Justin Sullivan/Getty Images News

Wells Fargo (NYSE:WFC) is exposed to rising interest rates, but this has been offset from structural issues and therefore its discounted valuation compared to peers is justified and remains a value trap.

As I’ve discussed in previous articles, among large U.S. banks one of my least preferred plays is Wells Fargo due to some fundamentals issues that affect the bank’s long-term performance. As I’ve not covered Wells Fargo for some time now, I think it is a good time to revisit its investment case to see if its major hurdles were fixed in the past few quarters, of it the bank continues to struggle to improve its major financial metrics.

Background

Since my last article on the bank, back in April 2021, its share price has barely moved even though during this period the Federal Reserve has aggressively hiked interest rates, which theoretically would be a major boost for a bank with a business profile that is highly geared to retail banking.

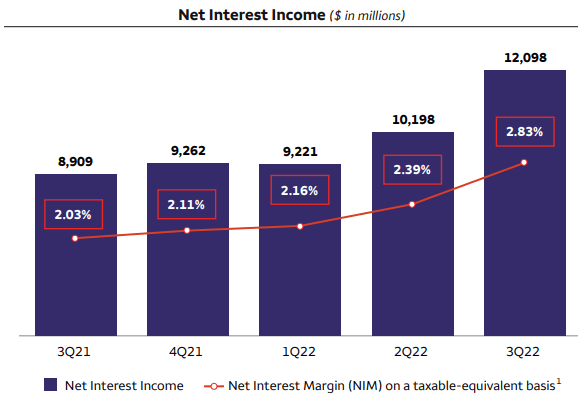

Indeed, among U.S. large banks, Wells Fargo is among the banks with higher exposure to interest rates, as its business is retail-oriented and has very little exposure to investment banking and capital market activities. Indeed, in Q3 2022, net interest income amounted to $12.1 billion, while total revenue was $19.5 billion, which means net interest income (“NII”) accounted for 62% of the bank’s overall revenue. For instance, JPMorgan’s (JPM) NII accounted for 53% of total revenue in the last quarter, while Goldman Sachs (GS) only generates some 17% of its revenue from NII.

This business profile was not particularly good during the pandemic (2020-21), which was a period particularly good for capital markets and boosted revenue and earnings for investment banking activities, but theoretically would benefit Wells Fargo more than its competitors during from a rising interest rate period.

However, as can be seen in the next graph, Wells Fargo stock (white line) has not a much different return compared to other large U.S. banks since my last article, even though it has outperformed by a large extent Citigroup (C) and also has a better performance than Bank of America (BAC) and JPMorgan.

Share price performance (Bloomberg)

Moreover, when I last analyzed Wells Fargo, its stock was trading at a considerable discount to peers, considering that it was trading below book value, while the U.S. banking sector was trading at close to 1.3x book value. This could suggest that Wells Fargo was undervalued and had higher upside potential than peers, but as I suggested at the time, the bank was a value trap despite the prospects of rising interest rates ahead.

In fact, investors bid up its share price in late 2021 due to the rising interest rate environment, but since the beginning of 2022 its share price is down by 11%, practically in-line with the U.S. financial sector during this period. While this muted performance can be justified, at least in part, by cyclical issues, in my opinion, this is mainly justified by the bank’s fundamental issues that continue to affect negatively its progress, a trend that started in 2016 when it was fined for its sales practices.

Fundamental Performance & Recent Earnings

Since then, Wells Fargo has faced significant legal and litigation costs, plus it has operated for many years under a Fed constraint on its balance sheet, which has put severe limitations on its ability to grow its business. Its $2 trillion asset-cap has been a major hurdle, not allowing the bank to benefit from a positive macroeconomic environment over the past few years, and also leading to a less efficient bank as costs have increased in recent years.

Indeed, while its efficiency ratio was quite stable from 2010-2017 between 58-60%, this ratio increased to 66% in 2019 and reached its worst level in 2020 at 77%. Note that a higher ratio means lower efficiency, as costs are covered by a lower revenue stream. In the last quarter, Wells Fargo’s efficiency ratio was 73%, still much higher than its peers despite the positive effect of higher interest rates on net interest income. For instance, JPMorgan reported an efficiency ratio of 58% in Q3 2022, or about 15 percentage points better than Wells Fargo.

This is a worrisome outcome, given that Wells Fargo has high exposur e to interest rates and its NII increased by some $3.2 billion, compared to 3Q 2021, representing annual growth of 36% YoY. This clearly shows that Wells Fargo is benefitting greatly from the rising interest rate environment, a trend that is expected to persist for a few more quarters.

NII (Wells Fargo)

With the major revenue line increasing by 36% YoY in the last quarter, it would be reasonable to expect a major positive impact on earnings. However, this was largely offset by lower noninterest income, which declined by $2.5 billion year-on-year, due to lower loan originations in mortgages and auto loans, and lower fees on investment advisory. Indeed, mortgage loans originations collapsed by 58% YoY to $21.5 billion in the quarter, being a major drag on mortgage banking fees ($324 million in Q3 vs. $1.26 billion in Q3 2021), while investment advisory fees declined to $2.1 billion (vs. $2.9 billion in Q3 2021).

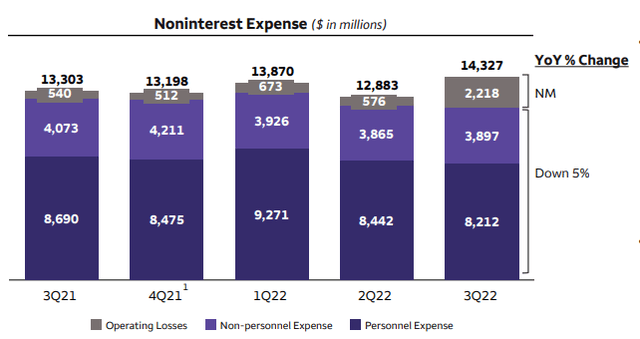

While overall revenue increased by $671 million in Q3 2022, on the cost side the bank’s developments were not particularly good. Due to historical issues, the bank reported another $2 billion charge related to litigation, customer remediation, and regulatory matters. This led total expenses to increase by more than $1 billion on an annual basis, to $14.3 billion. This was the major reason why its efficiency ratio deteriorated compared to Q3 2021 (73% vs. 71% one year ago), despite interest rates being much higher and NII increasing at a very strong pace.

Adjusted for extraordinary litigation expenses, its total expenses would have been about $12.3 billion, and its adjusted efficiency ratio is 63%. This is an acceptable efficiency ratio, but the issue is that Wells Fargo has consistently reported extraordinary costs in the past few quarters, as shown in the next graph in the operating loss line, and this is a trend that is likely to persist in the coming quarters as most past issues are not yet fixed.

Costs (Wells Fargo)

Therefore, even though Wells Fargo has been able to cut operating costs and reduce its headcount in recent quarters, its reported efficiency ratio is not expected to improve markedly in the coming quarters, as the bank continues to have outstanding litigation, customer remediation, and regulatory matters, which are likely to negatively impact its operating losses in the near future.

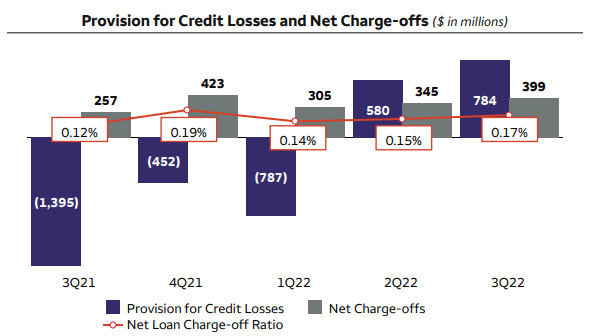

Another potential issue affecting its profitability in the short term is the weakening economic environment in the U.S., with a recession likely in 2023. While so far the impact on loan-loss provisions has been manageable, as the cost of risk was only 17 basis points in the last quarter, this is likely to increase in the coming quarters and have a negative effect on the bank’s earnings.

Provisions for credit losses (Wells Fargo)

Therefore, Wells Fargo’s return on equity ratio (ROE), a key measure of profitability in the banking industry, is not expected to improve much in the next few quarters, despite the bank having considerably exposure to higher interest rates. In Q3 2022, its ROE was 8%, which is below its cost of equity, and also lower than its historical pattern before the pandemic (ROE between 10-13% during 2010-19).

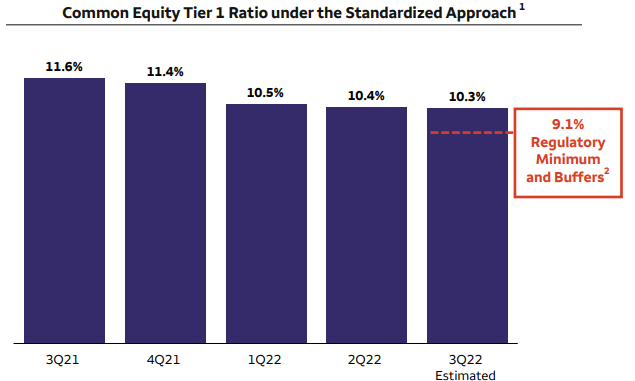

Another potential issue is the bank’s relatively low capital ratio, given that at the end of last quarter its CET1 ratio was 10.3%, which is relatively low compared to its peers (JPMorgan had 12.5% for instance at the end of Q3) and much lower than one year ago. Not surprisingly, Wells Fargo did not repurchased shares during the last quarter due to this weak capital position, and if this position does not improve in the coming quarters it can also represent a headwind for dividend growth.

CET1 ratio (Wells Fargo)

Conclusion

Wells Fargo is one of the U.S. large banks with higher exposure to rising interest rates and this is having a great positive impact on its NII growth. However, despite this boost, the bank’s woes continue to offset NII strength, namely related to litigation costs, and the prospects of a recession in the coming quarters is also not good for provisions in the near future.

This means that Wells Fargo’s fundamentals are not expected to improve much despite the rising interest rate environment, plus its capital position is also a reason for concern. Wells Fargo is currently trading at around book value (at a discount to other U.S. banks), but close to its historical average over the past five years, which seems to be justified by the bank’s issues and therefore remains a value trap for the time being.

Be the first to comment