D-Keine

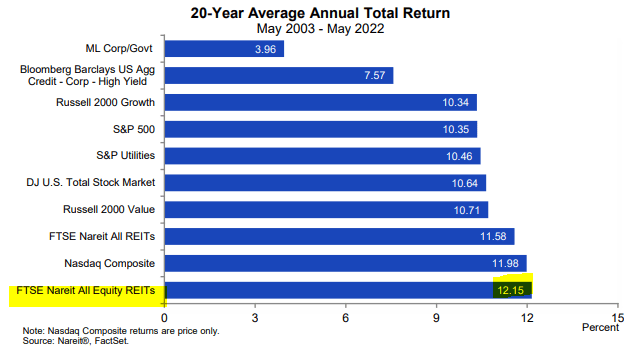

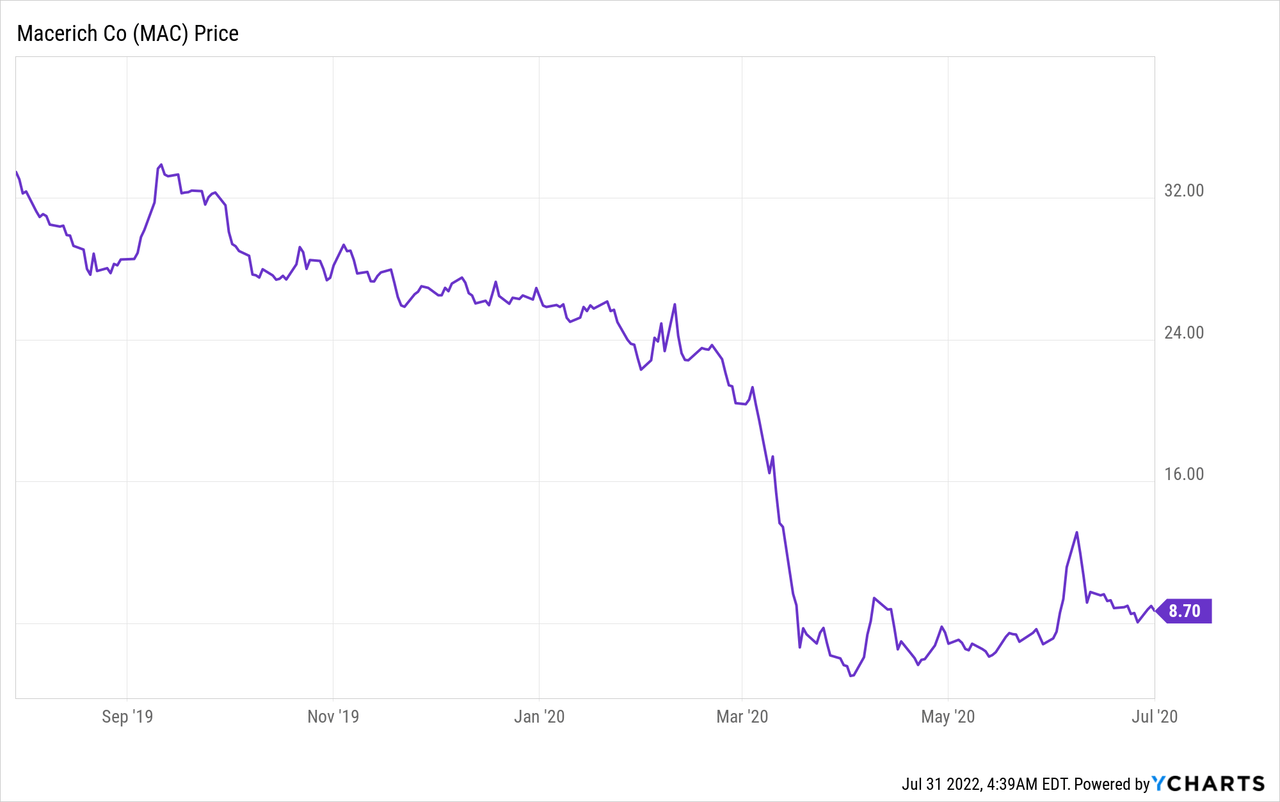

Historically, REITs have been some of the most rewarding investments of all time, earning as much as 12% per year on average:

NAREIT

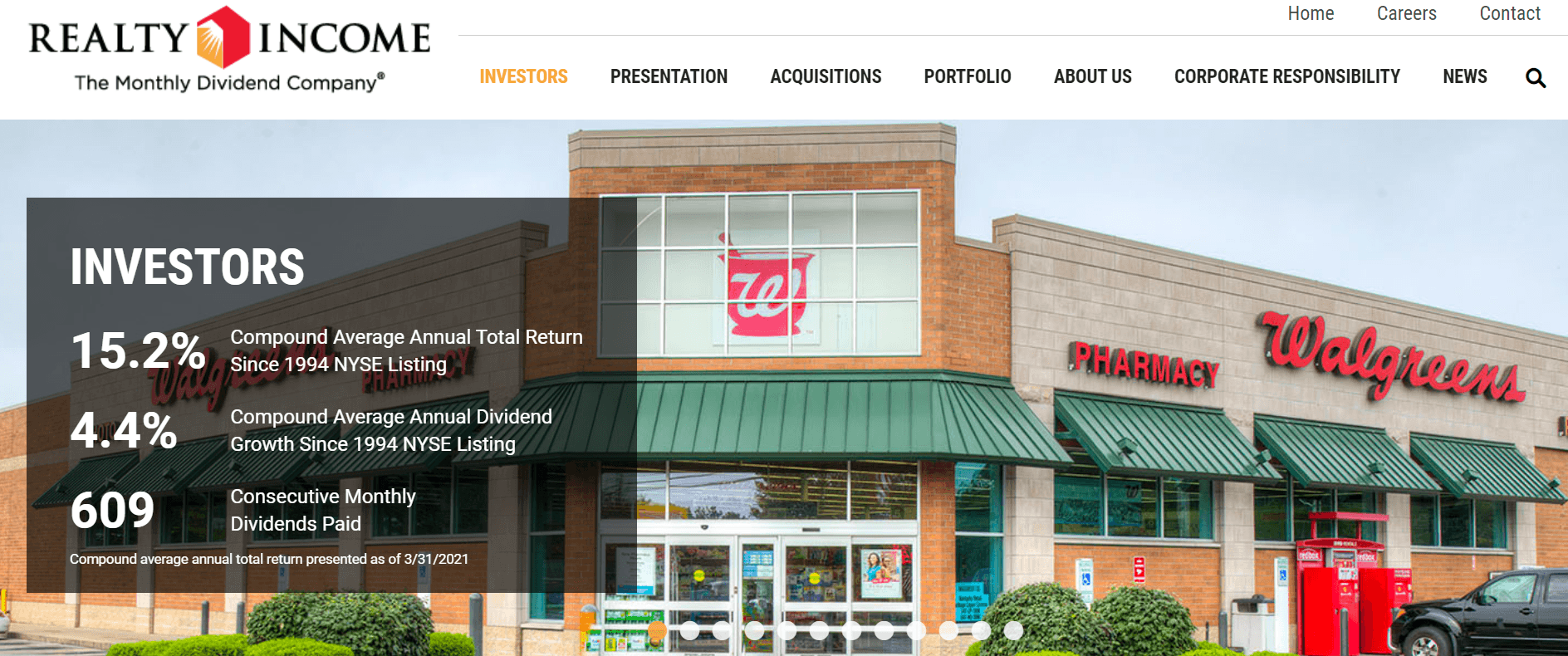

This is just the average, which includes the good and the bad. If you were selective and managed to weed out the good from the bad, you could have earned annual returns as high as 15% per year. Realty Income (O), as an example, has compounded investors’ capital by 15.2% annually since its IPO in 1994:

Realty Income

But unfortunately, the vast majority of REIT investors never actually experience such returns.

I know this because I sure didn’t in my early years as a REIT investor, and after writing 100s of articles on REITs here on Seeking Alpha, I have learned that most new REIT investors make similar mistakes that cost them dearly.

In what follows, I want to highlight the 5 biggest mistakes to avoid as a REIT investor. If you can just avoid these mistakes, your returns should improve materially:

Mistake #1: Chasing Yield At All Cost

The average dividend yield of REITs is today about 3.5%.

But there are a number of REITs that yield far more. Some yield as much as 10%.

And since we all love earning dividends, a lot of investors will naturally go for the higher-yielding names.

The name of our investment community here on Seeking Alpha is “High Yield Landlord” so I certainly understand the appeal of earning higher dividends.

But here’s the issue: most higher-yielding REITs are priced at a high yield for a good reason. Their dividend is not sustainable, it is highly risky, and it isn’t growing. In the end, higher-yielding REITs typically generate lower total returns than the lower-yielding REITs in the long run.

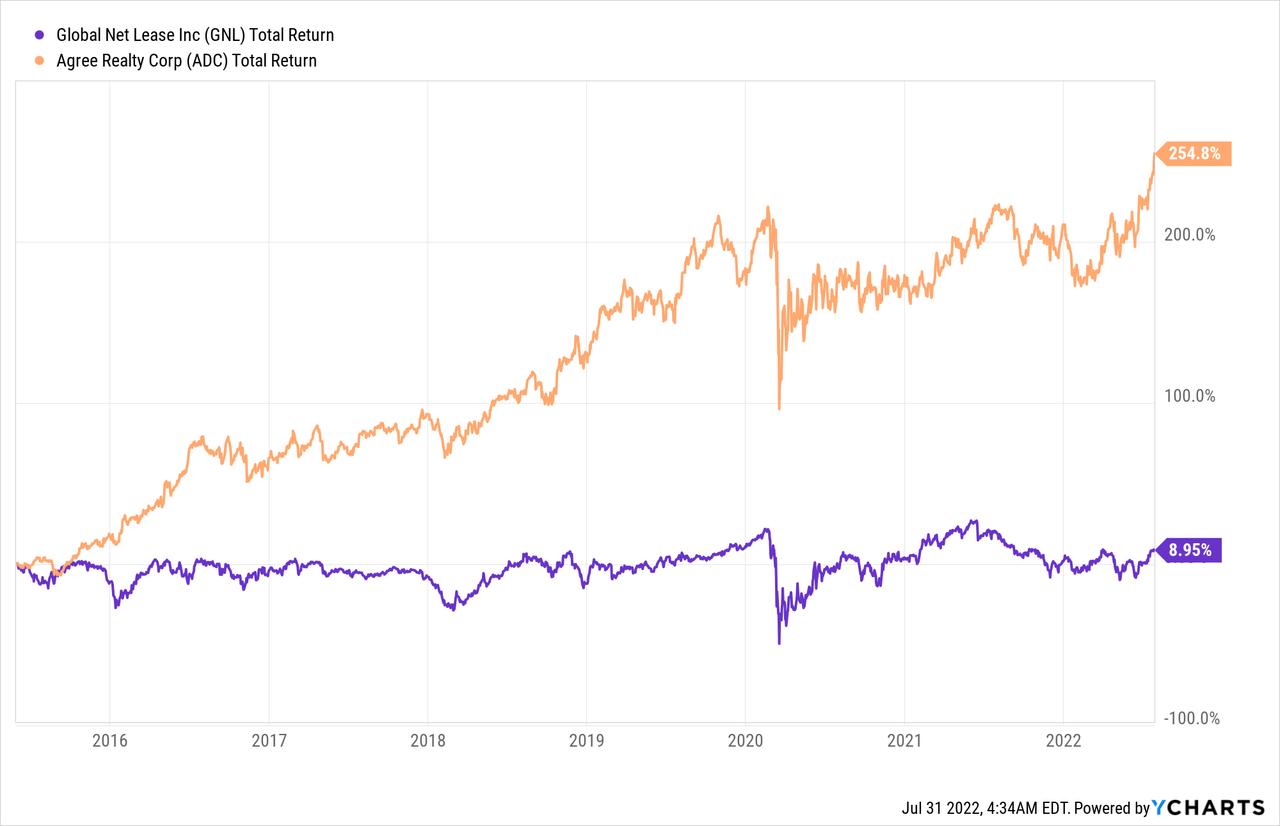

Just to give you an example: Global Net Lease (GNL) has yielded 8-12% throughout its history and yet, it has generated far lower returns than its net lease peer Agree Realty (ADC), which commonly yields only about 3-4%:

GNL has repeatedly cut its dividend throughout its history because it was overpaying and not retaining enough cash flow for growth.

ADC, on the other hand, took the opposite approach, which allowed it to grow its dividend even during times of crisis, and the stock market rewarded it accordingly.

This is a good reminder that REITs are not just income vehicles. I think that a lot of new investors come to REITs because they are attracted by the high dividend payments, but they fail to realize that REITs are total return vehicles and growth matters just as much, if not more than the income you receive.

A good rule of thumb is that higher dividend payments will commonly result in lower total returns over time and vice-versa.

Mistake #2: Investing in Externally-Managed REITs

REITs can be internally managed or they can be externally managed.

This seemingly small difference can have a huge impact on investment performance.

Internally managed REITs hire their management as employees of the REIT and they earn salaries for their work.

Externally managed REITs, on the other hand, outsource the management to an external asset management company that receives fees in exchange.

The internal management structure is today the most popular because it does a much better job at aligning the interests of the management with those of shareholders. The management is hired as employees and therefore, their sole focus is on the REIT and their salaries are commonly tied to some performance indicators.

However, there are still a lot of externally managed REITs and new REIT investors will often invest in them not even knowing that they are externally managed.

The issue with the external structure is that the manager has a completely different profit motive than the REIT. The manager earns fees that are typically tied to the size of the REIT and therefore, it will attempt to grow at all costs, even if it dilutes shareholders and leads to poor long-term returns.

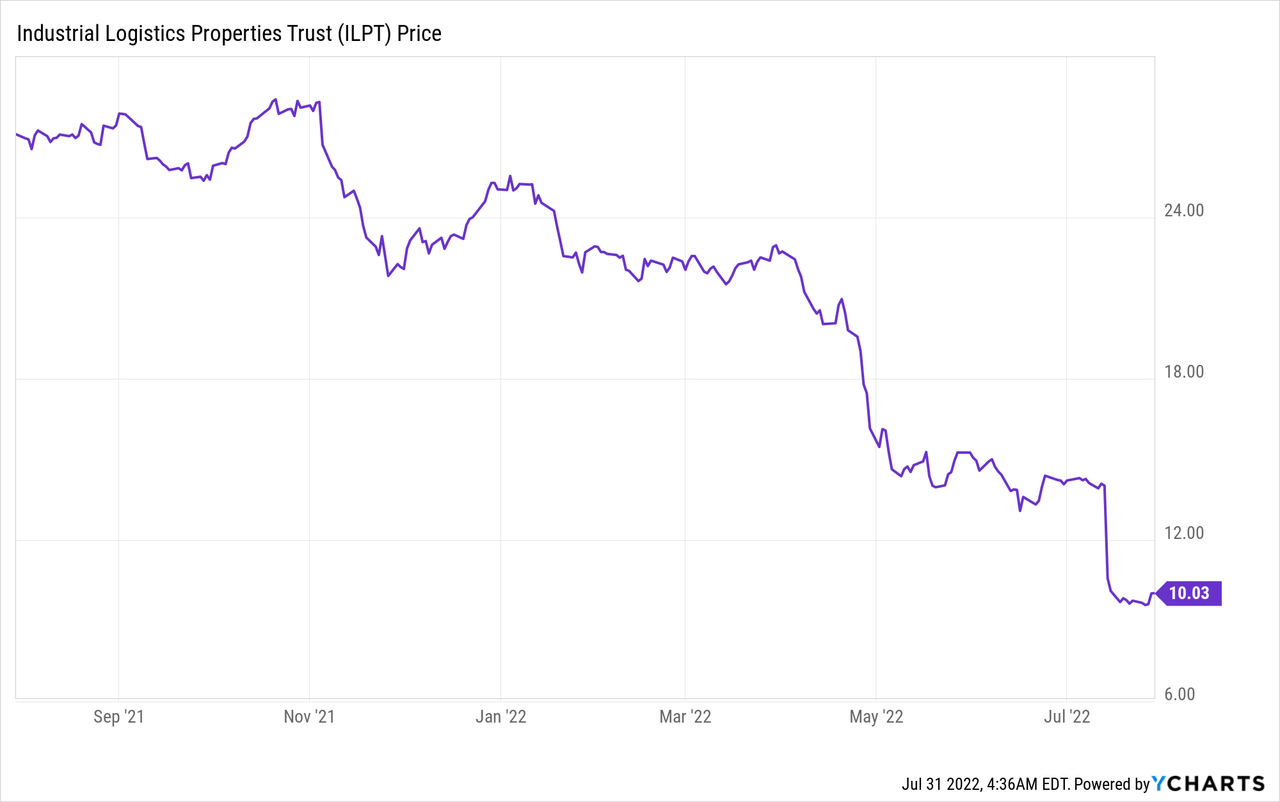

A great recent example is Industrial Logistics Properties (ILPT). It is externally managed by RMR (RMR), a notoriously conflicted asset manager that’s solely interested in earning fees. Late last year, it pushed for a massive acquisition to grow its assets under management (and its fees) and take a look at the consequences that shareholders suffered:

So before you invest, make sure that your REIT is managed internally. Unless you follow REITs very closely and really know what you are doing, simply stay away from externally managed companies.

Mistake #3: Forgetting to Check the Balance Sheet

Today, REIT balance sheets are stronger than ever. Their debt relative to assets is at an all-time low of around 35% and debt maturities are also historically long at 80 months on average.

It may seem counter-intuitive but studies have shown that lower debt results in higher returns over time.

Higher leverage can help you earn greater returns during the good years, but it can also ruin you during downturns, which then also ruins your average annual returns over a full cycle.

It is preferable to earn somewhat lower returns during the good years, but then also preserve your gains during the downturns and even enhance them by being able to buy properties from distressed sellers at bargain prices.

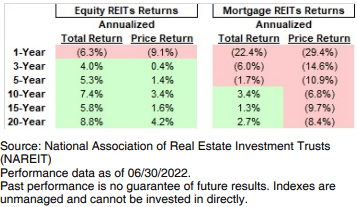

Taking the example of mall REITs: Macerich (MAC) was overleveraged leading up to the pandemic and it forced it to cut the dividend and issue expensive equity, diluting shareholders at the worst possible time. Its share price is yet to recover from the crisis:

Its close peer, Simon Property Group (SPG), had a stronger balance sheet, and it allowed it to play offense when others were merely trying to survive. Its decision to maintain a stronger balance sheet has resulted in higher returns over time.

Mistake #4: Not Differentiating mREITs from eREITs

I remember that my very first REIT investment was an mREIT, which stands for mortgage REIT. They are officially structured as “REITs” but they are very different from traditional equity REITs, or eREITs.

Unlike eREITs which invest in properties, mREITs will commonly invest in mortgages and securities.

Their business model is much closer to that of a bank than a landlord and they also commonly use a lot more leverage.

New investors are attracted by mREITs because they pay high dividend yields but their long-term track record of creating lasting value for shareholders is very poor:

Edward Jones

The issue with mREITs is that they are heavily leveraged, often externally managed, and they are making bets on the direction of interest rates and their spreads, which are very unpredictable things.

