Roman Tiraspolsky/iStock Editorial via Getty Images

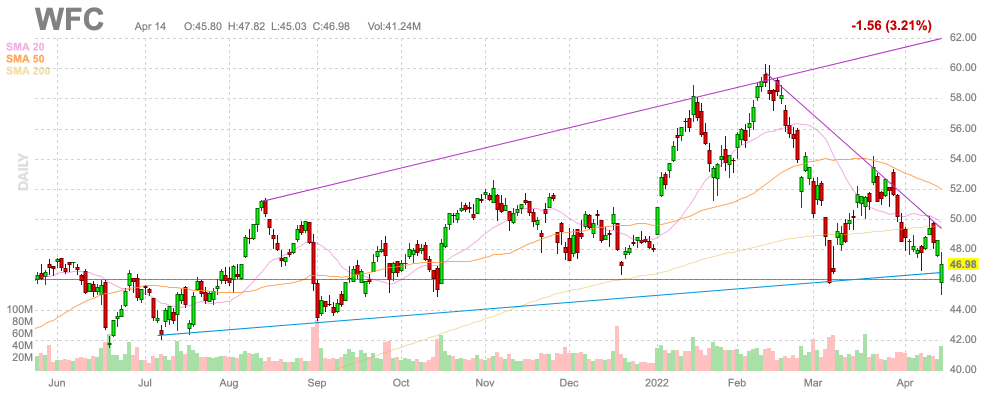

Just as the bank stocks were supposed to benefit from higher interest rates, the sector has been hit with recession fears leading to more loan defaults and lower profits. Wells Fargo (NYSE:WFC) continues on a path to higher profits regardless of the current bumpy ride in the economy. My investment thesis remains Bullish on the large bank stock back trading below $50.

Source: FinViz

Not The Best Quarter

In the Q1’22 earnings release, CEO Charlie Scharf eloquently summed up the path forward for Wells Fargo:

While we will likely see an increase in credit losses from historical lows, we should be a net beneficiary as we will benefit from rising rates, we have a strong capital position, and our lower expense base creates greater margins from which to invest.

The large bank reported that revenues both fell from the prior year and missed analyst estimates, yet the company earned $3.7 billion in net income. EPS declined $0.14 during Q1’22 from the $1.02 level reported last Q1.

Wells Fargo saw a big 14% hit to noninterest income due to lower mortgage banking income (33% decline) and a reduction in trading activity and investment banking fees. All banks face volatile periods due to the ebb and flow of economic activity in their core markets.

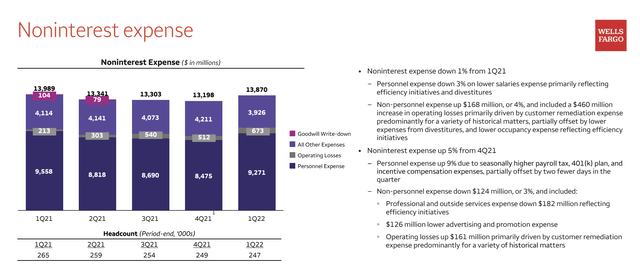

The large bank didn’t make as much progress on cutting noninterest expenses with a minimal 1% cut from prior year levels to $13.9 billion. Wells Fargo is still expected to strip a substantial amount of expenses out of the income statement, but these results were disappointing with non-personnel expenses up $168 million due to $460 million in higher operating losses from historical remediation expenses. These costs should disappear in future periods leading to the 3% decrease in personnel expenses

Source: Wells Fargo Q1’22 presentation

The company forecast a big improvement in the efficiency ratio this year. Wells Fargo still forecasts noninterest expenses at $51.5 billion for the year, or equivalent to ~$12.5 billion per remaining quarter in 2022. As the above chart shows, the large bank spent ~$13.2 billion per quarter over that period in 2021.

Any expense reduction in the $0.7 billion range per quarter would have a huge impact on lowering the efficiency ratio. Even with this level of expense cuts, the efficiency ratio would still be stuck excessively high above 60%. Regardless, the income boost would be very material to a business with 3.2 billion shares outstanding and heading much lower via the large share buybacks.

Bull Case

Despite the weak quarterly results, Wells Fargo was able to repurchase 110.1 million shares for $6.0 billion. In Q1’22 alone, the large bank was able to reduce the outstanding share count by nearly 3.5%.

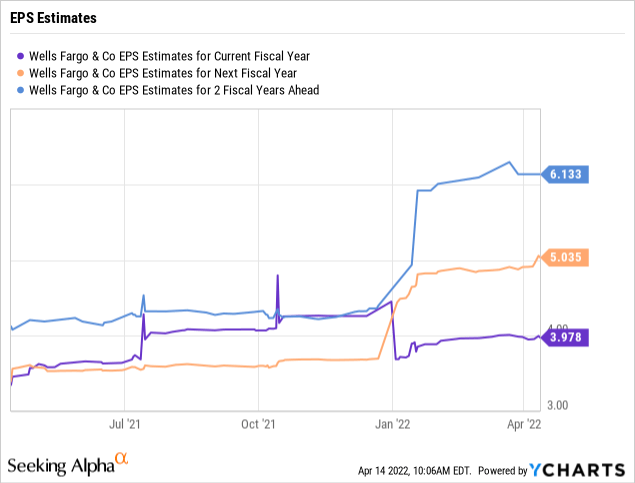

After a normalization period in 2022, the consensus estimates were already set for Wells Fargo to boost EPS substantially in 2023 and 2024. The company was forecast to hit a $5 EPS in 2023 and a $6+ EPS in 2024.

Just the share buybacks alone will provide most of the 25% EPS boost forecast for next year. Since Q2’21, Wells Fargo spent an incredible $18.3 billion on share buybacks which is very impressive considering the market cap is only $178 billion now after the big 4% dip in early trading.

The stock even offers a 2% dividend yield on top of these strong capital returns via share buybacks. The total capital returns over the last three quarters amounted to $20.9 billion.

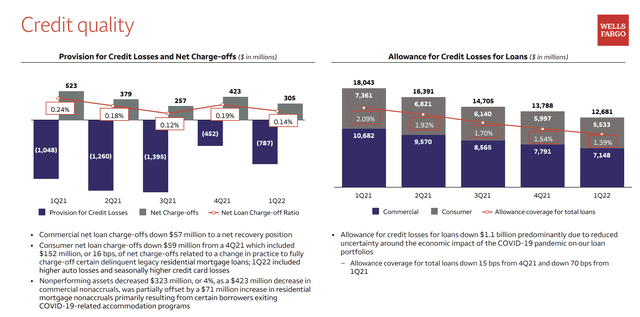

Naturally, the biggest risk to the bank story is higher credit cost in 2022 and beyond. The provision for credit losses remains historically low, below $1 billion quarterly, and the net loan charge-offs are near non-existent. Any minor blip higher in loan provisions due to an impending recession in the next year would naturally impact reported quarterly profits.

Source: Wells Fargo Q1’22 presentation

Takeaway

The key investor takeaway is that Wells Fargo didn’t report a great quarter due to banking sector issues. Over the long term, the large bank should see a substantial benefit from the ongoing boost to interest rates leading to higher net interest income. Once the higher income is combined with lower expenses and substantial reduction in the share count, the stock will again look very attractive trading below $50 with an earnings stream heading toward $6-plus.

Be the first to comment