Takako Hatayama-Phillips

By Valuentum Analysts

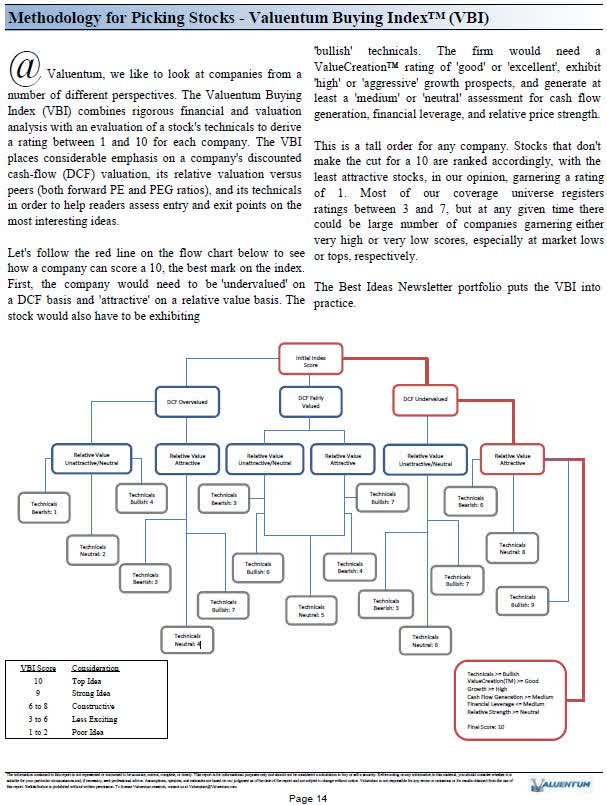

At Valuentum, we use discounted cash-flow [DCF] analysis as the bedrock of our process. However, we also use relative valuation and technical and momentum indicators and blend that into an output called the Valuentum Buying Index rating, or the VBI rating. We like to help members sort ideas in a systematic fashion so they can apply our work in any way that they would like.

As shown in the flow chart below, we’ll show how Salesforce (NYSE:CRM) registers a 3 on the VBI, as it garners an fairly perspective on our DCF process, an unattractive view from a relative valuation basis, and bearish technical assessment. A pretty neat, process, with so much embedded in one number, no? Let us know in the comments below.

The flow chart shows how we derive a rating for each company. (Valuentum)

Let’s now talk Salesforce, in particular. Salesforce is a provider of enterprise cloud computing (software) solutions. The company delivers customer relationship management, or CRM, applications via the Internet, or ‘cloud.’ The company sells to businesses of all sizes across industries on a subscription basis. The Americas remains its dominant geography.

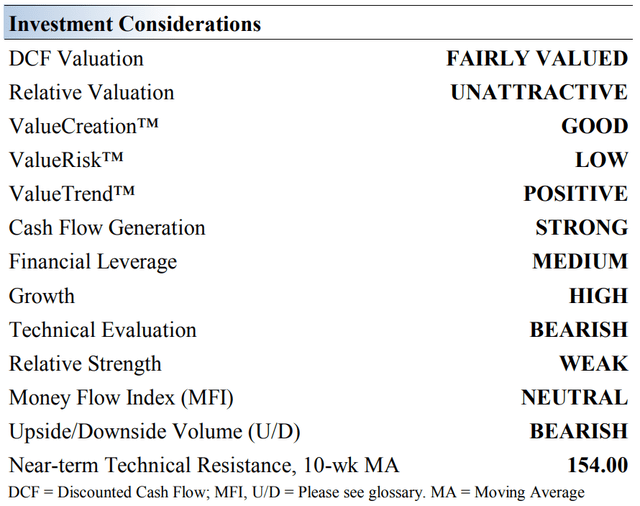

Salesforce’s Key Investment Considerations

Investment Considerations (Valuentum)

We forecast significant top-line growth and operating margin expansion going forward, made possible via the highly scalable nature of Salesforce’s business model. We recently cut our fair value estimate materially as we took a more cautious view on shares.

Salesforce put up another year of robust revenue growth in fiscal 2022. It is one of the fastest-growing enterprise software companies in the world and one of the quickest to reach $20.0+ billion in revenue. Various acquisitions have helped it get there (such as its deals to buy Slack and Tableau), and Salesforce will likely remain highly acquisitive going forward.

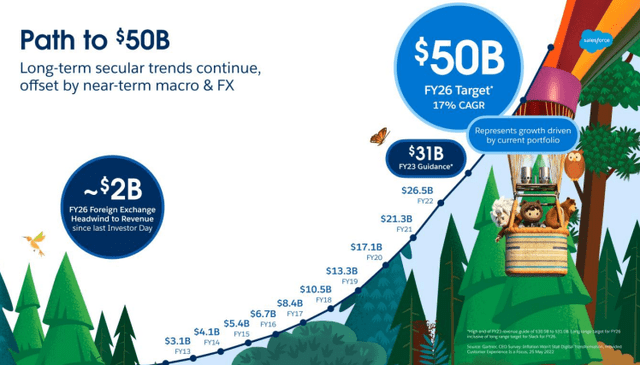

Salesforce’s business is driven by long-term secular growth trends. (Image Source: Salesforce)

The company’s deferred revenue and backlog continue to grow, revealing material future expansion potential. Salesforce expects sales to remain robust, and the firm is targeting $50.0 billion in sales by fiscal 2026 (as shown above). Cloud software companies may be largely recession-resistant, but they won’t be immune to pressures. For example, Salesforce recently announced that it would be cutting jobs due to “weakening of demand in some countries.”

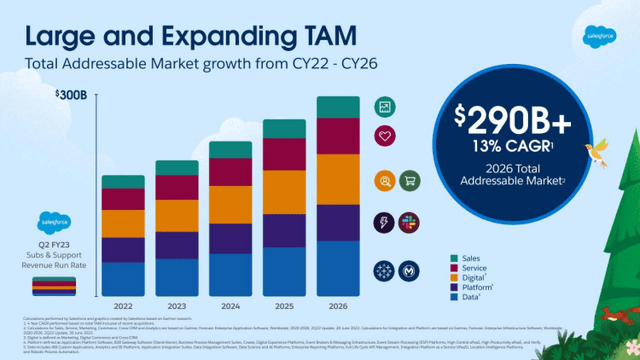

Salesforce has a large and growing addressable market. (Image Source: Salesforce)

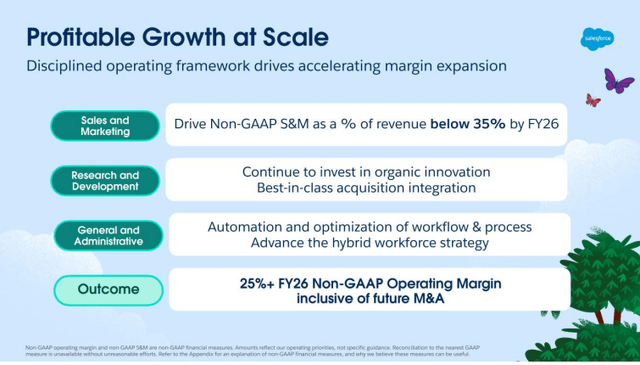

Revenue growth is the company’s current top priority, as the firm’s total addressable market could reach $290+ billion by 2026, a huge number. Long-term, however, Salesforce is targeting a mid-20% operating margin (as shown below). If it hits this, significant upside to our fair value estimate may exist, though operational execution will be key.

Management is targeting a mid-20% operating margin in the longer-term. (Image Source: Salesforce)

Salesforce reported second quarter results for fiscal 2023 in late August. Though results beat expectations on the top and bottom line, the firm lowered its fiscal 2023 guidance, now targeting $30.9-$31 billion in revenue, down from the prior expectations of $31.7-$31.8 billion. This is partly why we’ve grown cautious on shares, and the recent job cuts haven’t been as encouraging.

Salesforce’s Economic Profit Analysis

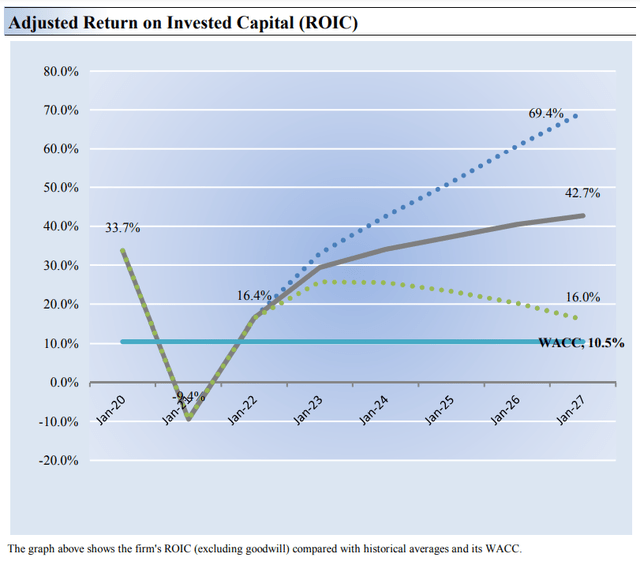

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Salesforce’s 3-year historical return on invested capital (without goodwill) is 13.6%, which is above the estimate of its cost of capital of 9.3%.

As such, we assign the firm a ValueCreation rating of GOOD. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. On a forward-looking basis, we assign the company an attractive Economic Castle rating.

Salesforce’s Cash Flow Valuation Analysis

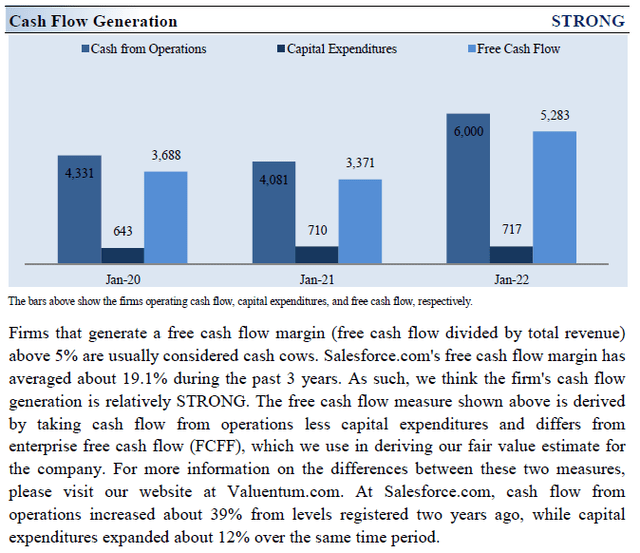

Cash Flow Generation (Image Source: Valuentum)

We think Salesforce is worth $163 per share with a fair value range of $130- $196. Shares are trading at ~$154 at the time of this writing. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 14.4% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 25.9%.

Our valuation model reflects a 5-year projected average operating margin of 19.9%, which is above Salesforce’s trailing 3-year average (but still below long-term targets). Beyond year 5, we assume free cash flow will grow at an annual rate of 6.1% for the next 15 years and 3% in perpetuity. For Salesforce, we use a 10.5% weighted average cost of capital to discount future free cash flows.

Salesforce’s Margin of Safety Analysis

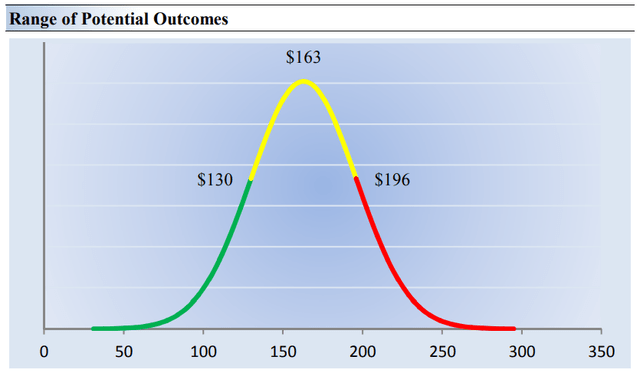

Range of Potential Outcomes (Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Salesforce’s fair value at about $163 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Salesforce. We think the firm is attractive below $130 per share (the green line), but quite expensive above $196 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Reduced guidance for fiscal 2023 and impending job cuts have us cautious on shares of Salesforce. The company’s total addressable market is huge, its revenue growth targets impressive, and the firm’s operating margin goals are notable, but the near-term could pose some difficulties. Our fair value estimate is only modestly above where shares are trading at the moment, and we’d demand a wider margin of safety to grow interested. If the trajectory of our assumptions don’t change, we think shares of Salesforce are cheap under $130 each.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment