Dilok Klaisataporn/iStock via Getty Images

Article Thesis

Apple Inc. (NASDAQ:AAPL) is an ultra-high quality blue-chip company with an excellent brand and growth opportunities in health, automotive vehicle tech, and virtual reality. On the other hand, investors should note that the company’s already very large size will likely prevent Apple from growing at an overly high pace in the coming years. Buybacks will also be less impactful due to an above-average valuation, and total returns could therefore be significantly lower compared to what investors got used to over the last couple of years.

AAPL Stock Key Metrics

Apple has excellent fundamentals. This includes strong margins, which are the result of a brand that warrants premium prices for Apple’s products. Strong margins naturally mean that the company earns large amounts of money for each product it sells, but margins are also of importance due to a couple of other factors. High margins mean that inflationary pressures do not hurt Apple too much, for example. If margins were to compress by 100 base points due to higher input costs, the hit to Apple’s bottom line would be a pretty small 4%. A competitor with a weaker net profit margin of 10% would see profits take a 10% hit in the same margin compression scenario. In a way, Apple’s strong margins thus reduce risks for shareholders, as the company is able to stomach inflation, recessions, etc. easier compared to peers that are less profitable.

Apple also has a strong balance sheet and generates excellent cash flows. Per the company’s most recent 10-Q filing, Apple Inc. had $203 billion of cash and equivalents on its balance sheet at the end of the first quarter. This was partially offset by $123 billion of debt, for a net cash position of $80 billion. At the same time, Apple’s free cash flow came in at a gigantic $102 billion over the last four quarters, with capital expenditures of $10 billion already being accounted for. Capital expenditures of $10 billion aren’t high for a company the size of Apple, but that can be attributed to its asset-light business model. Without costly manufacturing equipment, production plants, etc., the company is able to turn most of its operating cash flows into free cash. This naturally benefits shareholders as Apple can finance immense shareholder returns via dividends and buybacks.

Apple’s Growth Potential In Different Markets

Apple’s biggest business today is its iPhone franchise. That is not a high-growth market, however. Many people around the world have smartphones already, and those that do not own a smartphone generally do not buy a (high-priced) iPhone as their first product, instead opting for lower-priced entry phones. That being said, the iPhone business should still generate some growth through price increases over the years, but that will not be a major growth driver. Apple’s very fast iPhone profits allow the company to invest in other areas, however. On top of that, the iPhone user base is important when it comes to growing revenues in the services segment.

As iPhone users acquire additional apps and consume more services and media through their phones over time, Apple’s services (Apple Music, iCloud, Apple Pay, and the take from sales in its App Store) will experience growth over time. During the most recent quarter, Apple’s Services revenue hit a new all-time high, with revenue of $19.5 billion, which was up 23% year over year. I expect that the addition of new services over time and the growing usage of existing services will allow Apple to grow its Services revenue meaningfully over the coming years.

Apple also seeks to expand in other areas. This includes Apple’s Health ventures, as well as the Apple Car project. In both cases, Apple addresses a large market, which means that these projects could eventually move the needle very meaningfully for Apple. At least in the very near term, those will not be relevant growth drivers, however.

Some projections see the Apple Car project add $50 billion in revenue by 2030. That sounds like quite a lot, but on a relative basis, it’s not that much, to be honest. Apple has generated revenue of $380 billion over the last year, thus the Apple Car business would add around 13% to that. If that were to happen during a single year, that would be outstanding, of course. But if it happens over roughly ten years, then the annualized growth boost is relatively slim, at just 1%-2%. When Apple’s iPhone sales started to soar, the company generated year-over-year revenue growth rates of 50% and more during some quarters. The Apple Car project, even if successful, will not replicate that. The law of large numbers dictates that growing at a high relative growth rate becomes harder the larger a company gets. And with sales in the $380 billion a year area, Apple is very large already, which means that even successful product introductions will almost certainly not allow Apple to deliver another 50%+ revenue gain in the future, ever.

Still, between growth from its existing businesses and the introduction of new products over time, Apple will continue to deliver reasonable business growth over the years. Analysts are currently predicting a revenue growth rate of 7% a year through the next decade. My personal estimate would be slightly lower, at around 5%, but Apple may very well hit the 7% level — which would be a strong result for a company this large, even though some of Apple’s owners might be hoping for (way) stronger growth.

Will The Metaverse Impact Apple?

Apple also has ambitions when it comes to the Metaverse. Those haven’t been broadcasted as widely as those from Meta Platforms (FB), Microsoft (MSFT), etc. But still, Apple seeks to become a major player in this future industry. Apple’s CEO Tim Cook first started publicly speaking about Augmented Reality in 2017, and that’s also when Apple’s ARKit was introduced. There are rumors that Apple might introduce its first AR/VR headset Apple Glass as early as this year, although there are no guarantees for that, of course. Still, it seems pretty clear that Apple’s expansion into this space will continue over the coming years. Apple’s revenue potential is uncertain, however. Whether AR/VR tech will become big enough to move the needle in a big way seems questionable for the next couple of years at least. But even if the Metaverse impact remains relatively small for the foreseeable future, the growth in the businesses laid out above should allow Apple to grow meaningfully going forward.

Where Will Apple Stock Be In 10 Years?

Business growth opportunities do not necessarily translate into strong equity returns. Cisco (CSCO) grew its business considerably between 2000 and 2010, as revenue rose by close to 100%. And still, Cisco’s shares went down by more than 60% in that time frame, as valuation compression was even more impactful than the business growth the company experienced in that time frame. In Apple’s case, total returns will be stronger, but multiple compression could still be a headwind going forward:

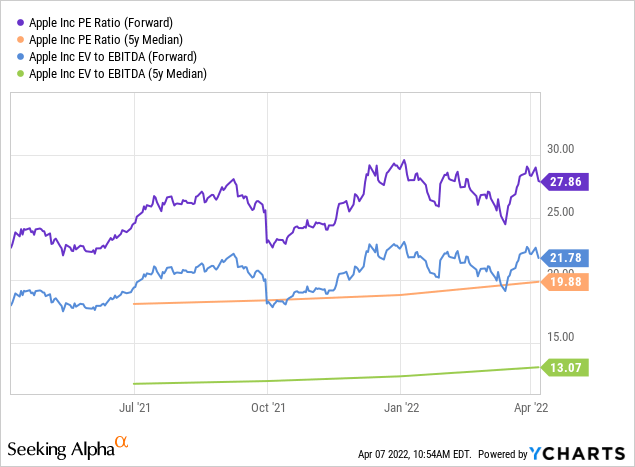

Apple trades at a ~30% premium compared to the 5-year median when we look at its earnings multiple, while the premium compared to the 5-year median is ~50% when we look at Apple’s enterprise value to EBITDA ratio. Clearly, Apple is significantly more expensive than it used to be in the past. When we look at the median valuations over the last ten years, the current premium is even more pronounced.

If Apple manages to grow its revenue by 7% a year over the next decade, in line with what analysts are expecting, we could see earnings per share growth in the 10% range, once we account for buybacks. Those have slowed down to just 2% over the last year, but let’s still assume that Apple will be able to buy back around 3% of its share count in the future. With 10% annual earnings per share growth, Apple would be a pretty fast-growing enterprise, considering its already very large size. In that scenario, earnings per share could climb from $6.15 in 2022 to around $15.90 in 2032. If Apple were to trade at 22x net profits a decade from now, the share price would be $350. In this scenario, where Apple is trading in line with the 5-year median valuation, Apple would deliver annual share price gains of 7%.

When we consider that the last five years have been pretty good for equities and that this will not necessarily be the case going forward, one can also make a case for a lower valuation, however. Rising interest rates could definitely result in lower valuations in future years, compared to how Apple and other equities were valued in the recent past. If Apple were to trade at 20x net profits a decade from now, the share price would be $320 in 2032, which would translate into 6% annual share price gains. If the earnings multiple drops to 18, the 2032 share price target is $286, which would result in annual share price gains of 5%. Some investors might believe that a valuation this low is highly unlikely, as AAPL is trading well above that level today. But once we consider that the 10-year median earnings multiple is even lower, at 16, a high-teens earnings multiple does not seem that unlikely after all.

All in all, we can summarize that Apple’s growth outlook over the coming years is solid thanks to cash cow businesses like the iPhone that allow for growth investments in other areas. Share buybacks should also allow AAPL to grow its earnings per share more quickly compared to the business growth rate. That being said, the share price might not rise that much over the coming decade. Depending on circumstances such as market sentiment, interest rates, etc. a share price in the $280 to $350 range seems realistic, I believe. That would translate into annual share price gains of 5%-7%.

Is AAPL Stock A Buy, Sell, Or Hold?

Apple is an excellent company, and it has been a great investment in the past. But the fact that Apple has delivered outstanding returns over the last five or ten years does not mean that this will repeat. Shares were cheap a decade ago, and they are trading at a huge premium compared to the historic valuation today. To me, it seems realistic that Apple will deliver mid-to-high-single-digits annual returns going forward. That’s far from bad, but I do not believe that this makes Apple a Buy today.

Be the first to comment