everythingpossible

| NAV increase, net |

Inception |

Annualized |

PF 2019 |

2020 |

2021 |

2022 |

|

WBCP |

62.51% |

15.27% |

17.60% |

19.05% |

37.16% |

(15.38%) |

|

S&P 400 |

30.33% |

8.06% |

5.72% |

13.66% |

24.76% |

(13.06%) |

|

S&P 500 |

36.50% |

9.53% |

9.36% |

18.40% |

28.72% |

(18.10%) |

|

As of December 31, 2022 Inception of White Brook Capital Partners was August 16, 2019 Performance figures are provided by the administrator. Prior years are audited. 2022 is unaudited Performance is net of all realized and accrued fees |

Portfolio Review

White Brook Capital Partners outperformed the S&P 500 again this calendar year -15.38% to -18.10%, the fourth consecutive, but underperformed the more comparable S&P Midcap 400, -13.06%. Since inception, the partnership continues to outperform, up 62.51% vs the S&P 500, up 36.50% and the S&P 400 up 30.33%.

The partnership did not add or exit any positions during the third or fourth quarter. Positions that were added and exited during the first and second quarter have been remarked upon in previous commentaries.

During the year, Mosaic, Inc. (MOS), and Box, Inc. (BOX), our largest two positions, were also the top contributors to performance. B Riley (RILY) and Greenbrier Companies, Inc. (GBX) were the top detractors from performance.

The year started strong with the partnership meaningfully outperforming during the first quarter. Towards the end of the first quarter, I repositioned the portfolio, sold outperformers and repositioned the portfolio to new long-term themes. While I continue to believe that the portfolio is well positioned for the period we’re now in, it’s impossible to not notice that after repositioning for an era of higher interest rates and slower growth, the portfolio underperformed when a hard recession became a consensus view. Selling a somewhat expensive food company to buy a cheap housing supply company was a trade that was early, but given the facts at the time, seemed prescient, and in my view, still was smart. We also lost money buying a railroad supplier, a company and thesis we’ve since become more convinced.

Every major drawdown in an individual security at White Brook triggers a First Principles review. A First Principles review means that prior convictions and prior theses statements are disposed of and the investment thesis is rebuilt from the ground up. This occurs even when the portfolio outperforms the market, like it did this year. In 2022, the main detractors to performance were investments in a railcar supplier and in an investment firm that masquerades as a bank, both triggered reviews, the former I’ll detail here. I believe both underperformers should reverse during 2023 and beyond.

Today, the Greenbrier thesis is slightly different from what it was before the review with increased conviction around a couple points. For practitioners, the Greenbriar thesis is two fold, over the next couple years, the company has significant tailwinds to operationally revert. Secondly, the company is using its excess cash flow to invest in a structurally advantaged leasing fleet that will improve the regularity of its outyear cash flows. In many ways, the company is doing an as-a-service conversion in the industrial sector, building a low-risk, secured, better yielding, commercial bank operation while also being one of two large-scale suppliers of railcars to the railroad and shipping industry. In three years, the company should generate more free cash flow at a higher return on invested capital and with much increased regularity.

Having endured a significant decline, meant that the The First Principles review for Greenbrier Companies, Inc needed to more expressly confirm each of those points or prove another thesis altogether to remain in the portfolio. It resulted in increased conviction based on three points.

- Demand is solid. Currently, few railcars are in storage, and the ones that are in the words of one expert, “are for a reason”. Railcars are 40-50 year assets, the oldest of which date back to the deregulation of the railroad industry. Current demand for this year and forecasted demand for the next 3 years, is entirely replacement demand for cars reaching end of life. Even taking into account that each railcar’s capacity has grown by 15% and therefore can shrink count by the same, the next 3 years of demand, only replacing those that are aging out, is likely to result in compounded year over year growth. In 2023, aided by the Freight Railcar Act of 2022, backlogs are likely to fill, providing for plannable and fillable demand. Because two large players dominate the industry, and demand is unfillable in the near term by the industry at large, evidence that textbook Cournot pricing dynamics – which allows firms to maximize profit – are occurring. Current forecasts do not include any benefit from US reshoring manufacturing broadly nor do they account for railroads taking share from trucking. They do account for increased operational efficiency by the railroad companies (resulting in needing fewer cars). Should either of the positive developments occur, another leg of growth in the outyears is likely to occur and should railroad service levels continue to struggle – that would prove a mild positive to demand.

- Greenbrier’s leasing operation is best in class and the foundations were built by the same person who previously built the other best in class leasing operation. Greenbrier began its leasing operation in 2021 by partnering with Longwood Group, run by Stephen Menzies, the former President of Trinity’s (TRN) railcar leasing group. Greenbrier’s fleet has similar best in class operating metrics to Trinity’s, a similarly advantaged operation with first priority on Greenbrier’s output and a broad repair shop presence, and best in class leasing rates and usage.

- Margins should increase significantly. During 2022 Greenbriar relocated significant manufacturing capability to Monclova, Mexico – near Trinity and other railroad supply companies. For Greenbrier, whose margins are significantly inferior to its larger competitor, this is a positive, as it allows for operational expertise to more freely mingle.

With demand almost irreversibly strong, line of sight to stable recurring cash flows, potential margin expansion in the manufacturing business, and European operations closer to being back on their feet, the missing piece is actual execution. This hasn’t yet occurred. Typically, when a company is in an opportunity rich position, as Greenbrier’s is, an able management team begins to manifest positive developments for the company and therefore the stock, before or while the operational outcomes are occurring. The Company has to execute, and should it, the stock should prove to exceed White Brook’s hurdle for continued investment. If execution continues to falter, while I imagine it would be a ripe candidate for activism, White Brook’s investment will be rethought.

Market View

Expectations of a recession starting during the 2nd or third quarter of 2023 is now near ubiquitous. Incoming pricing data also points to inflation continuing to ebb as energy prices decline at a surprising pace, joining the cost of transportation’s fall over the course of 2022. The cost of debt remains high relative to the immediate past, but mortgage rates, particularly for jumbo mortgages, are declining rapidly. While large cap and unprofitable technology companies loudly announce layoffs, employment trends are still strong. Home builder sentiment is extremely low and the expectation is that smaller home builders may not survive the low levels of build activity. New starts and permitting data appears to be elastic to achievable mortgage rates, however, and I believe could surprise to the upside. White Brook continues to be bullish housing over the medium term, given what I believe is a long-term housing shortage and positive demographics. Given the underlying strength in employment, its historical tie to housing, and housing’s importance to the nation’s economy, I believe anything more than a minor recession is improbable and the likelihood of something better than that, while non-consensus, is probable.

I thought it useful to highlight the points that could change the overall view to help delineate signal from noise.

- Inflation is on a downward, but reversible trend. Confidence in the latter and a continuation of the former would both be positive catalysts while the reverse is also true.

- China’s reopening/ending of zero covid policy is complicated with potentially severe consequences. Depending on the pace and course of the reopening, Chinese demand could inflate energy prices while simultaneously deflating finished goods prices as additional Chinese manufactured goods add to already full inventories. The impact of China’s reopening is uncertain with a wide range of potential outcomes.

- The US Dollar has begun to weaken as the Federal Reserve indicates that further increases may be limited. This should boost the competitiveness of US companies as well as the reported earnings of US companies with considerable foreign exposure.

- The weather has cooperated this winter in the US and Europe, depressing heating energy demand and the worst forecasts of energy cost drainage in Europe. The worst economic cases for 2023 are unlikely.

But there are some things worth flagging this year.

- Big Tech and China regulation appear to be the two meaningful areas where Republicans and Democrats in the US Government can find common ground. Action on either is most detrimental to large cap companies.

