Justin Sullivan

Wells Fargo & Company (NYSE:WFC) had just doubled its dividends the last time we wrote on it. The dividend, hike inclusive, was still less than 50% of the pre-pandemic levels, so it did not do much for the dopamine levels of the collective market. The bank simultaneously announced a buyback of $18 billion worth of shares or 10% of its market capitalization, which would have an accretive impact on shareholder earnings down the line. While not very enthused about the prospect of buybacks at a premium to tangible book value, we acknowledged the bank’s efforts and concluded with:

WFC perhaps disappointed investors with the dividend hike. But do remember it is sending a lot of excess capital your way through buybacks. If you think this expansion has ways to go, then WFC’s strategy should pay off. The bank is handicapped by the asset cap that remains in place, but that likely means more buybacks down the line as less regulatory capital is tied up with loans. For our part, we expect the 10-year yields to hit a minimum of 2.5% during the course of this cycle and think investors should overweight financials. Financials also represent spectacular relative value to the S&P 500. That said, we don’t own any of the big banks as there are far better values in the small regional banks.

Source: The New Dividend From Wells Fargo Is A Good Start

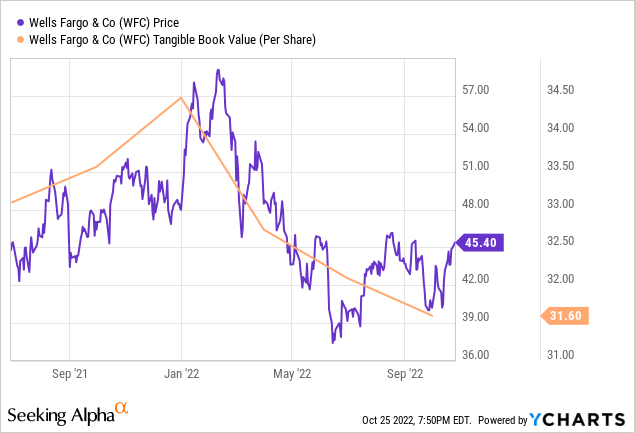

The price has remained pretty much flat since then, which cannot be said for the tangible book value.

The bank is exercising financial prudency though and that was recognized in the form of upgrades from Citigroup Inc. (C) and The Goldman Sachs Group, Inc. (GS) in 2022.

Dividend Hike and Capital Return Plan

WFC increased its dividends twice since then and now stands at 30 cents/quarter versus a comparable 51 cents pre-pandemic. WFC completed the 2021 announced share repurchases in Q1-2022 and did not have any further buybacks in Q2 and Q3. At the end of Q3, the bank’s CET1 ratio was 10.3%, which was above the regulatory minimum of 9.2% as they are exercising prudency and retaining the buffer due to the hit a portion of its assets is taking.

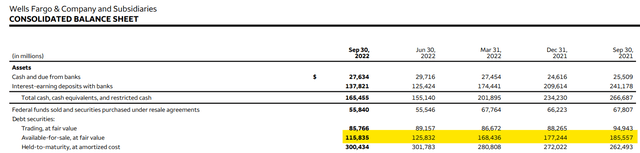

We are seeing this across banks on their available-for-sale portfolios. The combination of rising credit stress coupled with duration hits has decreased the value of this portion of their balance sheet markedly. Nobody really expects any real long-term losses here, but one has to mark them to market. That creates a larger requirement for retained earnings to offset the decrease in capital ratios.

What’s A Good Deal?

WFC provides a sub-3% yield, and investors may find it hard to justify purchasing the common when the risk-free rate is higher than that. With the buyback on hold, investors are not seeing any benefits from the big earnings either. There is one security that one can consider.

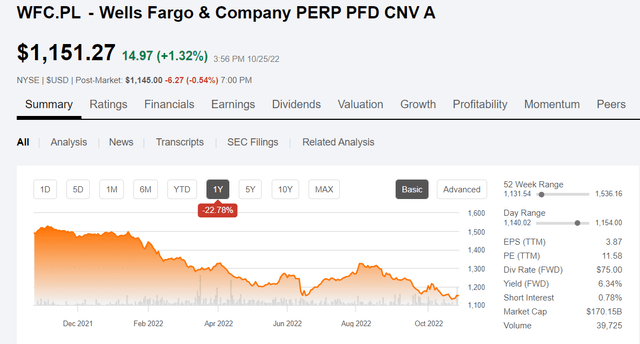

The Wells Fargo & Company Non-Cumulative Perpetual Convertible Class A Preferred Stock, Series L (NYSE:WFC.PL) provides an interesting alternative.

The Preferred

A few relevant points on this preferred share class that we think investors should grasp are presented below.

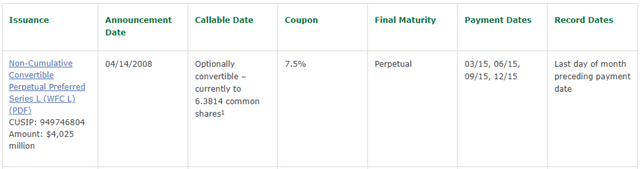

WFC.PL was issued in 2008 with a $1,000 par value. The shares rank in line with the other preferred issues and, like the rest of the publicly traded securities, have non-cumulative dividends. However, the preferred share investors do need to be paid before the common shareholders.

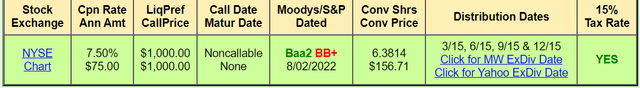

This class of preferred shares is not redeemable by the company. The holder has the option to convert their preferred shares into 6.3814 common shares plus cash in lieu of fractional shares. These preferreds were inherited by WFC from the Wachovia merger and the conversion rate of 6.3814 is based on the merger conversion rate of 0.1991 times the original (Wachovia) conversion rate of 32.0513. The conversion does not make sense at the current market price (preferred $1,151 versus $45 for common). The $44 common shares would only equate to $287 in total.

The fine print also allows WFC to force a conversion of all or some of the outstanding issues, on or after March 15, 2013, if the common share exceeds $203.72 (130% of the conversion price of $156.71) for 20 trading days during any 30 consecutive trading day period. But all things considered, this is a Class A busted preferred, with redemption possible during a hyperinflationary event.

Yield

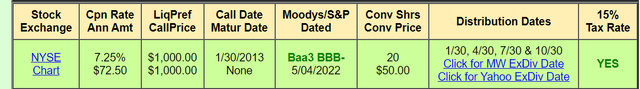

With a 6.4% yield, the preferred shares are not going to make you rich. They have also dropped a lot less than some other preferred stocks we follow. Bank of America Corporation 7.25% CNV PFD L (BAC.PL) is a similar issue that we have previously talked about, though that has a far greater chance of being converted to Bank of America (BAC) common equity in our lifetimes. That yields about 6.4% as well. While both yield about the same, it is interesting to note that BAC.PL has a different credit rating.

This contrasts with the following ratings for WFC.PL.

While we don’t necessarily see BAC.PL as safer than WFC.PL, all other things being equal, we would naturally defer to the higher-rated one.

Verdict

WFC.PL is a good choice for investors wanting the WFC play with a higher income. But the current yield is actually quite low in our opinion, considering the amazing choices out there. We are even finding investment grade debt across 3-5 years that is yielding more than WFC.PL. If you had to choose one bank preferred with no chance of redemption, we would go with BAC.PL. WFC.PL would have to yield at least 1% more than it is today (assuming all other securities stay constant) for us to get interested.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment