Capuski/E+ via Getty Images

Investment Thesis

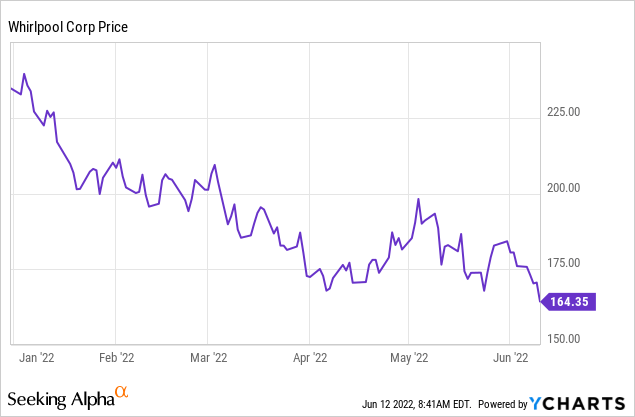

Over the last few months, the broad market has seen increased volatility and price multiple contractions. Increased inflation, monetary tightening and slower economic growth have led to price multiple contractions. Whirlpool Corporation (NYSE:WHR) is one of the companies that have suffered as it is down 30% year to date and currently trades at 33% below its 52-week-high. In this article, we explore WHR further and argue that this is a good entry point for investors.

Underlying Business

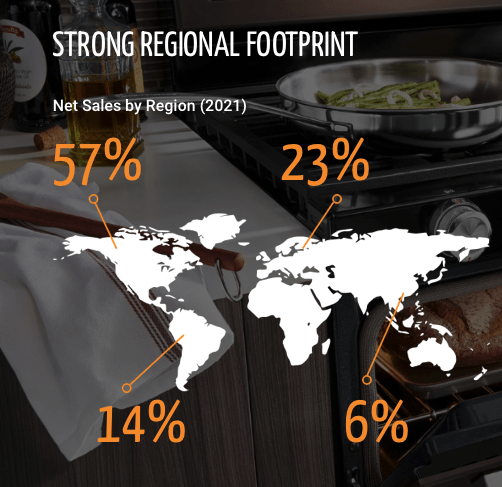

WHR provides kitchen and laundry appliances operating under some well-known brands such as Whirlpool, KitchenAid, Maytag, Consul, Brastemp, Amana, Bauknecht, JennAir, Indesit and Yummly. The business has a global reach with main operations being North America at 57% of net sales for the full year of 2021 followed by Europe, Middle East & Africa at 23%.

Investor relations

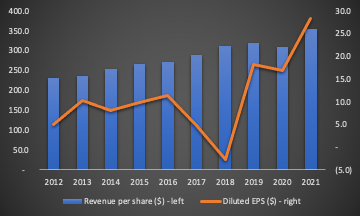

Over the years, management has managed to grow the top and bottom lines of the company on a per-share basis.

Own analysis

As we can see above, revenue per share has been consistently rising over the last decade, with diluted EPS experiencing some volatility but overall moving in the right direction. Over the last 10 years, revenue per share increased by 52% or on an average of 4.8% year-on-year. Diluted EPS growth was 460% or an average of 21.1% every year. It is worth noting that the increased volatility of diluted EPS, especially in 2018 was due to an accounting adjustment. In 2018 the company completed an impairment assessment for its EMEA business, taking a hit of $579m leading to negative earnings.

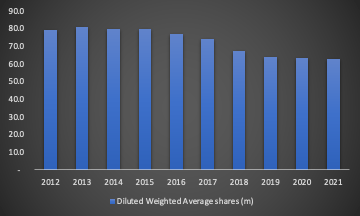

As expected, the higher growth of diluted EPS was partially driven by share buybacks. Increased free cash flow and debt led to significant purchases of outstanding shares by management over the last 10 years. As we can see below, over the last 10 years management repurchased 20.7% of the diluted weighted shares outstanding.

Investor relations

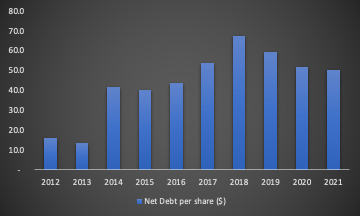

As mentioned above, the cheap cost of debt was also utilised to fund the business and share repurchases. Total debt over the same period increased by 152% and as we can see below net debt per share went from $16.3 to $50.3 an increase of 145%. Over the next 5 years the company will need to repay $1.75bn based on the contractual maturities at the end of 2021 whilst last year’s free cash flow generated was $1.7bn. Hence, these debt levels are conservative.

Investor relations

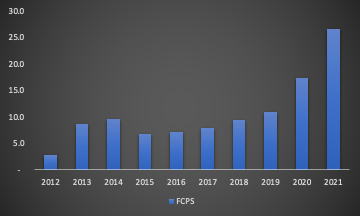

Lastly, free cash flow per share increased significantly over the last 10 years. As we can see below since 2015, there has been a consistent upward trajectory with last year’s growth accelerating. Free cash flow per share increased by 842% or an average of 28% every year since 2012. Management’s long-term goal is to grow annual organic sales by 5%-6% and maintain a free cash flow yield of 7%-8%, so the expectation is that free cash flow per share will grow even further if management achieves these goals. It is also worth mentioning that at the current market cap of the company, the free cash flow yield for the last full financial year is 17%.

Investor relations

Below, we turn our attention to the Q1 2022 results and valuation.

Q1 2022 Results And Valuation

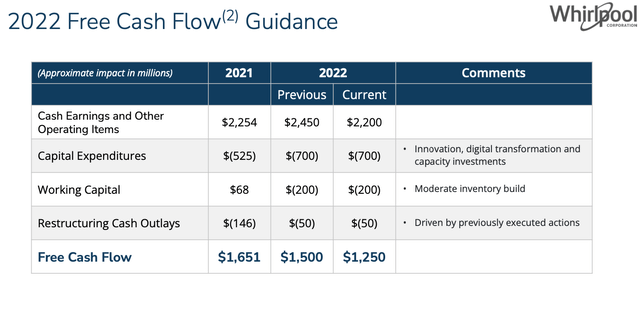

The key highlight from the Q1 2022 results was the downward revision for the 2022 guidance. Looking at the free cash flow guidance, management expects free cash flow to be $1.25bn for 2022 down from $1.50bn as per the previous guidance. As time passes we should receive more colour if additional revisions will be communicated, but as of Q1 2022 results, the downward revision for free cash flow was 17%. As we can see from below, this was due to less cash generated.

On a free cash flow per-share basis, the guidance was reduced by 14.5% which reflects increased share buybacks. During the earnings call, management also highlighted challenges around increased inflationary pressures in their cost basis. Logistic and energy costs, as well as raw materials such as steel and resins, are adding to the costs that the company will absorb temporarily as the EBIT margin will be reduced. Some of these challenges are unlikely to go away in the short term, as they take time to resolve. Management communicated that they are tackling these by raising prices, cost reduction initiatives and moving toward higher-margin products and businesses.

How does WHR compare to its peers?

|

P/E (FWD) |

6.8 |

15.6 |

12.1 |

|

EV/ EBIT (FWD) |

6.4 |

17.5 |

8.0 |

|

P/Cash Flow (FWD) |

6.2 |

– |

7.7 |

Source: Seeking Alpha

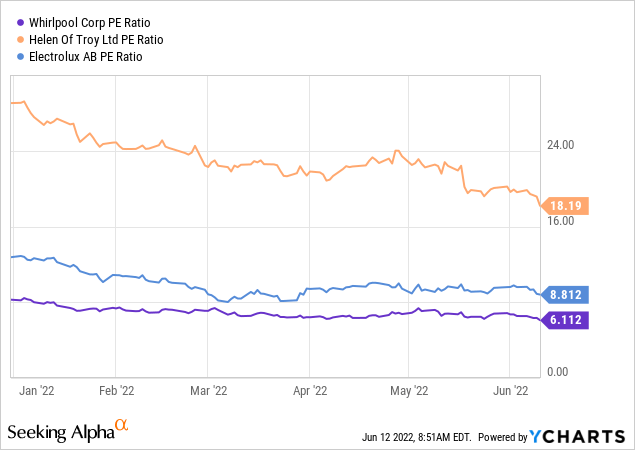

Looking at its peers, WHR is relatively undervalued. Looking at the closest peer in terms of valuation, WHR is undervalued by 44% on a price to earnings multiple, 20% on an EV/EBIT multiple and 19.5% on a price to cash flow multiple. YTD all three companies have experienced price multiple contraction in line with the rest of the market.

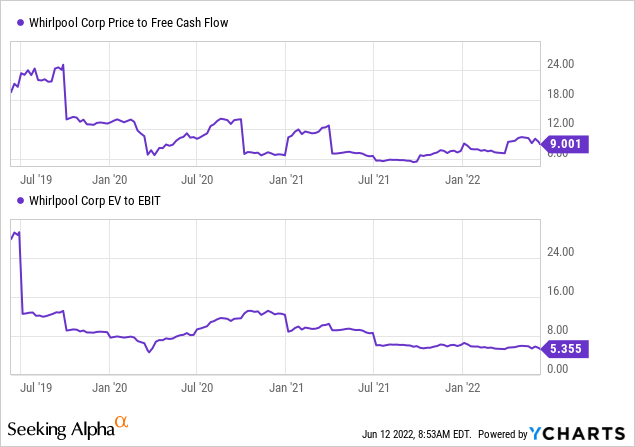

As we can also see below, over the last few years, price to free cash flow and EV to EBIT multiples have declined. A reversion to the mean would imply double-digit returns from price appreciation. As we discuss below, the dividend yield and share buybacks can lead to additional returns, which makes the current price a good entry point for WHR.

Dividend And Share Buybacks

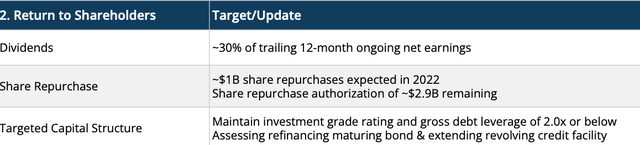

WHR has a good dividend record and makes an interesting case for dividend income investors. Management’s capital allocation strategy is to pay out 30% of trailing net sales.

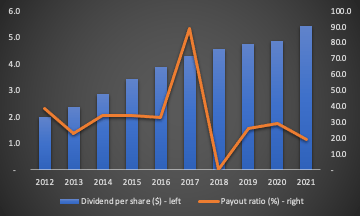

This, in combination with the long-term goal of 5%-6% annual organic net sales growth, suggests that shareholders could see a 5%-6% growth in dividend income whilst the starting dividend yield is 4.3%. As we can see below, management has increased the dividend per share from $2.0 in 2012 to $5.5 per share in 2021 whilst maintaining a modest payout ratio that currently sits at 24%.

Own analysis

In addition, the dividend CAGR for the 10-, 5- and 3-year periods are 12.2%, 9.0% and 10.7% respectively. In Q1 2022 they also announced a quarterly dividend increase of 25%. We see the current dividend being sustainable due to the high cash generation, good debt levels, low valuations and share buybacks. Last year’s cash from operations covered dividends paid by 6.4x.

Shareholders should also benefit from share buybacks given the current valuation levels of the company. In Q1 2022 management bought back $533m of shares, and they expect to return a total of $1.5bn in 2022. At the current market cap, it means that the management will return another 10% for the rest of the year in share buybacks. The outstanding share repurchase authorisation is $2.9bn and as the stock price falls further and valuations remain relatively low it means that share buybacks will work harder for shareholders. $2.9bn of share buybacks represents around 30% of the total market cap of the company. Combining the authorised share repurchase amount with the last decade’s purchases as we discussed above makes a compelling 50% of the shares being repurchased.

Risks

There are a few things we see risky with WHR. To start with, given the nature of the headwinds, there is no easy solution to the reduction in profit margins. Increased costs such as logistics take time to sort. In addition, high inflation leads to a wider increase in prices and real wages stay behind, hence consumers will get squeezed which makes passing the costs to consumers more challenging. In addition, monetary tightening will further lead to squeezing the consumer and bring equity valuations in general down. In addition, inflationary pressures can lead to a slowdown in house market supply and demand. Even though house demand is relatively high in the U.S. supply is still behind. Fewer homes to fill appliances with and lower spending power from consumers can prove to be a challenge in increasing volumes and prices.

Summary

WHR offers a good starting dividend yield that we expect will continue to grow in the future. The combination of a starting forward dividend yield of 4.3%, share buybacks and low valuation metrics make WHR a buy. The stock price may fall further due to lower guidance and increased inflationary pressures, but at this price, it is a good entry point.

Be the first to comment