RHJ/iStock via Getty Images

Published on the Value Lab 19/8/22

Westlake Chemical Partners LP (NYSE:WLKP) is run by the same people that run their primary customer, Westlake (WLK), which has been a beneficiary of recent construction trends and efforts to finish incomplete houses and get them on the market. WLKP benefits from a very stable relationship with WLK that provides a lot of cash flow certainty. Those agreements will eventually expire, but they are rather likely to be renegotiated on similar terms. Regardless, ethylene markets aren’t too bad to have commodity exposure to in the worst case. This doesn’t gel with a rather high yield for the company and the fact that feedstock inflation headwinds are not likely to get much worse. Even at these trough EBITDAs, the company trades cheaply with a 7.4% FCF covered dividend. A nice buy for dividend investors.

Westlake Chemical Partners’ Cash Flow Review

WLKP benefits from a sales agreement with WLK which owns the majority of the company, however it doesn’t control the assets. This incestuous arrangement is the reason why WLK has an obligation to buy almost all the ethylene that WLKP produces on a determined, cost plus basis. The demand side is well protected by the solvency of a very vigorous WLK business until 2026, when the agreements expire. Again, due to the ownership of WLK in WLKP, they are likely to establish similarly favourable agreements again, likely for more output if WLKP decides to use CAPEX to expand capacity. For now, they run on a maintenance CAPEX basis.

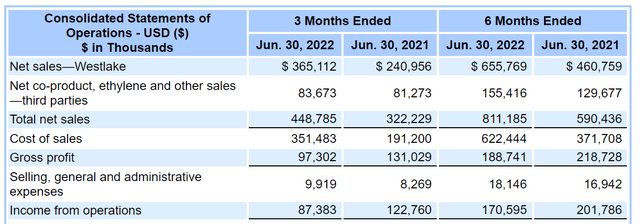

Their sales are well protected, and their CAPEX regime predictable. The volatility can only come from the supply side through COGS which have grown substantially YoY due to elevation in feedstock prices of natural gas and naphtha.

IS Snippet (WLKP 10-Q)

Income from operations have come down substantially on account of that.

Worst Case

We think that energy prices are unlikely to rise higher due to both demand destruction and also latent problems in the economy. Consumers are less confident while corporates are more confident. Corporates sell to consumers down the line so this cannot last. Unemployment will come if not from that reckoning then from continued Fed action. At least the COGS issue should reverse.

On the demand side there is the concern that once 2026 comes the new agreement with WLK could be worse. Because it owns 80% of the company we doubt they will shortchange WLKP and annoy unitholders, it would cost more than it’s worth as they only give away 20% of the value from a favourable agreement. We think that the reason the agreement is set to expire is for WLKP to plan new capacity so the next agreement can incorporate that new potential output. Nonetheless, even if the agreement falls through and all purchasers become third parties, spot prices for ethylene aren’t too volatile for an intermediary, and the markups on contracts are probably better nowadays than how they were when the WLK agreement was brokered.

Supposing that COGS doesn’t decline, at least for the next four years the EBITDA will cover the value of the assets. Calculating for NCIs, the EV is around $2 billion, and annualised EBITDA from this quarter which was worse than the last is $560 million. A 3.5x multiple is real low for even an intermediary producer. COGS is likely to decline with natural gas already retreating from highs, just as crack spreads and crude prices are also retreating.

Conclusions

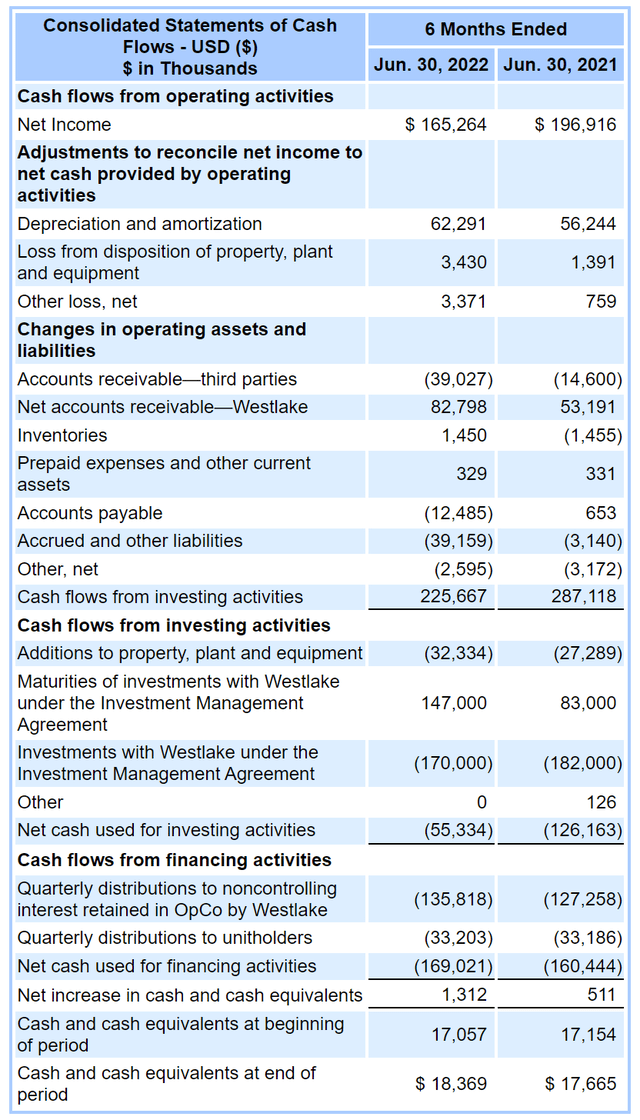

Even this quarter operating cash flows was high at $225 million, and CAPEX is pretty stable and falls under typical maintenance CAPEX behaviour.

CFS (10-Q WLKP)

The investing cash flow line related to investments in Westlake amounts to nothing more than a liquidity agreement with WLK whereby WLKP provides cash and WLK provides some nominal return for those treasury services on top of a guarantee to meet WLKP liquidity needs in turn were cash flows to be hurt. They can be ignored from the FCF calculation. Doing so results in a 75% FCF payout ratio which is still pretty low despite the temporary pain in feedstock prices to WLKP. Those are likely peaking, and when they decline you have a 7.5% dividend yield at entry price, with a 3.5x multiple on a shrunken cash flow. Great dividend buy.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment