Sergei Dubrovskii

Whitecap Resources Inc. (OTCPK:SPGYF, TSX:WCP:CA) is a must-own in the oil & gas space, and it’s giving investors an even better reason to buy in now. Whitecap is set to see its dividend almost double over the next 6-12 months – assuming we don’t have a commodity price collapse. That’s going to either send the yield through the roof, or the share price is going to appreciate as the increases come to reality. In all honesty, I’m good with either!

Whitecap reported yet another strong quarter where they saw 91% growth year-over-year in cash flows. While the share price may be in no man’s land, I don’t think you can go wrong, tucking this dividend payer away for a rainy day.

How Was Q3?

I don’t know if I stand alone at this point, but when it comes to the mid-caps in oil & gas, like Whitecap, given where we are in the market and their balance sheets, I just look for dividend increases or buyback updates when it comes to earnings day. That said, let me dive into everything that leads to said increases.

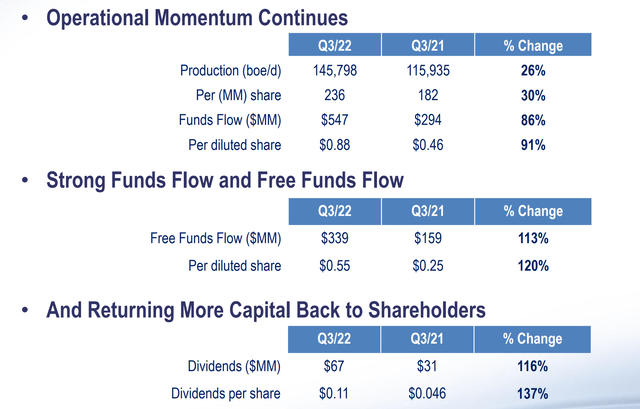

And there is nothing but solid momentum to report here. We saw production climb to 145,798 barrels per day, which is up 26% year over year. This includes 1 month of XTO-acquired volumes, and it is still further ahead than they thought they would be. The third quarter saw the company post the second-highest quarterly cash flow per share result ($0.88/share) in the company’s history. This was a 91% increase year-over-year. Net debt, which we have all been watching, fell to $2.2 billion and represents a debt-to-EBITDA ratio of 0.8x.

Capex for 2022 is still expected to land between $670 – $690 million. This leads us to believe that they are on pace to hit their first debt target of $1.8 billion before year-end. Of course, that assumes that we don’t see major price collapses. 2022 production is set to average 144,000 barrels a day, which will land them at the high end of their target range.

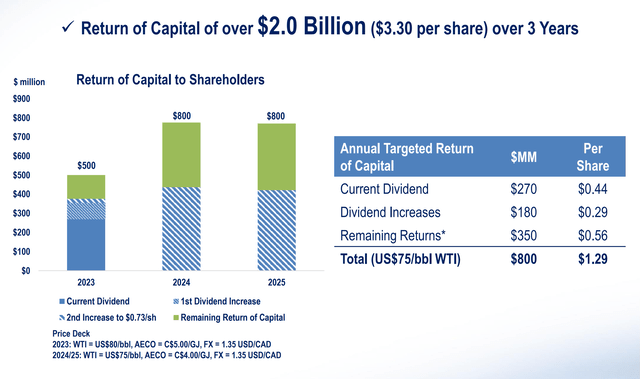

Looking ahead to Q4, we are expecting to see upwards of 165,000 barrels per day as operational momentum continues to churn forward. This leads to 170,000 – 172,000 barrels per day in 2023, which will get Whitecap to its $1.3 billion debt target by mid-2023. And that’s where the fun really begins for us, as they see 75% of free funds flowing back to shareholders once the $1.3 billion mark is achieved.

How About That Dividend?

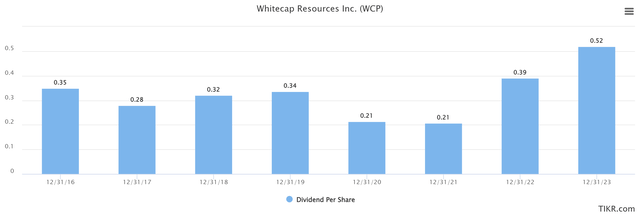

What a wild run it has been. I still remember when the dividend was $0.75 per share back in 2015 and how it felt when it was crunched in 2016. But I also remember feeling like it was the right move. And it was the right move in 2020 to cut it once again. I’m on record with the issue of how some oil companies, “like Exxon Mobil (XOM)”, handled their dividend during Covid. I also praised companies like Whitecap, which sacrificed the dividend in the short term to protect the company in the long term. And this year, we will see the company pay out the most on an annual basis since 2015.

Whitecap has not been shy about putting numbers out there, either. They have said that they are targeting a $0.73 dividend, which would match the highest they have had. This is expected to come through sometime in the next 6-12 months. In order for all of this to happen, we need to see:

- Maintain Debt/EBITDA <1x

- Debt milestones of $1.8B and $1.3B were achieved over the next 3-12 months.

Once we see the debt fall below $1.8B, we can expect to see a $0.12-$0.14 increase. This is expected sometime in the next 3 months. After $1.3B falls, we will see an additional $0.13 – $0.15. This could happen in the next 6-12 months, depending on commodity pricing. The best news is that this is sustainable down to $50/bbl WTI and C$4/GJ AECO. Once these debt levels are achieved, Whitecap is targeting a capital return of 75% of free funds flow, which explains the dividend increases. If we see elevated oil prices ($75+) over the next couple of years, we will see even more increases, buybacks, or special dividends.

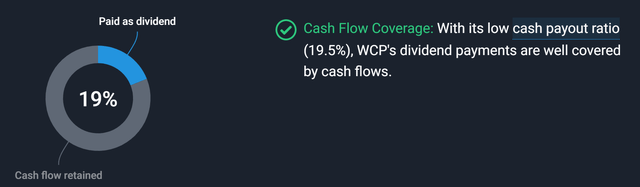

With respect to safety, I won’t spend much time on it. The current dividend is 4.5x covered by 2023 free funds flow and represents only 13% of the 2023 funds flow. If the price of oil collapsed, there could obviously be cuts to future plans, but so long as we continue to trade over $50, there isn’t much risk in the dividend getting cut at all.

What Does The Price Say?

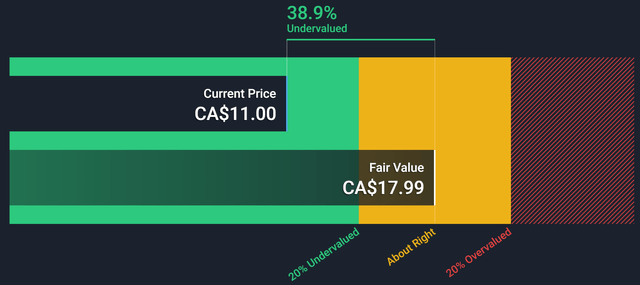

When I last wrote on Whitecap, the share price was around $9.30. As stated, this is one of my favorite companies and my largest holding thanks to its performance over the last few years. I already spoke about why I love the company from a fundamental perspective, so let me dive into the price point. Looking below, we can see that the company is still undervalued based on fair value. Fair value accounts for future levered cash flows. Which, even if oil were to move to $65, would still be extremely strong. But, that doesn’t mean I just blindly hold. I always base my buying and selling on the technical side, assuming the company already meets the fundamental picture I’m looking for.

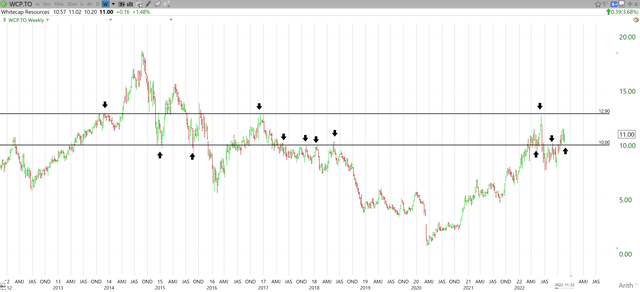

Do I think this stock gets to $18? You bet I do. When is the question. We have been there before, dating back to 2014. When the stock fell below $1, many weren’t sure if it would even be around much longer. Two years and a half years later, and were holding strong at $11.

Back in February, I highlighted a few key levels to watch, and boy have they paid off. I had $10.00 and $12.90 circled as points of resistance that needed to fall. We saw $10.00 fall shortly after, and the stock ran up to $12.71 before topping out, for now. We then saw re-tests of $10.00, which eventually fell and became resistance once again. Now we are currently floating between the two. This puts us in a bit of a stalemate in terms of whether it’s time to buy or sell. Looking below, you can see the history at these current levels over the last 10 years.

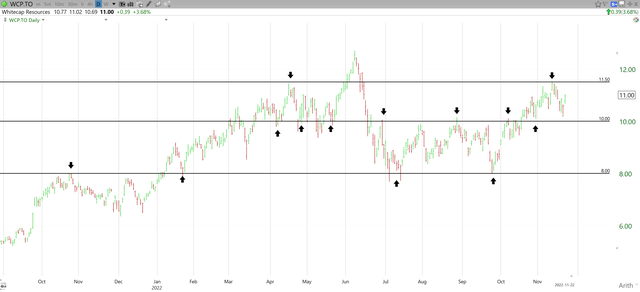

So where does that leave us in the short term? Below is a daily chart with 3 levels highlighted. You’ll see the common theme of $10.00, then $11.50, and worst case $8.00. Back in February, $8.00 was my 50% stop. Now it’s my full stop. Below $8.00 gets scary, and we have seen two successful dips get bought right at $8.00 as seen below. This exposes me to about a 27% drop. But I am playing with profits at this point, and I’m okay with that given what the return here has been (not to mention the current dividend). However, if you are new to the stock, you might want to use $10.00. It looks like we are going to be moving back up for a run at $11.50. A break of $11.50 would likely mean we are going to challenge that $12.71 high. But if we see rejection, we could be headed for $10.00 once again.

This will remain volatile and is definitely not a low-risk stock given the industry it resides in. But allowing the charts to make decisions makes it a lot easier to sleep at night. I remain very long on Whitecap and bullish on the industry as a whole.

Wrap-Up

As you can see, there is a lot to like about what Whitecap has been doing and what they will continue to do. One of the main draws to this company is the balance sheet and the stability they offer. They now have solid cash flows and a safe dividend that is going to almost double over the next year. With the dividend increasing and increasing the right way, the share price is due to appreciate as well. This stock is a great buy with a 4% yield in today’s market. Set your stops appropriately, and you’ll be a happy Whitecap Resources Inc. shareholder over the next year.

Be the first to comment