catalby

Intro

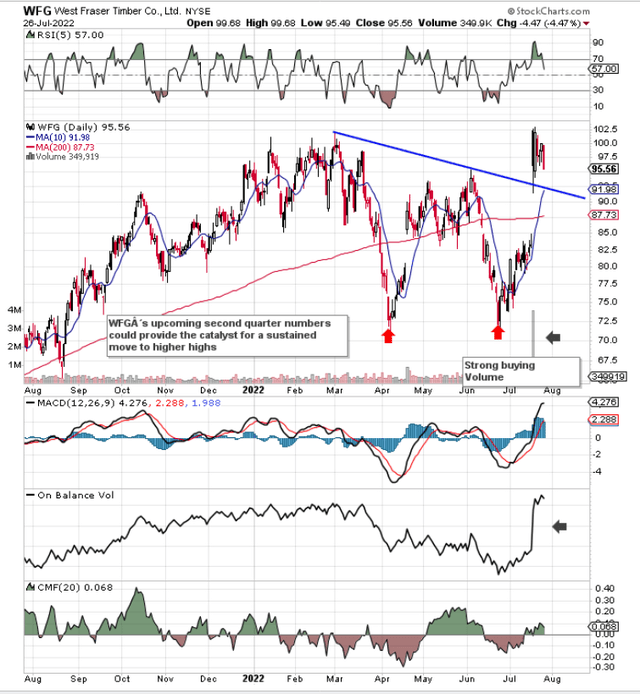

We wrote about West Fraser Timber Co. Ltd. (NYSE:WFG) back in March of this year when we recommended that investors buy the dip. Although our timing was not the best, shares finally bottomed in late June above $70 a share and really have not looked back since. In fact. if we take a look at the technical chart, we can see that there is a strong possibility that a double bottom formation pattern is playing itself out here. We state this because:

- The recent June lows managed to stay above the April lows.

- In recent sessions, shares were able to spike above the pattern’s depicted neckline as well as WFG’s overhead resistance (June highs) resulting in a significant move back above the stock’s decisive 200-day moving average.

- It did this on very strong volume registering an upside gap in the process. Suffice it to say, if upcoming second-quarter earnings meet or exceed expectations, there is every opportunity that this neckline will now act as very strong support meaning it will not be breached to the downside.

Potential Double Bottom In WFG (Stockcharts.com)

WFG Stock Price Target $120

Suffice it to say, the opportunity in WFG is derived from the height of the pattern in question (Up to $25 per share). This means a possible price target for the stock would come in between $115 to $120 a share (23% above the prevailing share price) before the bottoming pattern would have played itself out in full. The longer we stay above support (neckline), the more likely that our chart pattern is correct.

The projected earnings number for West Fraser’s fiscal second quarter (being announced on Wednesday the 27th after market close) comes in at $6.88 per share. Given the fact that this estimate has increased by over 11% over the past 30 days alone, along with the company’s earnings record where we have seen consistent earnings beats over the past 12 months, the odds are high that we will see another convincing earnings beat here in Q2.

Strong ROC & Low Valuation

We state this because West Fraser’s technical chart is essentially a read on the company’s known fundamentals at this point in time. Whereas other West Fraser investors may try to predict how housing starts, lumber prices, interest rate fluctuations, or takeover bids will change the paradigm here, we try to keep it simple by focusing on metrics under our control. Suffice it to say, we like to ask questions like, does the company generate strong returns on capital? Is the stock trading at an attractive valuation? Do shareholders get rewarded consistently?

If we focus on the first two questions initially, West Fraser’s return on capital (profitability) currently comes in at an excellent 32%+ over a trailing 12-month average. From a valuation standpoint, the company’s cash flow multiple (2.35) and earnings multiple come in at 3.20 both over a trailing twelve-month average. Despite the fact that bottom-line earnings are expected to fall this year by roughly 18%, the above valuation multiples remain super attractive for the following reason.

Many times in our commentary, we state that growth metrics are overrated, and for good reason. Just look at the financial base West Fraser is working from. The company continues to generate buckets of cash flow and continues to have the wherewithal to invest that cash and generate high double-digit returns. Growth essentially has to come eventually which the market is fully clued in to.

West Fraser’s Cash Flow Is Rewarding Shareholders

With respect to shareholder returns, West Fraser recently announced a second quarterly dividend increase of $0.05 per share to bring the quarterly payout to $0.30. Although investors may focus on the average 1.2% forward dividend yield, the payout has now increased by an inflation-beating 40% over the past 12 months. Furthermore, shareholders continue to get rewarded through sustained share repurchases with $233 million worth of stock being bought back in the first quarter alone. Strong sustained buybacks should not surprise investors given the scale of cash flow this company generates. Management touched on this in the recent first-quarter earnings call and remains in the privileged position of being able to invest, pay down debt, and reward shareholders from internally generated cash flows. These trends should continue to drive book value, sales and profitability forward over the long term which is what long-term investors want to see.

Conclusion

Therefore, to sum up, we believe there is every chance that West Fraser will break out to new highs once the company announces its fiscal second-quarter earnings. Aggressive investors may look to take a small position before the announcement. Otherwise, WFG remains a strong buy on an earnings beat. We look forward to continued coverage.

Be the first to comment