luvemakphoto

In conjunction with our follow-up note on International Paper (IP), we decided to analyze WestRock’s (NYSE:WRK) implications after FedEx’s (FDX) earnings alarm. Last Friday, Wall Street was already depressed due to the Federal Reserve interest rate decision that is expected in two days, but FedEx’s preliminary results were a wake-up call to the global economy. WestRock and the entire paper segment suffered a massive capital downside. The Tennessee-based transportation giant’s results were far below consensus estimates, and the company also withdrew its full-year earnings guidance due to the economic slowdown. The warning comes as consumers worldwide are struggling with higher costs for basic necessities like food and fuel. As already explained in IP analysis, WestRock’s stock price decline was further depressed by Jefferies’s note, in which the analyst was not favorable towards the whole sector due to 1) an ongoing lower demand in containerboard, 2) clientele inventory level and 3) a recession fear based on lower consumer expenditure.

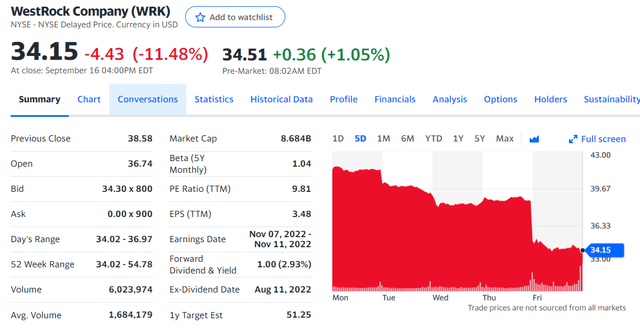

WestRock’s stock price evolution (last 5 days) (Yahoo Finance)

So, What’s Next?

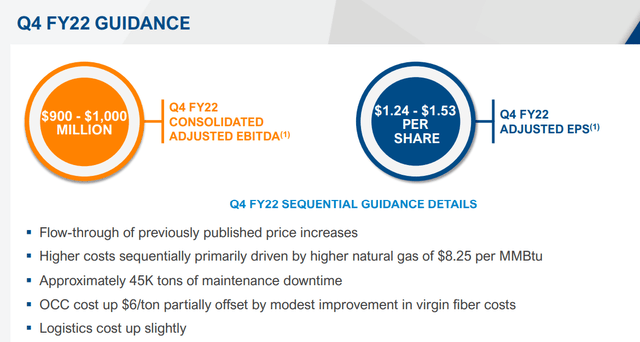

In Q3, WestRock delivered a good set of numbers with record top-line sales and EBITDA. After having increased the company’s guidance during the Q2 presentation, Management confirmed once again its future outlook. In our conclusive paragraph, we forecasted a $3.5 billion EBITDA for year-end, estimating the low range of WestRock guidance emphasizing the company’s resiliency and profitability.

WestRock guidance (WestRock Q3 Results)

As already said in our IP analysis, containerboard demand was lower in July, but it was already up on a monthly basis in August. In addition, WestRock’s main market is the US (even considering the latest Mexican acquisition) and consumer demand is not suffering as in Europe. Due to the European energy price development, WestRock might even increase its export demand and get a slice of the Old Continent market share. Despite a softer containerboard July demand, during the Q&A presentations in early August, WestRock was positive for the full-year and price increases were expected as well for a continuous raw material pass-through.

Conclusion and Valuation

In our initiation of coverage, we analyzed WestRock’s past challenges, and we were even more confident after the Investor Day analysis. In the past, the company was involved in too many acquisitions, however, with the CEO’s change in 2021, we knew that WestRock was undertaking a new cost-cutting program aimed to enhance the company’s profitability. The recent Panama City mill closure is just a tangible example. In addition, WestRock has no exposure in Russia. Jefferies analyst Philip Ng was not positive on the structural long-term growth, but we do believe that a 2% terminal growth rate is a very good proxy for the population increase. E-commerce growth, ESG fund picking selection, Plastic to Paper evolution thanks to customers’ sensitivity towards the environment, and plastic bans are, in fact, too many positive trends to ignore (and to support the company’s valuation). If we add the new divisional split in WestRock’s presentation, this will grant “greater transparency around its margin structure, both for the time being and for the future“. We don’t have to say more. Our buy rating is confirmed.

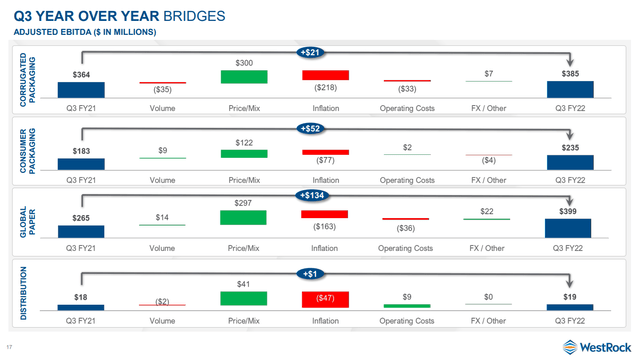

WestRock Q3 pricing delta in the new reporting division (WestRock Q3 Results)

Be the first to comment