urfinguss/iStock via Getty Images

Shares of Whirlpool Corporation (NYSE:NYSE:WHR) have been hammered this year as investors fear a retrenchment in all sectors housing related, down 42% this year. While the business definitely faces headwinds, this decline is too steep. Whirlpool generates significant cash flow, is pivoting its business, and making a shrewd acquisition. These steps will insulate the firm from the downside, and now is a compelling entry point.

To be clear, Whirlpool is definitely exposed to a slowdown in housing. Buying new appliances is an activity correlated to buying a home, and so if fewer homes are built, there will be lessened demand for appliances. Additionally, there was a surge in durable goods demand in the immediate aftermath of the COVID pandemic as millions were trapped at home and used their stimulus checks to improve them. Some of this tailwind is naturally reversing. Managing through this normalization is critical for household durables manufacturers, and WHR is well-positioned to do so.

We are seeing that normalization hit the financial results. In the company’s second quarter, revenue fell by 4.3% to $5.1 billion. North America was a bit better, with sales down 2.3%. This came even as industry volumes were down 6% as price increases helped to make up some ground. Europe has been Whirlpool’s problem with thinner margins and lower market penetration, and sales here fell 10.3% on a constant-currency basis. Whirlpool continues to gain traction in emerging markets, with sales in Latin America up 3% and in Asia up 26% on a constant currency basis. These account for about 20% of Whirlpool’s business.

Importantly, Whirlpool has announced a strategic review of its European operations, having already sold its Russia business. This business has contributed very little cash flow for years, with a 0% EBIT margin anticipated this year. Still, the unit generates about $4 billion in sales per year. At a 0.5x price to sales (a 20% discount to Whirlpool’s overall enterprise valuation), this unit should fetch about $2 billion in proceeds and would be a good fit for firms like LG or Samsung who with their existing operations could add scale to this unit, reduce cost, and improve cash flow.

Those proceeds will be particularly useful for the company because it has agreed to buy InSinkErator from Emerson Electric Co. (EMR), which is the nation’s premier garbage disposal brand for $3 billion. This brand has 70% market share in the United States and will be maintained as a separate brand post-closing. Sales have also been rising at a 4% annual pace over the past 10 years. Its large installed base provides recurring sales as replacement parts and maintenance work is needed. This purchase should immediately add about $1.25 in EPS in the first year and $100 million in free cash flow.

InSinkErator’s domestic focus is in keeping with management’s strategy to leave Europe and focus on its core North American market. The fact Whirlpool also gets 20% of sales from Asia and Lat-Am and has been growing there does provide opportunity to grow the waste disposal business in these markets, making the transaction even more accretive over time. With the existing EMEA operations under strategic review, management is trying to essentially trade legacy Europe exposure for a tangential opportunity in the Americas, a strategy that makes sense to me.

Generating some proceeds from Europe will also be critical because a core driver of Whirlpool’s bull case is ongoing shareholder returns alongside a solid balance sheet, with management committed to investment grade ratings and a 2.0x debt/EBITDA ratio. This year, the company expects to generate about $1.25 billion in free cash flow, buying back $1 billion in stock and paying out nearly $400 million in dividends, that is similar pace of buybacks as last year. The company has $2.7 billion remain on its authorization, and with a $7.5 billion market capitalization, if the company keeps buying back shares at this pace, it will be reducing the share count by 10% per year. This would greatly increase EPS growth, all else equal.

In 2022, the company should generate about $2.25 billion in EBITDA, which would support $4.5 billion in net debt. It currently has $5.1 billion in debt and $1.6 billion in cash for net debt of $3.5 billion, giving it $1 billion in borrowing capacity, plus $340 million in added capacity from InSinkerator (2x its $170 million in 2022 EBITDA). That leaves $1.66 billion of borrowing that would push it above its leverage target and would likely lead to slower buybacks until leverage returns to normal. However, with $1.5-2 billion in proceeds from its European operation, this shortfall is made up, leaving leverage right around management’s target, enabling buybacks to continue at a strong pace in 2023.

With a 16.7% free cash flow yield and a P/E of just 6.1x using the low-end of its $22-24 EPS guidance, the valuation certainly screens as very cheap. Markets are clearly discounting a meaningful deterioration in Whirlpool’s business as housing construction slows (which definitely is happening). However, let’s keep in mind InSinkErator will add $1.25 to EPS. Additionally, the company’s share count is falling swiftly due to its large buyback. Its share count is down to 59.7 million from 62.9 million at year-end (a 5% decline) and from 77.2 million at the end of 2016 (a 22% decline). With more shares likely to be bought back over the balance of this year and another 7-10% of the float next year, net income would have to fall by over 12% for EPS to fall. Including the benefits from InSinkErator, earnings at legacy Whirlpool will have to fall by about 20% before EPS declines at all.

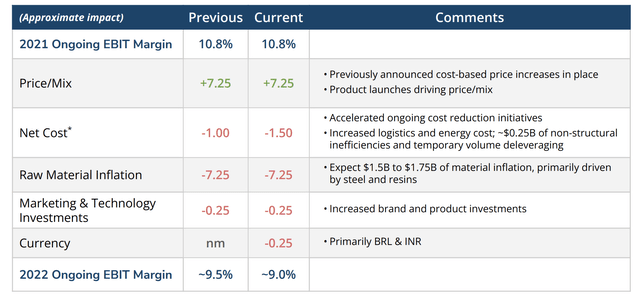

Additionally, it should be noted that the $22 WHR is slated to earn this year comes despite significant cost pressures. As you can see below, raw material inflation is a 7.25% hit to EBIT margins this year. However, commodity prices, transportation costs, and supply chain issues have all been improving in recent months. What was a headwind that has suppressed 2022’s profits below 2021’s $28 in EPS will be a tailwind next year.

If next year the price/mix is just 2% better than raw material inflation, a very reasonable benchmark given the decline in commodity prices, that is a $400 million tailwind or $7 per share. When we factor in M&A, the lower share count, and the tailwind from lower commodity prices, there is about $11 per share of positive factors, so underlying earnings would have to fall in half before EPS falls from 2022’s anticipated $22. That would be a $660 million year-over-year decline in profitability, and in the past 10 years, net income excluding extraordinary items has never fallen by more than $550 million in a year.

As a consequence, investors should feel comfortable in WHR’s ability to generate $20+ in earnings next year even as the economy slows. And the good news is with the stock so low, the share repurchases are even more powerful, making it even harder for EPS to decline and giving remaining shareholders a larger piece of the company. As investors grow more comfortable in WHR’s ability to generate $20 in earnings, I believe shares can return to $200, or a 10x multiple. In the meantime, investors collect an over 5% dividend, creating a compelling total return package.

Be the first to comment