evrim ertik/E+ via Getty Images

Description

I believe Westrock Coffee (NASDAQ:WEST) is worth $17.16, representing 75% upside from the date of writing (Oct 12, 2022). WEST is an established player in a large industry benefiting from secular uptrends. This along with the growth levers that it could pull makes this an attractive investment opportunity. In my opinion, the market is not reflecting WEST’s true value today because of the weak macro-environment and sentiment. WEST stock price should reflect its intrinsic value as long as it can keep being the leader and meet its guidance.

Company overview

WEST is a leading integrated coffee, tea, flavors, extracts, and ingredient solutions provider in the United States. It provides services like coffee sourcing, supply chain management, product development, roasting, and distribution to retail, packaging, food service, restaurants, convenience stores, travel centers, non-commercial accounts, CPG, and hospitality industries around the world.

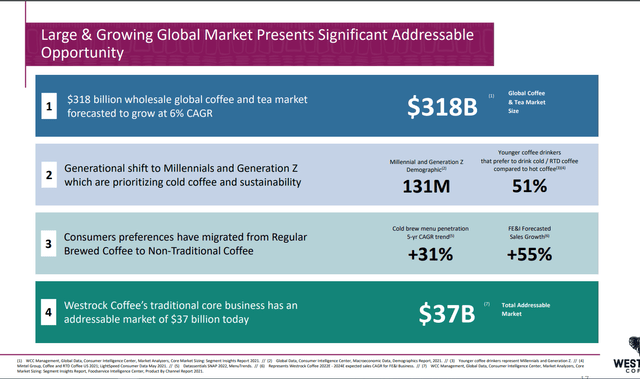

Large addressable market opportunity

Research from Global Data has shown us that the wholesale global coffee and tea industry, which was $318 in 2021, is expected to increase by 6.3% between 2021 and 2025, according to WEST. One would expect that the growth would stop for a couple of years before picking up again. However, that is not the case as the number keeps increasing as the days pass. The reason for this growth is attributed to the shifting preferences of the younger generation. Millennials and Generation Z now prefer cold coffee, unlike prior generations that always loved their coffee hot, and I am not surprised that these trends are gradually being passed down to Generation Z. Statistics show us that Cold Brew Coffee and Iced Coffee menu penetration has gone from 2.6% and 12.8% in 2016 to 10.2% and 15.7% in 2021 (Source: WEST S-1).

WEST investor presentation Jun 2022

It is also very important to note that this generational shift in the United States and around the world plays a very significant role. The millennial and gen Z population is large (40% of US population, or approximately 131 million people (Source: Statista)) and is in its prime spending age.

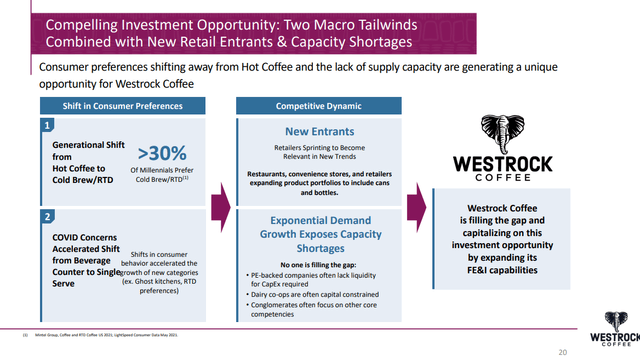

Global coffeehouse franchises are challenging the dominance of traditional fast food and convenience stores. These companies need a collaborator to help them develop new products and keep up with consumer demand for cold brew and related liquid coffee extracts. So, this is where we bring in WEST. WEST is able to provide for all the needs of conventional quick-service eateries and convenience stores. Numbers wise, over the next five years, cold and ready-to-drink coffee is predicted to grow at the fastest rate (8% CAGR) of all non-alcoholic beverages consumed in the United States (Source: WEST S-1).

WEST Investor presentation Jun 2022

Scaled player

WEST has great market leadership, a comprehensive solution offering, and a strategic partnership approach that makes them a unique brand-behind-the-brand. Because of these characteristics, they are able to serve customers across a wide range of product types and distribution channels with innovative and enticing beverages. Operators who are interested in new and innovative products can benefit greatly from working with them because of the company’s emphasis on a collaborative product development process that begins with consumer insights tailored to the distribution channels and consumer profiles. All in all, WEST is a global full-menu beverage solutions provider thanks to their massive international footprint, industry-leading sustainable sourcing, and seamless vertical integration of their supply chain.

Another thing about WEST is that their skilled team has over 380 years of collective experience of success working in blend matching and taste profiling. A unique partnership approach that enhances their ability to drive beverage program profitability is definitely a plus. In addition to being able to match any coffee and guarantee consistency in every cup, as well as quickly and reliably ship a bespoke product that is ethically sourced to anywhere in the world, they stand out from the competition.

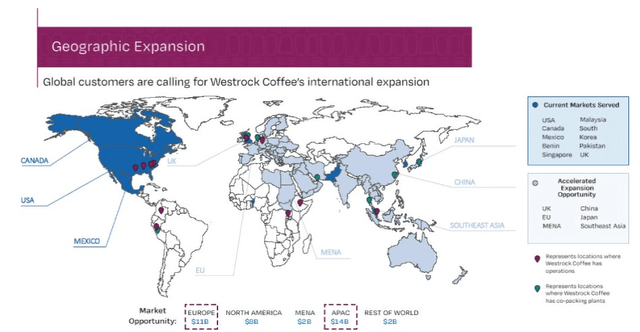

Blue chip customer base with broad geographical reach supports growth

WEST has a whole lot of value propositions. However, one of their key value propositions is its scale and global reach, as it serves blue-chip customers with a global presence. WEST’s A-list clients include international chains of eateries, motels, supermarkets, and department stores. Approximately 88% of their customer stores are located in the United States, while only 1% are located in other international markets. Because of this, they have a great chance to boost sales to existing customers by setting up shop where those customers are already at internationally.

They supplied customers in the United States, Canada, Virgin Islands, and Australia, amongst others, in the beverage solutions segment. Expansion will be done over time to places like China, Japan, the United Kingdom, the European Union, the Middle East, and North Africa. Alongside satisfying the current customers, they are also looking to expand the blue-chip customer base to further penetrate their existing channels. Since 2020, 25 new countries have been added through the new pipeline. There are more than 100 new targets in the blue-chip customer pipeline (Source: WEST S-1).

WEST Investor presentation Jun 2022

Proprietary technology that enables traceability is a strong value proposition to clients with focus on ESG factors

WEST’s ability to provide a paper trail is an invaluable asset. Increased demand for ethically produced and responsibly sourced food and beverages can be attributed to consumers’ growing awareness of sustainable sourcing options. For worldwide tracking and connectivity, WEST utilizes a number of different technologies. The goal is that this technology can make opaque and disjointed supply chains more open and interconnected.

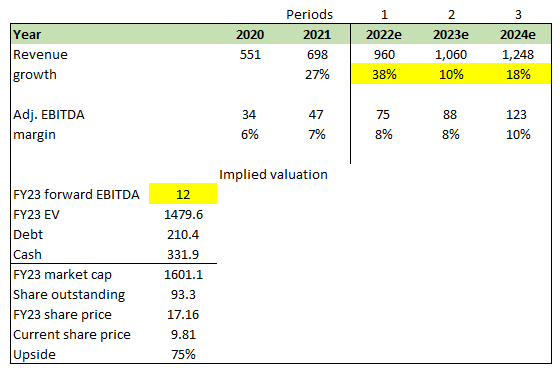

Valuation

I believe MTY is worth USD17.16 representing 75% upside from the date of writing. This value is derived from my model based on the following assumptions:

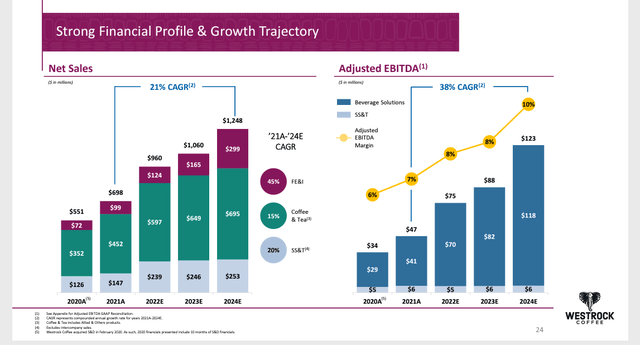

- Revenue growth to follow management guidance until FY24, supported by continuous organic growth and market share capture.

- Adj. EBITDA margins to follow management guidance, expanding from 8% in FY22 to 10% in FY24

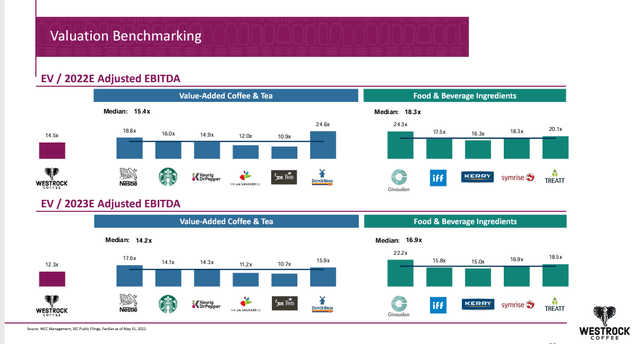

- Valuation is where I differ from the market and believe that WEST deserves to trade at a higher multiple than what it deserves today, especially when we look at where other value-added coffee and tea players are trading today. On average, the other players are trading at a median forward adj. EBITDA multiple of 14 to 15x, and I would argue that WEST deserves to trade at a similar range. That said, the peer group includes brands like Nestle and Starbucks, who have a better brand and scale than WEST, hence I applied a slight discount in my assumption.

GYS Investing estimates WEST Investor presentation Jun 2022 WEST Investor presentation Jun 2022

Key risks

Trend is Hard to Predict

Every business’ main goal is to offer satisfying services to their customers. WEST is no different, as their main goal is to satisfy their customers with beverage products. To generate revenue and maintain or improve WEST’s operating results will require consumers to continue purchasing these products. Customers definitely do not have the obligation to continue patronizing, and there is no assurance that customers will continue to extend their purchases for similar periods or for the same amount of the product.

Execution is Key

I believe that WEST’s future does not only depend on serving existing customers but also on getting new customers as well as expanding their distribution base not only in the United States but also globally. In new geographic markets, they might face new challenges that are different from the ones they have encountered before. If their evaluation does not seem to be forthcoming, it could have an adverse effect on the business, financial condition, and results of operations.

Summary

WEST is undervalued at its current share price as of the date of this writing. Reliability, productivity, transparency, and integrity are things that should be present in every business. From having mastered flavors for many years, to having a proprietary technology that enables consumers to trace where their products are coming from, and to a whole lot of other things that WEST brings to the table. This company should be able to keep riding the secular tailwinds and meet management’s expectations.

Be the first to comment