Nastassia Samal/iStock via Getty Images

As institutional investors, we most often represent risk as annual standard deviation or tracking error. But when we implement changes in our portfolios, the real-time risk happens much faster. Those standard deviations will impact portfolios not on an annual scale but in hours or even minutes. What happens in those minutes can have lasting effects on performance.

Investors generally don’t have visibility to the real-time implementation slippage that can occur without an intentional focus on real-time exposures. Very few investors have detailed real-time post-implementation reporting to verify that their exposures were managed appropriately throughout the course of implementation.

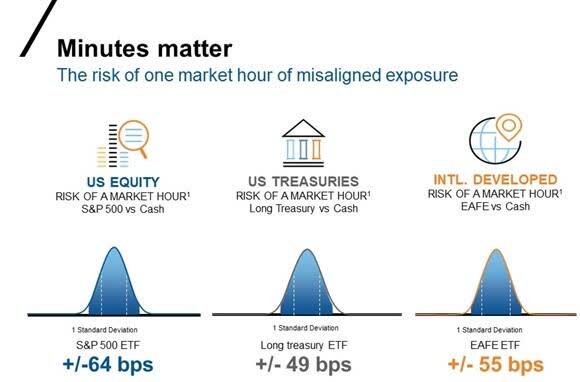

The cost of just one hour of misaligned exposure

How much can a market hour of misaligned portfolio exposure impact performance? The risk of a market hour, as represented in the chart below, demonstrates just how impactful it can be. In U.S. equities, just one market hour can have a standard deviation of +/-64 basis points. In U.S. Treasuries, that same hour has a standard deviation of +/- 49 basis points. And in the international developed sector, we see a one-hour standard deviation of +/- 59 basis points.

The Risk Of One Market Hour Of Misaligned Exposure (Author)

1 – Market Hour represents hourly price observations, starting from prior nights closing price until end of day close price. Standard deviations calculated based upon 60-day historical hourly price changes for S&P 500 ETF (SPY), Long Treasury ETF (TLT), MSCI EAFE ETF (EFA) and cash through 06/30/2022. Standard & Poor’s Corporation is the owner of the trademarks, service marks, and copyrights related to its indexes. For illustrative purposes. Data is historical and not a guarantee of future results. Indexes are unmanaged and cannot be invested in directly.

How can investors better manage real-time implementation exposure risks?

- Use an overlay manager. An adept overlay manager can provide needed market exposures with derivatives, while providing the flexibility to quickly execute exposure trades to balance or offset physical trading activity or pooled fund redemptions and subscriptions.

- Use a transition manager for large changes to physical portfolios. Work with a skilled transition manager who is accountable for portfolio performance and is focused on managing real-time risk exposures. This is industry best practice for large portfolio changes.

- If possible, ensure the overlay manager and transition manager reside within the same organization. The ability of the transition manager to work with the overlay manager in real-time, on the same systems, with precisely synchronized execution of derivative and physical transactions provides the most seamless implementation of large asset allocation shifts. This harmonized implementation structure affords the investor confidence that exposures are intentional and aligned for success. Compare this synchronized TM/OS provider to the alternative of separate firms managing different portions of the implementation. You’ll easily see that the disparate organizations trying to coordinate trading activity leaves the investor open to exposure gaps and more implementation slippage.

The bottom line

Investors should be aware of potential real-time market exposure risks when implementing large changes to their portfolios, and they must be intentional in managing these risks. The risks are particularly large when making asset class shifts and when international markets are involved with discontinuous market hours. Capabilities are key, but the strategy in which those capabilities are applied is even more critical to success. Many asset managers and brokers have derivatives and physical trading capabilities. That’s the easy part. But effectively combining these capabilities to minimize market exposure risks, often across numerous mandates, in real-time, at a single provider is a rare organizational structure.

To successfully manage large-scale portfolio changes, investors need to partner with a firm that has a core competency in coordinated trading in local market physical securities and derivatives, with best-in-class currency execution facilities. This combination of capabilities doesn’t come about by chance. Rather, it must be intentionally built, with the expertise and infrastructure to effectively manage large portfolios in flux.

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page. The information, analysis, and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity.

This material is not an offer, solicitation or recommendation to purchase any security.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

The Russell logo is a trademark and service mark of Russell Investments.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

UNI-12086

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment