Could one of these REITs be going out of business? The proposal has been made.

Justin Sullivan/Getty Images News

Get ready for charts, images, and tables because they are better than words. The ratings and outlooks we highlight here come after Scott Kennedy’s weekly updates in the REIT Forum. Your continued feedback is greatly appreciated, so please leave a comment with suggestions.

There are so many things happening in the sector and so little space to discuss them. Since our prior article for the sector focused on some of the lowest risk preferred shares, we are going in a different direction with this one. This time we’re just going to highlight two things I want to talk about.

Orchid Island Previews Massive Book Value Loss, Stock Does Not Care

The first one is that Orchid Island Capital (ORC) provided their estimated Q1 2022 results. Book value per share is estimated by management at $3.34. Historically, management estimates for mortgage REIT book value are very close. We strive to model out the most likely results, but management has the actual value of every position. That’s a significant loss, down $1.00 per share (23%).

The REIT Forum (thanks to Scott’s work) had a projected range of $2.90 to $3.40, so the results land within our expected range. However, they do come in quite a bit above the middle of that range, so maybe that’s positive? Earnings of $.20 are pretty good as well, slightly ahead of Scott’s estimate and further ahead of the consensus estimate.

Consequently, there are two narratives here:

- ORC came in moderately above the best (historically most accurate to my knowledge) projections.

- ORC is announcing a huge drop in book value that some shareholders were surely blind to.

As more of the Q1 2022 earnings results come out, investors should expect to see many large drops in book value per share. Expect “large drop” to be the standard for the quarter among the agency mortgage REITs. They won’t all be the same, but this was simply a rough quarter for owning a leveraged position in agency MBS.

As a reminder, when interest rates move dramatically it usually triggers a decrease in book value. However, we’ve also seen an increase in the spreads between mortgage rates and Treasury rates, which is amplifying the loss. For a mortgage REIT to simply “hold onto” all of their positions, they would need to be using significantly more leverage since book value is lower.

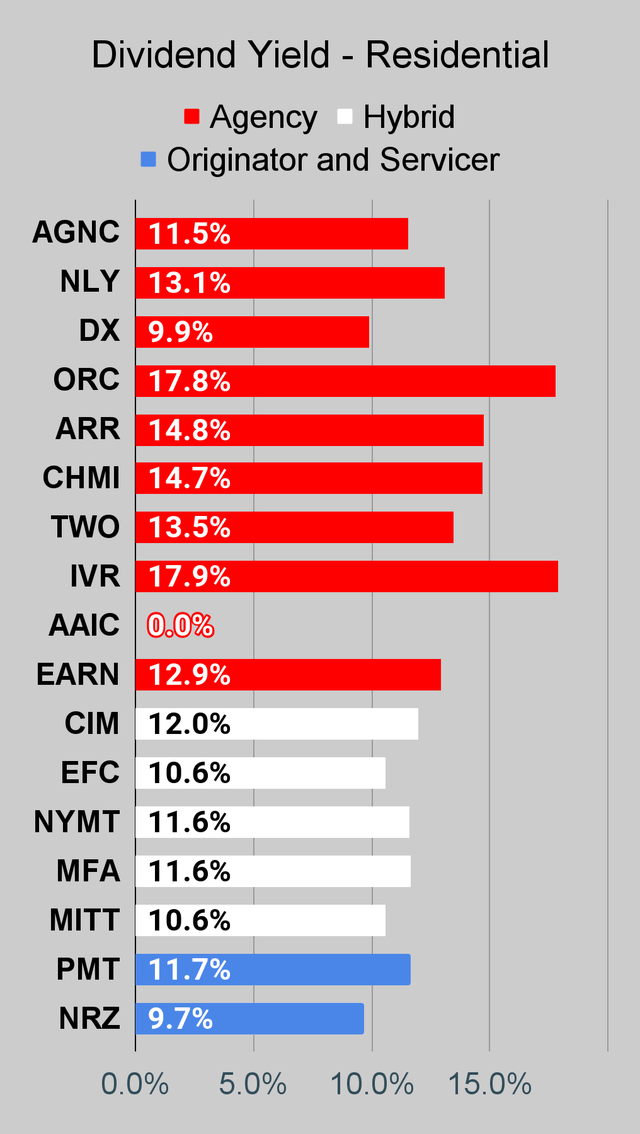

Expect some intense emotions as investors grapple with the conflict between the 18% dividend yield and 23% of book value disappearing in a quarter. To be fair, spreads are wider now which is better. But that’s a pretty huge drop.

You might confuse the 18% yield with the 18% dividend cut:

Seeking Alpha

However, that cut came from March 2022. The point here is that the yield remains high, but investors should be wary. ORC still has the highest dividend yield among the REITs we’re covering, which is actually not a good sign.

Far more details are available in Scott’s Q1 2022 ORC Earnings Update (subscriber link).

Arlington Asset Investment Gets a Proposal

A shareholder of Arlington Asset Investment Corp. (AAIC) provided a proposal for AAIC to liquidate. After some strong disagreements, the proposal was included in Form 14A.

Why would anyone want that? Because AAIC trades at a huge discount to trailing book value and a huge discount to our estimates of recent book value. Trading at a large discount is not unusual as AAIC’s performance hasn’t exactly impressed.

To put it simply, AAIC’s management doesn’t appreciate the proposal. In Scott’s weekly update for The REIT Forum, he writes:

That said, some investors have grown “restless” with this long-term, cautious approach (and notable deterioration of BV over several interest rate/economic cycles). On 4/14/2022, it was disclosed within SEC filings (PRE 14A; annual proxy statement) that a particular shareholder, VA Property 1 LLC (VA Property), has proposed the liquidation of AAIC. The main reasons for this proposal are the continued high proportional share of operating expenses to overall earnings over the past several years (specifically referencing AAIC’s current Chief Executive Officer Rock J. Tonkel Jr.), continued erosion of BV over the past 10+ years, and the allegation AAIC’s board of directors (“BoD”) have not been acting in the best interest of shareholders to maximize value/returns. It was also disclosed, via public information-gathering resources, that AAIC originally tried to block this liquidation proposal from even being put on the annual proxy statement and was ruled against this request by the SEC. As such, it is pretty apparent management and the BoD did not want this proposal being voted upon at the annual shareholders’ meeting on 6/16/2022. Subsequentially, within the PRE 14A/annual proxy statement both management and the BoD has asked common shareholders to vote against this specific proposal (Proposal 5).

We will be considering the proposal, but will want to have all the latest data before making a final decision on our recommendation.

Scott shared the following commentary:

…Personally, I believe I’m currently ‘leaning heavily’ in one direction. That said, the vote is in mid-June and once I/we provide our ‘stance’ per se, I/we want it to be definitive/unwavering for subscribers. A ‘final’ decision very likely won’t occur until AAIC reports earnings for Q1 2022. Just gives me/us more pieces of the puzzle to work out a net liquidation value/realistic buyout offer. Again, I think most (if not all) of us are on the same page. I’m/We’re just being a bit patient for some updated quantitative data. Really doesn’t matter if I/we provide our definitive stance today/this weekend vs. in May. We’ll give subscribers amble time to vote their shares if they so desire…

The weekly update (linked at the top) goes into much greater detail on AAIC.

The rest of the charts in this article may be self-explanatory to some investors. However, if you’d like to know more about them, you’re encouraged to see our notes for the series.

Stock Table

We will close out the rest of the article with the tables and charts we provide for readers to help them track the sector for both common shares and preferred shares.

We’re including a quick table for the common shares that will be shown in our tables:

Let the images begin!

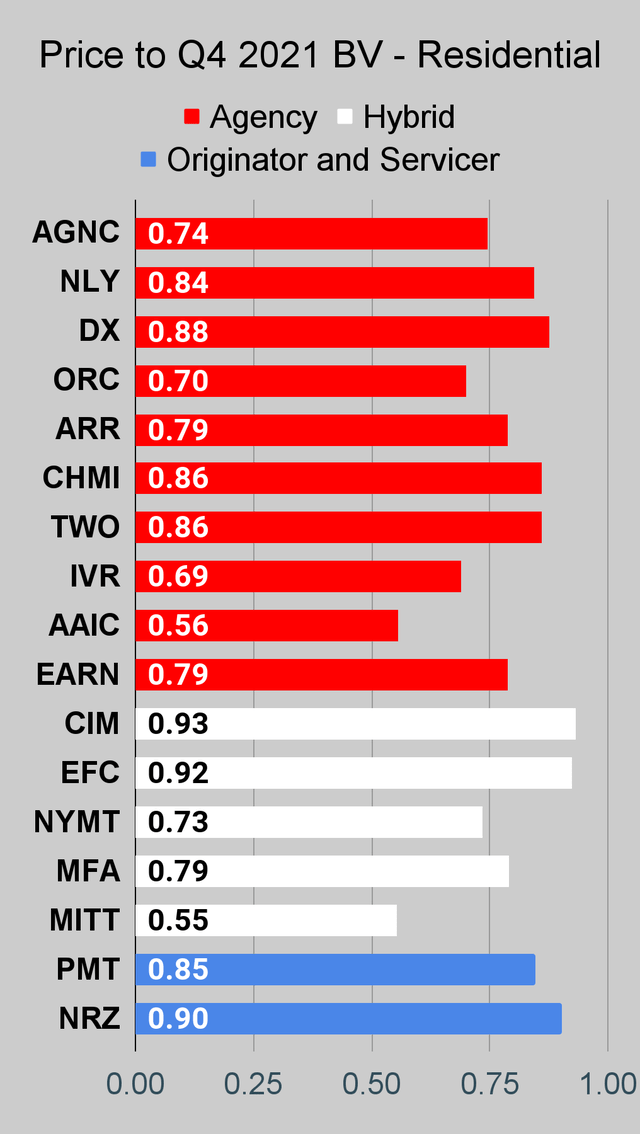

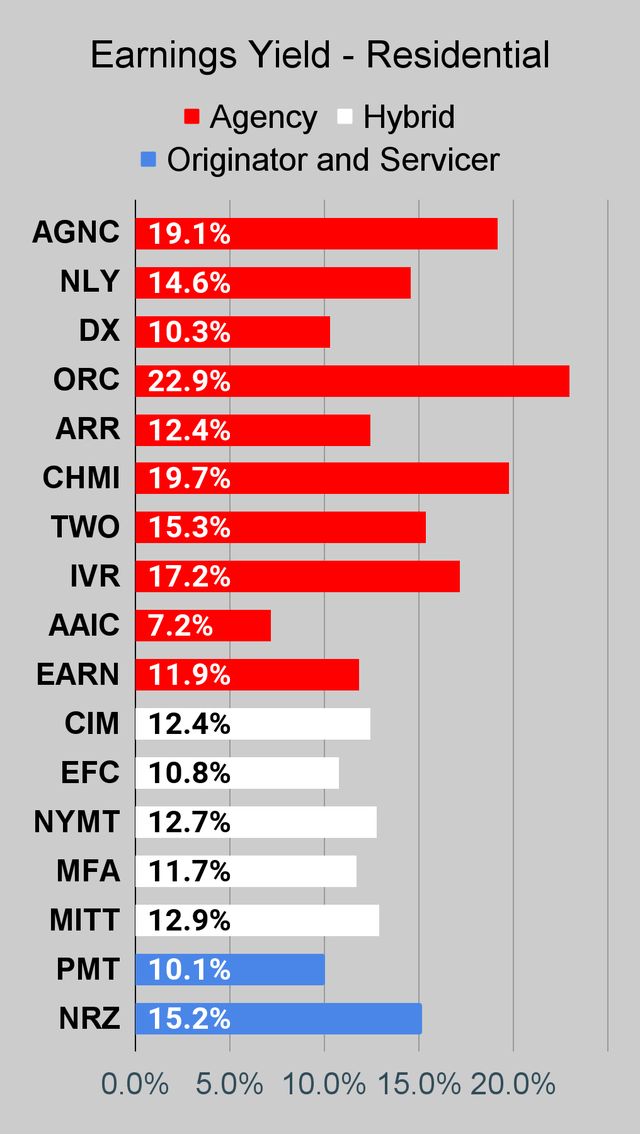

Residential Mortgage REIT Charts

Note: We are modeling some significant changes to BV since 12/31/2021 and some management teams have already publicly indicated a material change in BV per share. The chart for our public articles uses the book value per share from the latest earnings release. Current estimated book value per share is used in reaching our targets and trading decisions. It is available in our service, but those estimates are not included in the charts below.

Source: The REIT Forum

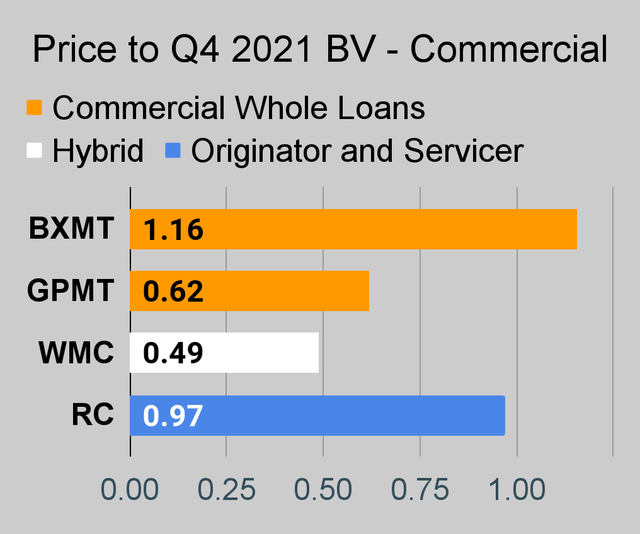

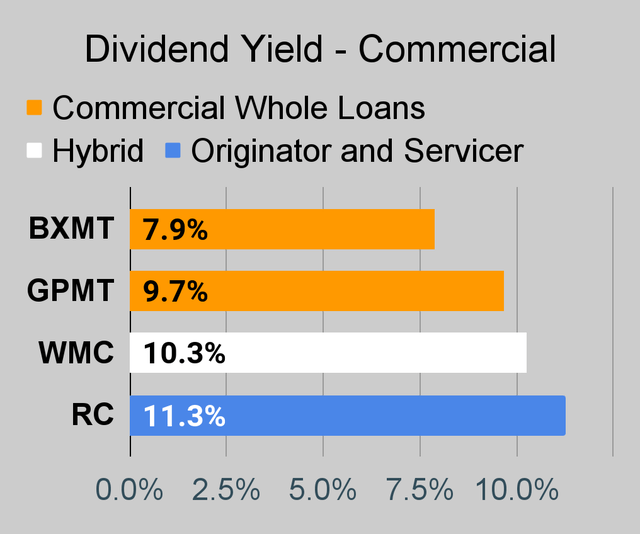

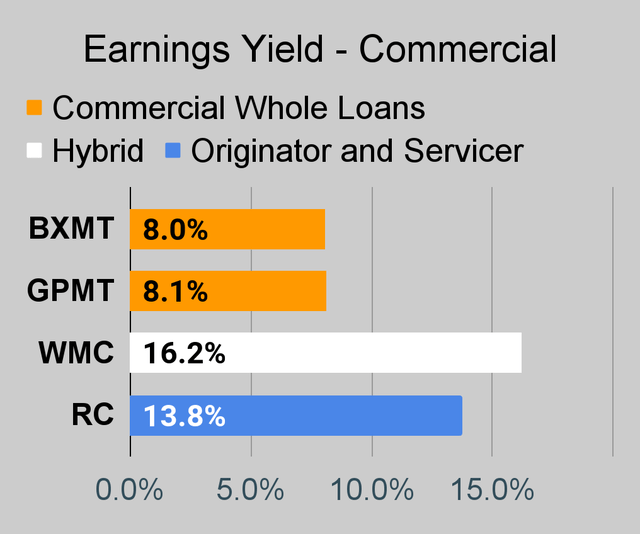

Commercial Mortgage REIT Charts

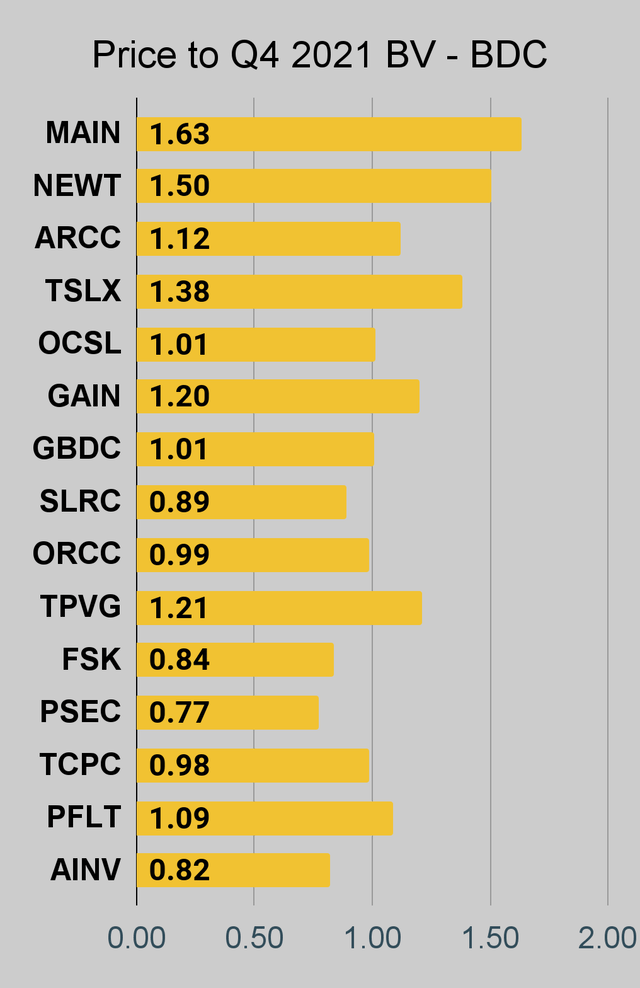

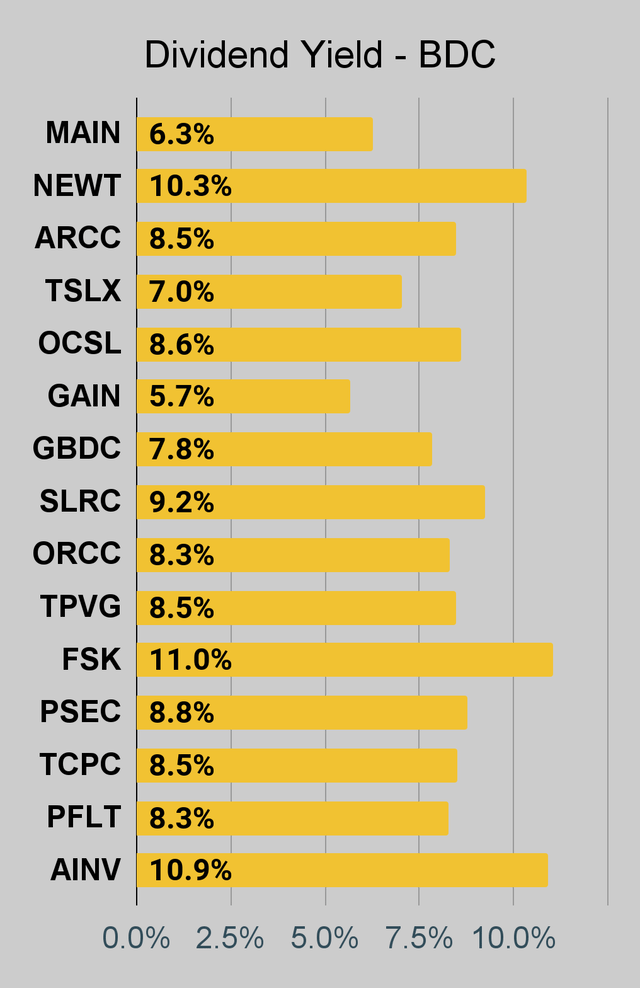

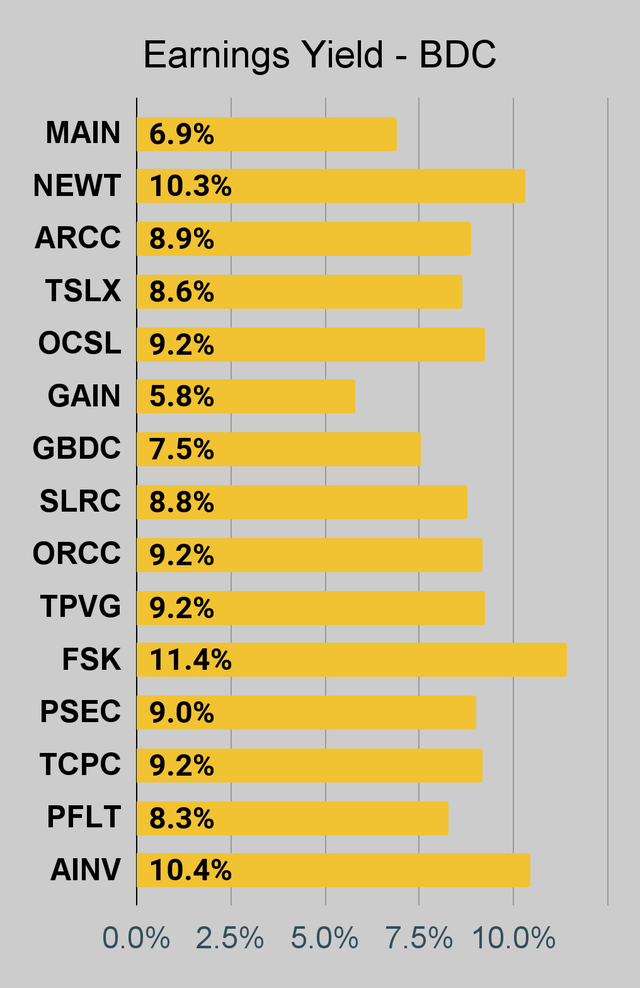

BDC Charts

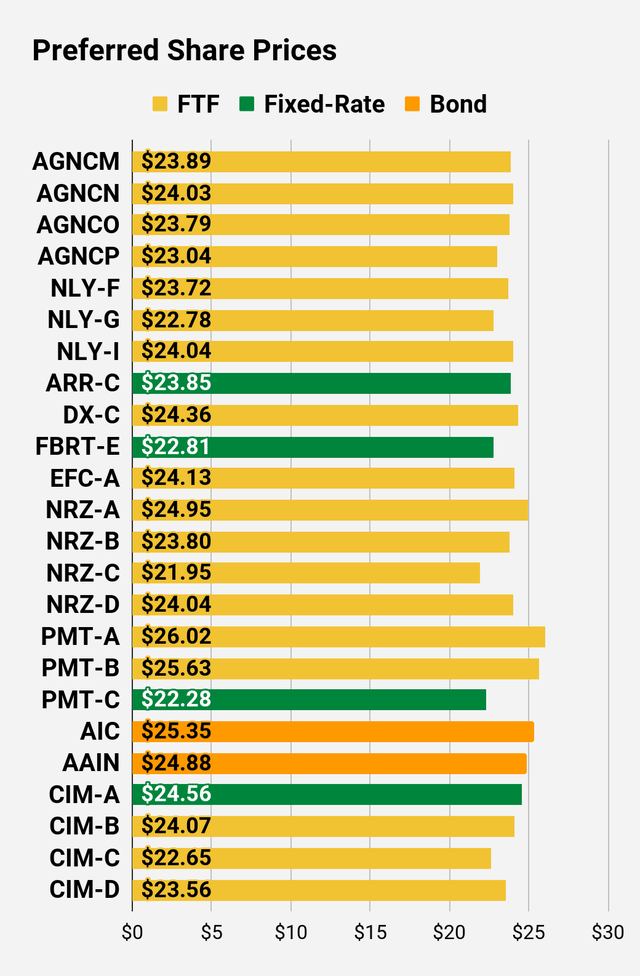

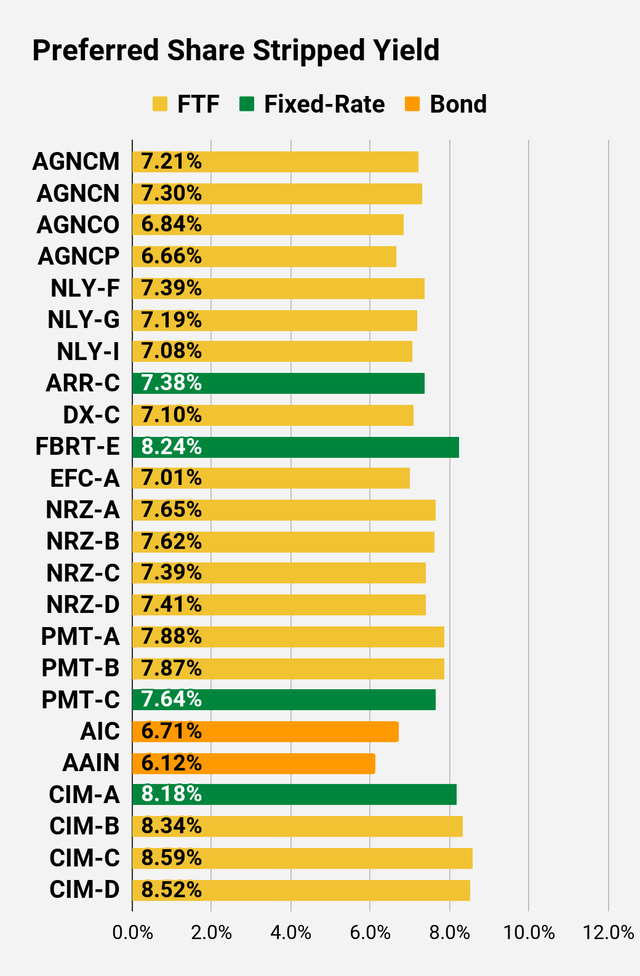

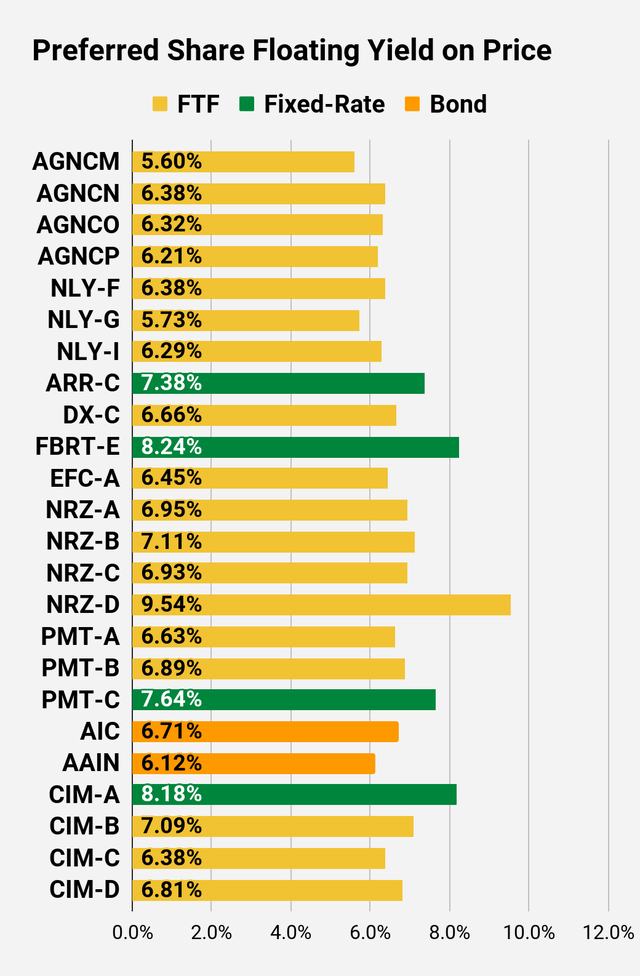

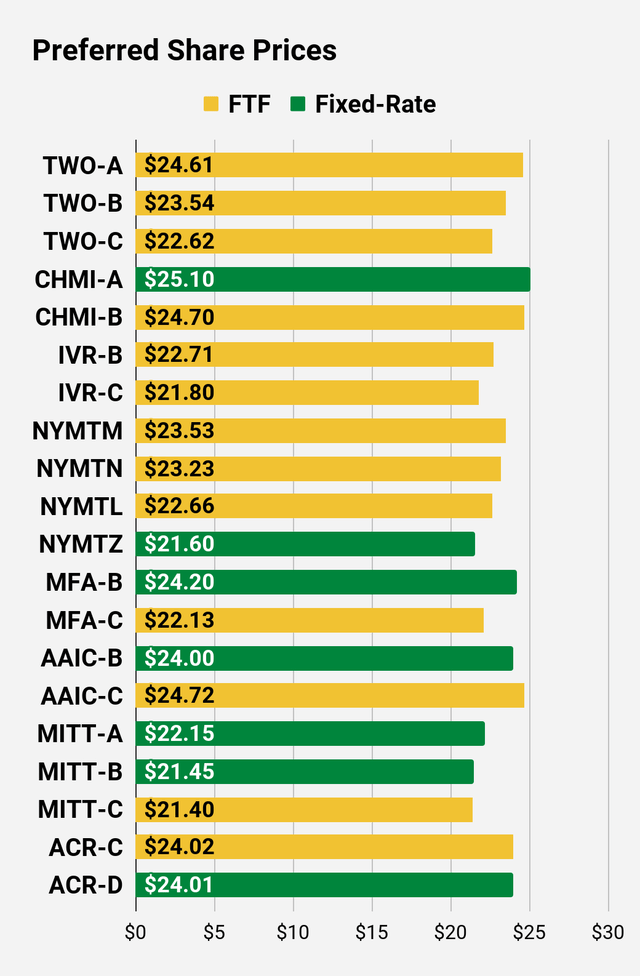

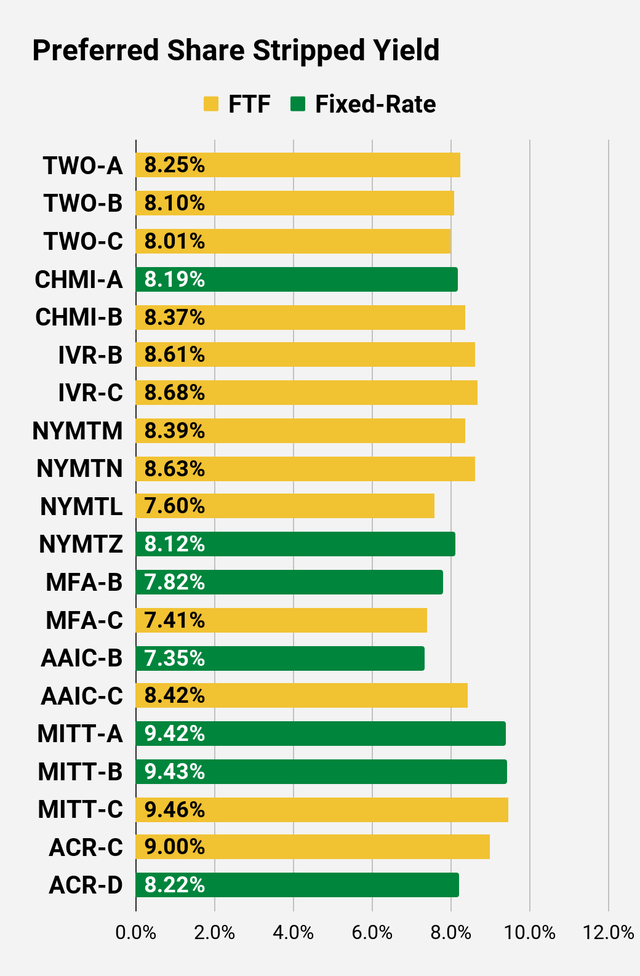

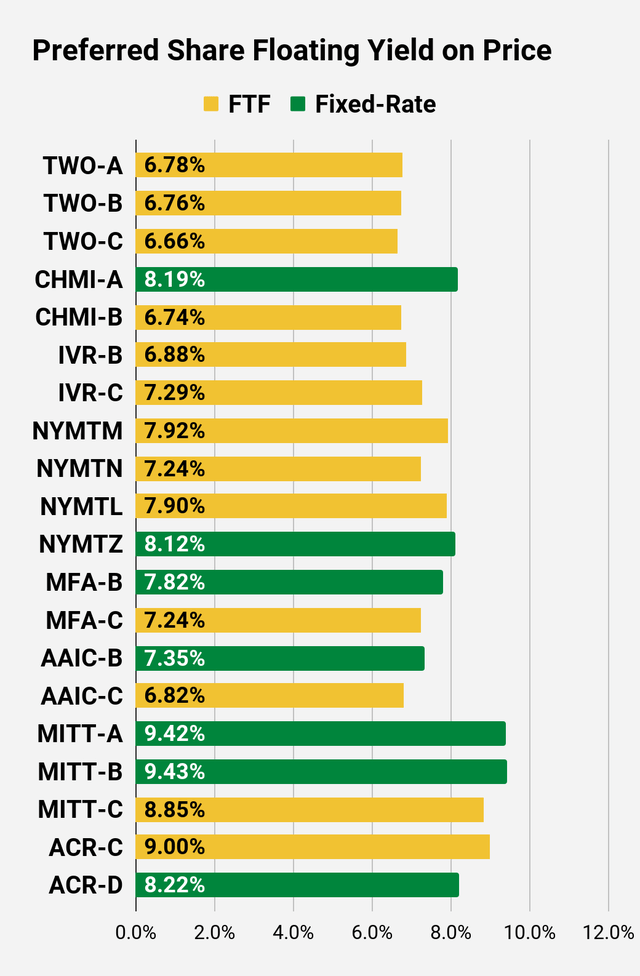

Preferred Share Charts

Preferred Share Data

Beyond the charts, we’re also providing our readers with access to several other metrics for the preferred shares.

After testing out a series on preferred shares, we decided to try merging it into the series on common shares. After all, we are still talking about positions in mortgage REITs. We don’t have any desire to cover preferred shares without cumulative dividends, so any preferred shares you see in our column will have cumulative dividends. You can verify that by using Quantum Online. We’ve included the links in the table below.

To better organize the table, we needed to abbreviate column names as follows:

- Price = Recent Share Price – Shown in Charts

- BoF = Bond or FTF (Fixed-to-Floating)

- S-Yield = Stripped Yield – Shown in Charts

- Coupon = Initial Fixed-Rate Coupon

- FYoP = Floating Yield on Price – Shown in Charts

- NCD = Next Call Date (the soonest shares could be called)

- Note: For all FTF issues, the floating rate would start on NCD.

- WCC = Worst Cash to Call (lowest net cash return possible from a call)

- QO Link = Link to Quantum Online Page

Second Batch:

Strategy

Our goal is to maximize total returns. We achieve those most effectively by including “trading” strategies. We regularly trade positions in the mortgage REIT common shares and BDCs because:

- Prices are inefficient.

- Long-term, share prices generally revolve around book value.

- Short-term, price-to-book ratios can deviate materially.

- Book value isn’t the only step in analysis, but it is the cornerstone.

We also allocate to preferred shares and equity REITs. We encourage buy-and-hold investors to consider using more preferred shares and equity REITs.

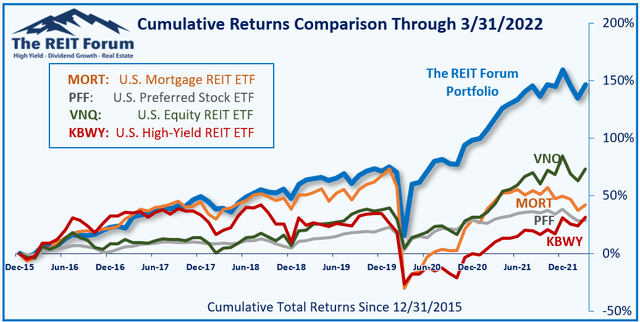

Performance

We compare our performance against 4 ETFs that investors might use for exposure to our sectors:

The REIT Forum

The 4 ETFs we use for comparison are:

|

Ticker |

Exposure |

|

One of the largest mortgage REIT ETFs |

|

|

One of the largest preferred share ETFs |

|

|

Largest equity REIT ETF |

|

|

The high-yield equity REIT ETF. Yes, it has been dreadful. |

When investors think it isn’t possible to earn solid returns in preferred shares or mortgage REITs, we politely disagree. The sector has plenty of opportunities, but investors still need to be wary of the risks. We can’t simply reach for yield and hope for the best. When it comes to common shares, we need to be even more vigilant to protect our principal by regularly watching prices and updating estimates for book value and price targets.

Be the first to comment