- The United States will begin to experience the first non La-Nina weather pattern in 4 years this spring. After 3 years, many analyst expectations have been adjusted to assume extraordinary patterns are normal. More normal weather patterns are a tailwind to US agriculture’s potential yields even as fertilizer and crop prices are somewhat elevated compared to recent years, excluding 2022. Additionally, Ukraine’s contribution to global food supplies is uncertain and could be a net positive or negative versus 2022.

- Needed funding is more expensive and bankruptcies will finally increase.

- ChatGPT and other artificial intelligence models are as revolutionary as the internet was in the early 2000’s. The benefit of the internet likely speeds determined transitions but the costs are also an order of magnitude higher.

I continue to believe that select investment in the stock market is the best opportunity for capital appreciation and am an advocate for higher allocations at these prices. Previous to the fourth quarter 2022, I recommended holding needed cash over investing in bonds. With more reasonable bond prices available, smart bond investments are now generally preferred to cash. I can recommend a somewhat diversified model portfolio of bonds of intermediate maturity that I believe are safe to own over the next three years that yield approximately 6%.

Clients should reach out if interested in more specific advice.

The Midcap Opportunity

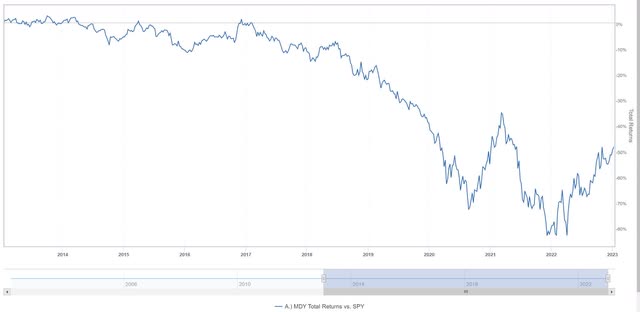

As an update to a longstanding and self-serving thesis that midcap stocks have underperformed and are set to outperform – the opportunity in middle capitalization stocks continues to be significant and I continue to be a proponent of increasing exposure.

Midcaps outperformed during 2022, despite dramatically underperforming large caps since 2016. I believe that recent improvements in the relative performance of midcaps may be a harbinger of more.

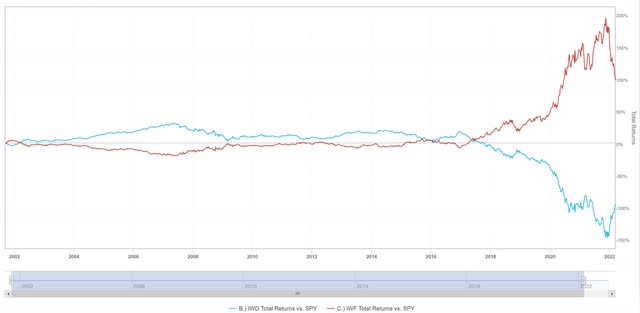

The second graph plots the performance of so-called “value” and “growth” factors vs the S&P 500. It illustrates the outperformance of growth over value since 2017 and the extremity of its current outperformance defying the long term correlation. While value recovered in 2022, it remains very far from the historical relationship.

I continue to believe that midcap stocks present a compelling opportunity, especially relative to large cap stocks, and that exposure to the asset class provides an enduring tailwind for the Fund as it reverses.

As always, feel free to reach out to discuss this or any of your investments at White Brook Capital. I thank you for your support and will strive to continue to earn your trust.

Sincerely,

Basil F. Alsikafi, Portfolio Manager

| All investments involve risk, including loss of principal. This document provides information not intended to meet objectives or suitability requirements of any specific individual. This information is provided for educational or discussion purposes only and should not be considered investment advice or a solicitation to buy or sell securities. The information contained herein has been drawn from sources which we believe to be reliable; however, its accuracy or completeness is not guaranteed. This report is not to be construed as an offer, solicitation or recommendation to buy or sell any of the securities herein named. We may or may not continue to hold any of the securities mentioned. White Brook Capital LLC and/or their respective officers, directors, partners or employees may from time to time acquire, hold or sell securities named in this report. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment