Wheaton Precious Metals: Impacts Of COVID-19

Wheaton Precious Metals (NYSE:WPM) – the second-largest royalty and streaming company by market cap, trailing only Franco-Nevada (NYSE:FNV) – recently provided investors with a corporate update.

Wheaton owns a diversified portfolio with 20 producing assets and 9 development projects, located mainly in North and South America.

As a result of the impacts of the coronavirus disease (COVID-19), and given the temporary shutdowns announced by several of its mining partners, Wheaton has withdrawn its production guidance for 2020. The company had previously guided for production between 685,000 and 725,000 gold equivalent ounces, which it expects to rise to an average of 750,000 ounces between 2020 and 2024.

This is the third royalty/streaming company that has withdrawn guidance, as of writing. Sandstorm Gold (NYSEMKT:SAND) made the announcement in March, and Maverix Metals (NYSEMKT:MMX) also withdrew its guidance. Royal Gold (NASDAQ:RGLD) issued an update, but left its guidance unchanged, while Franco-Nevada has yet to provide an update.

Short-term impact on Wheaton

Wheaton is arguably going to get hit the hardest by COVID-19 out of its peers. The company says that the Voisey’s Bay, Constancia, Yauliyacu, and Peñasquito mines have temporarily suspended operations, and others are likely to follow.

It is looking like its production and cash flow could take a 15-20% hit in Q2 based on the impacted mines. Constancia and Yauliyacu made up a combined 11% of Wheaton’s 2019 production and 9% of its cash flow, according to the company’s corporate presentation. Peñasquito is its top producing silver asset, contributing nearly 2 million ounces of silver in Q4 2019 and 6.21 million ounces in 2019.

Voisey’s Bay has been suspended, and this is one of its largest development projects, as it purchased a large cobalt stream from the mine’s operator, Vale (NYSE:VALE), for $390 million in cash.

Hudbay Minerals (NYSE:HBM) shut down the Constancia mine in Peru following the government’s declaration of a state of emergency, which was declared on March 15 and was set to last until March 30, but it has since been extended until April 12 as cases have continued to rise.

Newmont (NYSE:NEM) announced on April 1 that it will ramp down operations of Peñasquito; Mexico’s federal government published a decree mandating the temporary suspension of all non-essential activities (which includes mining) until April 30.

Surprisingly, we have not yet seen First Majestic (NYSE:AG) announce the suspension of operations at its San Dimas mine in Mexico, but investors should expect that to happen soon. San Dimas is a core asset for Wheaton, which acquires 25% of the gold and 25% of the silver production. It’s producing over 11,000 attributable gold ounces each quarter.

Is Wheaton in trouble?

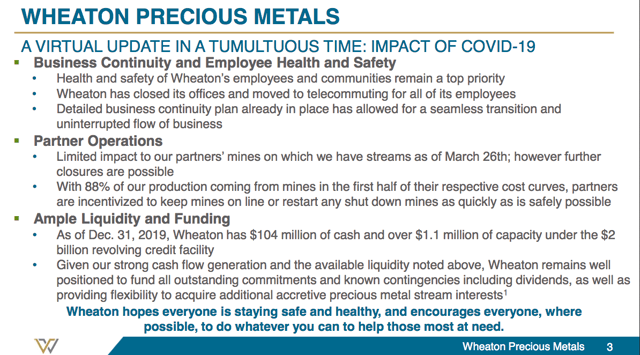

(Wheaton has ample liquidity to weather the current crisis. Credit: Wheaton corporate presentation)

Investors should not be concerned about Wheaton’s financial position here. The company is well-financed with $104 million in cash and cash equivalents, and it has over $1.1 billion of available capacity under the $2 billion revolving facility (as of Dec. 31, 2019).

Its dividend also looks safe: Wheaton’s dividend policy pays out approximately 30% of the average cash generated by operating activities in the previous four quarters, divided by the company’s outstanding common shares. Based on its current share price as of Friday morning and its $0.10 per share quarterly dividend, the stock yields 1.46%.

Gold and silver prices have also been steadily rising over the past week with gold flirting with $1,700/oz on Monday.

I think Wheaton’s stock will perform well over the long term because of its high margin, lower risk business model. But its stock may take a short-term hit when the mine closures show up on its Q1 and Q2 earnings, and I think shares may underperform peers this year.

If you want more gold mining stock analysis, please consider subscribing to The Gold Bull Portfolio. I’m dedicated to helping my subscribers find the best money-making opportunities in the gold and silver sector.

Receive frequent updates on gold mining stocks, access to all of my top gold and silver stock picks and my real-life gold portfolio, a miner rating spreadsheet with buy/hold/sell ratings on 100+ miners. A 2-week free trial is available.

I offer a substantial discount on annual subscriptions – you can save 37% per year, or $271 annually, and shield yourself from any further price increases.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment