Steve Jennings/Getty Images Entertainment

Zendesk (NYSE:ZEN) does want to get acquired after all. After declining a takeout offer of around $127 per share earlier in the year, ZEN has agreed to be acquired for $77.50 per share. The discrepancy does need to be taken into context – tech stocks overall have been thrashed since February. In this report, I look at the company’s key metrics and discuss what shareholders can look forward to moving forward.

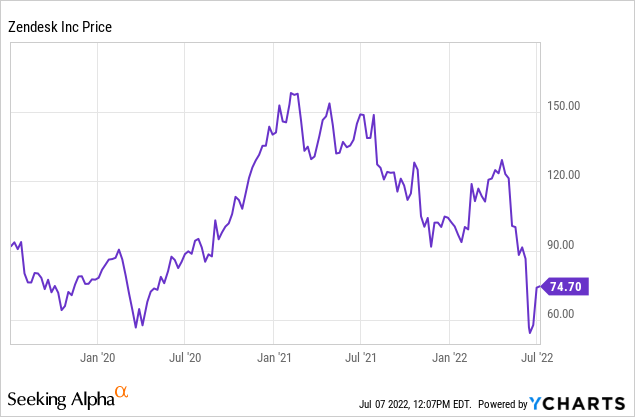

ZEN Stock Price

ZEN peaked above $150 per share, rejected a takeout offer rumored to be between $127 and $132 per share in February, and crashed as low as $54 per share.

The stock has since traded up very close to the $77.50 per share acquisition price.

ZEN Stock Key Metrics

ZEN has been a consistent grower in the enterprise space, with revenues growing 30% in the latest quarter. While ZEN is not yet profitable on a non-GAAP basis, it has generated non-GAAP profits including a 5.2% non-GAAP operating margin in the latest quarter.

ZEN has guided for the next quarter to see 30% revenue growth and for the full year to see up to 27.7% revenue growth.

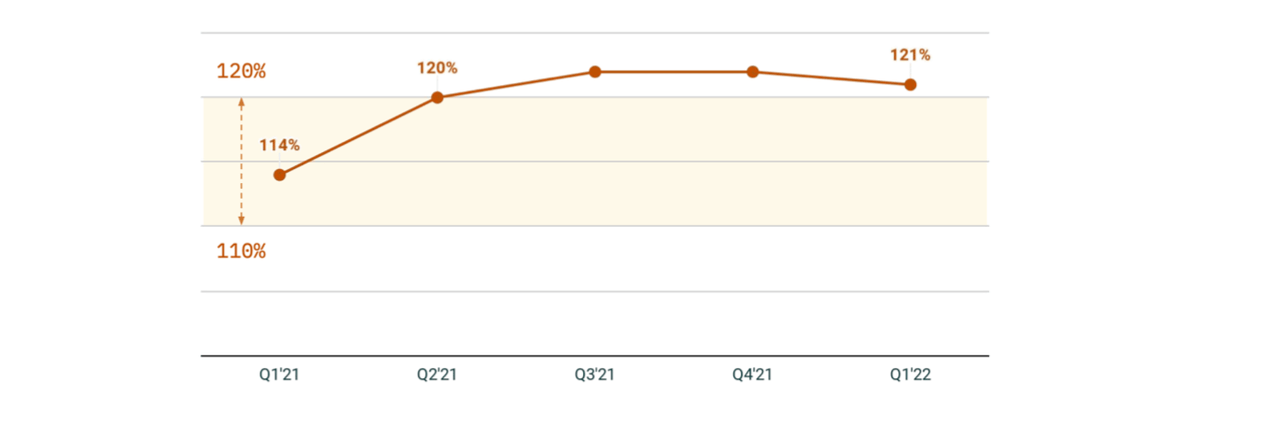

ZEN has been able to power its consistent growth through impressive net expansion rates that stood at 121% in the latest quarter.

2022 Q1 Shareholder Letter

ZEN had $1.6 billion of cash and marketable securities versus $1.1 billion of convertible notes. The convertible notes mature in 2025, carry a 0.625% interest rate, and are convertible at a price of $164.17 per share (net of capped call transactions). The low interest cost of the debt plus the overall net cash position highlight the strong balance sheet position.

Who Acquired Zendesk?

On June 24, 2022, ZEN announced that it was being acquired by an investor group led by Permira and Hellman & Friedman LLC (“H&F”) in an all-cash transaction valued at $10.2 billion – equating to a purchase price of $77.50 per share. That deal represented a 34% premium to where ZEN traded the day prior to the announcement.

How Will Acquisition Impact ZEN Investors?

If the deal is completed, then ZEN shareholders stand to receive $77.50 per share in cash. With the stock currently trading around $74.71 per share, shareholders might be able to earn a 3.7% return if held through completion. ZEN shareholders still need to vote on the deal, which some might feel has some chance of losing approval due to the fact that the company previously had an offer in the $127 range. But that offer was in February, and since then, many other tech stocks besides ZEN have fallen by a large magnitude as well.

What Is The Future Of Zendesk?

I see two paths forward for the stock. The more obvious path is for shareholders to approve the deal – at around 5.5x sales, the purchase price looks reasonable considering where other tech names trade.

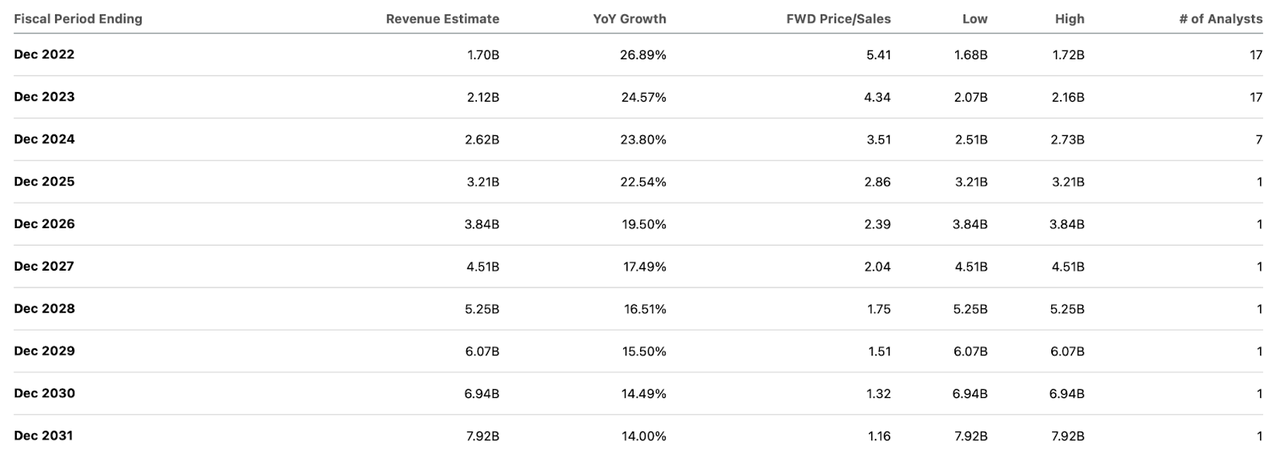

The deal might also fall apart, at which point the stock will need to perform on its own right. It is possible that ZEN might fall back down to the pre-deal price of $57.84 per share, but the stock is cheaply priced as it is today. ZEN is expected to grow at a 20+% clip for many years.

Seeking Alpha

I can see the company earning a 25% net margin over the long term. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), ZEN might trade at 9x sales in 2025, representing a stock price of $236 per share or 47% annual upside over the next three years.

Is ZEN Stock A Buy, Sell, Or Hold?

That’s tricky. This is a case where the max upside might be slim at 3.7% if the deal goes through. But based on the attractiveness of the stock at that purchase price, the investment proposition actually looks more compelling if the deal falls apart. I am doubtful that the stock will initially rally on such an event as sentiment in the tech sector remains quite low, suggesting that the stock has 3.7% max upside and unlimited downside at least in the near term. Because I like the stock more without the deal, I also prefer to buy tech peers that do not have a takeover transaction in place. The near-term risk is if the deal falls apart – 3.7% potential upside does not appear like much to compensate for that risk. The long-term risks include growth slowing down faster than expected and long-term profit margins not materializing to my expectations. The long-term risks are more concerning for those with a longer-term time horizon. I rate the stock a buy due to its attractiveness even if the deal falls apart, but note that one might want to wait for the deal to fall apart before buying the stock, unless they are practitioners of merger arbitrage.

Be the first to comment