Generally speaking, we stay away from mREITs. We only own 2 of them in our Core Portfolio at High Yield Landlord.

Mistake #5: Investing Too Much in Traditional Property Sectors

The REIT sector is vast and versatile.

There are REITs for practically all property sectors, including farmland, billboards, and even casinos.

And yet, most new REIT investors will mainly focus on apartment communities, office buildings, and other traditional property sectors.

The reason why they invest in these assets first is that they have a sense of familiarity with them. As an example, they understand that everyone will always need a roof over their head, and therefore, apartment community REITs like Mid-America (MAA) should do fine over time.

The issue is that everyone knows this already and to earn alpha, you must invest in sectors that are overlooked and misunderstood by others.

Casinos are a good example. They are perceived to be risky and cyclical by most REIT investors. Despite that, VICI Properties (VICI), our largest REIT holding, is today priced at all-time highs. What investors appear to have ignored is that VICI leases its casinos on a long-term basis and it has very strong leases that protect it even during the worst crises. Not even the pandemic could stop its cash flow.

VICI Properties

So don’t invest just in apartment communities just because you are lazy to learn about new property sectors. The best opportunities are often in niche property sectors that are ignored by others.

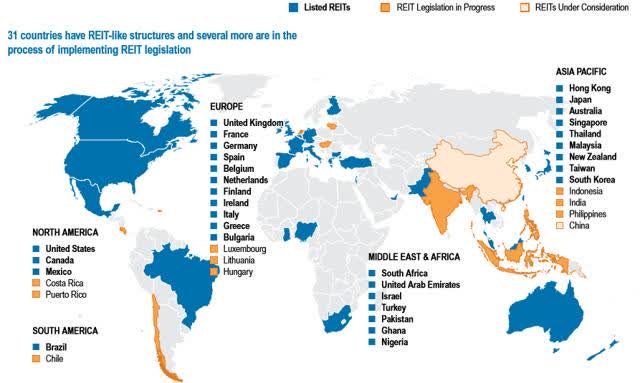

Mistake #6: Ignoring Foreign Markets

Today, there are REITs in over 30 countries and yet, most REIT investors only look for opportunities in the US.

NAREIT

By investing abroad, you can boost your returns and lower risk thanks to diversification.

It is a no-brainer if you ask me.

It sure takes some effort to learn about foreign markets and finding research on these opportunities is more complicated, but it is well worth it.

Mistake #7: Not Paying Attention to NAV

As a REIT investor, it is important to remember that you are buying real estate, and in real estate investing, the money is made at the time of the purchase.

If you overpay, you already lost. If you underpay, you have already built in a cushion of future profit.

We pay close attention to the value of the real estate that’s owned by the REIT and only invest if we can get it at a nice discount.

To give you an example, BSR REIT (OTCPK:BSRTF / HOM.U), a Texas-focus apartment REIT is currently for sale at an estimated 35% discount relative to the value of its assets, net of debt. That’s a good deal and we are buying it.

The ‘Landlord’ Approach to REIT Investing

In my early years as a REIT investor, I underperformed the market averages by making many of the mistakes highlighted in this article.

But I learned from these mistakes and developed my own approach, which eventually resulted in significant market outperformance.

In short:

- We follow a total return-oriented approach, seeking a good mixture of yield and growth, instead of chasing yield at all costs.

- We only invest in internally managed REITs with managers that have a lot of skin in the game.

- We pay close attention to the balance sheet to not just grow value, but also preserve it during downturns.

- We recognize that mREITs are very different beasts from eREITs, and favor eREITs in most cases.

- We heavily favor specialty property sectors that present better growth, income, and value for investors.

- We invest in foreign markets when we can find better opportunities abroad. It boosts our upside and also diversifies our portfolio.

- Finally, we pay close attention to the price we pay. We are value investors and always try to get a discount.

We like to call this the “landlord” approach to REIT investing because we are buying REITs as if we were buying rental properties.

We are very selective just like most rental property investors and only invest in the very best opportunities that the market has to offer.

Be the first to comment