terms. The 3.9-year weighted average remaining term, with an elevated amount of leases constantly rolling over, allows for faster rent growth as market rates rise amid the backdrop of high inflation.

Whitestone REIT Presentation

Portfolio occupancy ended the first quarter at 91.0%, a very slight dip from the 91.3% at which it ended 2021. Management aims to raise occupancy up to 92-93% by the end of the year.

WSR is somewhat unique among shopping center REITs in that they mostly utilize triple-net leases in which tenants are required to reimburse WSR for all or most of the property’s common area maintenance, taxes, and insurance. Taxes are the biggest operating expense for shopping center properties, and most shopping center leases provide only partial reimbursement for taxes, or none at all.

As such, each percentage point increase in occupancy is more meaningful for WSR than for the average shopping center REIT.

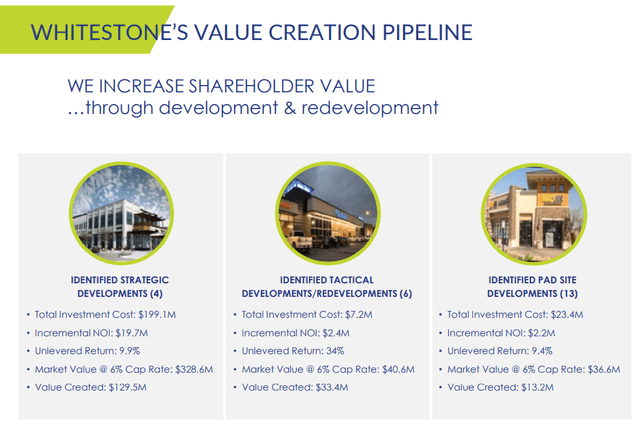

While cap rates for multitenant retail properties are typically priced between 5-7%, there are a multitude of attractive reinvestment opportunities within WSR’s existing portfolio.

Whitestone REIT Presentation

The REIT has the opportunity for development of 10-15 pad sites in total across WSR’s 55 wholly owned shopping centers. These are outparcels carved out of a large parking lot that can be developed into a quick service restaurant, coffee shop, donut shop, auto parts store, etc.

WSR has additional opportunities for ground-up construction of properties on five wholly owned land parcels being held for future development.

Both of these investment opportunities – reinvestment and ground-up development – should render returns higher than simply acquiring new centers.

Also, WSR owns a portfolio of eight legacy properties in a joint venture in which WSR has an 81.4% ownership stake. Among this JV portfolio are two office buildings, one in Dallas and the other in Houston. The Houston office building is where WSR’s headquarters is located, so WSR plans to keep that one. But the plan for the Dallas office building is to market it for sale in the second half of the year in order to reinvest the proceeds into the core business of shopping centers.

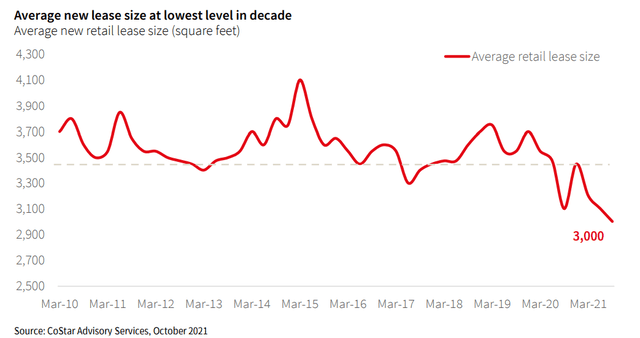

WSR’s typical center is about 100,000 square feet, which is on the smaller side, and it has mostly small shop spaces of around 2,000 SF. This is the perfect size for most retailers, who have been trending toward smaller spaces in recent years.

JLL Research

WSR generated same-property NOI of 5.7% for 2021 and 12.8% in Q4. That strong same-property NOI growth ticked up slightly further in Q1 2022 to 12.9% year-over-year. If this momentum continues in the second quarter, management may need to revise upward its 3-5% same-property NOI growth guidance for 2022.

Interestingly, WSR’s renewal rent rates rose more than its new lease rents in Q4 2021: about 11% for new leases and 15% for renewals. This reverted back to the usual pattern in Q1 2022, as new lease rents rose 12.7% while renewals were up 9.6%.

On the back of these strong fundamentals, management hiked the dividend by 11.6% earlier this year.

Primary Weakness: The Balance Sheet

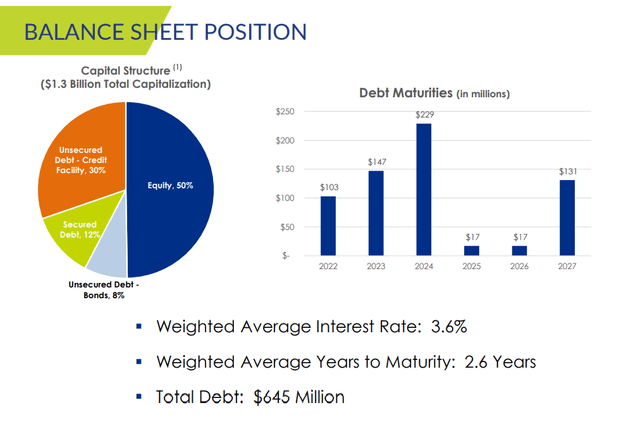

By far the weakest aspect of WSR is its balance sheet, but the good news is that it is improving. What’s more, management has made explicit their goal of continuing to strengthen the balance sheet through deleveraging.

In the first quarter, net debt to annualized EBITDA sat at 7.3x, down significantly from 9.1x for 2021.

Also good news are the facts that:

- WSR’s weighted average interest rate is relatively low at 3.6%,

- Most of its debt is unsecured, and

- Around 90% of its debt is fixed rate.

The bad news is that, in the face of rising interest rates, WSR has an elevated amount of debt maturing in the coming years. In fact, most of the REIT’s debt will need to be rolled over in the next three years.

Whitestone REIT Presentation

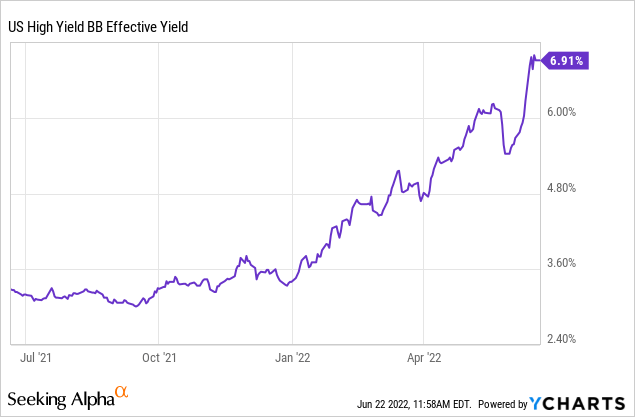

This creates some uncertainty as interest rates continue to rise, especially considering WSR is non-credit rated and junk bond yields have doubled in the last year.

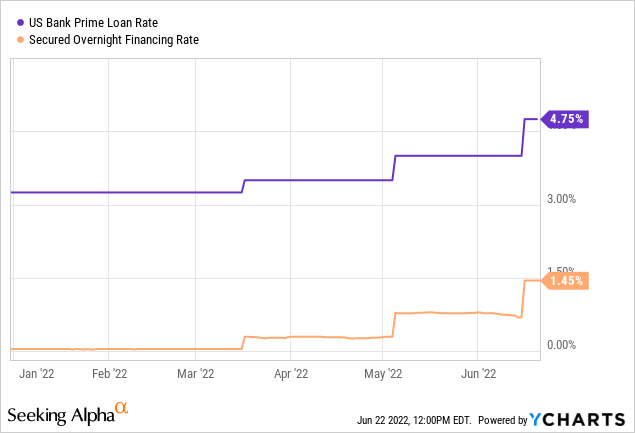

However, management still has options to pursue to refinance its debt. For instance, commercial mortgage rates are typically based on the bank prime rate or SOFR rather than bond yields.

Admittedly, these have also spiked higher along with Fed Funds rate hikes, leaving WSR with fewer financing options.

For now, refinancing with a mortgage may be WSR’s best option, but that option may evaporate after a few more Fed meetings.

So, WSR’s borrowing costs will almost certainly rise in the coming years, unless there is a sharp reversal in interest rates at some point.

Of course, one option to deleverage would be to sell one of its properties and use the proceeds to pay down upcoming debt maturities. While this plan may not be ideal, it would prevent locking in unattractively high borrowing costs for multiple years.

Bottom Line

With a reinvigorated management team that expressed their commitment to creating shareholder value and producing per-share profit growth, WSR is now in a much better position than it was just a year ago.

The REIT does face meaningful refinancing risk as interest rates continue to rise, but the worst-case scenario is that management has to bite the bullet and accept a significant increase in interest expenses.

Remember, though, that rent rates have been rising, and same-property NOI growth has reached into the double-digits as a result. In other words, as WSR’s cost of debt rises, its effective asset yields are also rising, thereby maintaining a healthy spread over WACC.

I believe WSR will survive the current headwinds and go on to produce strong results in the years ahead. Meanwhile, the $0.48 annualized dividend is well-protected, as it represents less than half of WSR’s $1.00 FFO per share guidance for 2022.

Though I can’t predict when it will be realized, I foresee 50% upside for this small-cap retail REIT.

Be the first to comment